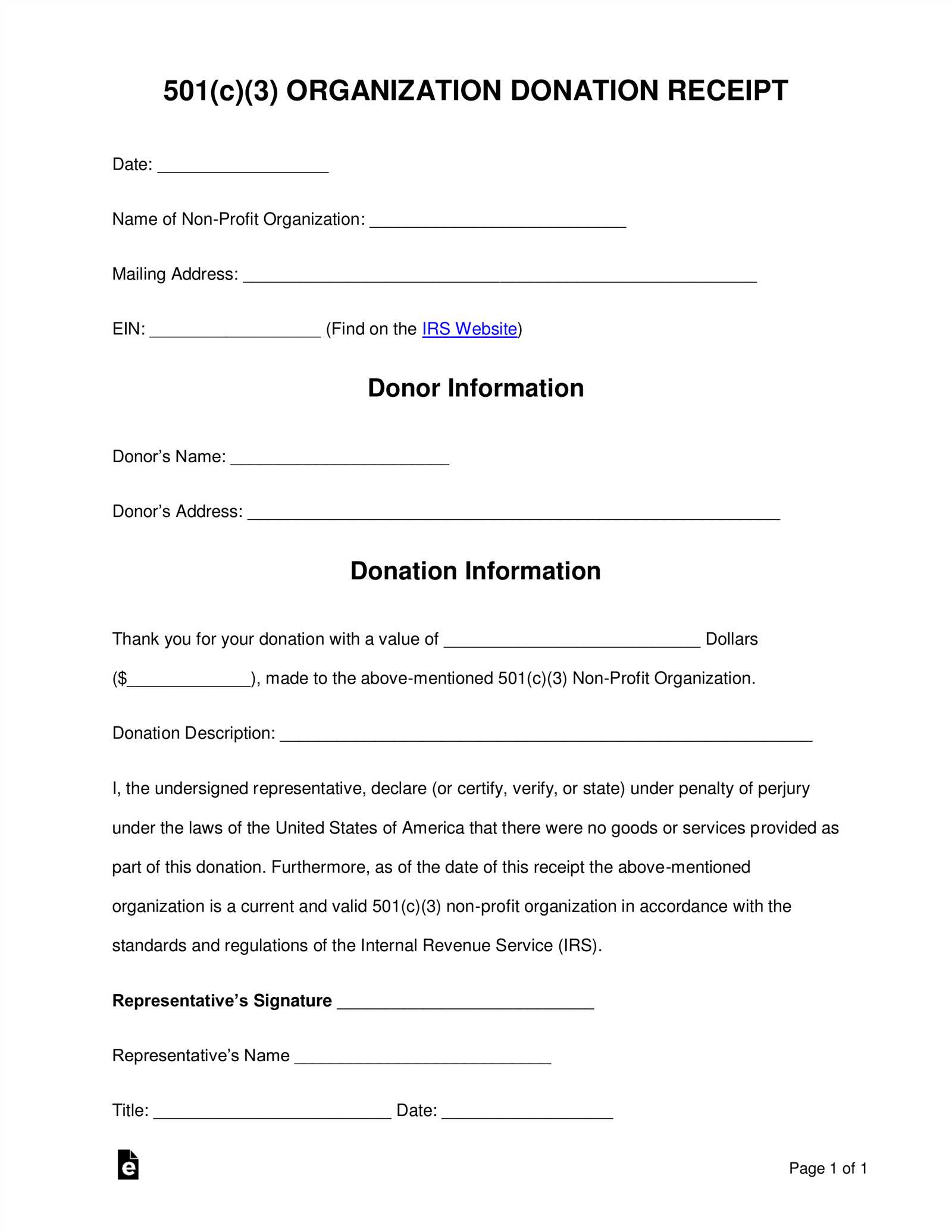

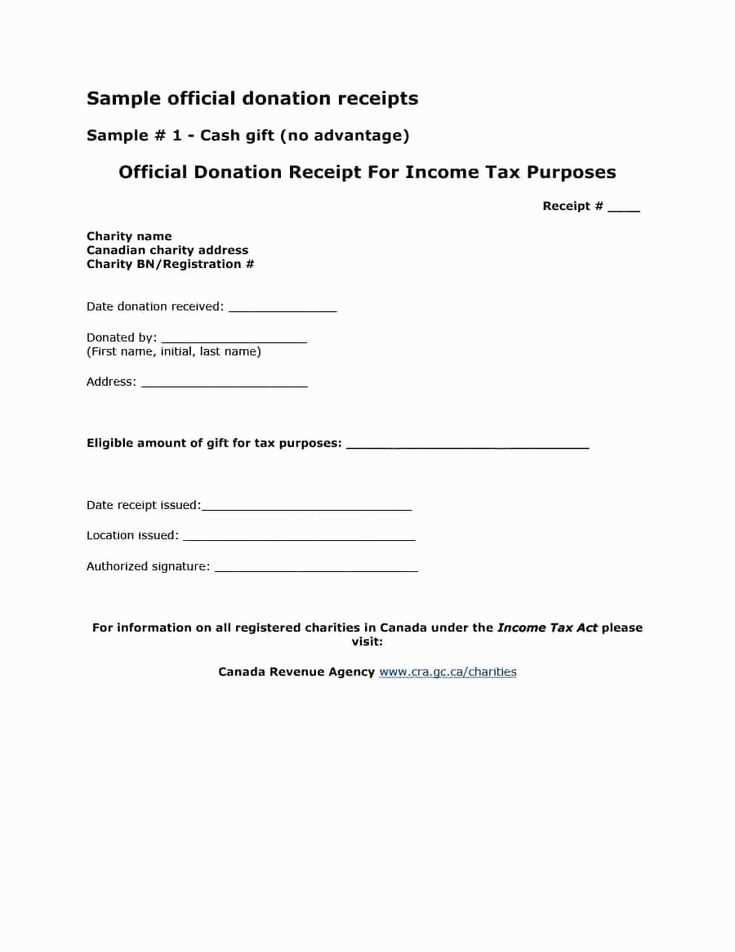

For accurate record-keeping, make sure to include the necessary details in your non-profit receipt template. Include the organization’s name, address, and tax-exempt status information at the top. This helps ensure transparency and compliance with tax regulations.

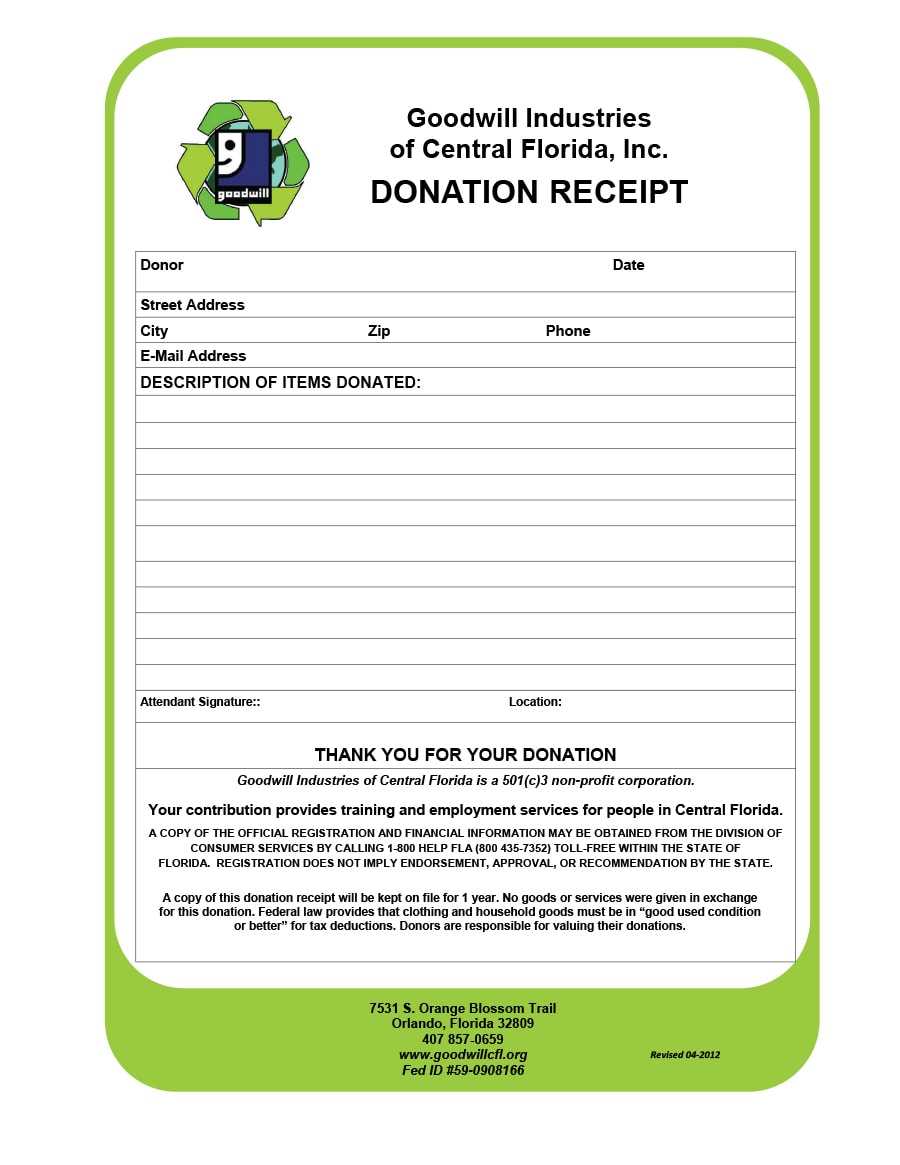

List the donor’s full name and address, along with the date of the donation. Clearly state the amount of the donation, as well as whether it was cash, check, or property. If applicable, provide an estimated value for non-cash donations.

Ensure that the receipt specifies that no goods or services were provided in exchange for the donation, as this distinction is key for tax purposes. If any goods or services were provided, be sure to mention their value as well. End the receipt with a thank-you note and a signature from an authorized representative of the organization.

