Template Overview

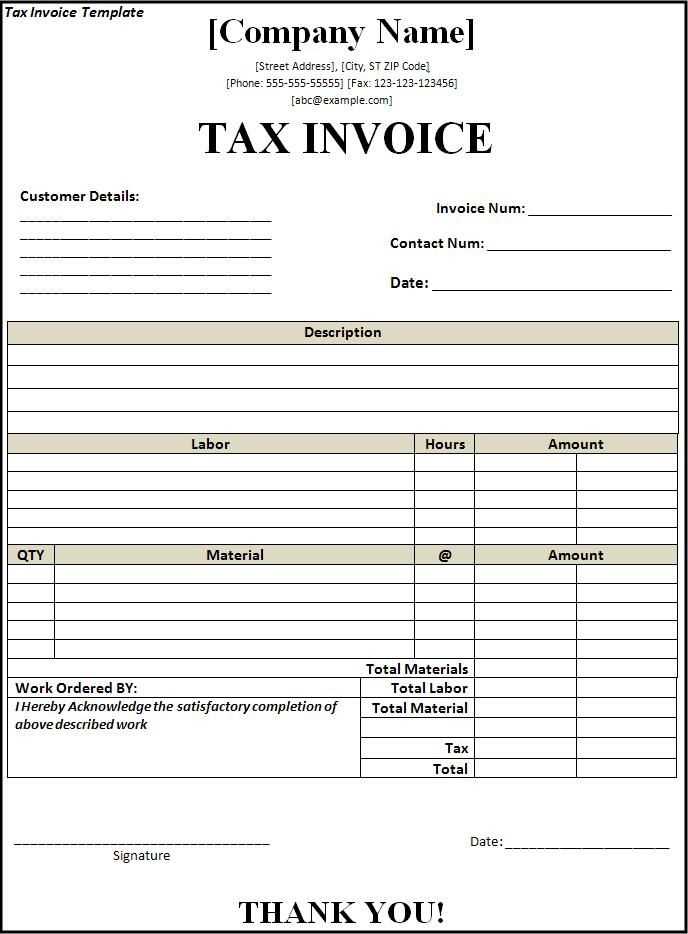

For truck drivers handling their taxes, it’s crucial to have a clear, easy-to-use receipt template. This allows you to document all relevant expenses and income related to your work. A well-organized tax receipt helps simplify your tax filings and ensures compliance with local regulations. Below is a breakdown of what to include in a truck driver tax receipt template.

Key Information to Include

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Date of Transaction: Clearly indicate the date of the expense or income.

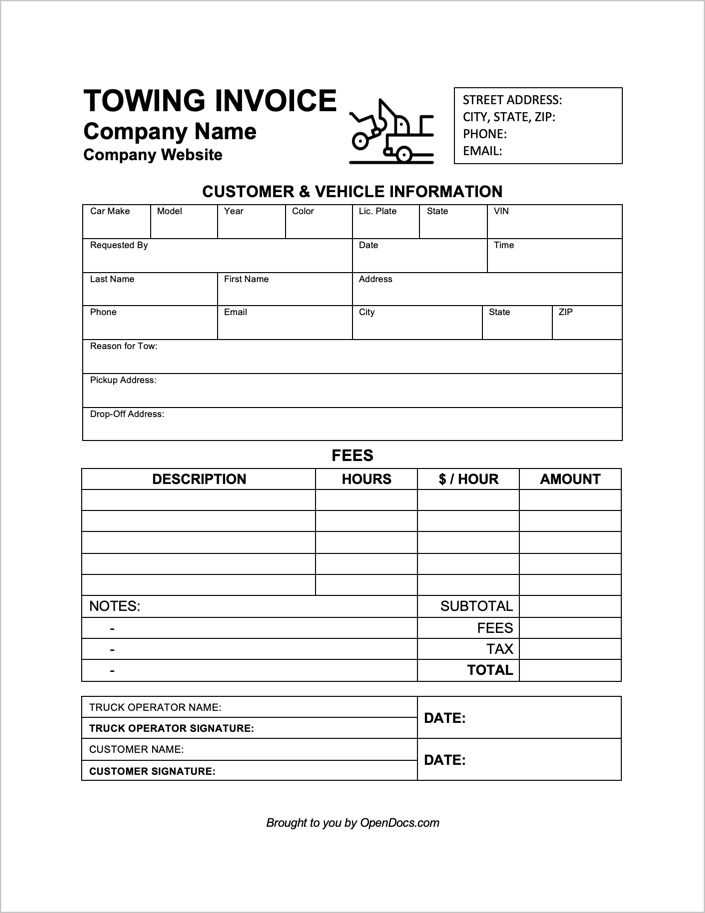

- Truck Details: Include the truck’s make, model, and registration number.

