Creating a wages receipt template can save you time and help you stay organized. A clear template ensures that all necessary details are included in each pay statement, making it easier for both employers and employees to track earnings and deductions. Use a format that is simple, yet detailed enough to reflect the full compensation package.

Make sure to include key details such as the employee’s name, salary period, and net pay. Also, include deductions for taxes, insurance, and any other withholdings to provide transparency. Having these specifics clearly laid out in a receipt helps avoid confusion and ensures both parties are on the same page.

The structure of your template should be straightforward. Start with basic employee details at the top, followed by the breakdown of earnings, deductions, and the final net pay. Don’t forget to include the date and payment method at the end of the statement to keep a proper record. Keep the design clean and uncluttered to ensure readability, even for those with limited experience in reviewing financial documents.

Here is the corrected version:

To create a clear and concise wages receipt template, focus on including the following elements:

Key Components of a Wages Receipt

| Item | Description |

|---|---|

| Employee Name | Full name of the employee receiving payment. |

| Pay Period | Start and end dates for the pay period covered by the receipt. |

| Gross Pay | Total earnings before deductions. |

| Deductions | All deductions made (taxes, insurance, etc.). |

| Net Pay | The total amount the employee takes home after deductions. |

| Employer Details | Company name, address, and contact information. |

| Payment Method | How the payment is made (e.g., bank transfer, check). |

Ensure that the format is easy to read and all figures are accurate. The layout should also allow for quick updates as required, ensuring both the employer and employee have a clear understanding of the payment breakdown.

Formatting Tips

Use consistent font styles and sizes. Align numbers to the right for clarity, especially for monetary values. Ensure that there is adequate spacing between different sections for easier readability.

- Wages Receipt Template Guide

Creating a wages receipt template is straightforward when you know what elements to include. Here’s how to structure it for clarity and accuracy.

Basic Information

- Employee Name – Clearly state the full name of the employee receiving the wages.

- Employee ID – Include the employee’s unique identification number for reference.

- Pay Period – Specify the start and end dates for the pay period being covered.

- Payment Date – Indicate the date the wages are being paid.

Wage Details

- Hourly Rate or Salary – State the agreed hourly rate or monthly salary.

- Total Hours Worked – Mention the total number of hours worked in the pay period, if applicable.

- Gross Pay – Display the total wages before deductions.

- Deductions – List any applicable deductions such as tax, insurance, or pension contributions.

- Net Pay – Clearly show the final amount after deductions have been subtracted.

Ensure the template is easy to read, with all fields clearly labeled and neatly organized. This way, the employee can quickly verify the information for accuracy.

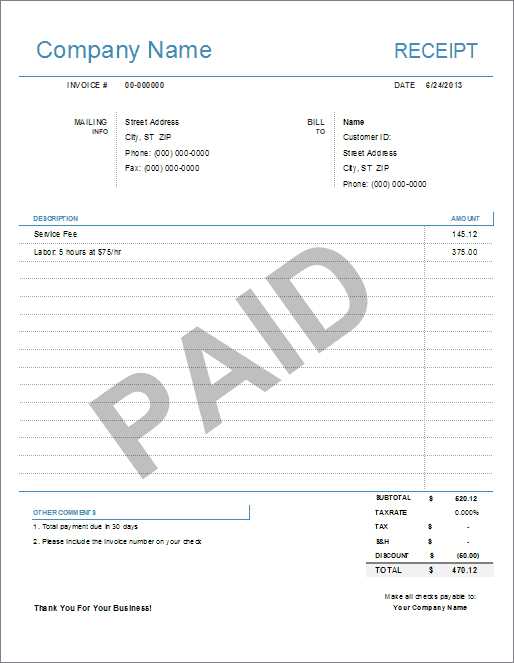

To create a basic receipt, begin by organizing the necessary details. Include the company name and contact information at the top. This can be followed by the recipient’s name and address for clarity. Each receipt should list the date of the transaction and the items or services provided.

