Using a clear and structured work receipt template can save time and reduce errors when documenting completed tasks. This simple document ensures that both parties involved have a clear understanding of the work done and the terms agreed upon.

Start with basic details: include the date, description of the work, and payment terms. Be specific in describing the task to avoid misunderstandings later. A well-drafted work receipt helps establish trust and transparency between the service provider and the client.

Include essential elements such as the worker’s name, contact information, and a breakdown of the services provided. It’s also wise to list the agreed-upon rate, hours worked, and any extra costs or adjustments. This ensures that all information is clearly communicated and easily accessible for both parties.

Lastly, ensure that both parties sign and date the receipt. This final step validates the work completed and confirms agreement on all terms. Always keep a copy for your records as well, ensuring a smooth follow-up if needed.

Here’s a detailed plan for an informational article on “Work Receipt Template” with 6 practical, specific, and narrow subheadings in HTML format:Work Receipt Template

1. Key Components of a Work Receipt

A work receipt should include key details like the name of the service provider, client information, the date the work was completed, and a brief description of the service or work performed. It’s important to note the scope of work to prevent misunderstandings. Include any payment details, such as the total cost, applicable taxes, and payment methods used.

2. Customizing the Template for Specific Services

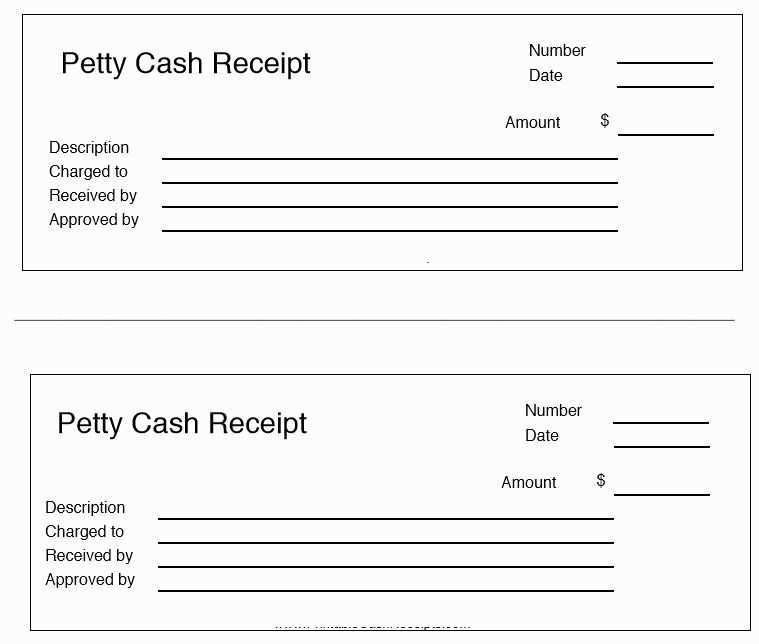

Each service might require specific sections in the receipt. For example, a mechanic might need to include the parts used, while a contractor could list the materials purchased. Ensure the template allows space for these unique elements to be added, improving clarity for both the service provider and client.

3. Ensuring Clear Payment Details

Be explicit about the payment amount, due date, and method of payment. If a partial payment is made or an installment plan is used, make sure to specify the amount paid and the remaining balance. This helps track payments and prevents confusion.

4. Legal Considerations in Work Receipts

Make sure the receipt complies with local laws and regulations. Some regions may require certain information to be included, like tax identification numbers or specific wording for warranty clauses. Always verify that the template adheres to these requirements to avoid potential legal issues.

5. Providing a Digital Version of the Work Receipt

Offer a digital version of the work receipt for easy storage and sharing. Whether via email or a downloadable PDF, having an electronic copy allows clients to keep a record of the transaction. Consider using online tools that automate the creation and delivery of digital receipts.

6. Using Templates for Consistency and Professionalism

A work receipt template ensures consistency across your business and enhances professionalism. Customizing it to your branding can further add to your business’s image. Using a consistent template also speeds up the process of issuing receipts and minimizes the risk of missing important details.

