Creating a custom duty receipt template for Turkey requires specific formatting and details to ensure compliance with local regulations. Focus on including the full breakdown of customs charges, such as VAT, customs duties, and any additional fees. Make sure to display the item description, quantity, value, and the country of origin clearly on the receipt.

Ensure accuracy by including the correct customs code for each item, and list the corresponding tariff rates. Including the importer’s information, such as name and address, is also necessary. The date and the unique reference number for the transaction will help with record-keeping and tracking purposes.

Customize the receipt template to match the specific needs of your business. You can include company branding, but make sure the mandatory details stand out. Double-check all the necessary fields before finalizing the template, and make sure it adheres to Turkey’s regulations to avoid any delays with customs processing.

Here’s the revised version with minimal repetition:

For creating an efficient Turkey custom duty receipt template, focus on clarity and precision. Make sure the document includes these key elements:

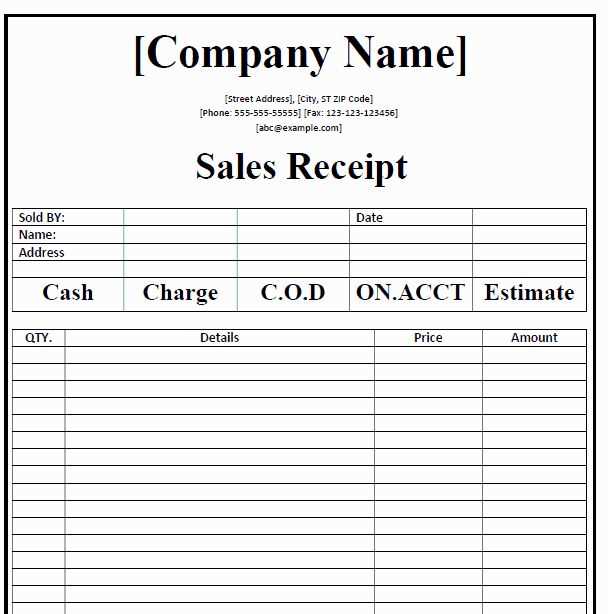

- Recipient Details: Include the name, address, and contact details of the buyer or importer.

- Transaction Information: Specify the date of the transaction, invoice number, and reference number to link the receipt to the original sale or customs declaration.

- Itemized List: Include a detailed description of the goods, along with their quantities and values. Specify the customs tariff code for each item.

- Customs Duties and Fees: Clearly state the applicable customs duties, taxes, and any additional fees. Break down the charges for transparency.

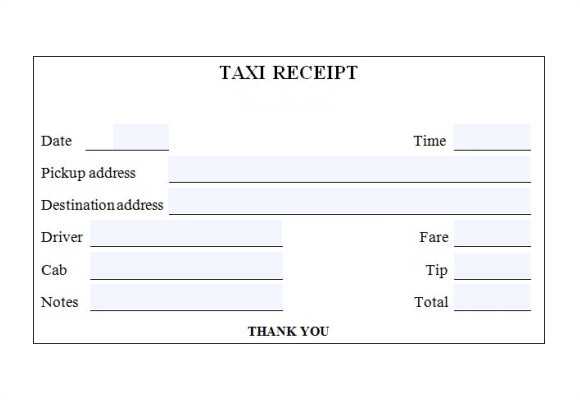

- Payment Information: Document the payment method and confirmation, including transaction numbers or proof of payment.

Avoid overloading the template with irrelevant data. Keep it concise and structured for easy verification by customs officers. Ensure all information is legible and correctly formatted to comply with Turkey’s customs regulations.

