If you need a reliable Wells Fargo receipt template, you can easily create one using simple tools like word processors or specialized online platforms. These templates can streamline your transaction documentation process, ensuring accuracy and professionalism.

Start by ensuring the template includes key details such as date of transaction, amount, merchant information, and payment method. It is also crucial to have a section for the transaction reference number to maintain clarity and avoid any confusion in the future.

For added convenience, consider customizing the template to match your brand or personal style. Platforms like Google Docs or Microsoft Word allow you to adjust fonts, logos, and layout easily, ensuring a polished final product. If you frequently generate receipts, it might be worth automating the process using software that integrates with your accounting system.

Having a consistent, well-structured receipt template is an easy yet effective way to keep track of your transactions, reduce errors, and maintain transparency in your financial records.

Here are improved lines with minimized repetition:

To create a streamlined Wells Fargo receipt template, focus on using clear, concise language and eliminating redundancy. Avoid repeating information such as the same transaction details across multiple sections. Instead, organize the receipt to display all necessary data in a single, compact format.

Key Elements of a Well-Structured Receipt

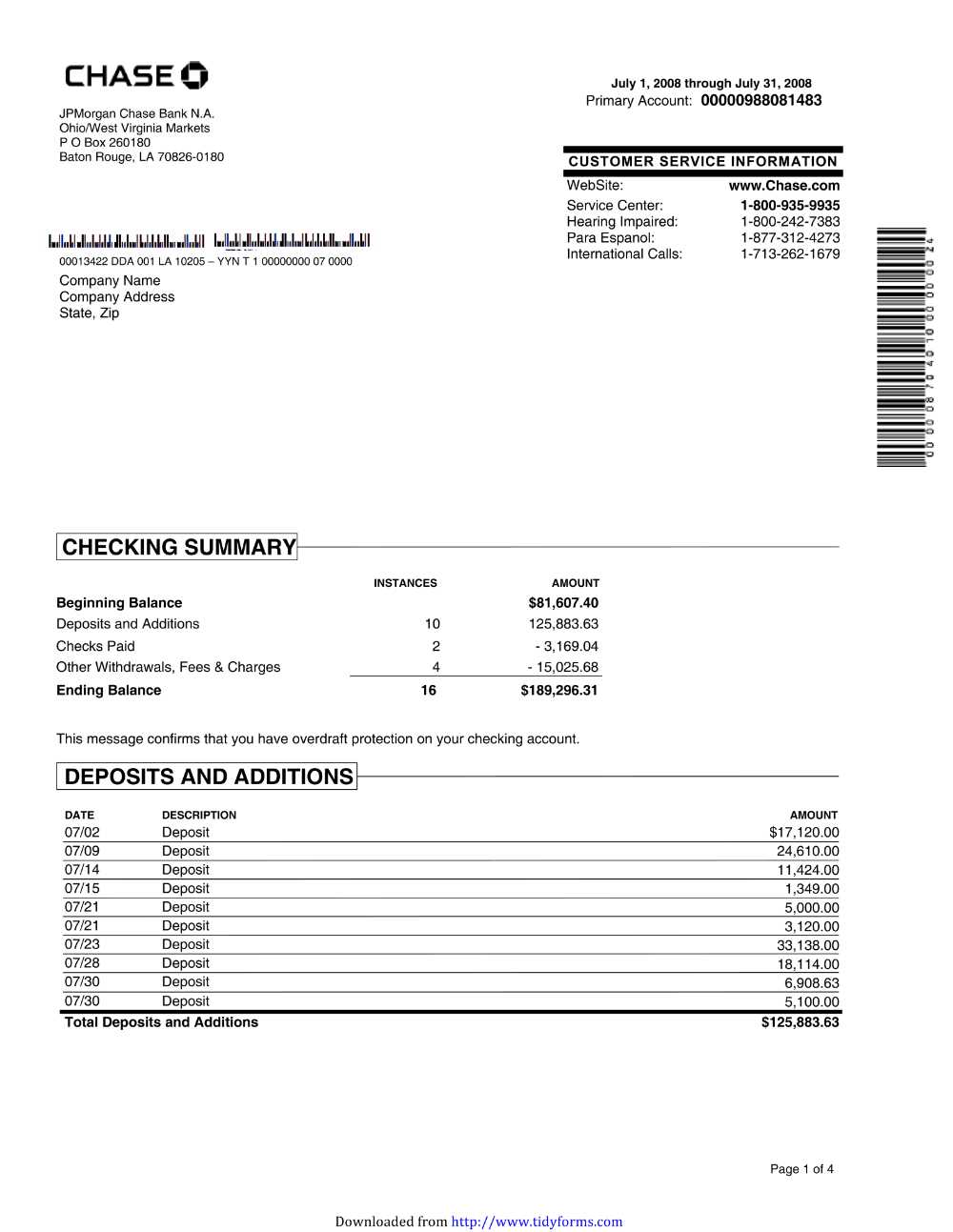

Keep transaction information well-organized by using tables. This allows for quick scanning without the need for repeated entries.

| Transaction Date | Amount | Payment Method |

|---|---|---|

| February 13, 2025 | $150.00 | Credit Card |

By grouping related data in a table, you reduce the chance of unnecessary repetition while maintaining clarity. This also enhances readability, ensuring the user can quickly find the most important details.

Data Organization Tips

Place essential information like the date, amount, and payment method in separate columns. Avoid including extra sections unless they add new, non-repetitive value to the template. This will allow for a compact receipt without sacrificing necessary details.

Wells Fargo Receipt Template: A Practical Guide

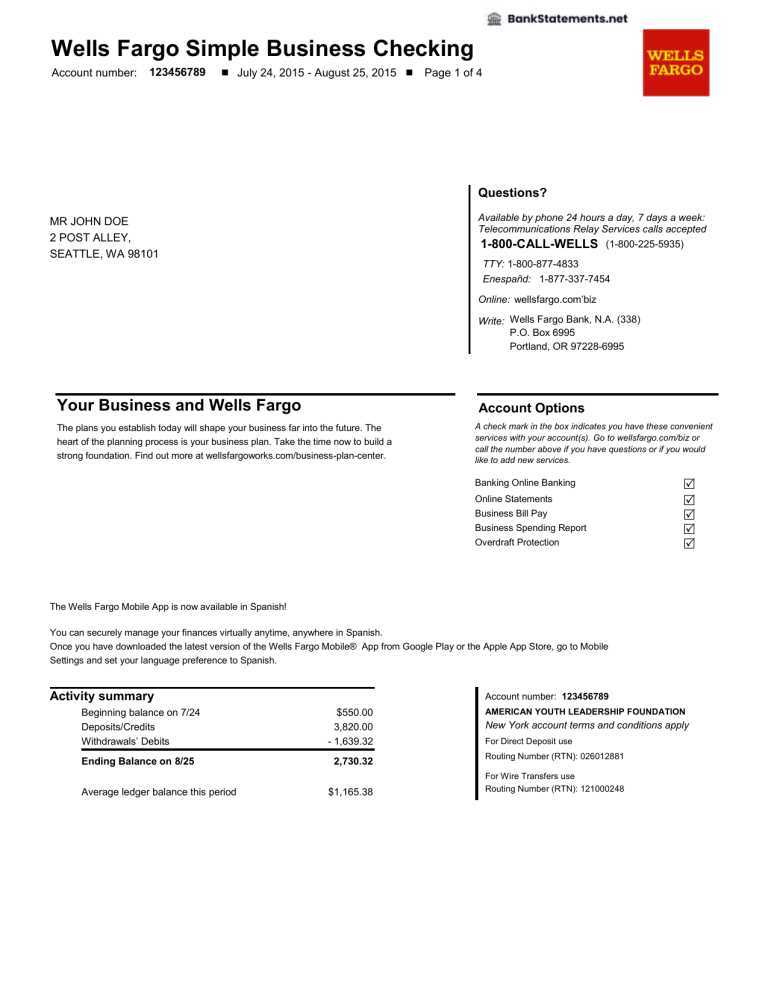

Creating a Wells Fargo receipt template involves setting up a clear structure that includes all necessary details for transactions. To build an effective receipt, include these key elements:

- Transaction Date: Ensure the date is clearly displayed at the top.

