Key Details to Include

Every wire receipt should contain essential transaction details to ensure accuracy and security. Missing or incorrect information can cause delays or errors in processing.

- Transaction ID: A unique identifier for tracking.

- Sender and Recipient Information: Full names and bank details.

- Amount and Currency: Specify the exact sum and currency type.

- Transfer Date: The date when the transaction was initiated.

- Reference Number: Used for verification.

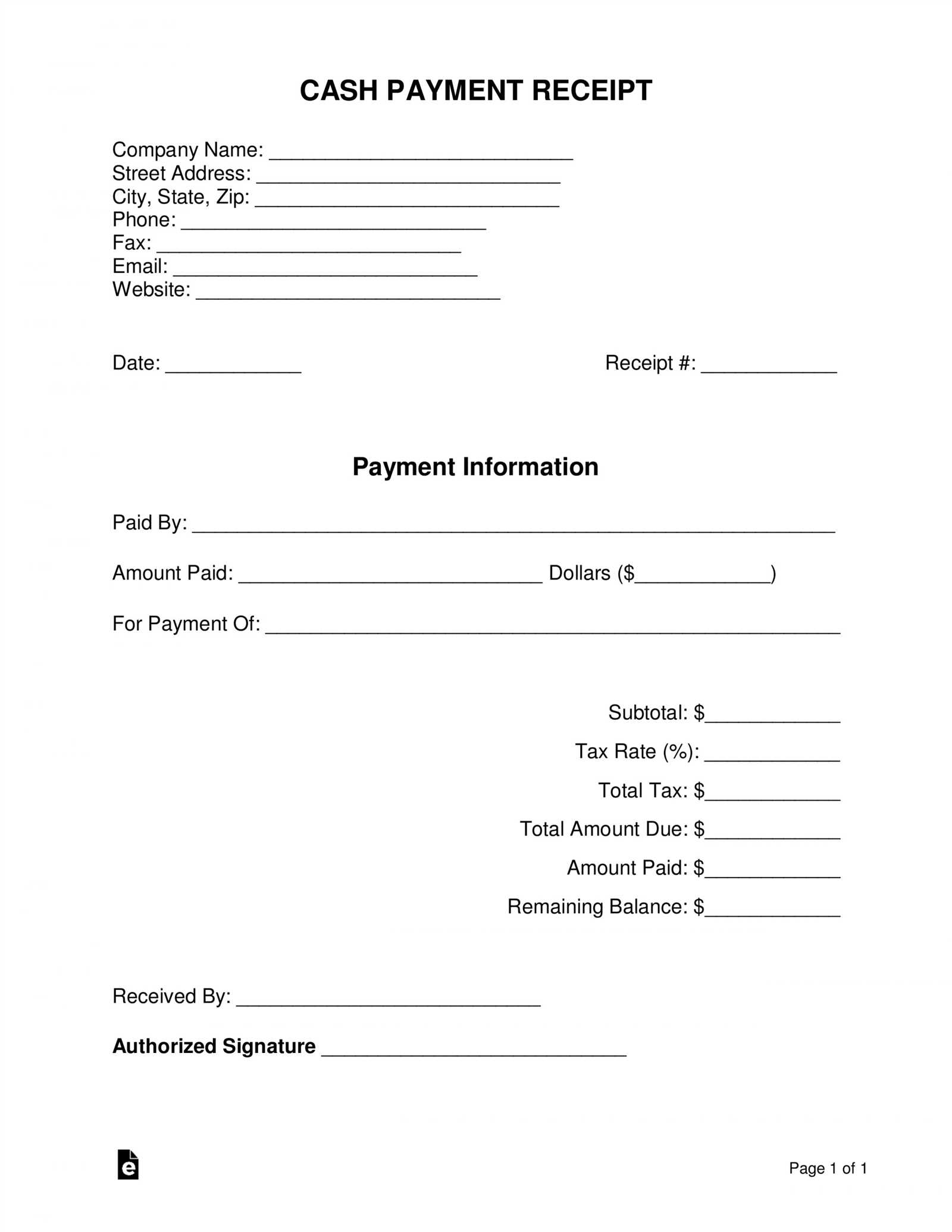

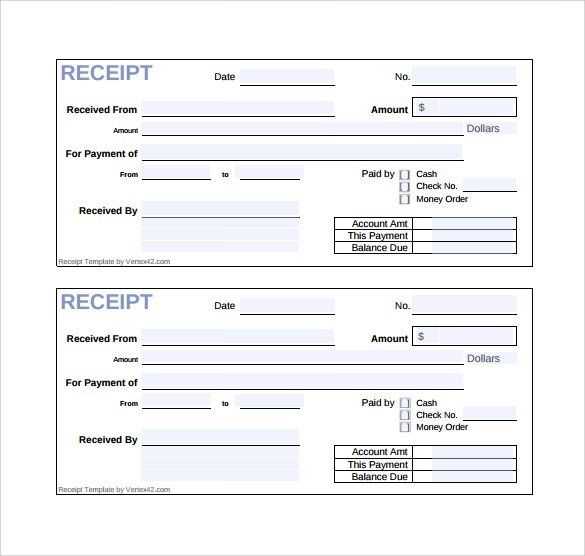

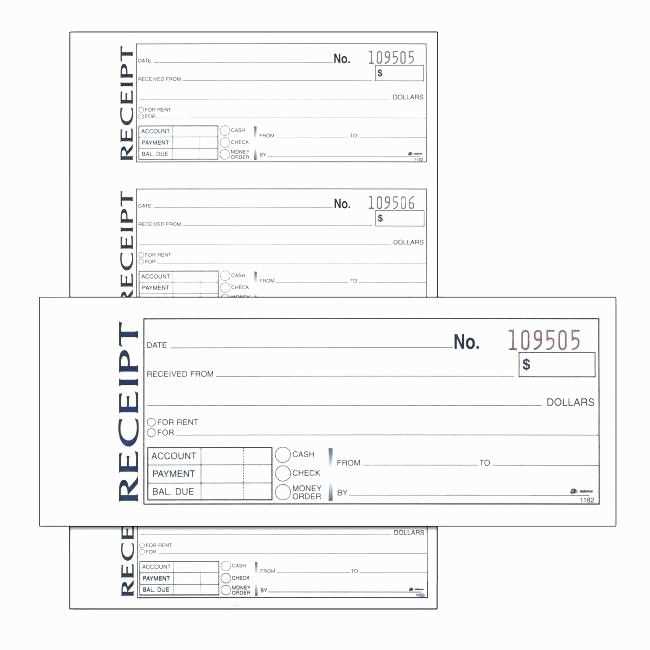

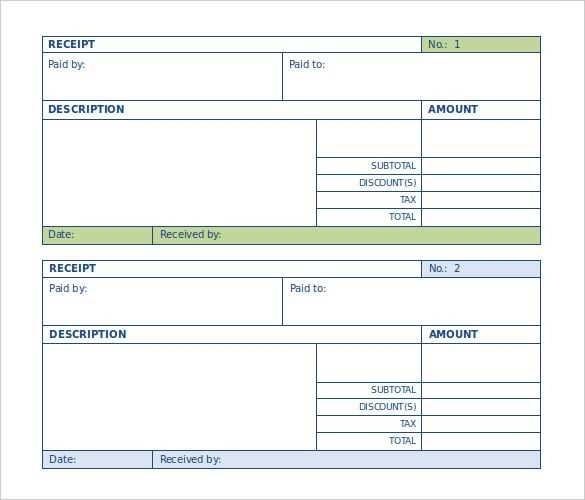

Sample Wire Receipt Template

Use the following template to structure your wire receipts effectively:

Wire Transfer Receipt ------------------------------------------------------ Transaction ID: [Unique Transaction Number] Date: [Transfer Date] Sender: [Full Name] | [Bank Name] | [Account Number] Recipient: [Full Name] | [Bank Name] | [Account Number] Amount: [Transfer Amount] [Currency] Reference: [Payment Reference] Notes: [Additional Information] ------------------------------------------------------

Why Standardized Receipts Matter

Using a structured wire receipt minimizes disputes, ensures transparency, and simplifies record-keeping. Banks and financial institutions rely on these details to process and verify transactions efficiently.

Best Practices for Accuracy

Before finalizing a wire transfer, double-check all details to prevent errors. Always request a confirmation from the recipient to verify that the funds have arrived as expected.

Wire Receipt Template: Key Aspects and Practical Application

