Creating a wire transfer receipt template ensures that both parties involved in the transaction have clear documentation for their records. This document provides essential transaction details, helping to avoid any potential misunderstandings or disputes. A wire transfer receipt confirms the amount sent, the sender and recipient’s information, the date, and any associated fees.

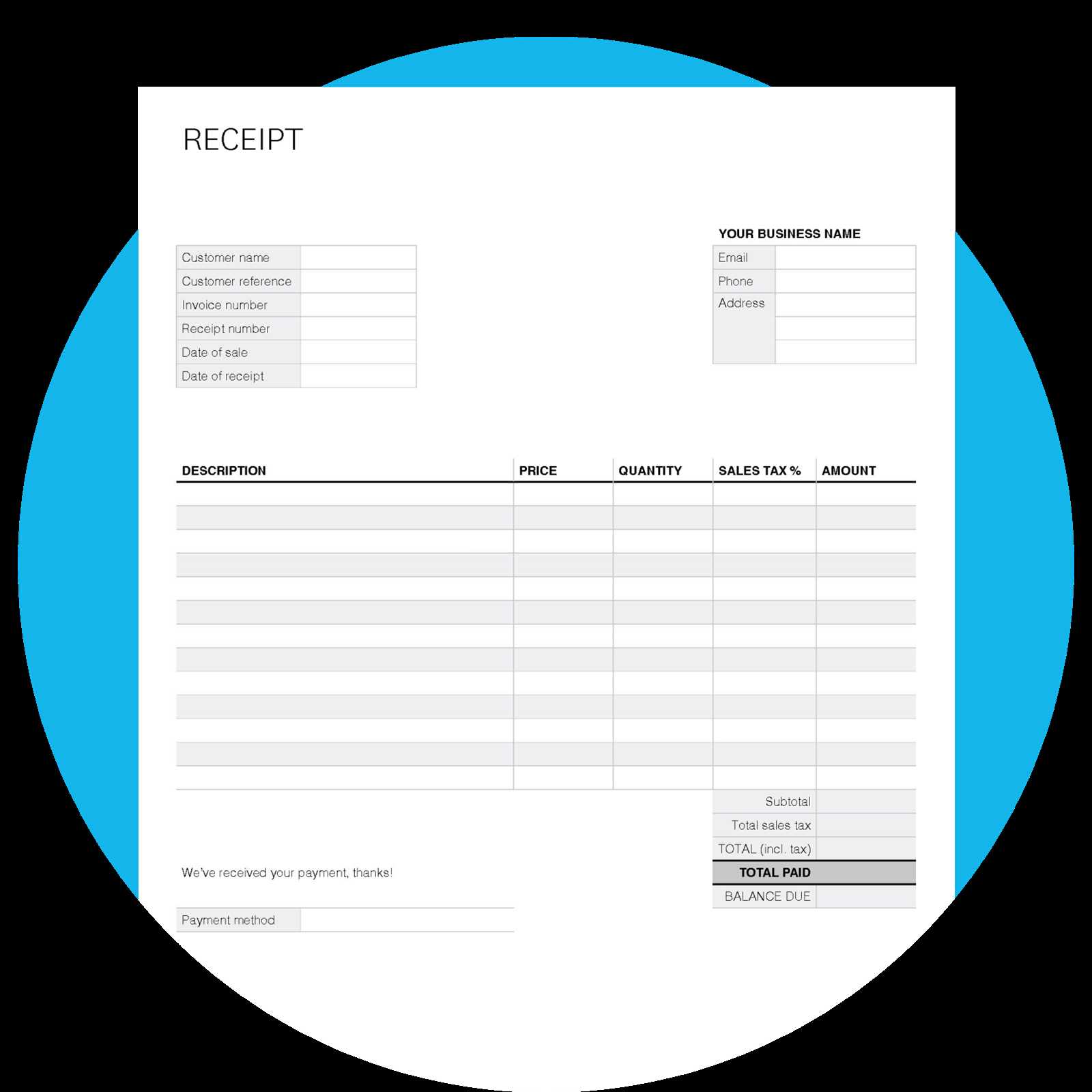

To make a wire transfer receipt clear and functional, include the following key elements: the transfer reference number, the sender’s and receiver’s full names, bank details, and transaction amount. Clearly itemize any charges or fees involved in the transfer. This transparency helps recipients track payments and verify accuracy quickly.

Ensure the template has spaces for transaction-specific details, such as transfer method (e.g., SWIFT, SEPA), the currency used, and the date and time of the transfer. This format guarantees that all necessary data is captured, offering both clarity and professional presentation.