- Receipt Number: Use a unique identifier for each receipt.

- Account Holder Information: Include the name and account number of the person making the transaction.

- Transaction Details: Provide a breakdown of the transaction, including the type (deposit, withdrawal, transfer) and amount.

- Location of Transaction: Specify where the transaction took place (branch or ATM).

- Bank Contact Information: Include a phone number or email address for customer service.

- Transaction Fee (if applicable): If there’s a fee, include the exact amount.

Steps to Customize Your Template

To create a personalized Wells Fargo receipt template, follow these steps:

- Select a template tool or program that supports text and image editing (e.g., Word, Google Docs, or specialized receipt software).

- Input the necessary elements mentioned above in their respective places. Start with the header for easy identification.

- Ensure that the font and layout are clean and professional to make reading easier for the customer.

- Consider adding the bank’s logo for branding consistency, if applicable.

- Save your template as a file type that can be easily edited and printed, such as PDF or DOCX.

Final Considerations

Before using your Wells Fargo receipt template, review the information for accuracy. Mistakes in the transaction amount or account details can lead to confusion. Additionally, keep the template updated with any changes in bank policy or transaction fee structures.

To create a customized Wells Fargo receipt, use a reliable template that closely resembles the format of the official receipt, but with room for your adjustments. Here’s how to proceed:

1. Choose a Template

Select a customizable template online that allows input for necessary fields like transaction date, amount, and recipient details. Look for templates with editable sections so you can add or remove information as needed.

2. Adjust Transaction Details

Modify the template to match the specifics of your transaction. Input the correct date, transaction number, and amount. Ensure the merchant’s name and your information are accurate.

Double-check all the entries before saving or printing the document. This helps in ensuring the accuracy of your customized receipt, making it valid for personal use. Save your customized version as a PDF for easy storage and sharing.

To begin editing a Wells Fargo receipt, first determine the format you have: Word or PDF. Each format requires a different approach for editing, so follow the appropriate steps below.

Editing in Word

If your Wells Fargo receipt is in Word format, follow these steps:

- Open the file in Microsoft Word by double-clicking it.

- Locate the section that needs to be edited, such as payment details, date, or transaction description.

- Highlight the text you want to change, and simply type in the new information.

- Adjust formatting if necessary (font size, bold, italics) to match the receipt’s original style.

- Save the file when you’re finished. Click “File” and select “Save” or “Save As” to ensure your changes are preserved.

Editing in PDF

For PDFs, the process is slightly different due to the format’s nature:

- Open the PDF in a PDF editor, such as Adobe Acrobat or any free online PDF editor.

- Use the “Edit” tool to select the text you need to modify.

- Edit the text by typing the new information in the highlighted area.

- Insert or delete content as needed by using the PDF editor’s available options for adding text boxes or erasing elements.

- Save your changes by clicking “File” and then “Save” or “Save As” to ensure your edits are applied.

If you encounter restrictions in editing the PDF, you may need to convert the file to Word or use OCR (Optical Character Recognition) software to extract editable text.

Ensure the template matches the transaction type. Using a generic receipt for specific transactions like refunds or partial payments can lead to confusion. Each type of transaction may need distinct fields such as refund amounts, original purchase details, or item condition. Be specific in what the template includes.

