A well-drafted trust receipt agreement helps streamline business transactions by clearly defining responsibilities and terms between parties. This document is particularly useful in scenarios where goods are entrusted to a third party for sale or processing, with ownership retained by the lender until obligations are met.

Key Components: Ensure your agreement outlines the identification of goods, terms for payment or return, and the rights of both parties. Specific clauses addressing security interests and liabilities protect against disputes and financial losses.

Practical Tip: Always include a detailed description of the entrusted items and specify conditions under which they may be sold or transferred. Clear payment deadlines and penalty clauses encourage timely compliance and protect business interests.

Using a comprehensive template provides a solid starting point for creating a customized agreement suited to your needs. Ensure legal review for accuracy and enforceability to safeguard your interests fully.

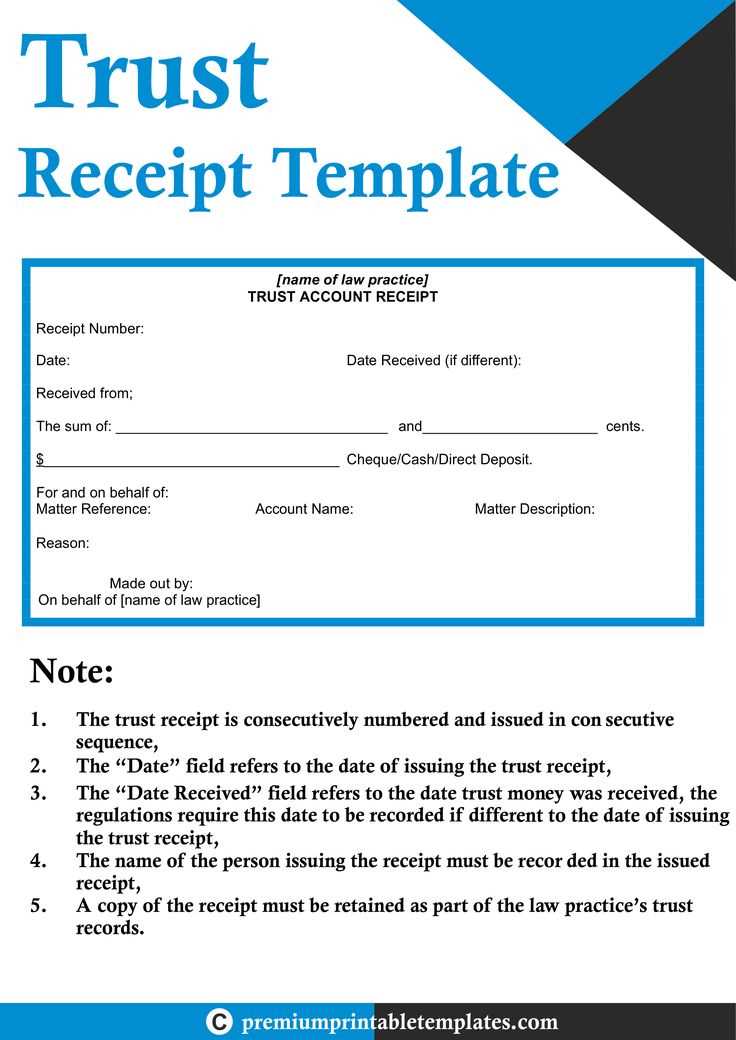

Trust Receipt Agreement Template

A trust receipt agreement clearly outlines the terms under which a borrower holds goods on trust for a lender until payment obligations are met. To make the document effective, specify the goods covered, their value, and the borrower’s responsibilities regarding care and storage.

Key Provisions to Include

Ensure the agreement includes the following essential clauses:

- Ownership Clause: Confirm that the lender retains ownership of the goods until payment is complete.

- Payment Terms: Outline clear deadlines and methods for repayment.

- Risk Allocation: Define which party bears the risk for loss or damage while the goods are under the borrower’s control.

- Default Clause: Specify the lender’s rights if the borrower fails to fulfill the agreement.

Tips for Drafting

Be precise and avoid vague language. State the terms in straightforward, legally enforceable language to reduce misunderstandings. Always consult a legal professional to ensure compliance with relevant regulations and secure both parties’ interests.

Key Clauses to Include in a Trust Receipt

Ensure the inclusion of a detailed description of the goods or assets covered by the trust receipt. This should specify quantities, serial numbers, or any identifiers necessary to avoid ambiguity.