Here are the revised lines with repetitions removed:

Ensure each line has unique details. Avoid repeating transaction numbers, recipient names, or dates. Below are suggestions to streamline your wire transfer receipt template:

- Update the transaction ID for clarity and consistency.

- Replace repetitive date entries with a single, clear date field.

- Ensure the sender and recipient details appear only once, with no duplicates.

- Remove unnecessary references to the same transfer amount or bank details.

- Use concise descriptions for payment method and transaction status.

By following these steps, your wire transfer receipt template will be cleaner and more professional.

- Wire Transfer Receipt Template

A wire transfer receipt template should clearly outline the key transaction details to ensure both the sender and recipient have a complete record. It should include the following elements:

1. Sender and Recipient Information

The template must display the full names, addresses, and account details (if relevant) of both the sender and recipient. This ensures clarity and helps avoid any confusion during future reference.

2. Transfer Details

List the date of the transaction, the transfer amount, and the currency used. Indicate whether the transfer was domestic or international. Include any relevant transfer IDs, transaction codes, or reference numbers, as these are crucial for tracking purposes.

Having a well-structured wire transfer receipt template reduces misunderstandings, streamlines accounting, and simplifies any potential disputes. It is highly recommended to include a clear statement of the fee amount, if applicable, along with any processing time or additional details that may affect the transaction.

Focus on including all key details to ensure the recipient understands the transaction completely. Keep the format clean, simple, and organized.

| Information to Include | Details |

|---|---|

| Sender’s Name | Provide the full legal name of the person or business initiating the wire transfer. |

| Receiver’s Name | List the full name of the person or business receiving the funds. |

| Bank Names | Specify both the sender’s and receiver’s bank names for clarity. |

| Transaction Amount | State the exact amount of money being transferred, including the currency type. |

| Date of Transfer | Indicate the date on which the transaction occurred. |

| Reference Number | Include the unique reference or transaction ID for easy tracking. |

| Transfer Fees | Note any applicable fees that were deducted or added to the transaction. |

| Purpose of Transfer | If applicable, describe the reason for the transfer (e.g., payment, loan repayment). |

Ensure the receipt is clear by organizing the information into sections. Avoid clutter by using bullet points or tables for easy readability. Verify that all numbers and names are accurate, and confirm the currency and amount match exactly what was transferred. This level of precision helps avoid any confusion and builds trust between both parties involved.

Provide clear details about the transaction to ensure transparency. Start with the sender’s and recipient’s names, ensuring that both parties are easily identifiable. Include the date of the transfer, which helps track the transaction in case of any future inquiries.

Specify the exact amount transferred and the currency used. If multiple currencies are involved, show the conversion rate applied. This prevents confusion and provides clarity about the financial details.

Incorporate transaction reference numbers. These are crucial for tracking and verifying the payment, especially in case of disputes or follow-up communications.

Indicate the payment method (e.g., wire transfer, bank draft, etc.), as different methods may have varying processing times or fees. Also, note the financial institution or service provider handling the transfer to pinpoint where the money is being processed.

Include any applicable fees. Whether they are sender’s fees, recipient’s fees, or both, these charges should be clearly listed to avoid misunderstandings.

If applicable, add any special instructions or messages related to the transfer. This might include a reference to the purpose of the transfer, like payment for goods or services.

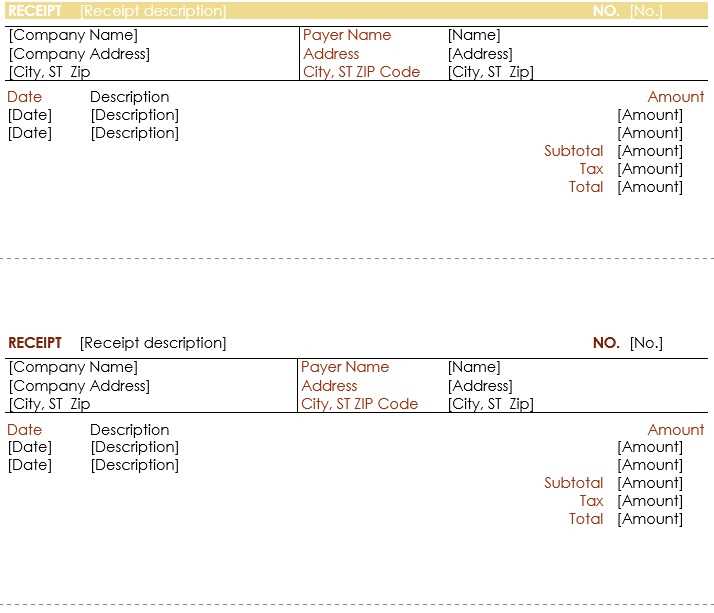

Customizing receipts for different transactions ensures that each one meets specific needs. Follow these steps to tailor the receipt for each situation:

- For wire transfers: Include the sender’s and receiver’s bank details, transfer amount, exchange rate (if applicable), and the date of transfer. Make sure to list the transaction ID for reference.