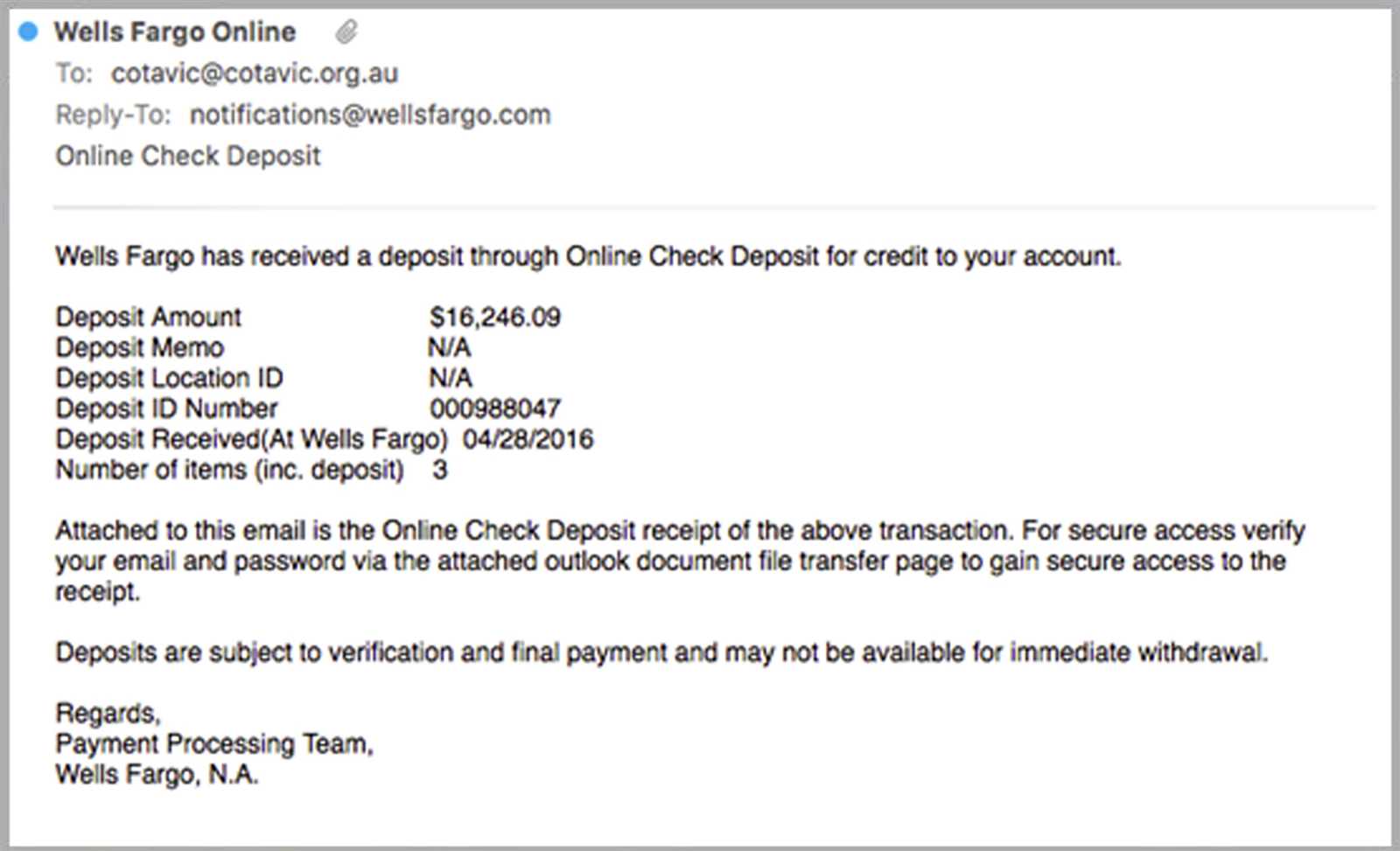

Incorrect Information

Double-check all details before finalizing the receipt. Incorrect amounts, dates, or buyer information can cause issues for both the seller and the customer. Cross-reference the template with the transaction details to avoid these mistakes.

Overlooking Customization

Don’t neglect to customize the receipt template with your business logo, address, and other branding elements. A template without these details can look unprofessional and may make it difficult for customers to contact you if they need to resolve issues.

