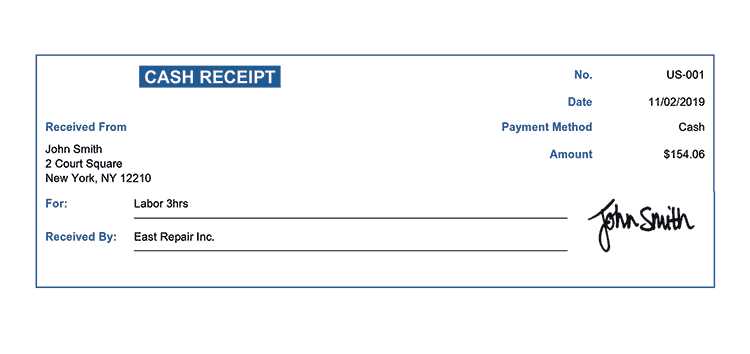

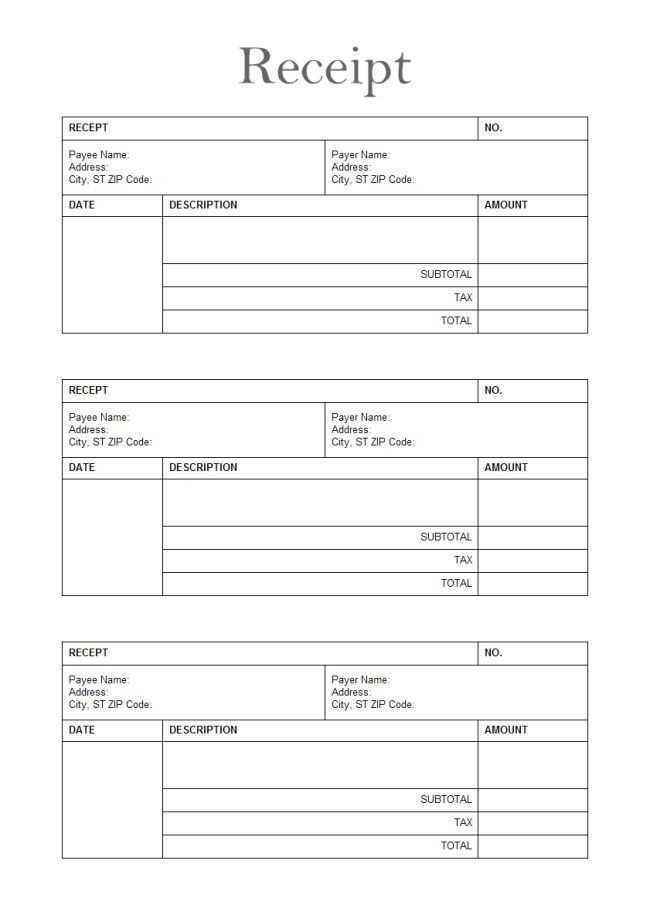

To create a professional and clear receipt, include the following key elements: the business name, address, contact details, and a unique receipt number for tracking. Ensure the date and time of the transaction are clearly displayed to help both parties identify when the purchase occurred.

The list of purchased items should be broken down, showing each item’s name, quantity, price, and any applicable taxes or discounts. For clarity, use a table format to ensure everything is easy to read.

Include the total amount, which should be clearly highlighted at the bottom. This should cover the subtotal, taxes, and any additional fees. Add the payment method used, whether it’s cash, card, or another form of payment.

Lastly, don’t forget a thank-you note or customer support contact information. This small detail enhances the customer experience and encourages repeat business.

Here’s the corrected version without repetitions:

Ensure each item on your receipt is clearly defined. Avoid redundancy by listing each product or service only once, with a clear description and corresponding price. If a discount is applied, specify it next to the original price to show the exact amount saved. Use concise language to keep the receipt easy to read and avoid crowding the layout with excessive details.

Incorporate a line for the total amount due at the end of the list. This should include all applicable taxes or fees. Double-check for accuracy in the calculations to ensure the total matches what is owed. The receipt should also include a space for the payment method used, whether it’s cash, card, or another option.

