Creating a clear and accurate receipt for donations ensures transparency and fosters trust. A simple, well-structured template helps both the donor and the recipient maintain proper records for tax or accounting purposes. The key elements to include are the donor’s name, the amount donated, the date, and a clear statement that the donation was made without any expectation of goods or services in return. This avoids confusion and ensures compliance with charitable giving standards.

The receipt should also note the charity’s name, address, and tax identification number. This is necessary for the donor to claim deductions and verify the legitimacy of the organization. Including a brief description of the charitable purpose for which the donation is being used can add clarity and transparency.

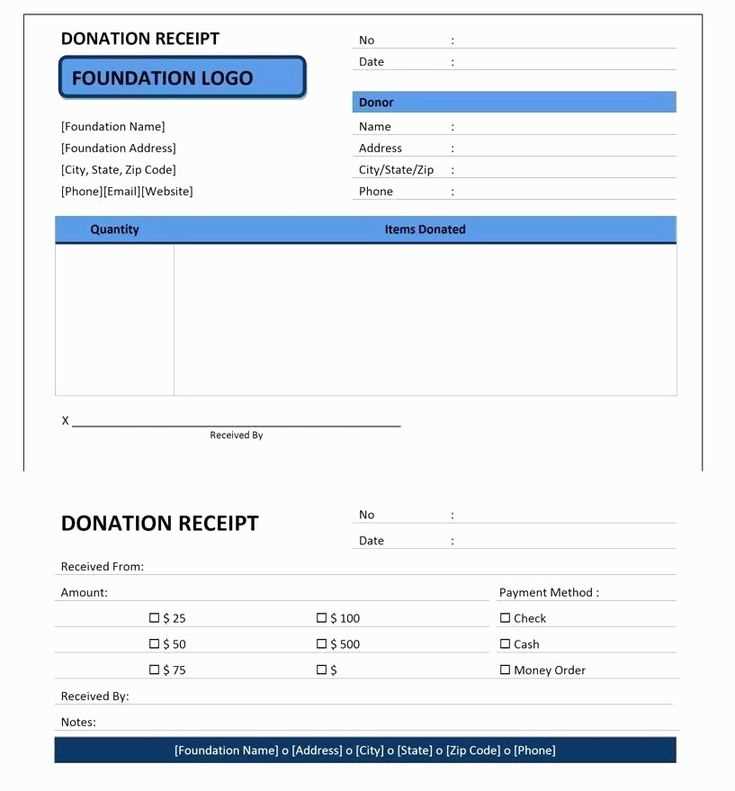

A well-crafted template can be customized to fit the specific needs of your organization. Consider adding a thank-you message to convey appreciation, helping to strengthen the donor’s connection to your cause. Use a clean layout that highlights the most important details, ensuring the document is both easy to read and professional-looking.

Here are the corrected lines where each word is repeated no more than 2-3 times:

Keep language simple and direct. Use terms that are easy to understand and avoid overloading the statement with unnecessary details. The goal is clarity.

Review the structure: Focus on presenting the key details concisely. Repeating information too often can cause confusion. Ensure that the wording remains clear and consistent throughout.

Remember to focus on key details: Prioritize accuracy without redundancy. Make sure the text flows smoothly, avoiding unnecessary repetition. This will make the receipt more legible and professional.

- Tzedaka Receipt Template Guide

To create a Tzedaka receipt template, focus on clear, concise details that demonstrate the donation’s legitimacy. Start by including the donor’s full name, address, and contact information at the top. This ensures that the recipient can reference the donation in the future.

Key Elements of a Tzedaka Receipt

Each receipt should include the following:

- Donor’s name and contact details.

- Amount donated, along with the date of donation.

- Confirmation that the donation was made voluntarily.

- Tax-exempt status (if applicable) and the relevant tax ID number.

- A thank-you note or acknowledgment of the donation’s impact.