Here’s the revised plan for the article on the topic “Valid Non-Profit Receipt Template,” with 3 distinct headings:

To ensure your receipt meets the legal requirements, start with a header clearly identifying your non-profit organization. Include the organization’s name, address, and a valid contact number. This gives credibility and makes it easy for donors to follow up if necessary.

Next, specify the date of the donation and the amount given. This is important for tax reporting and should be easy to spot on the receipt. If applicable, list the type of donation–whether monetary or in-kind. This helps clarify the donor’s contribution for future reference.

Lastly, include a statement confirming that no goods or services were exchanged for the donation. This is critical for tax-exempt status and ensures transparency. Make sure this section is clear and concise, with a simple “Thank you for your generous donation” to express appreciation while keeping it formal.

- Creating a Legally Compliant Donation Receipt

Ensure your donation receipt includes the donor’s name, donation amount, and the date of the contribution. If the donation is in-kind, provide a description of the items donated without assigning a value. For cash donations, the amount must be specified, and if the donation exceeds $250, include a statement that no goods or services were provided in exchange.

Clearly state the organization’s name, address, and tax-exempt status, along with any relevant identification numbers (e.g., EIN in the U.S.). Include a statement confirming that the donation was made without any conditions or goods received. If the donor received anything in return (like tickets or merchandise), this must be disclosed, and the value of the goods or services should be deducted from the total donation to determine the tax-deductible portion.

Ensure the receipt is signed by an authorized individual from your organization, especially if required by your local tax laws. If the donation exceeds a certain threshold, make sure to provide a receipt with detailed information that complies with the tax regulations in the donor’s country or state.

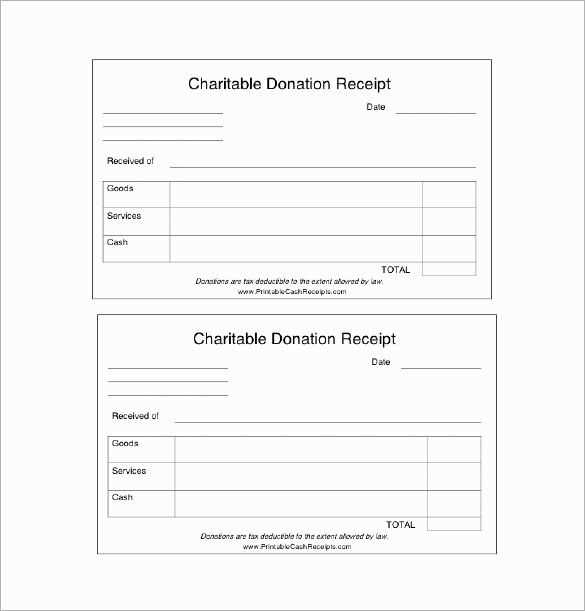

A non-profit receipt must include key details to ensure both donor and organization comply with tax regulations. The following elements should be present in every valid receipt:

- Organization Name and Address: Clearly state the non-profit’s name, address, and contact details.

- Donation Date: Indicate the exact date the donation was received.

- Amount of Donation: Specify the exact amount donated, whether it’s cash or in-kind.

- Donation Description: Provide a brief description of what was donated if it’s not cash (e.g., items or services).

- Tax Identification Number (TIN): Include the non-profit’s TIN for tax purposes.

- Statement of No Goods or Services: Include a statement that no goods or services were provided in exchange for the donation, unless applicable.

- Signature: The receipt must be signed by an authorized representative of the organization.

Double-check these details before issuing the receipt to ensure full compliance with tax reporting requirements.

For different types of donations, tailor the receipt format to reflect the specifics of the contribution. For cash donations, clearly state the total amount given. If the donation was in-kind, describe the items or services received, including their estimated value. Make sure to mention that the donor did not receive goods or services in exchange for the contribution, if applicable. This distinction is key for tax purposes.

For recurring donations, include the frequency and total value of the contribution over the year. If donations are made through a fundraising event, ensure the receipt mentions the event details, date, and the portion of the payment considered a donation versus the value of goods or services provided.

Include the donor’s name, address, and tax identification number if required. Also, don’t forget to mention your non-profit’s legal name, address, and EIN. For transparency, specify whether the donation is tax-deductible, including any applicable limits on deductions based on the type of donation.

By customizing the receipt for each donation type, you provide clarity to the donor and make it easier for them to claim their tax deductions. Keep the information simple and specific to ensure accuracy.

Ensure the template you choose includes a clear breakdown of the donation amount, donor’s details, and the non-profit’s tax-exempt status. This clarity will help the donor use the receipt for tax purposes with no complications.

Key Information to Include

Include the donor’s name, address, and contact details, along with the exact donation date and amount. A description of the donated goods or services, if applicable, should be provided for in-kind donations. Additionally, mention whether any goods or services were provided in exchange for the donation.

Formatting Tips

The receipt should have the organization’s name, logo, and contact information at the top for easy identification. Use a consistent format with proper alignment, making it professional and easy to read. For digital receipts, provide a downloadable version for the donor’s convenience.