- Service Provided: Specify the service provided, whether it’s freight hauling, delivery, or other transportation services.

- Amount Charged: List the total amount charged for the service.

- Payment Method: Mention whether the payment was made in cash, credit card, or another form.

Expense Breakdown

Track all operational costs, such as fuel, maintenance, and insurance. Each expense should have its own line, providing clarity for tax deductions. Make sure to include the following:

- Fuel Costs: Include the total fuel spent for the trip or period.

- Maintenance and Repairs: Document any repairs or regular maintenance on the truck.

- Insurance: Deductible insurance costs should be listed separately.

- Tolls and Fees: Any tolls, parking fees, or other travel-related expenses.

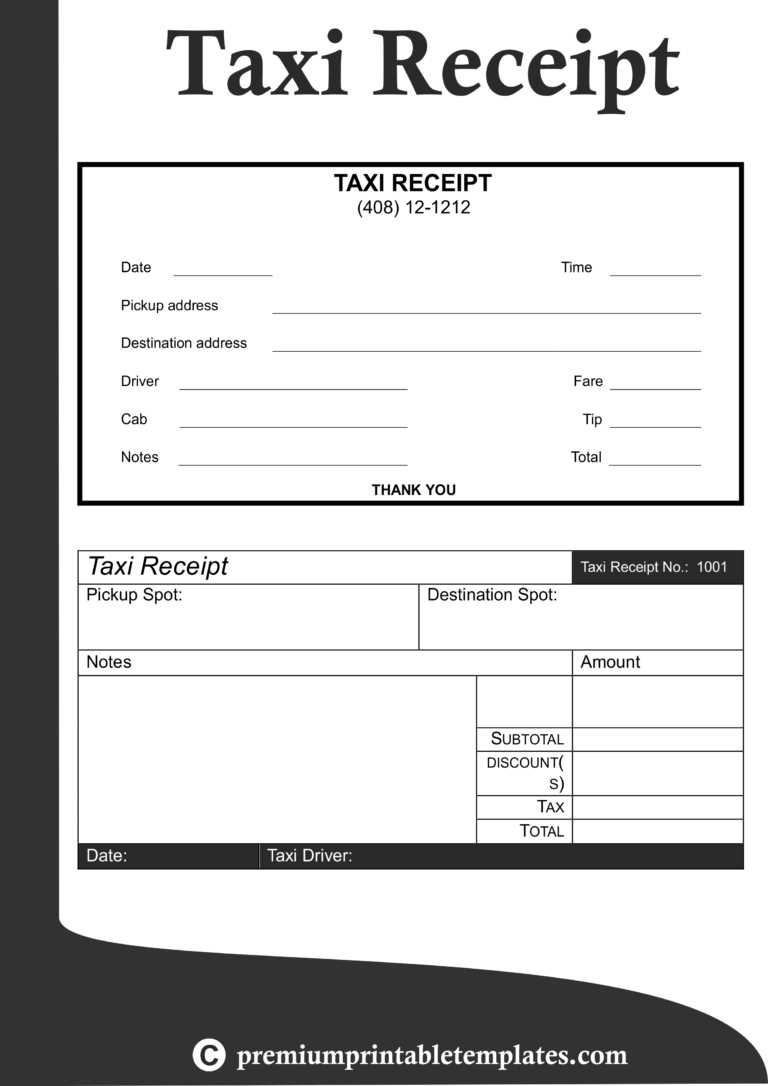

Template Structure

Here’s a sample outline of a truck driver tax receipt template:

- Receipt Header: Include your business name, contact details, and any relevant tax ID numbers.

- Service Information: Provide detailed descriptions of the services rendered or received.

- Taxable Amount: Clearly indicate taxable amounts, ensuring that tax calculations are correct.

- Signature: Include space for both the driver and recipient’s signatures.

Why This Matters

Having an accurate tax receipt ensures transparency and facilitates smooth tax preparation. It also provides a reliable record for both personal and business financial tracking. By following this template, truck drivers can streamline their record-keeping process and avoid costly mistakes during tax season.

