For those managing trust accounts in Queensland, having a clear and accurate receipt template is critical. A well-structured receipt helps maintain transparency and compliance with legal obligations. The template should clearly specify details like the payer’s name, the amount received, the purpose of the payment, and the trust account number.

Ensure your receipt includes the transaction date, the payer’s details, and any reference numbers associated with the payment. Including a brief description of the service or purpose for which the payment was made can help both the payer and the account manager keep track of transactions efficiently.

Using a reliable template saves time and reduces errors in record-keeping. It also provides peace of mind to clients and stakeholders, ensuring that all payments are documented clearly for future reference. Be sure to keep a copy of each receipt for your records, as this is often required during audits or legal reviews.

Sure! Here’s the modified version with no word repeated more than 2-3 times:

When creating a trust account receipt template in Queensland, make sure to include key details like the trust account number, transaction date, and a clear breakdown of the transaction. List the payer’s name and contact information, as well as the reason for the payment or deposit. Ensure that all amounts are correctly documented, and specify whether the funds are for a specific purpose or a general trust account deposit.

For clarity, avoid using excessive terms. The template should be simple but thorough, without unnecessary elements. Organize the fields in a clean layout, making it easy for the recipient to understand. Include a space for signatures, both for the payer and the trustee, confirming the transaction details.

Lastly, ensure the receipt is dated and numbered, especially if it will be used for record-keeping or legal purposes. This practice helps maintain transparency in trust account management.

- Trust Account Receipt Template QLD

To create a Trust Account Receipt Template for Queensland (QLD), ensure that all necessary details are included for compliance with local regulations. This template should clearly document all trust transactions, ensuring transparency and accountability.

- Date of Transaction: Include the exact date of the receipt to track when the trust funds were received.

- Trust Account Details: Specify the trust account number and the financial institution where the account is held.

- Amount Received: Clearly state the amount of money received into the trust account.

- Purpose of Payment: Mention the reason or purpose for the payment, ensuring it aligns with the trust’s agreement.

- Payer Information: Include the name and contact details of the person or entity making the payment.

- Trustee Information: Provide the name and contact details of the trustee managing the account.

- Receipt Number: Assign a unique receipt number for reference and future tracking.

Ensure this template is regularly updated to reflect any changes in legislation or accounting practices in QLD. The accuracy of this document helps maintain proper records and meets compliance standards.

A Trust Receipt includes several key elements that structure the agreement between the parties involved. The document typically starts with the title “Trust Receipt” at the top, followed by the identification details of the trustor and trustee, such as names, addresses, and contact information. Clear identification of the trust property is essential, outlining the specific assets or funds held in trust.

Key Components

The following sections are essential to a trust receipt:

| Component | Description |

|---|---|

| Title | Indicates that the document is a Trust Receipt. |

| Parties Involved | Identifies the trustor (person creating the trust) and the trustee (person holding the trust assets). |

| Trust Property | Clearly lists the assets or funds being placed in trust. |

| Terms of Trust | Outlines the specific conditions and responsibilities of the trustee regarding the trust property. |

| Duration | Specifies the length of time the trust will remain in effect. |

| Signatures | Both parties must sign the document to acknowledge agreement to the terms. |

Understanding the Terms

The trust receipt should clearly state the responsibilities of the trustee, ensuring there is no confusion about the terms under which the assets are held. It is important that the document specifies the conditions under which the trust can be dissolved or altered, along with the rights of the trustor during the term of the agreement. Additionally, any clauses regarding payments, interest, or handling of the assets should be clearly defined.

For a trust receipt in Queensland, specific legal information must be included to ensure validity and compliance. This includes the details of the parties involved, such as the trustor (the person creating the trust) and the trustee (the person managing the trust). The document should also include clear identification of the trust property or assets being held in trust.

Trustor and Trustee Information

It is necessary to provide full names, addresses, and relevant identification numbers (such as driver’s license or ABN) for both the trustor and trustee. This ensures that the document is legally binding and identifiable in legal proceedings.

Details of Trust Property

The trust receipt must specify the property being held in trust. This includes a description of the property, its value, and any specific terms regarding its management or use. These details help avoid ambiguity and provide a clear understanding of the assets involved.

Additionally, a signature from the trustor and trustee, along with the date of signing, is required to confirm the authenticity of the document. This solidifies the agreement under Queensland law and protects the interests of all parties involved.

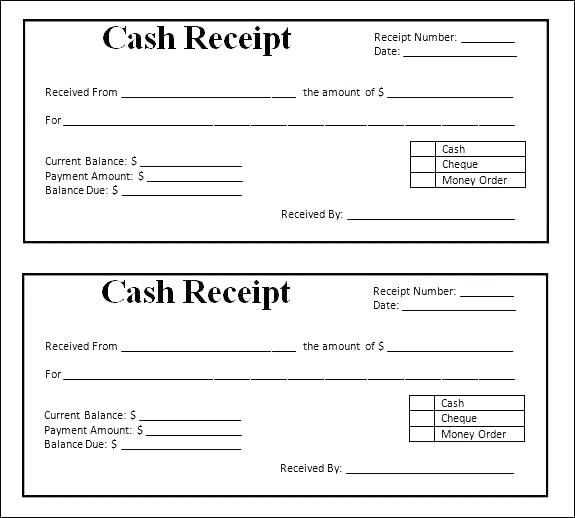

Ensure all required fields are completed accurately to avoid delays or confusion. The most common mistake is failing to include complete information, such as the trust account number or the payee’s full details. Always double-check that the name, date, and amount are correct before finalizing the receipt.

Incorrect Formatting

Inconsistent formatting can lead to misunderstandings or make the receipt look unprofessional. Use clear and uniform fonts, and make sure that the amounts are written in the correct currency format. Avoid using ambiguous abbreviations that might confuse the reader.