Additional Tips for Streamlining the Template:

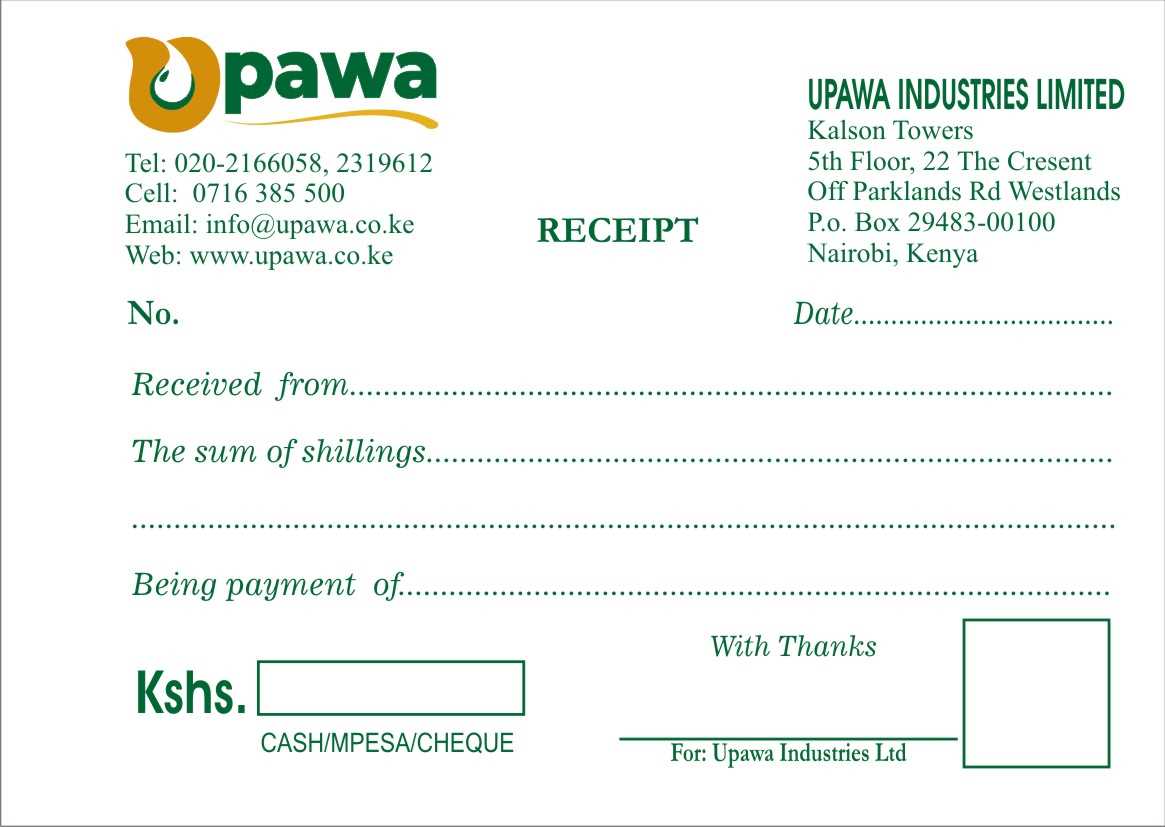

- Use a clean, professional design with easily readable fonts and a consistent layout.

- Incorporate official logos or stamps where necessary to enhance authenticity.

- Provide a space for customs officers to add additional notes or verification stamps.

- Detailed Guide to Turkey Customs Duty Receipt Templates

Ensure you use the official template when preparing your Turkey customs duty receipt. The form must clearly include details like the importer’s name, the customs office processing the goods, the date of payment, and the exact amount of duty paid. Include the transaction number and detailed item descriptions to ensure accuracy and transparency. Double-check the information before submission to avoid errors that could delay processing.

Customize the receipt template to match specific import regulations. For example, include a section for VAT details if applicable, as well as any applicable exemption codes. This will help ensure that your document complies with Turkey’s legal requirements and facilitates smooth processing through customs.

Always retain a copy of the completed receipt for future reference. This documentation may be required in case of audits or disputes regarding your duty payments. Keeping the receipts organized will streamline future import procedures and save you time.