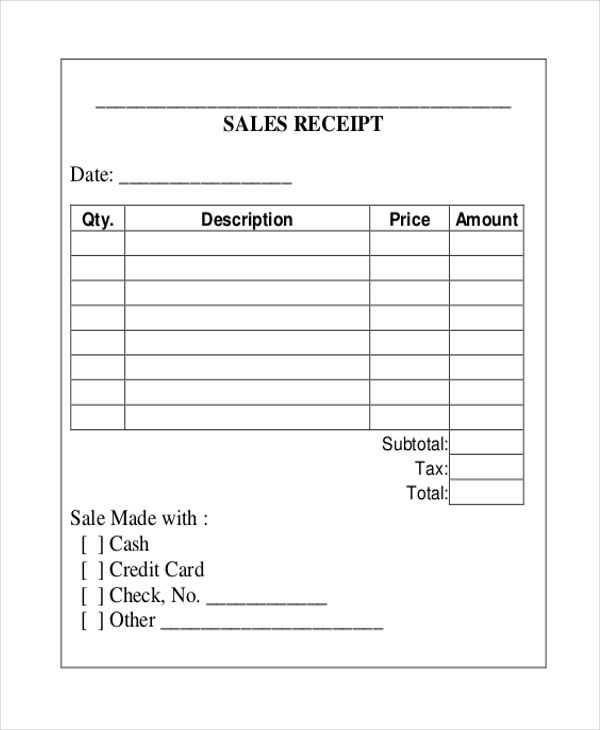

Itemization and Pricing

Clearly display each item or service purchased with the corresponding cost. Use a table format for easier reading. Include columns for item description, quantity, price per unit, and total cost. This will ensure the customer understands what they’re paying for. Always calculate totals accurately and ensure taxes or additional fees are clearly marked.

Payment Method and Total

Conclude the receipt by specifying the payment method, whether cash, card, or other forms of payment. Add the total amount paid, which should match the sum of the itemized prices, taxes, and any discounts or fees. Include a note of thanks and any return or refund policies if applicable.

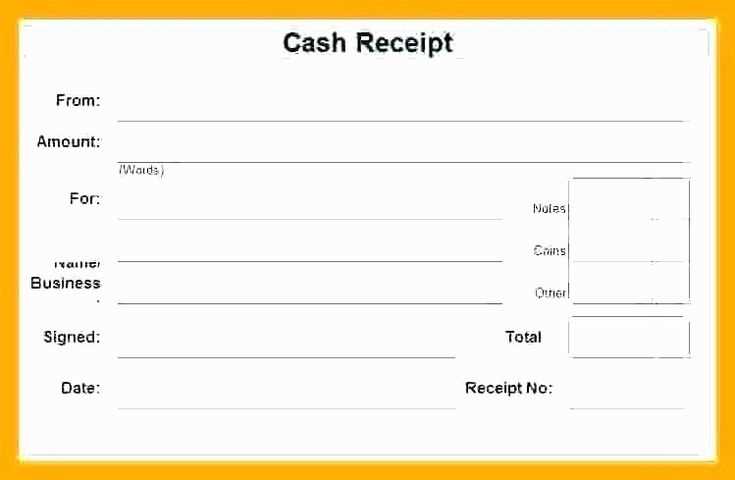

Include the payment amount clearly, as this ensures transparency. Display the currency used next to the amount to avoid confusion. Specify the date of payment, as this can be helpful for both the payer and payee for record-keeping.

Sender and Recipient Information

Clearly list both the payer’s and recipient’s names. The payer’s contact details should also be included for clarity. This helps in case follow-up communication is required.

Method of Payment

Detail the method used, whether it’s cash, credit card, or bank transfer. Include any relevant transaction reference numbers to help track the payment, especially in digital transactions.

Describe the nature of the payment, such as whether it’s for services rendered or a product purchase. This provides context and justifies the payment, which is useful for both parties.

Don’t forget to include a receipt number. This unique identifier will help locate and refer to the transaction in case of inquiries or disputes later on.

Adjust the layout of your wage receipt template to fit your specific needs. Customize the headers, such as “Employee Name” or “Payment Period,” to reflect your company’s terminology.

Incorporate your company’s branding by adding a logo or adjusting the color scheme. This personalizes the document and keeps it professional.

Ensure all relevant details are included, such as tax deductions, bonuses, or overtime pay. Tailor sections to highlight what’s most important for your workforce.

Choose an easily readable font style and size for a clean, organized look. Keep the font consistent to maintain a cohesive design across all sections.

Consider including payment breakdowns in a table format for better clarity. This makes it easier for employees to understand their wages and deductions at a glance.

Regularly update the template to reflect any changes in legal or tax requirements. This will ensure that your template stays compliant with the latest regulations.

Ensure clarity and accuracy in your wages receipt template by organizing information in a clear, structured manner. Each section should be easily readable, with essential details prominently displayed. List the employee’s name, job title, and payment period at the top. This provides immediate context to the receipt.

Detailed Breakdown

Clearly separate the components of the payment. Include columns for hours worked, rate of pay, deductions, and bonuses. Make it easy for employees to track their earnings at a glance.

Legal and Tax Information

Include the necessary legal disclaimers, tax deductions, and employer contributions. Ensure the format follows local regulations. This helps prevent misunderstandings and ensures compliance with relevant tax laws.