Understanding the Key Components

Focus on clarity and simplicity when creating a work receipt template. Make sure to include the following components for smooth functionality:

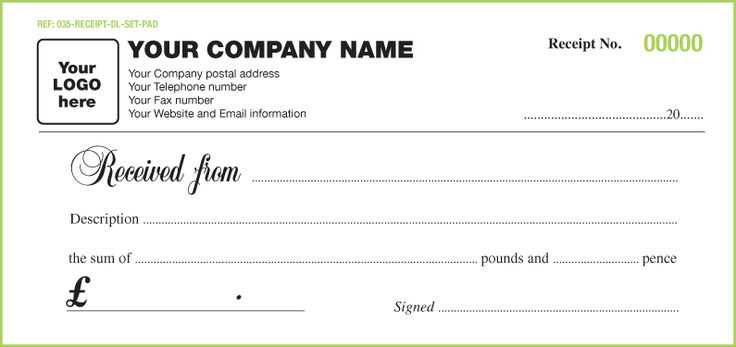

- Header: Clearly display the company name, logo, and contact details at the top.

- Date and Receipt Number: Ensure the date of the transaction and unique receipt number are visible for tracking.

- Recipient Information: Include the buyer’s or recipient’s name, address, and contact info for easy reference.

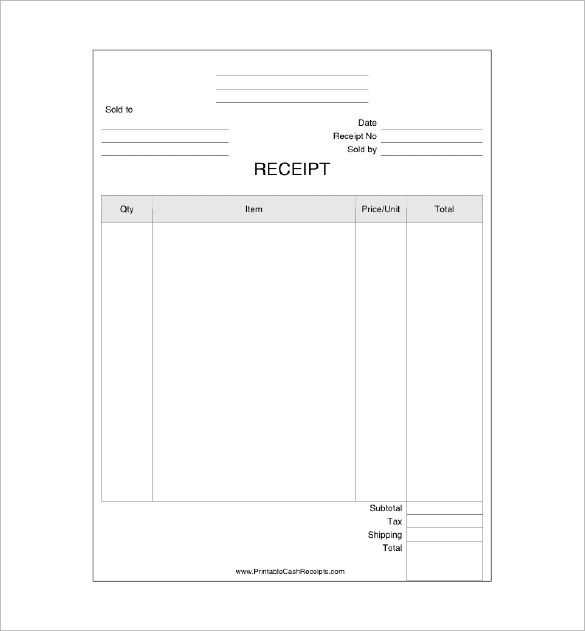

- Itemized List: List each item purchased or service rendered, with a description, quantity, and price. This should be clear and organized.

- Total Amount: Provide the total cost, including taxes and discounts, in a separate line for easy viewing.

- Payment Method: Indicate how the transaction was completed, whether by cash, card, or another method.

- Terms or Notes: Include any important details, such as return policies or warranties, in a clear section.

Keep these sections concise to avoid clutter, ensuring all the necessary details are easy to read and understand. This approach increases professionalism and helps both the buyer and seller keep track of transactions efficiently.

| Component | Details |

|---|---|

| Header | Company name, logo, contact details |

| Date and Receipt Number | Transaction date, unique ID |

| Recipient Information | Buyer’s name, address, contact |

| Itemized List | Description, quantity, price |

| Total Amount | Total cost including taxes and discounts |

| Payment Method | Cash, card, etc. |

| Terms or Notes | Return policies, warranties |

Explore the essential elements that make up a work receipt template, including sections such as date, services provided, and payment details.

A work receipt template must contain key sections to ensure it’s both functional and legally binding. Here’s a breakdown of the crucial components:

- Date: Include the exact date of the transaction. This helps both parties keep track of when the work was completed and the payment was made.

- Service Details: List the specific services provided, including a brief description of the tasks completed. If applicable, mention the duration or quantity of work done (e.g., hours worked or units delivered).

- Payment Information: Clearly state the total amount paid for the services, along with payment methods used (cash, credit, etc.). If there were any deposits or prepayments, note these as well.

- Contact Information: Include the contact details of both the service provider and the recipient. This ensures clarity in case of follow-up or future inquiries.

- Signature: Provide a space for both parties to sign, confirming the details of the transaction. This adds a layer of formality and legal value to the receipt.

These sections will ensure your work receipt template is clear, organized, and easy to reference when needed.

Customizing a Work Receipt for Your Business

Choose a template that fits your brand’s look and feel. Customize the header with your company’s logo, name, and contact details for a professional touch. Include fields for customer information such as name, address, and phone number, ensuring clarity and easy reference for future transactions.

Tailor the service description section to reflect the specifics of your business. Break down the services or products provided, including quantity, rate, and total. This will help prevent any confusion for both parties involved.

Make sure to include payment details such as accepted methods (credit card, cash, check) and payment terms. Providing clear due dates and any late fees will help set expectations upfront and avoid disputes.

Incorporate a section for signatures, ensuring both parties acknowledge the terms of the transaction. A well-defined work receipt should leave no room for ambiguity, making the process smoother for everyone involved.