Truck Driver Tax Receipt Template Guide

Understanding the Purpose of a Driver Tax Receipt

Key Information to Include in the Receipt

How to Format Your Driver Tax Receipt

Common Mistakes to Avoid When Creating Receipts

Customizing the Template for Specific Expenses

How to Use the Receipt for Tax Filing

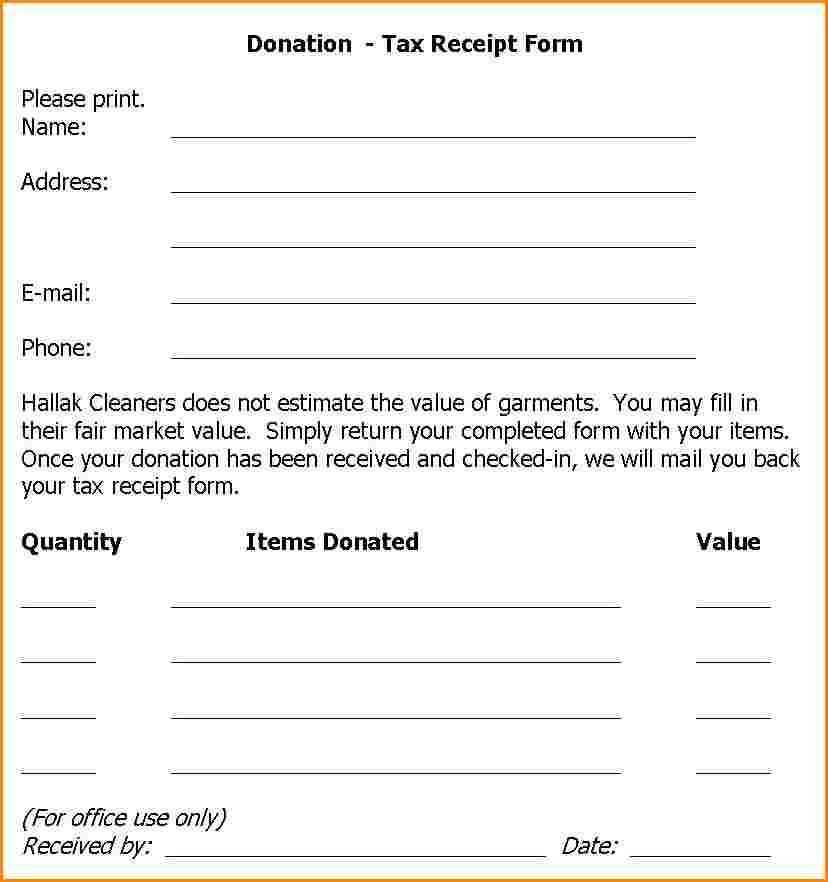

Begin by clearly defining the purpose of the driver tax receipt: it provides a record of the expenses related to truck driving that can be deducted from taxable income. Include the driver’s name, date, and details of the expense, such as fuel, repairs, or lodging. Make sure each entry is well-organized and easy to reference.

The receipt should contain specific details such as the date of the expense, vendor name, a clear description of the service or product, amount spent, and payment method. For fuel, indicate the number of gallons or liters and the total cost. For repairs, include the parts or service performed and their cost. Each entry should match the business’s accounting needs.

For a clean, professional look, format the receipt with sections clearly marked for each piece of information. Use consistent font sizes and spacing, with a simple layout that includes headings for the date, vendor, description, and amount. If possible, add a note for the truck’s identification number or job reference for easier tracking.

Avoid common mistakes such as leaving out the vendor’s name, not including the correct payment method, or failing to list the expense description. Omitting crucial details like tax amounts or unclear descriptions can lead to issues during tax filing. Also, ensure that all amounts are accurate, as discrepancies can result in complications.

Customize the receipt template by adding specific categories for different types of expenses, such as tolls, fuel, maintenance, or insurance. Tailor the layout to suit your business needs. For instance, if your truck expenses vary by location, you might want to add a field for the region or city where the cost was incurred.

Finally, use the receipt for tax filing by organizing the receipts according to the categories and amounts. This will help simplify the process when filing taxes. Keep track of all receipts, as you’ll need to provide them as evidence of your deductions. Ensure each entry is well-documented, and store receipts for future reference during audits.