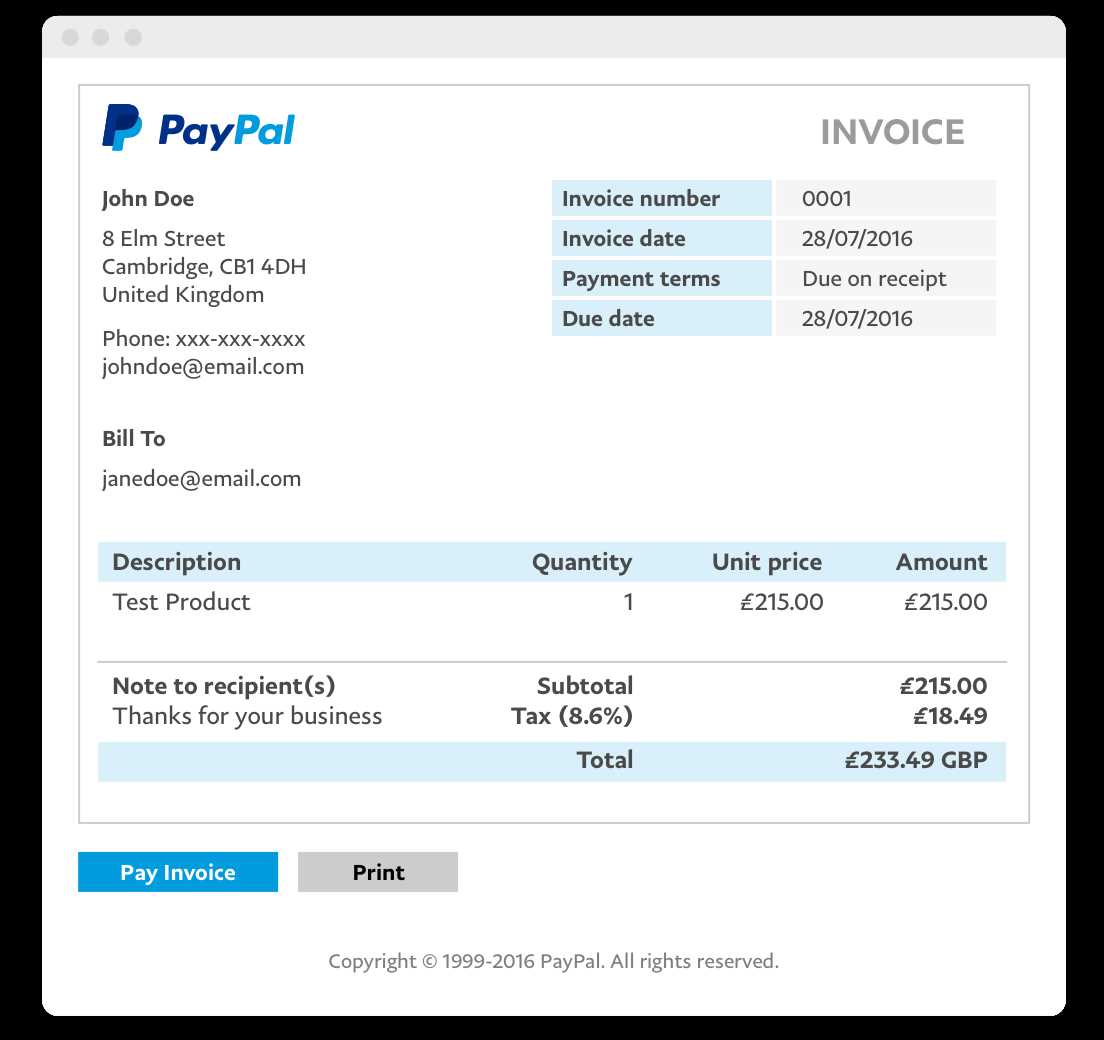

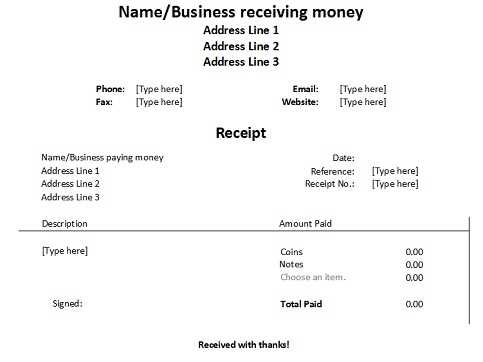

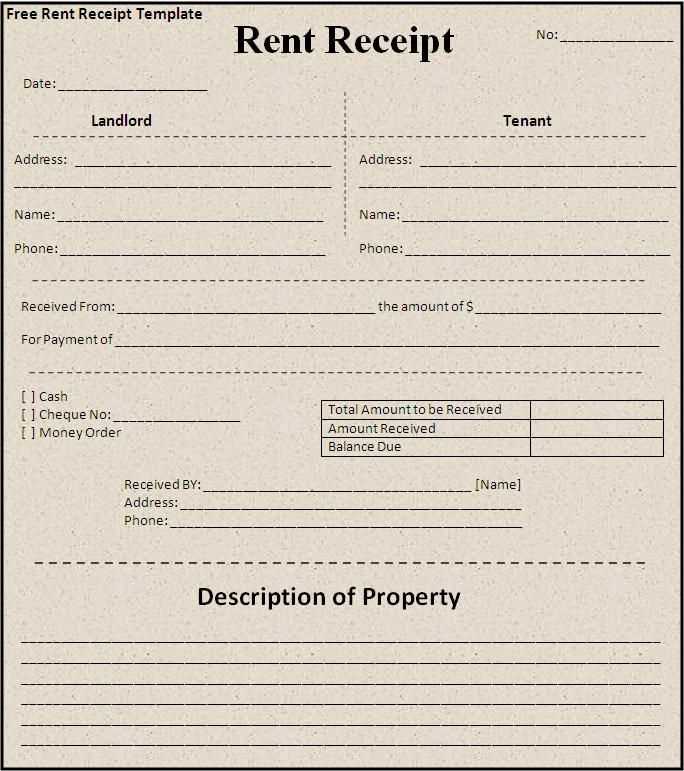

To create a UK receipt, start by including the business name, address, and contact details at the top. Make sure the title “Receipt” is clearly visible. This ensures that the purpose of the document is immediately obvious to the recipient. Add the date of transaction and a unique receipt number for easy reference.

Next, list the items or services purchased. Include a brief description, quantity, price per unit, and the total amount. This helps the customer easily verify the transaction details. Ensure that the total amount is clearly marked, along with any applicable taxes or discounts. For VAT-registered businesses, remember to show the VAT number and specify the VAT rate used.

Finally, include payment details such as the method used (e.g., cash, card, bank transfer). If applicable, mention any remaining balance or deposit. Close with a thank you note or a reminder of return policies, depending on your business’s practices.

Here’s the revised version:

For a UK receipt, include the following key details for clarity and legal compliance:

1. Seller Information

Provide the seller’s full name, address, and contact details. This helps verify the source of the transaction.

2. Buyer Details (if applicable)

While optional, including buyer information (e.g., name or company name) adds transparency to the transaction.

3. Transaction Date

Always mention the exact date of the transaction to avoid ambiguity.

4. Itemized List of Purchases

Break down the items or services purchased, including quantity, unit price, and total cost for each item.

5. VAT (Value Added Tax)

If VAT is applied, include the VAT rate and the total amount charged for each item or service. A breakdown of the VAT-inclusive total should be visible.

6. Total Amount Paid

Clearly state the total amount paid, including VAT if applicable. This ensures both parties are clear on the final sum.

7. Payment Method

Note the method of payment (e.g., credit card, bank transfer, cash), which can be important for resolving disputes.

8. Receipt Number

Including a unique receipt number helps track transactions and serves as proof of purchase.

UK Receipt Template: How to Create a Clear and Legally Compliant Document

A UK receipt must include certain key elements to be both legally compliant and easy for your customer to understand. Make sure your receipt includes the following:

- Date of transaction – Always include the exact date of purchase or service.

- Business details – The name, address, and contact details of your business must be clear.

- Customer details – If applicable, include the name or contact details of the customer for reference.

- Items or services purchased – List each item or service with clear descriptions and prices.

- Total amount paid – The receipt should clearly state the total amount, including taxes if necessary.

- Payment method – Specify how the payment was made (e.g., cash, card, bank transfer).

- VAT details – If you’re VAT registered, include your VAT number and breakdown of the VAT charged.

