To create a VAT receipt, make sure it includes all required information. This should consist of the seller’s name, address, and VAT registration number. Include the date of the transaction and a description of the goods or services provided. Ensure the total amount is clearly stated, along with the VAT rate applied to each item.

The format should also allow for easy verification of the VAT amount. Break down the price of the items, and clearly indicate the VAT amount charged. Use a simple and clean layout to avoid confusion. This structure will help your customers easily understand the transaction details and ensure compliance with tax regulations.

Be sure to include the VAT rate on each item, as it helps the buyer verify that the correct VAT has been applied. You can display the price before and after VAT to make the calculation clear. Make sure that all data fields are correct to avoid errors during audits or other checks.

Here’s the corrected version:

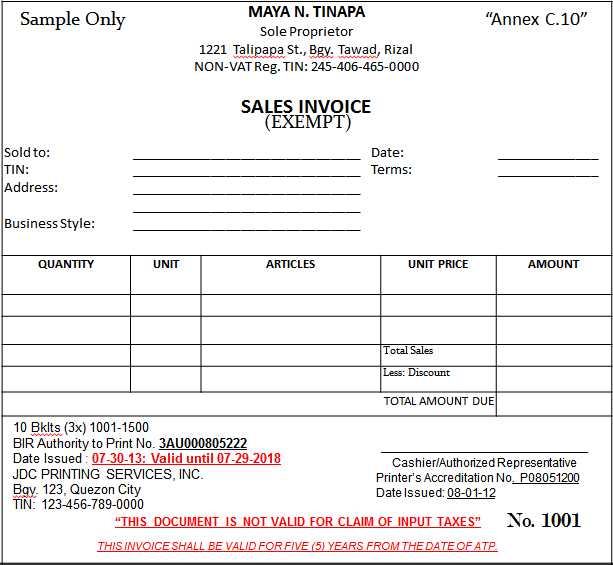

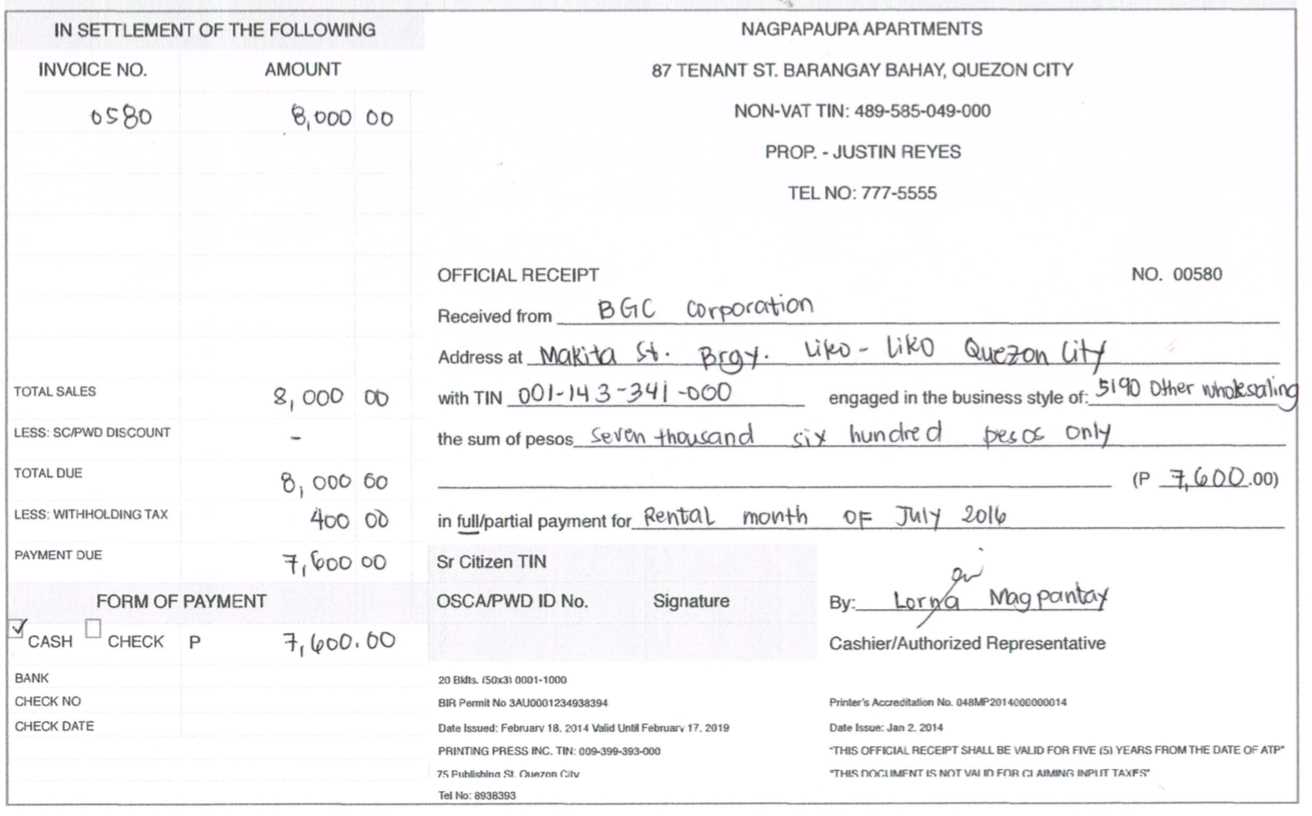

To create a VAT receipt template, begin by ensuring the basic information is clear. Include the seller’s name, address, and VAT registration number. Clearly state the date of the transaction and a unique receipt number for tracking purposes. List each item or service purchased with its description, quantity, and price, along with the corresponding VAT rate applied.

Key Details to Include

Make sure to specify the total amount of VAT charged on the goods or services, alongside the total cost before VAT. The final total should include the VAT amount. Also, provide a breakdown of VAT rates applied to different items if multiple rates are used.

Formatting Tips

Ensure the layout is neat and the information is easy to locate. Use a clean font and logical arrangement of details to improve readability. Keep the formatting consistent across all receipts to maintain professionalism.

VAT Receipt Template: A Practical Guide

Designing a clear and functional VAT receipt requires attention to detail. Focus on the necessary components, keeping the layout simple yet professional. The key elements include the seller’s information, transaction date, and the VAT amount charged. Each component must be legible and easy to verify for both the buyer and seller.

How to Create a Simple VAT Receipt Design

Begin by including your company name, address, and contact information. Include the VAT registration number if applicable. Ensure the date of the transaction is clearly stated. Specify the products or services provided, along with the cost before VAT, the VAT rate, and the total cost including VAT. Make sure the amounts are clearly separated for easy reference.

Key Information to Include in a VAT Invoice

The VAT receipt must show a breakdown of costs, including the net price, VAT amount, and total price. This breakdown should be clear to avoid confusion. Ensure that each product or service is listed separately along with its corresponding price and VAT charge. Don’t forget the invoice number for proper record-keeping.

Customizing your receipt template can be done by adjusting the layout to match your branding, while keeping the required legal details visible. Some businesses may benefit from including payment methods or terms, but these should not distract from the primary VAT information.