Clearly state the obligations of the borrower, including timelines for repayment or return of goods and any conditions that apply. Define penalties for breaches or delays to maintain accountability.

Include a clause specifying the rights of the lender to inspect the goods or assets while they remain under the trust receipt. This helps monitor compliance and safeguards the lender’s interests.

Define ownership terms clearly, affirming that title to the goods remains with the lender until all obligations are met. This clause protects the lender in case of disputes or insolvency.

Ensure there is a section detailing governing laws and jurisdiction. This reduces legal uncertainty and provides clarity on how disputes will be resolved.

Finally, incorporate provisions outlining procedures for terminating the agreement. Clarify what happens to the goods and obligations upon termination to prevent misunderstandings.

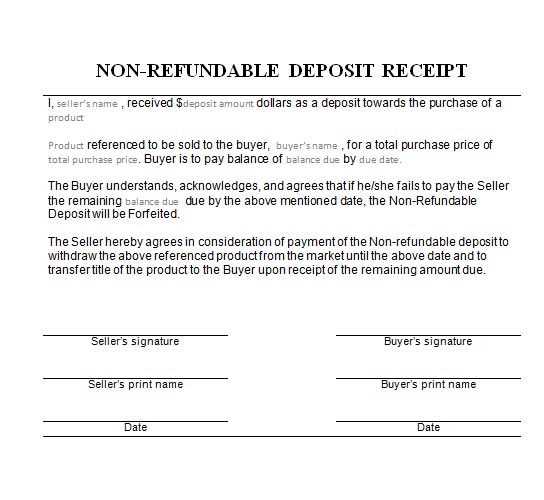

How to Structure Payment Terms

Define a clear payment schedule to avoid misunderstandings. Specify due dates, payment methods, and acceptable currencies directly in the agreement. Consider segmenting large payments into installments to reduce financial pressure on both parties.

Specify Penalties for Late Payments

Include a clause detailing interest rates or fixed fees for overdue payments. This encourages timely compliance and protects the creditor from potential losses. Ensure the terms comply with local laws regarding permissible penalties.

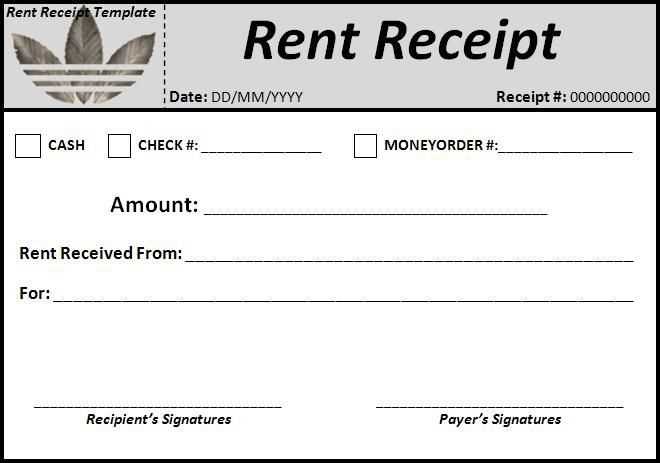

Outline Payment Verification Requirements

Request proof of payment, such as transaction receipts or bank confirmation numbers. Clearly indicate where and how these documents should be submitted to streamline record-keeping and dispute resolution.

- Indicate accepted payment methods (bank transfers, checks, etc.).

- List any service fees associated with specific payment methods.

- State if early payments qualify for discounts.

Thorough payment terms foster transparency and trust, reducing the risk of financial conflicts. Keeping these guidelines in mind will help create a well-structured agreement that benefits all parties involved.

Legal Responsibilities of the Borrower

The borrower must ensure timely repayment of the loan according to the terms outlined in the trust receipt agreement. Delays or missed payments can lead to penalties or legal actions, including asset repossession.

Maintain accurate records of all financial transactions related to the borrowed assets. Documentation should be readily available for review by the lender upon request.

Protect the borrowed goods from damage, theft, or misuse. The borrower is responsible for the safekeeping of these items and must compensate the lender if any loss occurs.

Any intended sale or transfer of the borrowed goods should only occur with the express written consent of the lender, as unauthorized transactions violate the agreement.

By fulfilling these responsibilities, borrowers can maintain trust and a positive relationship with lenders while mitigating potential legal risks.

