What to Include in a Trust Receipt

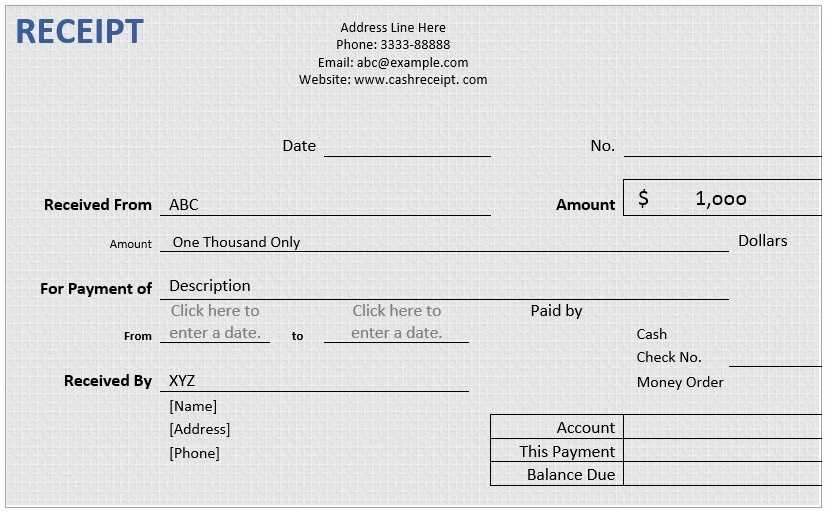

A well-structured trust receipt should clearly outline obligations and conditions. The following elements ensure clarity and legal soundness:

- Identification of Parties: Full legal names and contact details of both the trustee and beneficiary.

- Description of Goods or Funds: Detailed information about the assets held in trust, including serial numbers or invoice references.

- Purpose of the Trust: A concise statement explaining the intended use of the assets.

- Obligations of the Trustee: Specific duties, including safekeeping, return conditions, and reporting requirements.

- Ownership Clause: A declaration confirming that the beneficiary retains ownership until all conditions are met.

- Terms of Release: Conditions under which the trustee may transfer or use the assets.

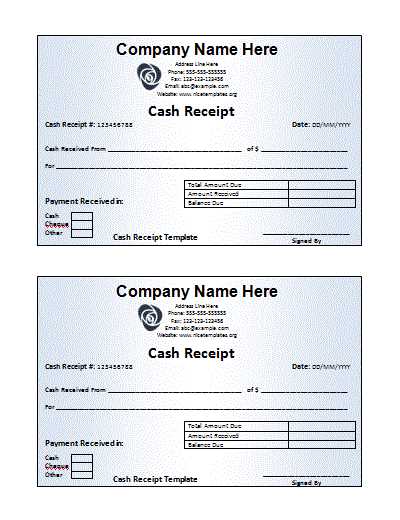

- Signatures and Date: Signatures of all involved parties with the execution date to validate the document.

Common Mistakes to Avoid

Unclear Terms

Ambiguous wording can lead to disputes. Every clause should be precise and leave no room for misinterpretation.

Missing Legal Protections

Failure to include liability clauses or jurisdiction information may expose parties to unnecessary risks.

Lack of Signature Verification

Unsigned or improperly executed receipts may be considered invalid. Ensure all parties review and sign the document properly.

Using a structured template prevents misunderstandings and ensures compliance with legal standards. Before finalizing a trust receipt, consulting a legal professional can help avoid costly errors.

Trust Receipt Template: Key Aspects and Practical Considerations

Ensure that the trust receipt clearly defines the roles of both parties. The trustee should acknowledge possession of the goods while the lender retains ownership until full payment.

Essential Legal Clauses in a Trust Receipt

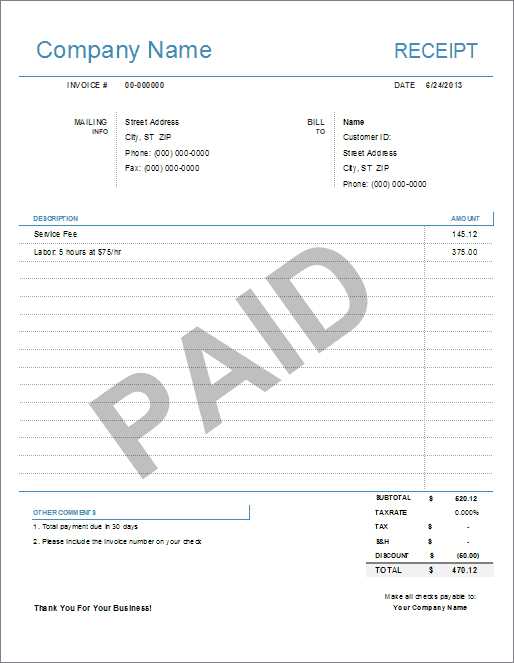

Include a retention of title clause to specify that ownership remains with the lender. A payment obligation section should outline the due amount, schedule, and penalties for non-compliance. The use restriction clause must prevent unauthorized sale or transfer of goods.

Customizing a Trust Receipt for Specific Transactions

Adjust the terms based on transaction type. In import financing, require immediate notification upon receipt of goods. For inventory financing, include stock rotation policies. Tailor default clauses to match industry-specific risks.

Common Pitfalls in Drafting a Trust Receipt

Omitting a clear default clause weakens enforcement. Ambiguous ownership terms may create disputes in case of insolvency. Failing to align the document with local regulations can lead to legal challenges. Avoid generic templates–each trust receipt should reflect the specifics of the agreement.