Key Elements of a VAT Receipt in UAE

To ensure VAT receipts in the UAE meet all requirements, include the following key elements:

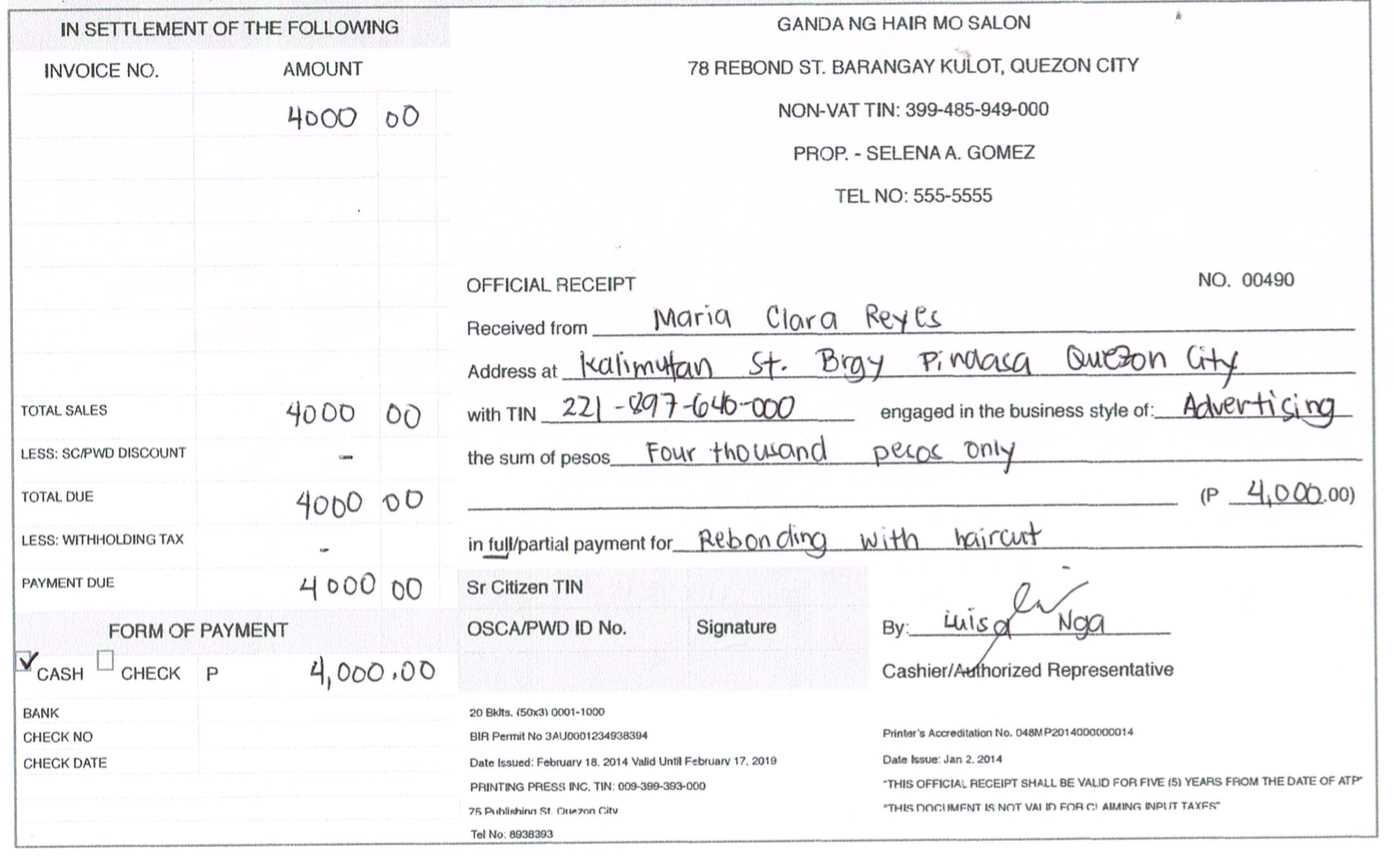

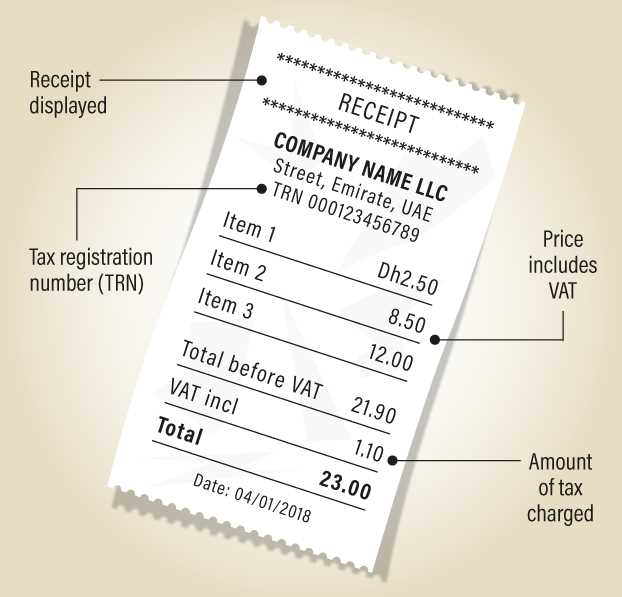

- VAT Registration Number: Display your company’s VAT registration number. This is crucial for tax reporting.

- Transaction Date: Clearly state the date when the transaction occurred.

- Receipt Number: A unique identifier for each receipt to keep track of all transactions.

- Seller Details: Include the business name, address, and contact information.

