A well-structured US receipt template ensures clarity in financial transactions. Whether issuing receipts for business sales, rental payments, or freelance services, a standardized format helps maintain transparency and professionalism.

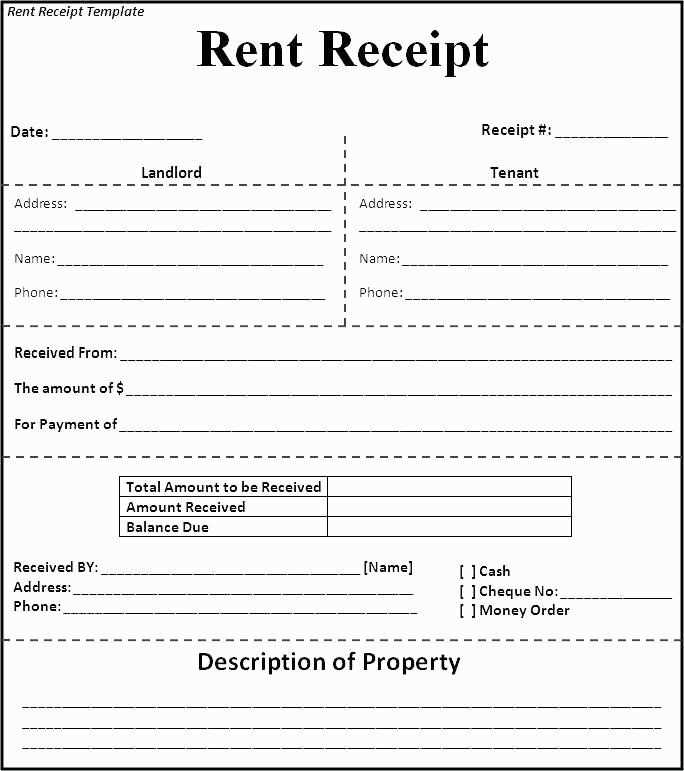

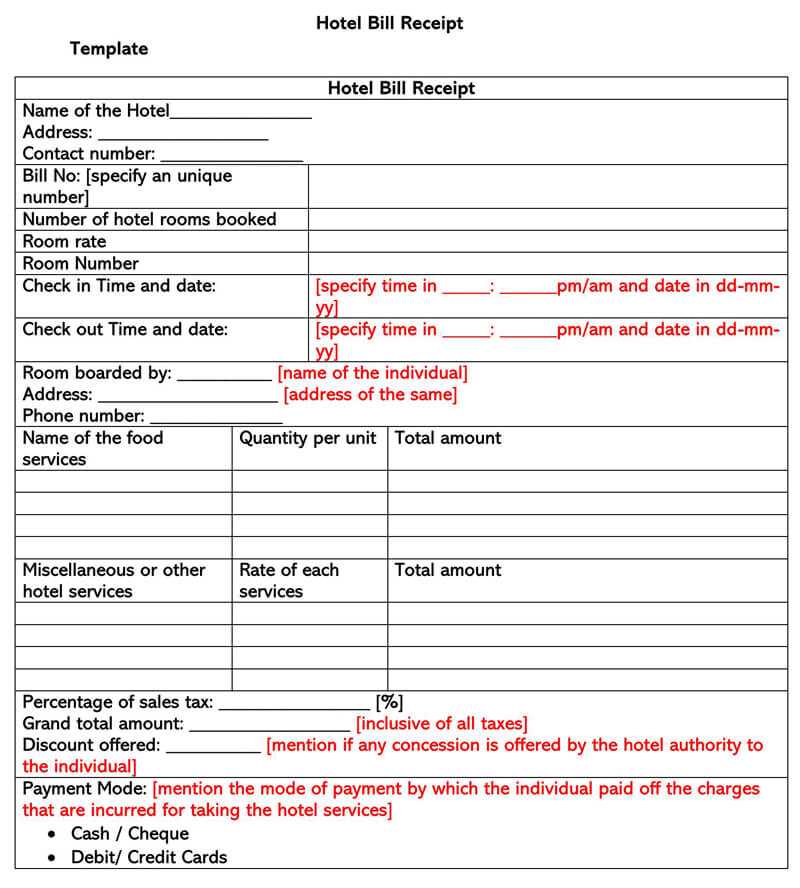

Include essential details such as the date of transaction, seller’s name and contact, buyer’s information, and a breakdown of purchased items or services. Each item should display quantity, unit price, and total amount. Sales tax, discounts, and payment methods must also be clearly outlined.

