Basic Structure

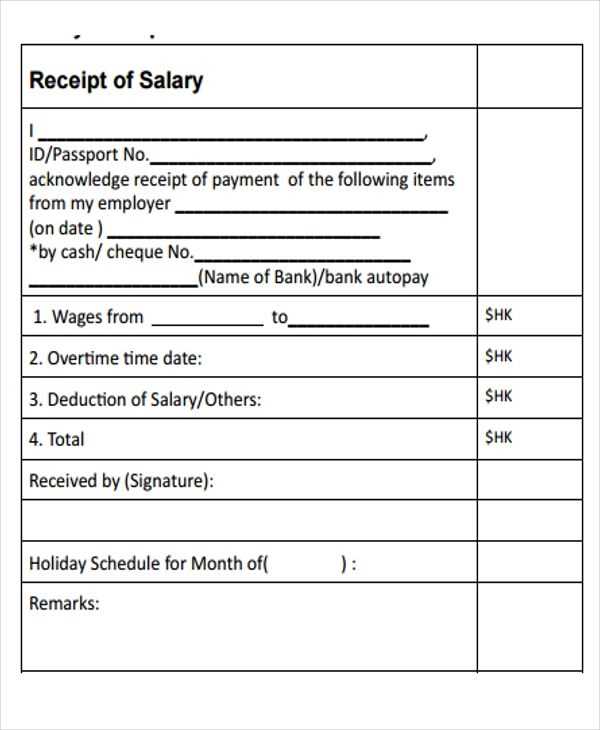

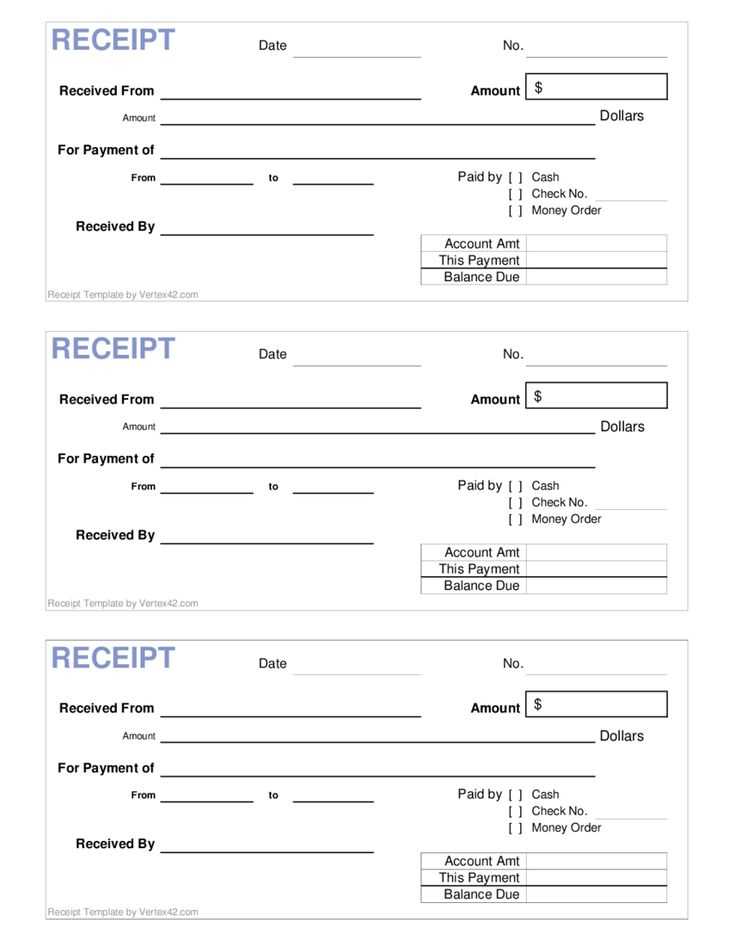

A wage receipt should clearly outline the details of the payment made to an employee. This includes their personal information, the period worked, and a breakdown of the wages earned. A template will make creating consistent and professional receipts much easier. Ensure that all sections are filled out completely for accuracy.

Key Sections

- Employee Information: Name, position, and employee ID.

- Company Information: Name, address, and contact details.

- Payment Period: Start and end dates for the wages being paid.

- Gross Income: Total income before deductions.

- Deductions: Taxes, benefits, and other withholdings from the paycheck.

- Net Income: Final payment after deductions.