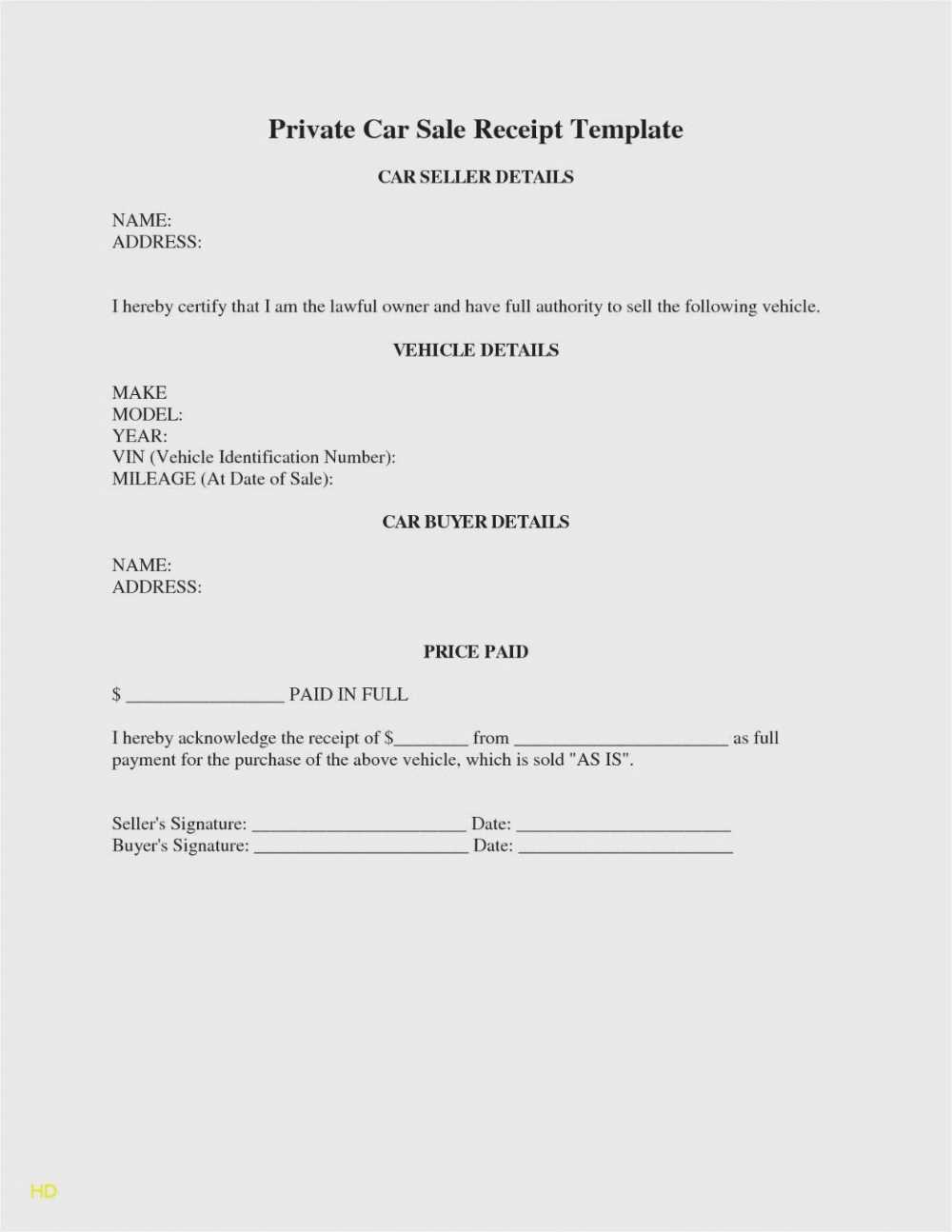

Customizing Your Receipt Template for Various Transactions

Adapt your receipt template based on the nature of the transaction. For example, if you’re selling products, include SKU numbers or product codes for easy identification. For services, detail the service provided and duration. If you sell both products and services, ensure both are clearly outlined with separate sections. Additionally, some businesses may offer discounts, so make sure to list any applied discounts and show the new total after the discount.

Common Mistakes to Avoid When Using a UK Receipt

One common mistake is failing to include clear and accurate information about the transaction. If any details are missing or unclear, it can cause confusion and potential issues for returns or refunds. Avoid using unclear terms or abbreviations that may not be universally understood. Always ensure the correct payment amount is shown, and double-check the date and customer details. Also, if you’re VAT-registered, ensure the VAT breakdown is displayed correctly to prevent any compliance issues.

This keeps the wording varied and maintains clarity without repetition.

When creating a UK receipt template, it’s important to ensure that the wording remains clear and easily understandable. To do this, avoid using the same phrases or terminology throughout the document. For example, if you’re describing payment, switch between terms like “paid,” “settled,” and “amount received” instead of repeating the word “payment.” This makes the text feel fresher and more engaging to the reader.

Use Synonyms for Key Terms

Don’t be afraid to use synonyms. For instance, instead of always stating “total,” try “final amount” or “grand total.” This not only enhances readability but also keeps the language natural and approachable. Switching up wording allows the key points to be highlighted without sounding redundant.

Be Specific with Details

Incorporating precise details can also break the monotony. Rather than repeating the same phrase for every item, specify the service or product, like “consultation fee” or “product purchase.” This adds clarity and ensures that each section of the receipt remains unique, while still communicating all necessary information.