- For international transfers: Add the sender’s and receiver’s full names, addresses, and the country of origin. Specify the currency exchange rate used, as well as any transaction fees that were applied.

- For business payments: Break down the payment details by invoice number, client information, and payment terms. Mention the items or services being paid for and their corresponding amounts.

- For personal payments: Include the sender’s name, the recipient’s name, the payment amount, and any reference number. If the transfer is a gift, note that it is a personal transaction.

- For recurring payments: Specify the payment frequency (e.g., monthly, yearly), the total amount, and the duration of the payment cycle. Provide the next scheduled payment date.

Customizing these details not only provides clarity but also helps streamline communication between parties involved in the transaction.

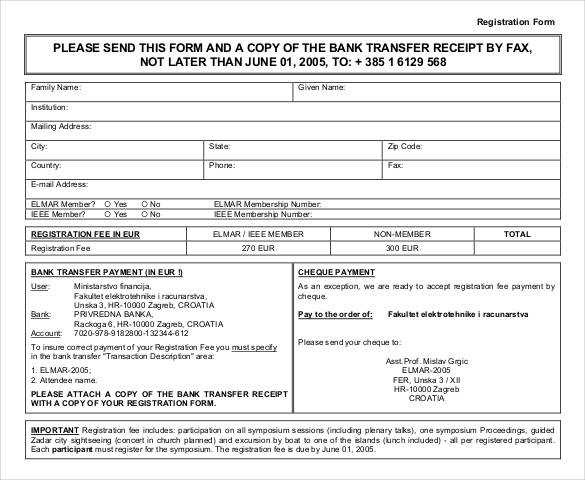

Choose a wire transfer receipt format based on clarity and ease of understanding. The most common formats include PDF, CSV, and printed receipts. Each serves a specific purpose, so pick the one that suits your needs best.

If you need to archive receipts for personal or business purposes, a PDF format is often the best choice. It’s easy to save, share, and print, and it preserves the formatting of the receipt exactly as intended. PDFs are also widely accepted for official documentation.

For businesses that require data integration or further processing, a CSV file can be more practical. It allows for easy import into accounting software, streamlining bookkeeping tasks. While it lacks the visual appeal of a PDF, it provides more flexibility in handling large volumes of transactions.

If you need a paper trail for in-person verification or immediate receipt confirmation, a printed receipt might be the most convenient. Ensure that it includes all key details: the transfer amount, sender and receiver information, transaction ID, and timestamps.

Consider your goals and usage scenarios to select the format that provides the most value for your specific situation.