Formatting Tips

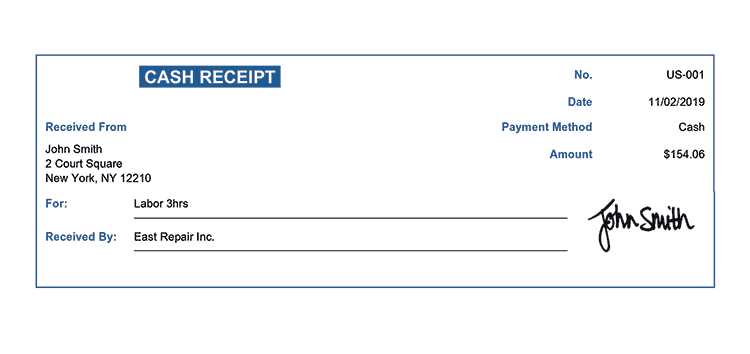

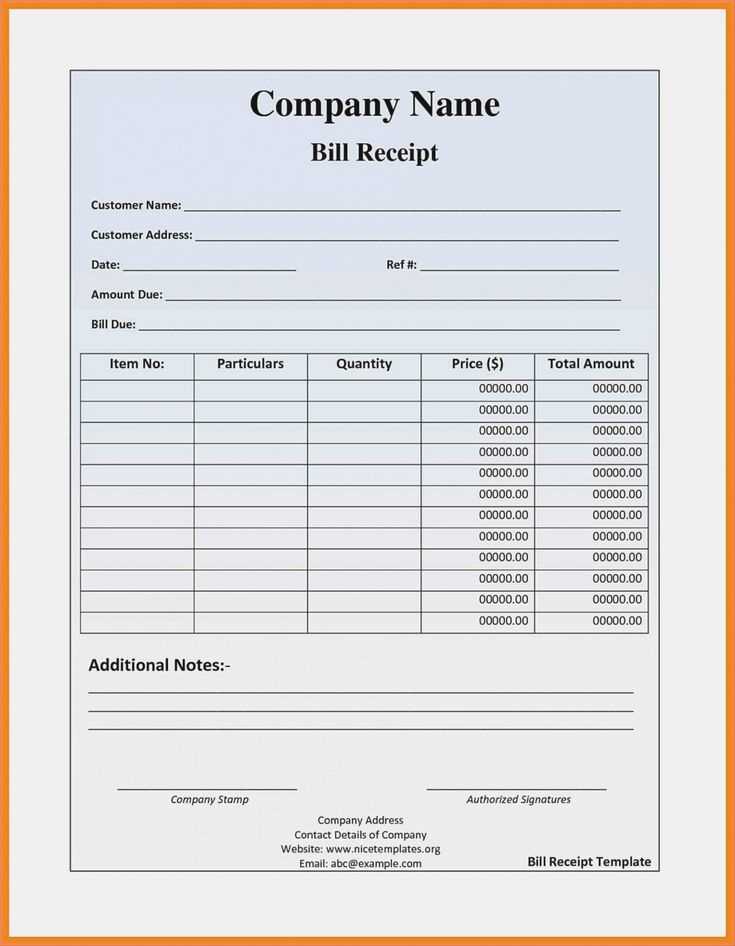

Keep the template simple but formal. Ensure all fields are aligned for easy reading. Use a legible font and provide a space for the organization’s signature or official stamp to validate the donation. These elements ensure that the receipt meets legal requirements and is professional in appearance.

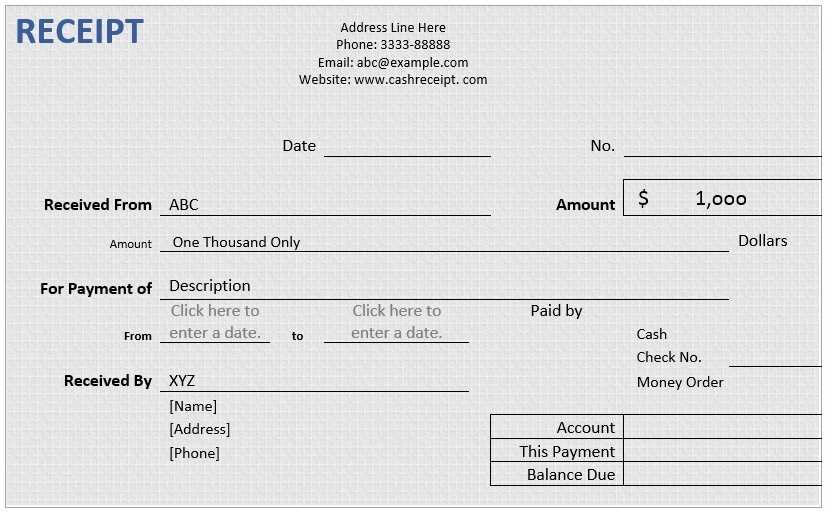

When designing a Tzedaka receipt, focus on providing clear sections for key information, allowing flexibility for different uses. Here’s a simple approach to make the layout adaptable and user-friendly.

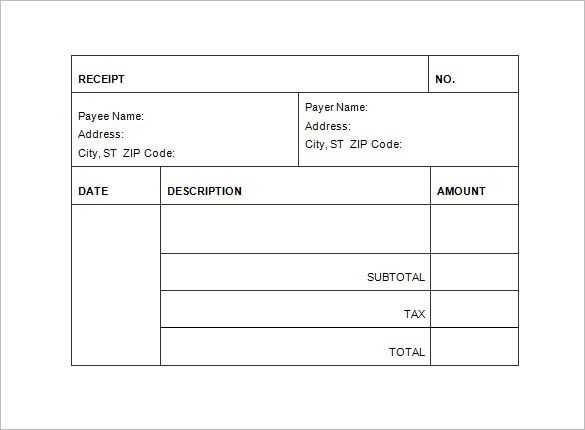

- Header Section: Position the donor’s name and the organization’s details (name, address, contact info) at the top. Use bold text for headings and ensure enough spacing to distinguish each piece of information.