Conditions for Ownership Transfer

The transfer of ownership under a trust receipt agreement often hinges on the fulfillment of clear, predefined conditions. These conditions ensure transparency and protect both the lender and borrower throughout the transaction.

Core Conditions to Meet

Ownership typically transfers when the borrower fully repays the secured amount, including any interest or fees stipulated in the agreement. This payment must be verified and recorded to finalize the transfer. Additionally, compliance with all contractual obligations is essential.

Documentation Requirements

Accurate documentation plays a vital role. The borrower must provide proof of payment, updated inventory records (if applicable), and any additional paperwork requested by the lender. Maintaining organized records expedites the ownership transfer process.

| Condition | Details |

|---|---|

| Payment Completion | Full repayment of the principal amount and related charges. |

| Contract Compliance | Adherence to all terms outlined in the trust receipt agreement. |

| Document Submission | Provision of payment proofs and additional required documentation. |

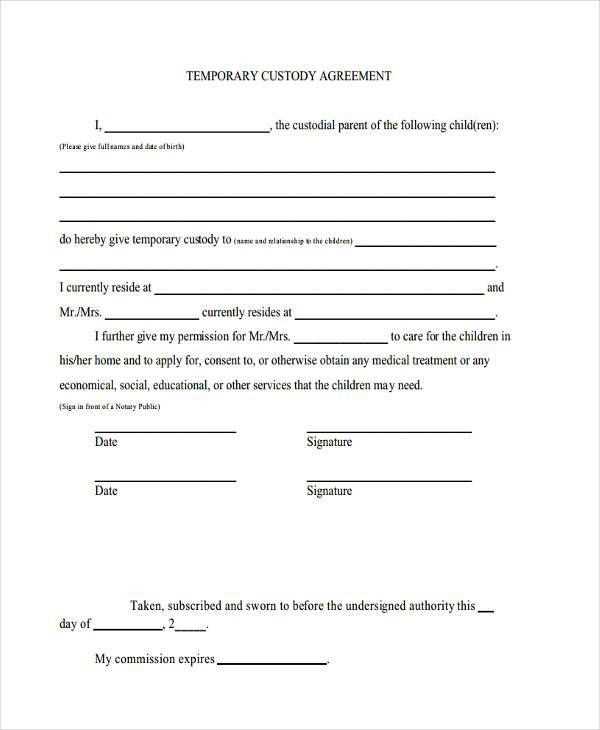

Steps to Draft a Custom Agreement

Identify the parties involved by clearly stating their names and roles at the beginning of the agreement. This ensures clarity on responsibilities and rights.

Define the scope and purpose of the agreement. Specify what each party agrees to provide, perform, or refrain from doing. Avoid vague terms; precise language minimizes misunderstandings.

Include detailed payment terms if financial obligations are involved. Specify amounts, payment schedules, and acceptable methods of payment.

Establish the duration of the agreement. Outline start and end dates, along with any conditions for renewal or termination.

Describe dispute resolution mechanisms. Indicate whether disputes will be handled through mediation, arbitration, or court proceedings, and specify applicable jurisdictions.

Ensure confidentiality clauses are present when handling sensitive information. Define the type of information protected and the obligations of each party.

Incorporate clauses on liability and indemnification. Clearly state limitations on liability and conditions under which parties will indemnify each other.

Conclude with signature sections for all parties. Include printed names, titles, and dates to validate the agreement.

Review the entire document carefully before finalizing. Consider seeking legal advice to ensure compliance with relevant laws.

Common Risks and Mitigation Strategies

Understand and address the risks involved in trust receipt agreements with the following strategies:

1. Risk of Default

Defaulting on a trust receipt agreement can lead to serious financial consequences. To reduce the likelihood of default:

- Conduct thorough credit checks on all parties involved.

- Ensure clear payment terms and set realistic deadlines.

- Establish collateral or guarantees to secure the transaction.

2. Risk of Fraud

Fraudulent activities such as misrepresentation of goods or financial status can undermine trust receipt agreements. Mitigate this risk by:

- Verifying the authenticity of all documents and the goods involved.

- Using third-party inspection services for high-value items.

- Regularly auditing the process to detect any irregularities early.

3. Legal and Compliance Risks

Non-compliance with local and international regulations can result in legal challenges. Avoid legal pitfalls by:

- Working with legal experts to draft and review the agreement.

- Staying updated on the laws affecting trust receipt agreements in different jurisdictions.

- Ensuring proper licensing and documentation is in place for all involved parties.