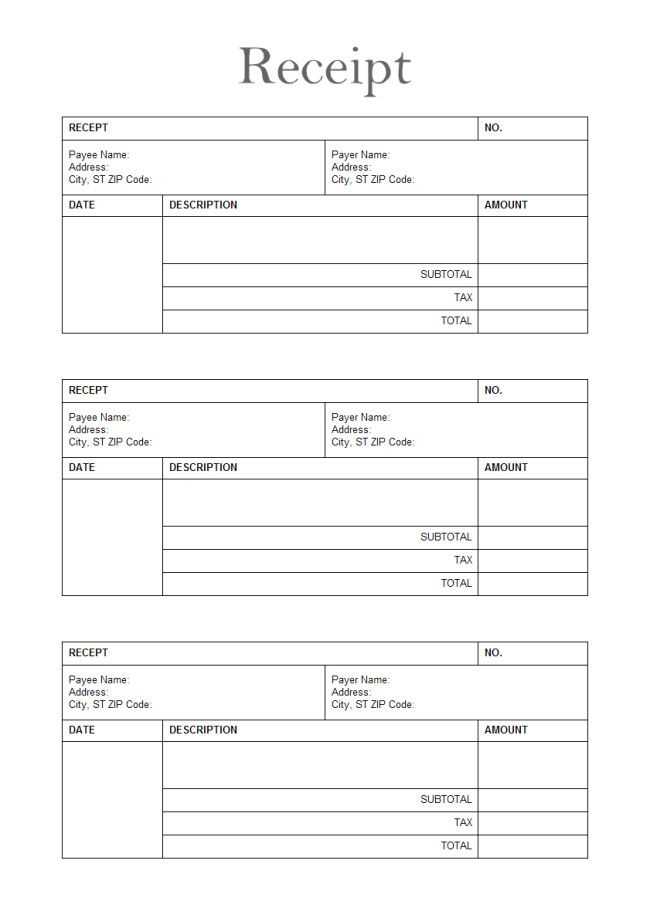

A customs duty receipt includes specific sections that provide important details about the transaction. Each element plays a key role in ensuring clarity and transparency for both the buyer and customs authorities. The receipt typically consists of the following components:

- Header Information: This section displays the receipt title, including the word “Customs Duty” to clearly identify the document. It also includes the issuing authority’s name, address, and contact details.

- Receipt Number: A unique identifier for the transaction, often used for tracking and record-keeping purposes.

- Transaction Date: The date when the customs duty payment was processed, indicating the timeline of the import/export process.

- Importer Details: Information about the person or business responsible for paying the duty, including name, address, and possibly identification number or tax ID.

- Goods Description: A brief description of the goods being imported or exported, including their value and classification code for customs purposes.

- Customs Duty Amount: The exact amount of duty that has been paid, typically shown in both the local currency and any foreign currencies involved in the transaction.

- Payment Method: This section indicates how the customs duty was paid, such as through bank transfer, credit card, or cash.

- Customs Officer Details: The name or ID of the customs officer who processed the payment and authorized the transaction.

Importance of Each Section

Each section of the customs duty receipt serves a clear purpose. The header information identifies the receipt’s origin, while the receipt number allows for easy tracking. Importer details ensure accountability, and the goods description provides transparency on the nature of the transaction. The duty amount section is critical for financial records, and the payment method offers insight into how the duty was settled. Finally, the customs officer’s information ensures accountability in the processing of the transaction.

Ensure the receipt clearly lists the customs duty amount, specifying the currency used (Turkish Lira or foreign currency). Include the recipient’s full name, address, and tax ID number, along with the importer’s contact details for clarity. The itemized description of the goods being imported should be detailed, including product name, quantity, and tariff classification code (HS code).

Also, mention the customs officer or relevant authority issuing the receipt, along with the exact date of payment. This helps avoid confusion in case of future inquiries. Ensure to include a unique receipt number for tracking purposes and provide a breakdown of any additional fees or taxes, such as VAT or service charges, in a separate section. This transparency aids both businesses and individuals in managing their imports effectively.

| Information Category | Details |

|---|---|

| Customs Duty Amount | Exact duty paid, currency used |

| Recipient Information | Name, address, tax ID, contact details |

| Goods Description | Product name, quantity, HS code |

| Issuing Authority | Customs officer, department, or agency |

| Receipt Number | Unique tracking number |

| Additional Fees | VAT, service charges, etc. |

Incorrectly formatted customs duty receipts can delay processing and cause confusion. Avoid these common mistakes to ensure smooth transactions.

1. Missing or Incorrect Data

Double-check the details on the receipt, especially the item description, value, and country of origin. Ensure the information matches the customs declaration. Incorrect or incomplete data can lead to delays or fines.