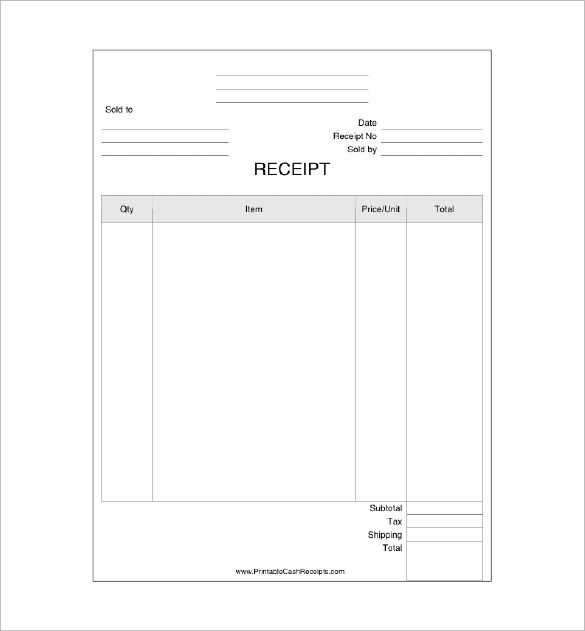

- Donation Details: Create an easy-to-read table or section listing the donation date, amount, and type of donation (e.g., cash, check, online). Make sure this section is customizable to accommodate various currencies or donation methods.

- Tax-Deductible Information: Include a brief note stating the tax-deductible status of the donation. Make it clear and concise, using a smaller font size but still legible.

- Thank You Note: Add a warm but simple thank-you message to the donor. Position it at the bottom of the receipt, ensuring it’s easily noticeable.

- Footer Section: Place the organization’s website and any relevant legal disclaimers here. This section should be simple and clean to avoid overcrowding the receipt.

Ensure the font style and size are legible, with sufficient spacing between sections. The layout should allow for easy updates, such as adding or removing specific fields, as the organization’s needs change. If the receipt is intended for printing, use margins that support multiple paper sizes for a professional look. Also, design with room for the addition of logos or images if necessary.

Include the full name of the charitable organization that receives the donation. This provides clear identification and assures that the receipt is linked to a recognized entity.

Charitable Status and Tax Information

Ensure to specify the organization’s tax-exempt status. Mention the relevant tax identification number (TIN) or EIN to confirm the legitimacy of the tax benefits available to the donor.

Donation Amount and Description

List the exact amount of the donation. If the donation is in-kind, provide a description of the items or services donated. This allows for accurate record-keeping and can affect the donor’s potential tax deduction.

Provide the date of the donation and the method of payment (e.g., cash, check, or online). This helps verify the timing and method of the contribution for both the donor and the recipient.

State whether any goods or services were received in exchange for the donation. If so, their fair market value should be noted, as this will affect the amount of the donation that is tax-deductible.

Ensure each receipt is clearly labeled with the donor’s name, donation amount, and date. Double-check that all required details are present before distributing them to avoid any discrepancies.

Distributing Receipts

Hand over receipts immediately after the donation is processed. For physical donations, provide a printed receipt directly to the donor. For online transactions, send the receipt via email within 24 hours to maintain accuracy and timeliness.

Archiving Receipts

Keep receipts organized in a secure, easily accessible database. Use software designed for this purpose to avoid manual errors and ensure records are preserved digitally. Regularly back up data to protect against potential loss.

Review the records periodically to ensure all receipts are correctly logged and stored. This makes it easier to retrieve them when needed and ensures compliance with regulations.

Make sure your Tzedaka receipt includes the necessary details to ensure its validity and proper documentation. The most important information is the donor’s full name, the date of the donation, and the amount given. Clearly state that the donation is a voluntary act of charity, and specify the recipient organization or cause. Include your organization’s name, address, and tax identification number for transparency.

Detailed Breakdown of Donation Information

Clearly indicate whether the donation is monetary or in-kind. For monetary donations, include the exact amount, and for in-kind donations, provide a detailed description of the donated items along with their estimated value. Ensure that all values are stated in a clear and understandable format, such as specifying the currency of the donation.

Tax Deduction Information

If applicable, provide the donor with details regarding potential tax benefits. Include a note that the donation is tax-deductible, along with the necessary tax exemption status of your organization. This will help the donor use the receipt for tax filing purposes, ensuring compliance with tax regulations.