- Buyer Details: If applicable, include the buyer’s name and address.

- Taxable Goods or Services: Specify what was sold, with descriptions of the goods or services.

- Total Amount Paid: Indicate the total sum, breaking down the VAT amount and the net amount before VAT.

- VAT Rate: Clearly mention the applicable VAT rate (5% for most goods and services).

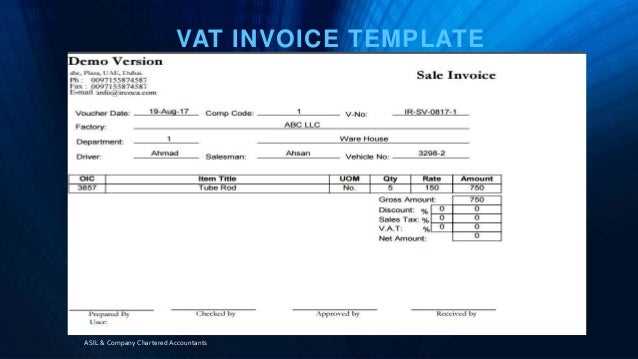

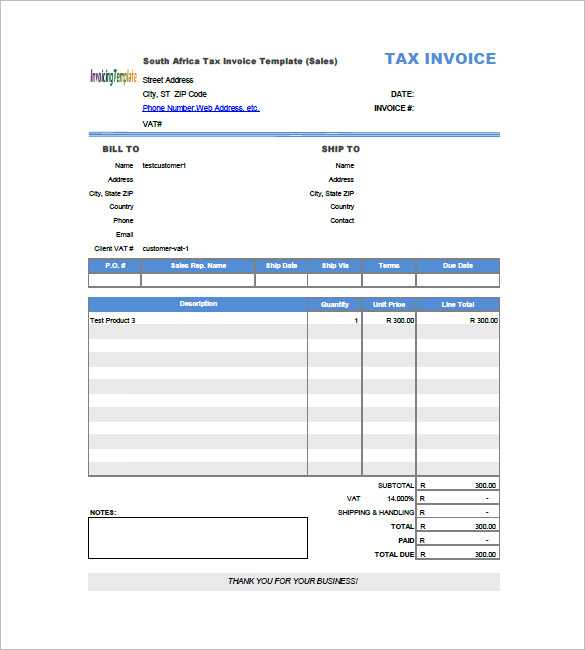

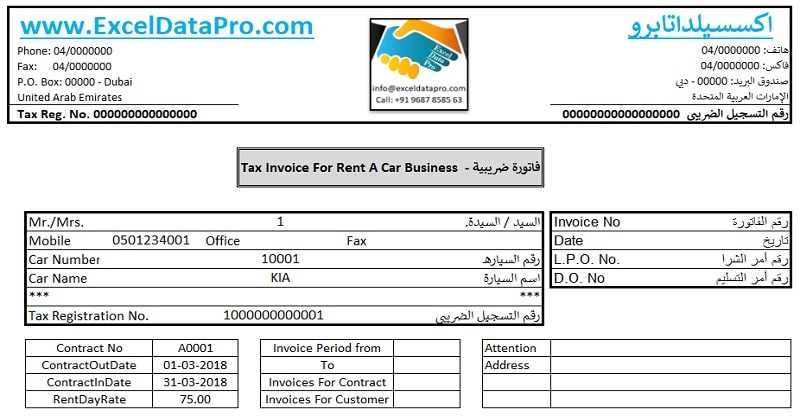

Example VAT Receipt Template

Here’s a simple format you can use for creating VAT receipts:

Invoice Number: [Insert Number] Date: [Insert Date] Seller Details: Business Name: [Company Name] Address: [Street Address, City, Emirates] VAT Registration Number: [Insert VAT Number] Buyer Details: Name: [Buyer Name] Address: [Buyer Address] Description of Goods/Services: 1. [Item 1 Description] - [Quantity] - [Price] 2. [Item 2 Description] - [Quantity] - [Price] Subtotal: [Amount] VAT (5%): [VAT Amount] Total: [Total Amount] Thank you for your purchase!

Other Considerations

Ensure that the receipt is issued promptly and matches the details of the transaction. Any discrepancies may lead to complications during tax audits or claims for VAT refunds.

Having a clear and professional receipt template can save time and reduce mistakes, especially when dealing with VAT filings or audits.

Here’s a detailed plan for an informational article on the topic “VAT Receipt Template UAE” with six specific and practical subtopics, presented in HTML format with

and

tags: How to Structure a VAT Receipt in the UAE, Key Elements Required for Compliance on a VAT Receipt, How to Include VAT Amounts and Tax Identification Numbers, Common Mistakes to Avoid When Creating a VAT Receipt in the UAE, Digital vs. Paper VAT Receipts: What You Need to Know, Templates and Tools for Easily Generating VAT Receipts in the UAE. In this version, I removed repeated words while maintaining the structure and meaning.

tags: How to Structure a VAT Receipt in the UAE, Key Elements Required for Compliance on a VAT Receipt, How to Include VAT Amounts and Tax Identification Numbers, Common Mistakes to Avoid When Creating a VAT Receipt in the UAE, Digital vs. Paper VAT Receipts: What You Need to Know, Templates and Tools for Easily Generating VAT Receipts in the UAE. In this version, I removed repeated words while maintaining the structure and meaning.

tags: How to Structure a VAT Receipt in the UAE, Key Elements Required for Compliance on a VAT Receipt, How to Include VAT Amounts and Tax Identification Numbers, Common Mistakes to Avoid When Creating a VAT Receipt in the UAE, Digital vs. Paper VAT Receipts: What You Need to Know, Templates and Tools for Easily Generating VAT Receipts in the UAE. In this version, I removed repeated words while maintaining the structure and meaning.”>

tags: How to Structure a VAT Receipt in the UAE, Key Elements Required for Compliance on a VAT Receipt, How to Include VAT Amounts and Tax Identification Numbers, Common Mistakes to Avoid When Creating a VAT Receipt in the UAE, Digital vs. Paper VAT Receipts: What You Need to Know, Templates and Tools for Easily Generating VAT Receipts in the UAE. In this version, I removed repeated words while maintaining the structure and meaning.”>

The VAT receipt in the UAE should be clear and concise, meeting all regulatory requirements. Ensure the structure includes all necessary information, such as the vendor’s name, VAT registration number, and a breakdown of taxable and non-taxable amounts.

Key Elements Required for Compliance on a VAT Receipt

A compliant VAT receipt in the UAE includes the supplier’s details, including their VAT registration number, and the date of issue. The breakdown of the sale must specify the taxable value, the VAT amount, and the total amount payable. Ensure that the document contains a clear reference to the VAT rate applied, typically 5% in the UAE.

How to Include VAT Amounts and Tax Identification Numbers

When listing VAT amounts, always separate the taxable amount from the VAT charge. The tax identification number (TIN) of both the supplier and the customer (if applicable) should appear clearly on the receipt, ensuring proper identification for tax reporting purposes.

Avoid common errors like missing VAT rates, incorrect totals, or unclear TIN numbers. These mistakes can lead to difficulties with tax audits or claims for VAT refunds. Ensure that all values are accurate and align with the transaction details.

If you’re considering digital or paper receipts, both formats are accepted in the UAE. However, digital receipts must meet the same legal standards as paper copies, and businesses should ensure they have a reliable system for storing these records for at least five years.

To streamline the process of generating VAT receipts, numerous online templates and software tools are available, allowing you to create standardized receipts that comply with UAE regulations. Using these tools can simplify your record-keeping and improve efficiency.