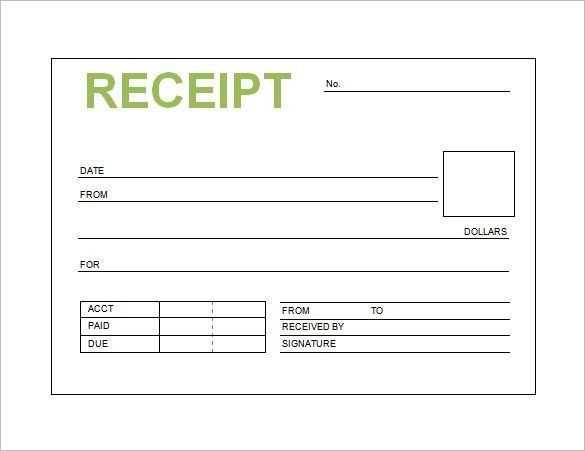

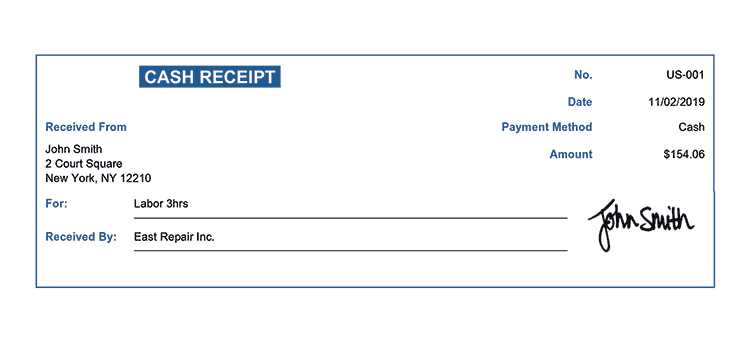

For legal compliance, verify that your template aligns with IRS requirements. Digital receipts should incorporate unique reference numbers, while printed versions must have a company logo and signature space for authentication.

Using editable templates in formats like PDF, Word, or Excel streamlines the process. Automated receipt generators further simplify record-keeping, ensuring consistency in all transactions.

US Receipt Template: Key Aspects and Practical Use

Legal Requirements for a Payment Receipt

Essential Components of a Template

Formatting Guidelines for Clear Layout

Ensure compliance with legal requirements by including the payer’s and recipient’s names, transaction date, payment method, and amount. Some states mandate additional details, such as tax identification numbers or business addresses.

Include key components like a unique receipt number, itemized list of goods or services, subtotal, applicable taxes, and total amount paid. If applicable, mention refund or warranty policies.

Format for readability by using clear section headers, consistent fonts, and adequate spacing. Align numerical values for easy scanning and ensure the receipt fits standard paper sizes or digital formats.

Enhance usability with optional elements like company branding, digital signatures, or QR codes linking to transaction records. Digital receipts should be saved in universally accessible formats like PDF.

Customizing a Template for Business Needs

Digital vs. Paper: Pros and Cons of Receipts

Frequent Mistakes to Avoid When Designing

Choose a template that matches your business model–consider the nature of your transactions, industry, and customer preferences. A well-designed receipt template should include key elements like your business name, address, contact info, transaction date, items purchased, and total cost. Make sure the template reflects your brand’s image, with consistent fonts, colors, and logos that align with your visual identity. You can also customize fields for additional information such as taxes or discounts.

Digital vs. paper receipts: weighing the pros and cons

Digital receipts offer convenience, allowing customers to keep track of their purchases electronically. They’re more eco-friendly and easy to store, reducing the risk of physical clutter. However, paper receipts may still be preferred by some customers for their tangible nature. They are often easier to handle and can be used for returns or warranty purposes. The choice depends on your customer base and how you intend to manage receipts in the future.

Avoid common mistakes when designing a receipt template

When designing your receipt, avoid overcrowding the template with unnecessary information. Keep it clear and concise to enhance readability. Don’t forget to test your template on different devices, especially for digital receipts, to ensure it displays correctly across all platforms. Avoid using fonts that are hard to read, and ensure the key information stands out. Lastly, double-check that all information is accurate, including taxes, totals, and transaction details, to prevent issues with customers or audits.