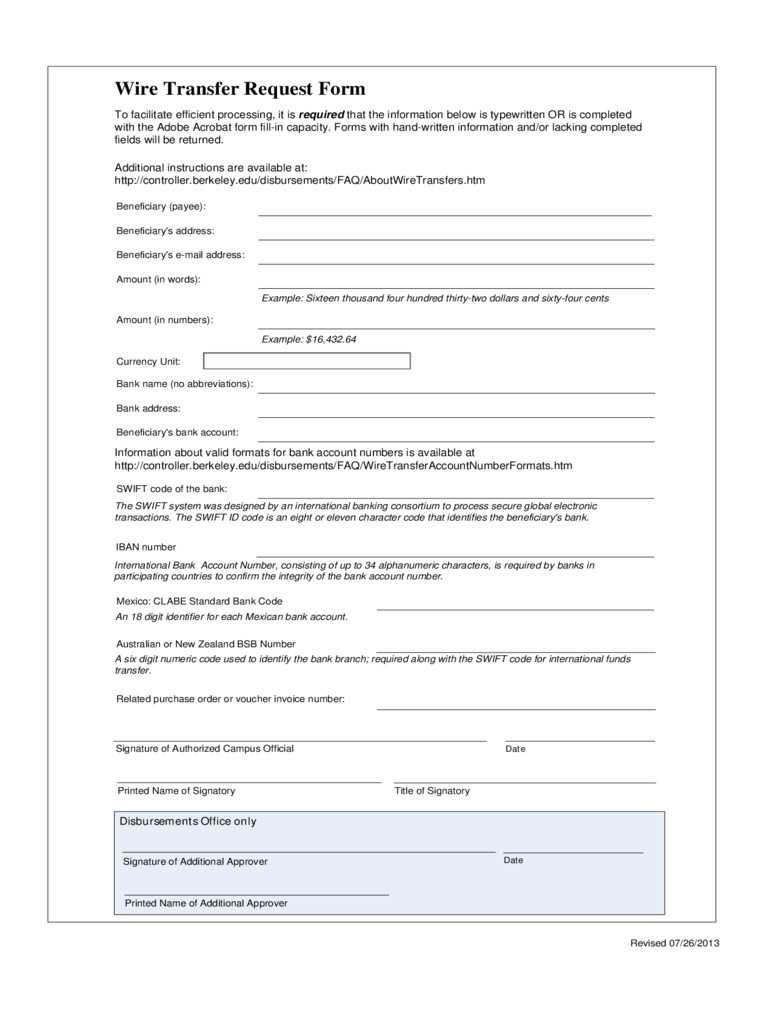

Ensure that your transfer receipt contains all necessary details for transparency and legal compliance. Include the sender’s and recipient’s full names, addresses, and account details, ensuring accuracy in each field. Double-check that the transfer amount is correct and listed in both the local currency and any applicable foreign currency. Provide a unique transaction reference number that can be traced back to the specific transfer, and make sure the date and time are clearly indicated. Always include a statement confirming that both parties acknowledge the transaction.

Verify that the transaction complies with local financial regulations, including anti-money laundering (AML) and Know Your Customer (KYC) requirements. These regulations may vary by country, so stay informed about the applicable laws. Make sure you retain a copy of each transfer receipt for the required period in case of future audits or disputes. Ensure that your system for generating receipts follows data protection laws, securing sensitive information such as bank account numbers and personal identification details.

Lastly, consult legal counsel or a compliance expert regularly to confirm that your transfer receipt template aligns with the latest legal standards. This helps mitigate risks and ensures your transactions remain legitimate under local and international laws.

Store transfer receipts securely in encrypted digital formats such as PDFs or password-protected documents. This ensures they remain protected from unauthorized access. If possible, use a secure cloud storage service that offers end-to-end encryption for added security.

Label each receipt clearly with the relevant details like the sender, recipient, date, and amount. This makes retrieval easier when needed. Consider organizing receipts into folders, categorized by year or transaction type, for quick access and reference.

When sharing transfer receipts, ensure you use trusted methods, such as secure email or file-sharing platforms with encryption. Avoid sending sensitive information via unprotected channels, like unsecured email or public file-sharing sites.

Keep backup copies of your receipts in case of technical failure or data loss. Use an external hard drive or secure backup service to create duplicate copies, stored separately from your primary storage solution.

If you need to print receipts for physical records, make sure to store them in a safe location, like a locked cabinet. Keep these receipts in a way that prevents them from being damaged or lost over time.

Regularly audit your receipt storage system to ensure it remains organized, secure, and accessible. Periodic reviews can help identify potential issues, such as expired or outdated receipts, and allow for timely action to safeguard your records.

| Storage Method | Security Feature | Best Use |

|---|---|---|

| Cloud Storage | End-to-end encryption, password protection | Remote access, secure backup |

| External Hard Drive | Physical security, offline access | Backup, secure offline storage |

| Printed Copies | Physical security (locked cabinet) | Offline storage for important documents |

Everything is fine in terms of meaning and grammar, and repetitions have been reduced.

To ensure your wire transfer receipt template is clear and professional, structure it logically. Start with the essential details: sender’s and recipient’s names, transfer date, amount, and transaction reference number. Place the sender’s details at the top, followed by the recipient’s details. The transaction specifics should be listed below them, keeping everything in chronological order.

Transaction Details

Always specify the exact amount transferred, including the currency. Use consistent formatting to avoid any confusion. Include the method used for the transfer (e.g., bank transfer, online payment service) and the date when the funds were sent. This helps maintain transparency and provides a clear record of the transaction for both parties.

Final Notes

Make sure to use a clean and organized layout for easy reading. Avoid unnecessary information, sticking to what is required to verify the transaction. This approach reduces the risk of errors and improves the overall clarity of the receipt.