Lastly, provide contact information or a website link for any customer inquiries. This section should be simple but effective, giving customers a way to follow up if needed. Clear formatting and a clean design enhance the user experience and minimize confusion.

- Typical Receipt Template

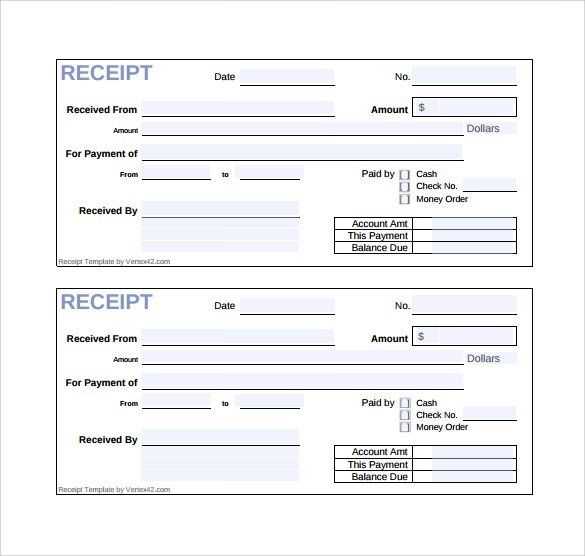

A receipt should be clear and easy to understand. Below is a template that covers the main components most receipts need.

| Field | Description |

|---|---|

| Receipt Title | Include the word “Receipt” or “Sales Receipt” at the top to make it clear. |

| Transaction Date | Indicate the date the transaction took place for record-keeping purposes. |

| Vendor Details | List the name, address, and contact information of the business or individual providing the receipt. |

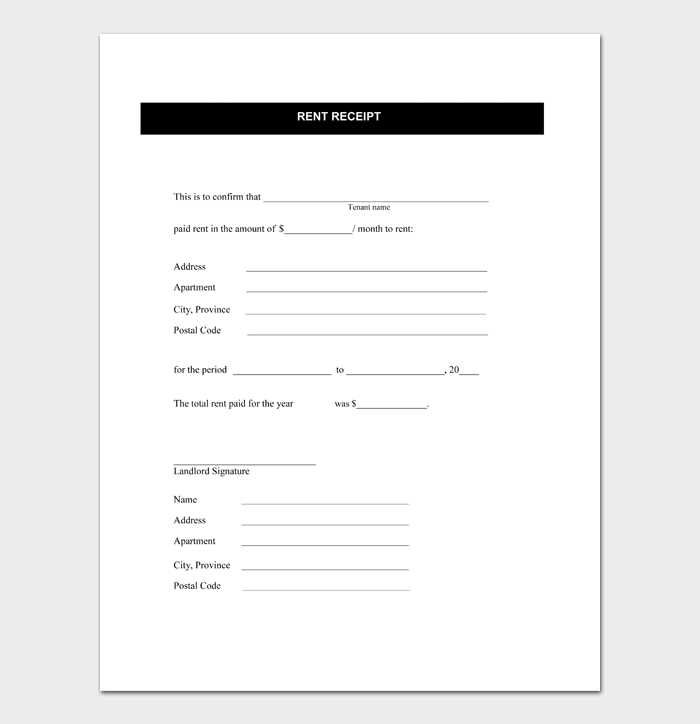

| Customer Details | Optional, but you can include the customer’s name, address, or contact details. |

| Item Description | Provide a brief description of each item or service purchased. |

| Quantity | State the number of items or services purchased for clarity. |

| Unit Price | List the price of a single item or service. |

| Total Price | Calculate the total price for each item or service (quantity x unit price). |

| Subtotal | Sum the prices of all items before taxes and discounts. |

| Taxes | Include the applicable tax amount for the transaction. |

| Discounts | If any discounts are applied, list them clearly with the amount or percentage. |

| Total Amount Due | Include the final amount the customer needs to pay, after tax and discounts. |