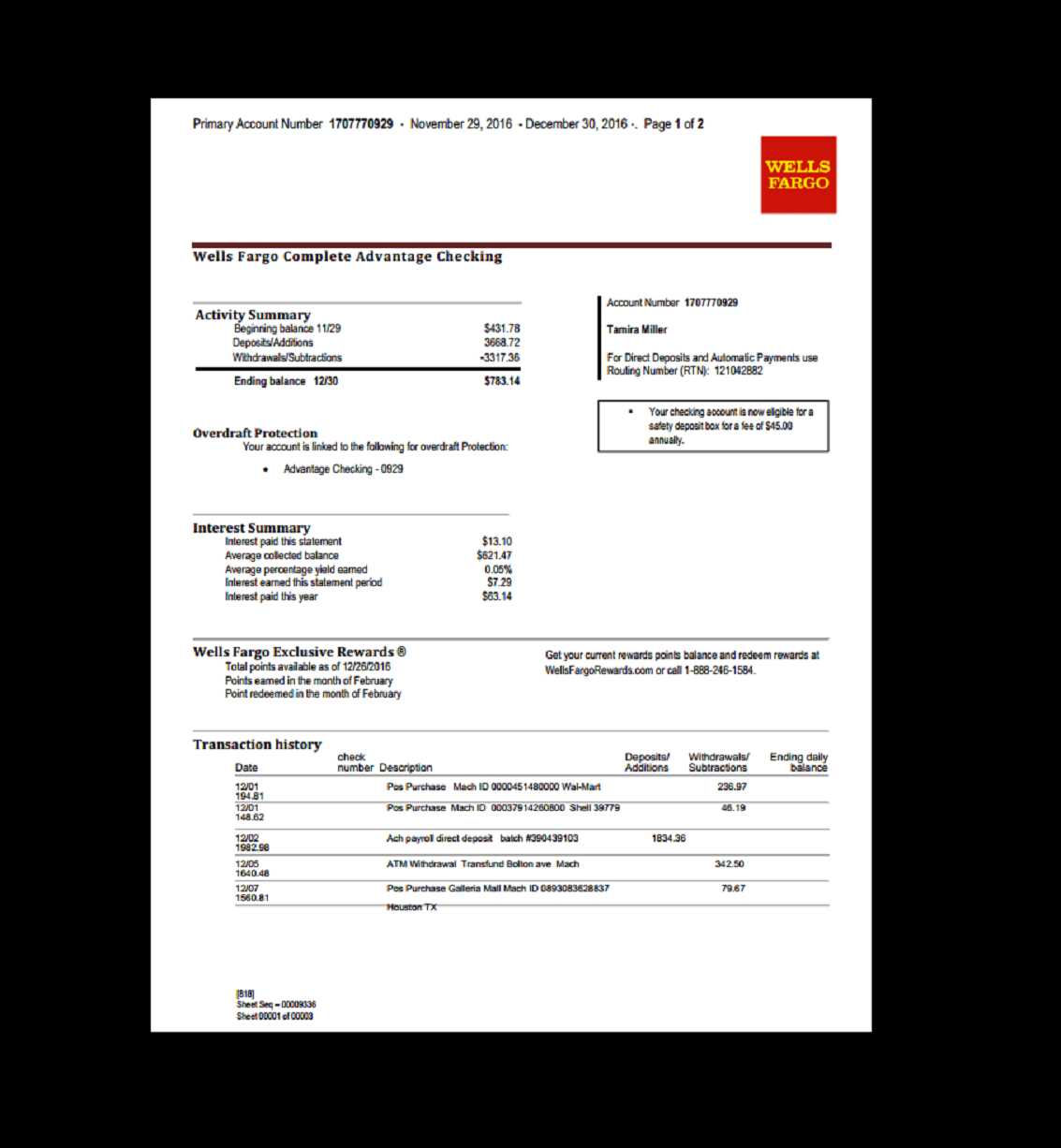

Another common error is not ensuring the template accommodates various payment methods. If you accept checks, cards, or cash, your receipt should reflect the payment method used. Failing to do so can complicate tracking and reporting.

Always test the receipt template before widespread use. Test for layout issues or missing information that may not appear clearly when printed or saved as a PDF. This helps avoid errors when you issue the receipt to customers.

For a streamlined and clear presentation, make sure each receipt element is properly listed in your template. The ordered list format is a great way to achieve this organization. Structure your receipt with the following key details:

Receipt Details

- Transaction Date: Clearly specify the date of the transaction.

- Itemized List: Include each purchased item with its description, quantity, and price.

- Total Amount: Clearly display the total amount after taxes and discounts.

- Payment Method: Specify the method of payment, such as credit card or bank transfer.

- Transaction ID: Include a unique ID for tracking and reference purposes.

Formatting Tips

Make sure to align the text neatly and use bullet points or numbering to make each section easy to read. This approach keeps receipts clean and ensures all necessary data is easy to follow.