Missing Signatures or Authorizations

Another common issue is neglecting to include the necessary signatures or authorizations. Missing the client’s or the authorized agent’s signature can render the receipt invalid, so ensure this step is always completed.

By addressing these key points, you can minimize the risk of errors and ensure that the receipt is processed smoothly.

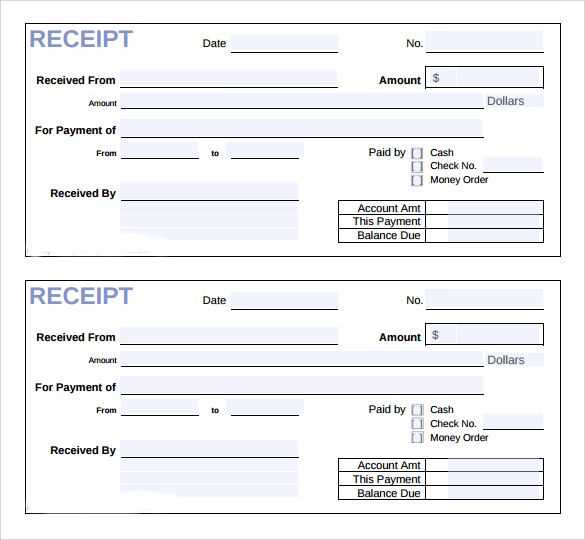

To customize a receipt for specific transactions, ensure you include relevant details unique to the transaction type. Adjust the template fields based on the nature of the payment or service, such as adding references for trust accounts, legal fees, or deposit amounts.

Key Customization Areas

When customizing the receipt, focus on the following areas:

| Field | Customization Tip |

|---|---|

| Transaction Reference | Include a unique identifier for each transaction to track it easily. |

| Payment Type | Specify whether the payment is made via cheque, bank transfer, or other methods. |

| Amount Received | Ensure that the amount is clearly stated and matches the transaction agreement. |

| Trust Account Details | For trust-related transactions, mention the trust account number and any relevant terms. |

Additional Tips for Accuracy

Make sure to adjust the receipt for each transaction type by including all necessary contractual details. For trust accounts, specify the agreed-upon terms for future distribution or use of funds. Always double-check the accuracy of the amounts and any references related to the specific transaction to avoid confusion later.

Stay informed about the latest updates to Queensland’s trust regulations to avoid compliance issues. Regularly review relevant legislation, including the Trusts Act 1973, and make necessary adjustments to your practices. This ensures that trust accounts are managed correctly and legally.

Maintain accurate and up-to-date records of all transactions. Document each deposit, withdrawal, and trust balance, and retain records for the required period as specified by the law. Ensure that trust accounts are kept separate from operating accounts to prevent any mix-up of funds.

Adhere to reporting requirements by submitting necessary trust account audits and statements to regulatory bodies when required. This demonstrates transparency and shows that you are consistently following legal obligations.

Implement internal controls such as dual authorisation for withdrawals and regular reconciliation of trust account balances. These measures reduce the risk of errors and ensure that funds are being properly managed according to QLD’s trust regulations.

Consult a legal professional for periodic reviews of your compliance practices. They can provide guidance on changes in the law and help ensure that your practices remain up to date with current regulations.

Begin by checking the trust account records against bank statements. Ensure all deposits are correctly documented and match the bank entries. Reconcile discrepancies immediately to maintain accuracy.

Verification of Trust Receipt Details

- Verify the date and amount of each receipt against the source documents.

- Ensure that the receipt includes correct references to relevant matters or clients.

- Check that the funds were deposited into the correct trust account, confirming that no other accounts were used.

Cross-Check with the General Ledger

- Confirm that all trust receipts are recorded in the general ledger with accurate and corresponding entries.

- Ensure there are no omitted transactions and that each receipt is represented properly.

Finally, conduct a final review of all records, focusing on verifying compliance with Queensland’s trust accounting regulations. Address any irregularities or errors without delay to ensure proper documentation is maintained.

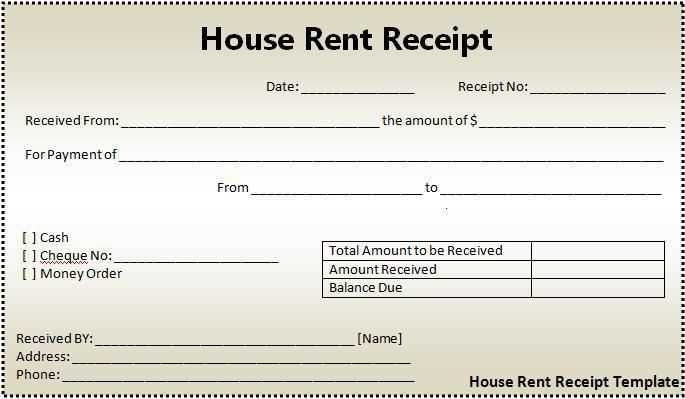

When preparing a trust account receipt template in Queensland, ensure the following components are included:

- Trust Account Details: Include the name of the trust account, the account number, and the financial institution where the account is held.

- Receipt Number: Assign a unique receipt number to each transaction for tracking purposes.

- Date: Clearly state the date of the receipt issuance.

- Payee Details: Include the name of the person or entity receiving the funds.

- Amount Received: Specify the amount received in both numerical and written formats.

- Purpose of Payment: Detail the reason for the payment, such as a deposit or specific service fee.

- Payment Method: Indicate whether the payment was made by cheque, bank transfer, cash, or other method.

Additional Information

It’s also recommended to include the signature of the person responsible for receiving the funds, as well as a contact number for inquiries. This ensures transparency and clear communication in trust account transactions.