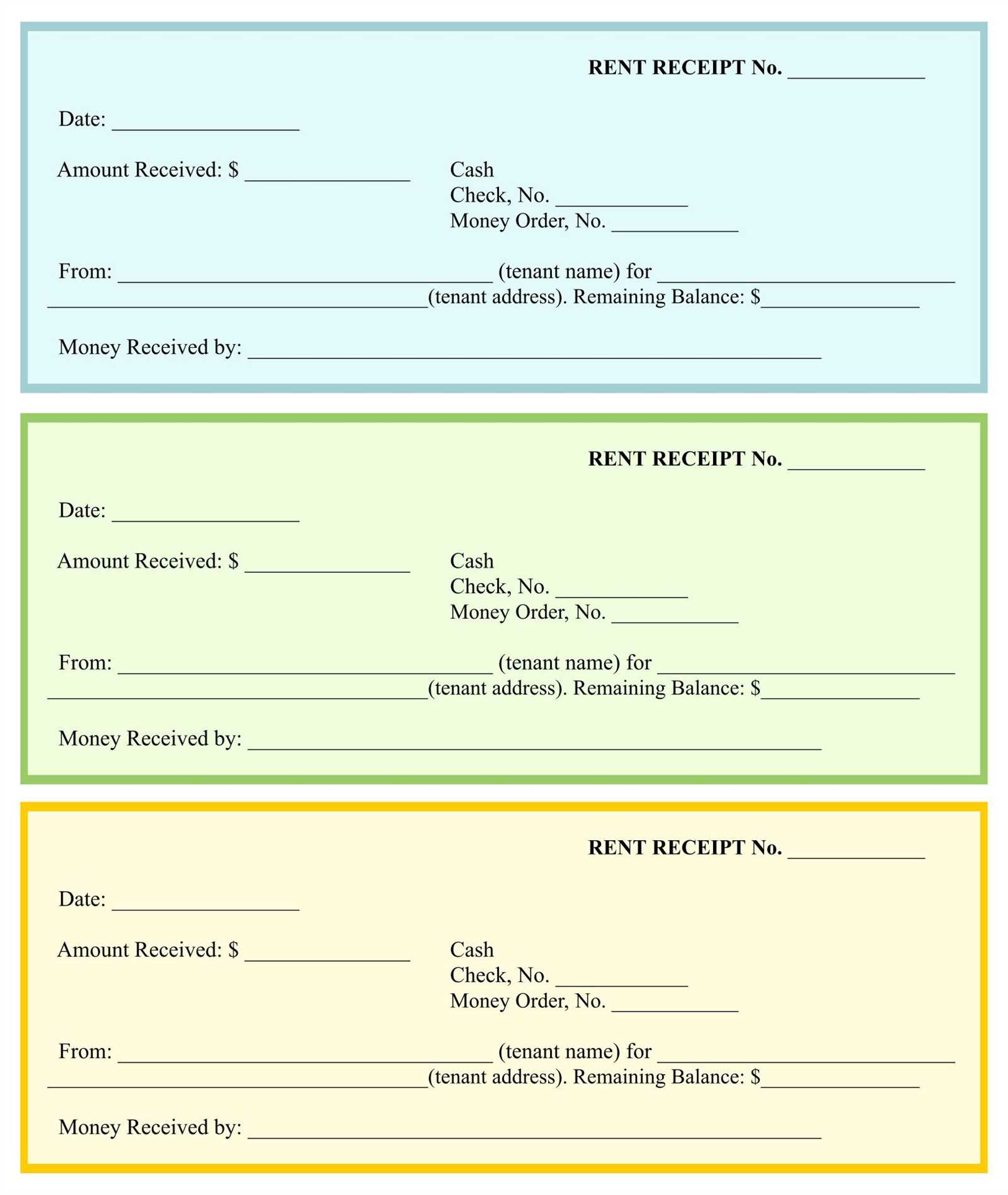

| Payment Method | Specify the payment method used (credit card, cash, check, etc.). |

| Receipt Number | Provide a unique identifier for the transaction to track it in your system. |

This template can be adapted for both physical and digital receipts. Ensure the information is accurate and clearly presented to avoid any confusion or disputes.

Begin with the store’s name and contact details at the top of the receipt. This helps customers quickly identify where the purchase occurred. Include the physical address, phone number, and email address, if available. Make the store name prominent and easy to read.

Next, include the transaction date and time. This is critical for both the customer’s record-keeping and any potential returns or exchanges. Use a consistent format, such as MM/DD/YYYY or DD/MM/YYYY, depending on the region.