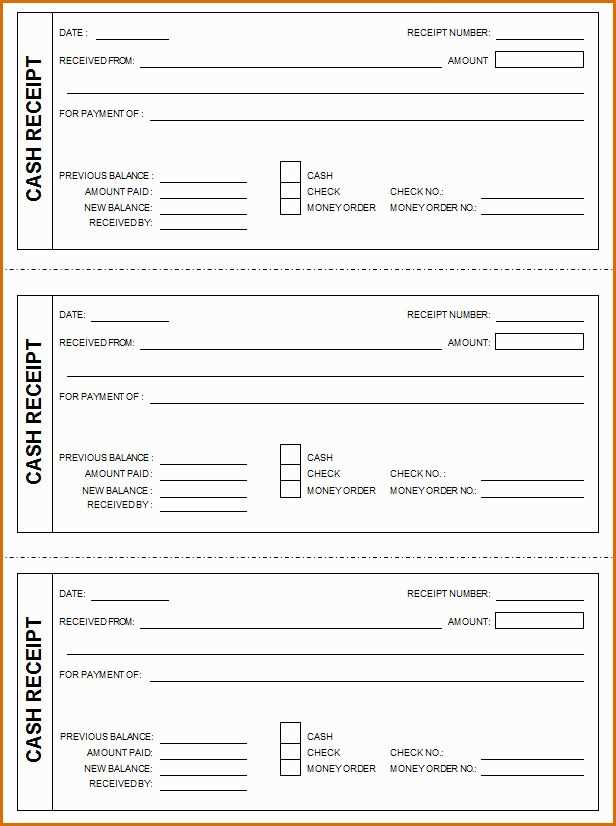

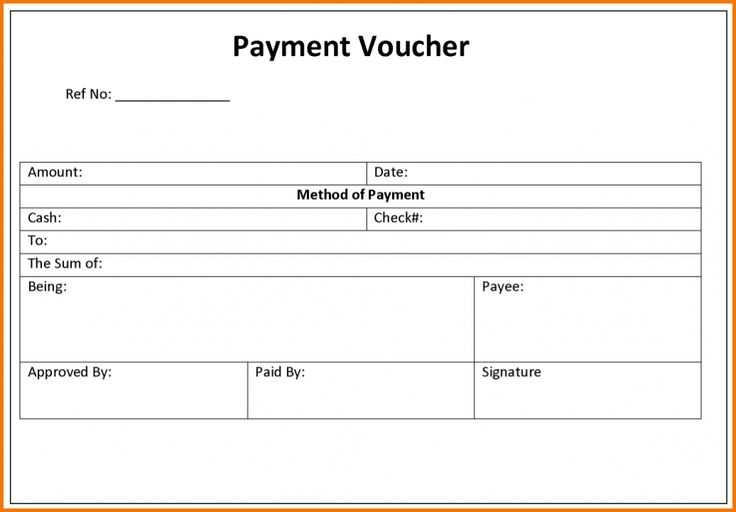

- Payment Method: Cash, check, bank transfer, or other payment methods used.

Example Template

Here’s a simple example of how the wage receipt can be structured:

Wage Receipt Employee Name: John Doe Employee ID: 12345 Position: Software Developer Company Name: XYZ Corp. Company Address: 123 Business Rd, City, Country Company Contact: (123) 456-7890 Payment Period: 01/01/2025 - 01/31/2025 Gross Income: $5000 Deductions: - Tax: $1000 - Health Insurance: $200 - Retirement Fund: $300 Net Income: $3500 Payment Method: Bank Transfer (Account #9876543210) Date of Payment: 02/01/2025

Best Practices

- Always verify the accuracy of all amounts listed.

- Keep a copy for record-keeping and compliance purposes.

- Provide wage receipts in a timely manner to maintain transparency.

By following this template, you will create clear, understandable wage receipts that ensure both employers and employees have the information needed for payroll and tax purposes.

Wage Receipt Template Guide: How to Create a Clear and Professional Payment Receipt

Designing a wage receipt requires focus on key details to ensure clarity and professionalism. Start by including the employer’s name, business address, and contact information. This helps establish the source of payment. Follow with the employee’s name, address, and job title to make the document specific to the recipient.

Key Details to Include in a Wage Receipt

List the payment date and period covered by the receipt. Break down the wages into clear components, such as regular hours, overtime, and bonuses. Specify deductions, such as taxes or insurance premiums, to provide transparency. Ensure the net amount paid and any unpaid balance are clearly displayed. Add a unique receipt number for future reference.

How to Customize a Payment Template for Different Employment Types

For full-time employees, include details such as salary type (e.g., hourly, weekly, or monthly) and paid leave. For freelancers or contractors, include project-based payment terms and invoice numbers. Tailor the document to reflect specific agreements or conditions relevant to part-time workers, temporary hires, or commission-based roles.