2. Inaccurate Calculation of Duties and Taxes

Ensure that the customs duties, taxes, and any additional fees are calculated correctly. Miscalculations can result in discrepancies between the actual amount owed and what is documented, causing complications during import or export processes.

3. Failing to Include Relevant Documents

Always attach required documents such as invoices, shipping receipts, and proof of payment. Incomplete receipts without supporting documents may be rejected by customs authorities.

4. Using Outdated Templates

Customs regulations can change frequently. Using outdated templates may cause non-compliance with current laws. Keep templates updated with the latest customs requirements to avoid penalties.

To adjust a custom duty receipt template for different import scenarios in Turkey, tailor it based on the specific category of goods being imported. For example, if you’re importing electronics, include details like product codes and specifications that reflect Turkey’s customs classification system. For goods with varying tariff rates, ensure that the template has editable fields for different duty percentages based on the product type.

If you’re handling products subject to special regulations, such as pharmaceuticals or food items, ensure that the template captures the required certifications and permits. Additionally, consider incorporating fields for VAT (Value Added Tax) and other taxes that may apply to certain imports, as these can vary depending on the product and its value.

For bulk shipments or consignments with multiple types of goods, organize the template to accommodate multiple line items with separate duty calculations for each item. Include a section for total duties, taxes, and fees to give a clear breakdown for customs officers and importers alike.

Lastly, ensure that the template aligns with Turkey’s customs declaration requirements, including the importer’s contact information, invoice details, and customs tariff numbers. Stay updated with any changes in Turkey’s import regulations to keep the template relevant and in compliance.

Ensure compliance with Turkish customs regulations by following these guidelines for duty receipts:

- Clear Identification of the Customs Authority: The receipt must display the name and logo of the issuing customs authority to confirm its authenticity.

- Specifics of the Imported Goods: Include a detailed description of the goods, including their classification, quantity, and value.

- Customs Duty and Tax Breakdown: The receipt must provide a clear breakdown of customs duties, taxes, and any other fees applied to the import.

- Recipient Details: Ensure the receipt includes the importer’s name, contact details, and tax identification number.

- Date and Receipt Number: A unique receipt number and the date of issuance are required for tracking and record-keeping purposes.

Requirements for Electronic Receipts

- Electronic Filing System: Electronic receipts must be generated and stored through Turkey’s e- customs system to comply with digital records requirements.

- Verification Codes: Electronic receipts should include secure verification codes to prevent fraud and ensure authenticity.

Penalties for Non-Compliance

- Legal Consequences: Non-compliance with duty receipt regulations can lead to fines, delays in customs clearance, and potential seizure of goods.

- Audit Risks: Incorrect or incomplete receipts increase the risk of audits, which may result in additional penalties or legal actions.

Tax receipt templates are easily created with a variety of tools and software. One popular option is Microsoft Excel. It allows for precise customization of templates, including the necessary fields for customs duty amounts, taxes, and dates. Templates can be saved and reused for efficiency.

For those seeking an online solution, tools like Wave and Zoho Invoice offer pre-built templates for generating professional receipts. These platforms also support integrations with accounting systems, streamlining the process further.

For businesses that deal with bulk duty receipts, specialized software like DutyCalc provides automated calculations and generates receipts instantly based on entered customs information. These tools minimize human error and save significant time.

If you need custom-built templates with advanced features, consider using Google Sheets with custom scripts or platforms like Canva for visually appealing designs. Both options allow easy sharing and cloud storage for accessibility across devices.

Ensure your receipt includes accurate details on the custom duty paid. It should contain the total amount, customs declaration number, and the date of payment. Each section needs clear and concise labeling to avoid confusion.

| Field | Description |

|---|---|

| Total Amount | Indicate the total customs duty paid, broken down if necessary. |

| Customs Declaration Number | Include the specific declaration number for the customs clearance. |

| Date | Provide the exact date when the duty payment was processed. |

| Invoice/Receipt Number | Reference the receipt or invoice number linked to the customs transaction. |

Double-check the details, especially for the accuracy of the customs declaration number and amounts. Avoid using unclear abbreviations or vague references. If necessary, consult a local customs agent for clarity.