Clearly list the items purchased. For each product, show the name, quantity, unit price, and total price. If there are any discounts or promotions, indicate them next to the relevant item(s) and display the adjusted price after applying the discount.

Provide the total amount spent. This should include taxes and any additional fees. List the tax amount separately for transparency, with a clear breakdown if necessary. Make sure this is easy to spot and understand, as it’s crucial for the customer’s financial record.

Include payment information. Specify the method of payment, whether cash, credit card, or mobile payment. For card payments, include the last four digits of the card number and the type (e.g., Visa, MasterCard). If the payment was made via other means (e.g., vouchers or gift cards), list that as well.

Offer a return or exchange policy at the bottom. This ensures customers are aware of their rights, making the process smoother if they need to return an item later.

Lastly, add any relevant legal or regulatory information. This might include warranty details, store policies, or required disclaimers, depending on the nature of the products sold. Keep this section brief but clear.

Every service invoice should include the following components to ensure clarity and avoid confusion.

1. Invoice Number

Assign a unique, sequential invoice number to each document. This helps both you and your client track payments easily and avoid duplicate records.

2. Service Provider’s Details

Include your business name, address, phone number, and email. This information ensures the client knows how to contact you for any questions or concerns.

3. Client’s Information

Clearly state the client’s full name or business name, their address, and contact details. This adds formality and helps in identifying the customer.

4. Date of Service and Invoice Issuance

- The date when the service was completed.

- The invoice issue date to establish a timeline for payment.

5. Detailed Description of Services Provided

Break down the specific tasks completed, including quantities, hours worked, or units provided. This section ensures transparency and shows exactly what the client is paying for.

6. Payment Terms

- Include the total amount due, any applicable taxes, and discounts.

- State the payment due date and acceptable methods of payment (e.g., bank transfer, cheque, PayPal).

7. Late Fees or Penalties

If applicable, outline any late fees or penalties that will apply if payment is not received on time. This encourages prompt payment.

8. Tax Information

If you are required to charge taxes, ensure you mention the applicable tax rates and total tax amounts for transparency.

9. Special Instructions or Notes

If there are specific instructions related to the service or payment, this is the place to include them. This can also be a good spot for a thank-you note to the client.

10. Terms of Agreement

- List any warranty, service guarantees, or disclaimers regarding the work.

- Clarify any limitations of the service provided or responsibilities for the client.

Begin by defining what information is crucial for your business. Include the basics like the company name, address, contact details, and the date. Decide what items should be included on each receipt–such as the product name, quantity, price, taxes, and total cost. If your business offers discounts or promotions, be sure to highlight them clearly.

1. Focus on Branding

Incorporate your logo and brand colors into the design. This helps create a consistent brand experience for your customers, making your receipts an extension of your business identity. Use a readable font and maintain a balance between style and legibility. Ensure that the design isn’t overwhelming, allowing customers to quickly spot essential details.

2. Adjust Layout Based on Your Operations

If you run a retail business, consider a vertical layout for the receipt, which can accommodate a long list of items. Service-based businesses, like salons or repair shops, may benefit from a more compact, horizontal design. Keep the layout simple to avoid confusion, and group similar information together, such as taxes and discounts, for clarity.

Include space for any necessary legal information, like refund policies or terms of service. If your business requires specific compliance notices, make sure those are visible but not distracting from the main content.

Test different versions and get feedback from both staff and customers. This ensures the final design serves both practical and aesthetic purposes while aligning with your business image.

Minimal Adjustments for Maintaining Original Meaning

Small modifications can preserve the original message while replacing redundant terms. This ensures clarity without altering the core content. Rephrasing repetitive words helps avoid unnecessary repetition, making the text more concise. Such changes make the content easier to read and understand without losing its intended meaning.

By focusing on key points and adjusting phrasing, we improve readability while maintaining accuracy. This technique is especially useful in making content more engaging and user-friendly. Simplifying complex sentences without compromising the message can significantly enhance comprehension.

Apply these adjustments by reviewing the text carefully, identifying redundant words, and finding alternatives that retain the original intent. This approach is effective in improving both flow and clarity in your communication.