If you need a structured and clean format for your Uber receipts, using a template is the best approach. A well-designed template allows you to manage your ride details efficiently and ensures all necessary data is captured without confusion.

Start by including date, pickup and drop-off locations, and ride fare. These elements should be clearly separated for easy readability. Also, make sure to add additional details like ride type, driver’s name, and any applicable discounts or promotions.

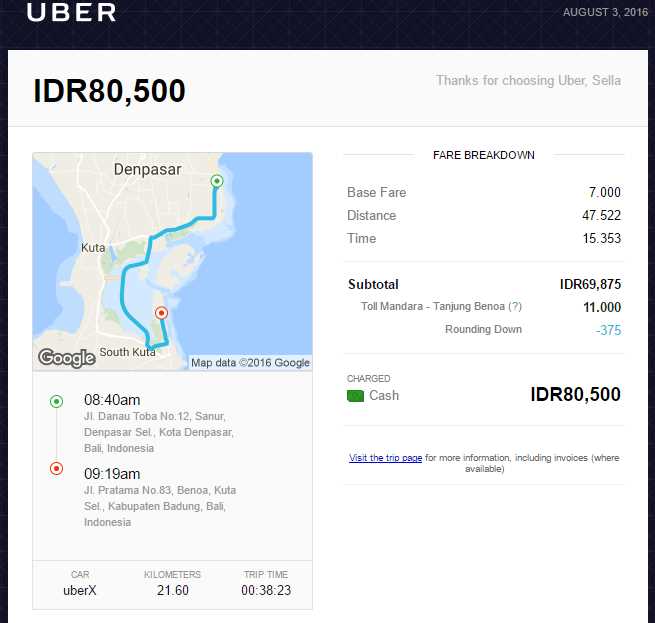

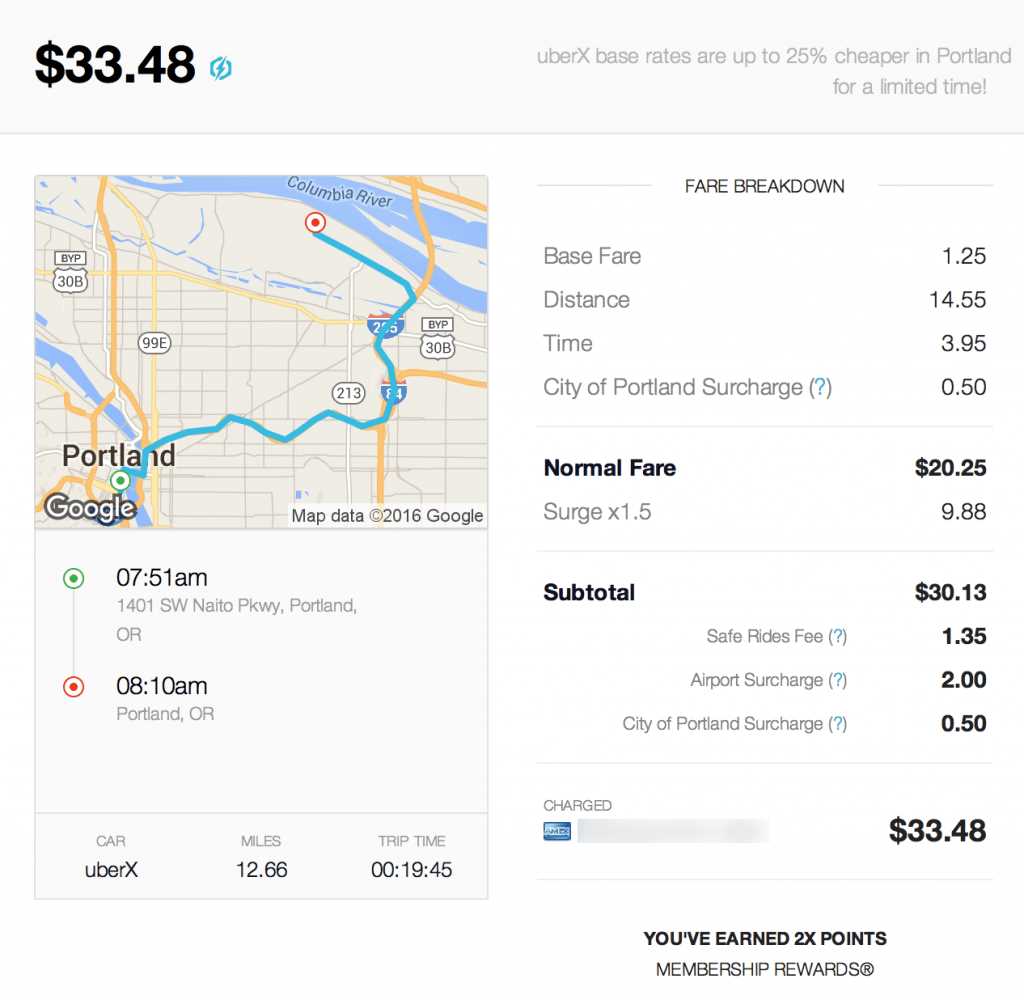

For enhanced clarity, use sections or tables to organize the information. A clear structure makes it easier to track your ride expenses and compare them over time. Incorporating a tax breakdown section will help if you need to calculate costs or submit reimbursements.

Having a consistent layout also helps if you need to access these receipts for tax purposes or for keeping a financial record. With the right template, you can save time and ensure all your Uber ride data is always well-organized.

Here is the revised text, where repetitions have been removed while maintaining meaning and correctness:

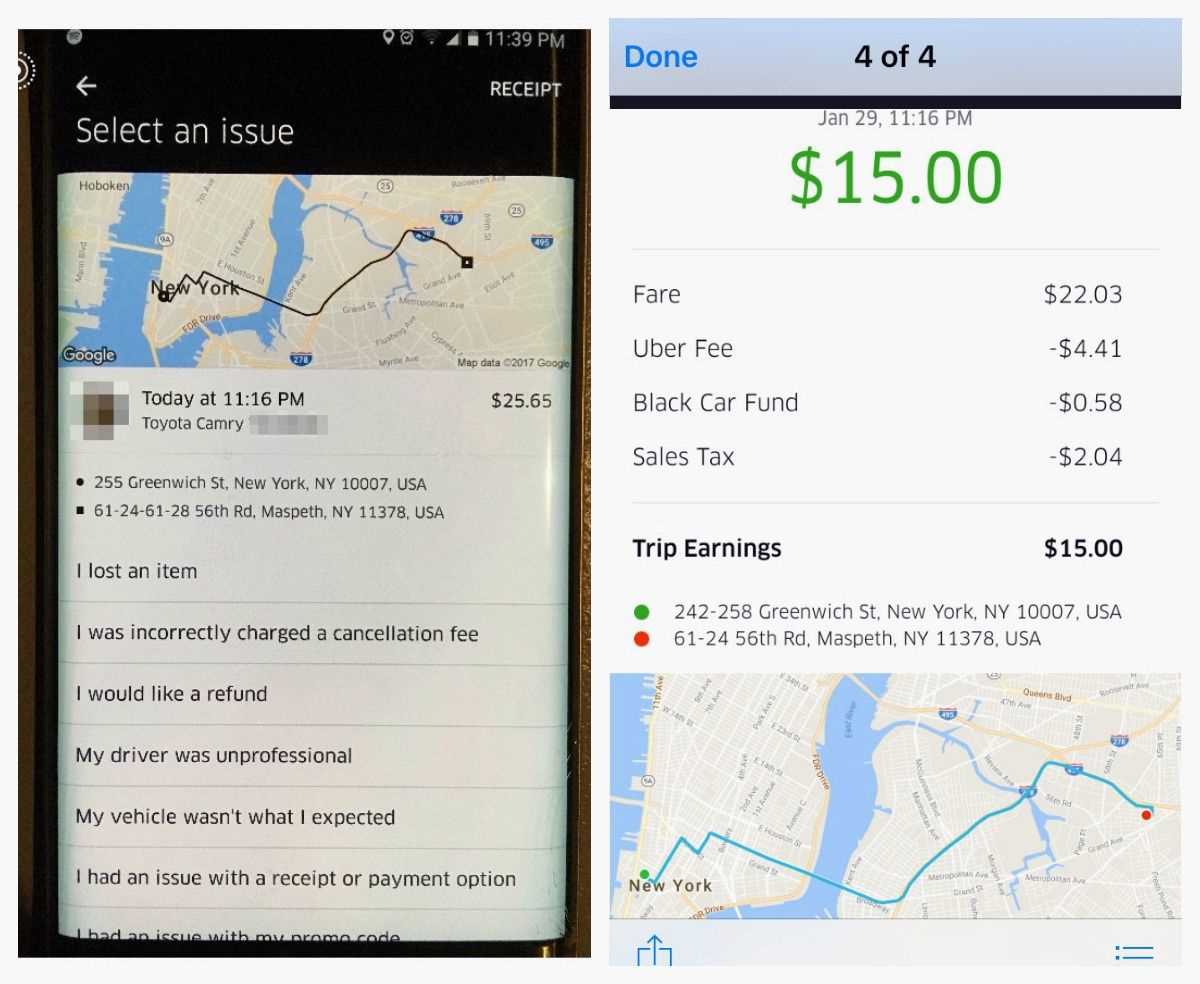

Ensure that your Uber receipts follow a clear and concise format. The template should display all relevant transaction details, including the date, time, fare breakdown, and any additional fees. It is important that each section is easy to read, with prices clearly marked and the service fees specified. You can customize the receipt to suit your business needs, but consistency is key. Focus on providing the customer with all necessary details without overwhelming them with unnecessary information. Include the trip start and end locations, the driver’s name, and the total amount charged. This ensures transparency and trust between the rider and the service provider.

For clarity, arrange the information in a logical order. Begin with basic details like the trip time and fare, followed by additional charges or discounts. The footer can display contact information or instructions for resolving any disputes. By keeping the layout organized and simple, you help your customers understand the cost breakdown quickly, avoiding confusion or frustration.

Uber Receipts Template: A Detailed Guide

How to Create a Template for Business Expenses in Uber

Customizing the Layout of Your Uber Receipt to Fit Your Needs

Understanding the Key Information to Include in an Uber Receipt

Integrating the Uber Receipts Template with Accounting Software

Managing Multiple Receipts for Different Uber Trips in One Template

Ensuring Compliance When Using Uber Receipts for Tax Purposes

Creating a well-organized Uber receipts template for business expenses starts by ensuring that each receipt includes the necessary details such as trip date, pickup and drop-off locations, total fare, and payment method. The key is to streamline the information in a way that makes it easy to categorize expenses for accounting and tax purposes.

Customizing the Layout of Your Uber Receipt

Design the layout of your Uber receipts template by structuring it into clear sections. Start with the basic trip details at the top, followed by a breakdown of charges (e.g., fare, tips, and fees), and finish with the total amount paid. Make sure the date and time of the ride are clearly visible to make tracking easier. Use simple fonts and enough spacing to ensure readability and reduce clutter.

Integrating with Accounting Software

Link your Uber receipts template with accounting software such as QuickBooks or Xero for a seamless workflow. Most accounting tools allow you to import receipts, either manually or automatically, saving time and reducing errors. If you’re using an automated solution, check if it supports Uber receipts or custom templates. This will allow you to categorize the trips based on expense types and generate reports effortlessly.

When you need to track multiple receipts for different Uber trips, consider creating a template that consolidates all trip details into a single document. This way, each entry remains separate but can be viewed within a consolidated view for easy reference.

For tax compliance, ensure that your Uber receipts include all necessary information that meets tax authority requirements. This includes the trip’s distance, duration, and specific charges that are allowable as business expenses. Keep your receipts organized and store them in a safe digital or physical location, especially if you’ll need them for an audit.