Ensure every wire receipt includes the sender’s and recipient’s full legal names, account details, transaction reference number, transfer date, and the exact amount. Missing any of these details can cause processing delays or disputes.

Mandatory Elements in a Transfer Receipt

Include a unique transaction ID, financial institution details, currency type, and a breakdown of fees. Specify the purpose of the transfer for clarity. Double-check all numbers to prevent errors.

Legal Compliance and Standard Structure

Align the template with financial regulations by incorporating all legally required elements. Confirm compliance with jurisdiction-specific laws to avoid regulatory issues. Retain records for the necessary duration as mandated by financial authorities.

Security Measures to Prevent Fraud

Use encryption for digital receipts and verify all recipient details before finalizing a transaction. Avoid sharing sensitive information via unsecured channels. Cross-check account numbers to prevent misdirected funds.

Customization for Business and Personal Use

Businesses should include tax-related fields, invoice references, and additional sender details. Personal transactions may require fewer details but should still ensure accuracy and transparency.

Digital vs. Paper Receipts: Advantages and Drawbacks

Digital receipts provide instant access, easy storage, and automated verification. Paper receipts offer a physical backup but risk damage or loss. Choose based on security, accessibility, and record-keeping preferences.

Frequent Errors in Drafting a Wire Receipt

Common mistakes include incorrect recipient details, missing transaction references, and failing to specify the transfer purpose. Avoid vague descriptions, double-check all entries, and confirm compliance with banking standards.