Lastly, keep a consistent format across all receipts for easy tracking and reporting. The design should reflect your company’s professionalism and be easily adaptable for different services or products you offer.

Learn how to tailor a receipt template to suit your business needs, adding relevant fields and adjusting layout for clarity.

Begin by determining which details your receipt needs to capture based on your industry. If you’re in retail, include item descriptions, prices, taxes, and totals. For services, ensure the work description, service fees, and payment methods are visible. Adapt the template to reflect the specific terms your business uses, such as loyalty programs or discounts.

Organize fields logically for easy comprehension. Place key information like total amounts, dates, and business details at the top. For clarity, leave enough space between sections, and adjust font sizes for readability. If you use a digital receipt system, consider adding a QR code linking to your website or a digital copy of the receipt.

Don’t overcrowd the template with unnecessary fields. Focus on what your customers need to know. Add the necessary legal or tax information required by your country, but make sure it doesn’t overwhelm the primary content.

Lastly, review your template’s layout regularly to make sure it remains user-friendly and adaptable to new business needs. Adjust as you grow or add new services to keep the receipt clear and easy to read.

Common Mistakes to Avoid

Ensure all required information is included, such as the date, amounts, and clear item descriptions. Omitting these details can cause confusion and delays in processing. Double-check the accuracy of the amounts listed to prevent errors in payment. Even minor discrepancies can lead to significant issues later.

Use a consistent format throughout the receipt. Mixing different fonts, styles, or layouts can make the document look unprofessional and hard to read. Stick to a simple and clear structure for easy understanding.

Avoid leaving out any necessary signatures or approval fields. These are critical for verifying the transaction and can prevent future disputes or misunderstandings.

Refrain from using vague terms or abbreviations. Be as specific as possible about the goods or services provided, as this can help avoid any confusion or misinterpretation down the line.

Always proofread before finalizing the document. Small mistakes like typos or incorrect dates can undermine the receipt’s reliability and create unnecessary complications.

Identify and avoid common errors when designing work receipts, such as missing information or unclear terms.

Ensure that all fields on the work receipt are filled out correctly. Missing key details like the date, client name, or service description can create confusion and lead to disputes. Double-check all the information before finalizing the receipt.

Use clear and precise language. Avoid vague terms that might be interpreted differently by the client. For example, instead of saying “service provided,” describe the exact work completed, such as “installed new plumbing fixture.” This eliminates any uncertainty about what was done.

Include proper identification details. Make sure to list both your business name and contact information, as well as the client’s details. This helps in situations where follow-up or communication is necessary.

Clearly outline payment terms. Specify if taxes are included, any applicable discounts, or the total cost breakdown. Avoid terms like “to be determined” or “approximately,” as they can lead to misunderstandings later on.

Avoid cluttering the receipt with excessive or irrelevant information. Keep it simple, focusing only on the necessary details. Too much text or unnecessary sections might make it harder for the client to focus on the important points.

Finally, ensure readability. Use a consistent and legible font and maintain proper alignment for a clean layout. A messy receipt can create the impression of disorganization, even if the content is correct.

Best Practices for Organizing Information

Structure your data in a logical, easy-to-follow order. Start by grouping related details together. For example, keep financial data separate from personal information, and categorize items by type or purpose. This simplifies finding and managing information.

Use Clear Labels and Headings

Choose descriptive and concise headings. This allows users to identify key sections quickly. Avoid jargon or overly complex terms–clarity is key. Headings should reflect the content they precede, so users know exactly what to expect.

Consistency is Key

Establish a consistent format for organizing similar types of information. Whether you’re documenting expenses, tracking hours, or listing products, use the same layout throughout. Consistency reduces confusion and makes the document easier to navigate.

Discover effective methods for arranging work receipt data to ensure accuracy and ease of understanding.

Organize data chronologically to provide a clear timeline of events. Ensure that the most recent transactions are listed first to offer an intuitive reading experience.

Group similar information together. Categorize details like date, time, item description, and price in separate sections, allowing users to quickly find specific data.

Include references to related documents or previous receipts to allow easy cross-checking. Use hyperlinks or reference numbers where applicable for quick access to additional details.

Maintain consistency in formatting. Use the same structure for each entry, such as aligning dates, using the same font size for item descriptions, and bolding totals for better visibility.

Double-check for accuracy by reviewing the data after input. Ensure that all amounts, dates, and other crucial details are correct to avoid errors that could cause confusion.

Incorporating Legal Requirements

Ensure that your work receipt template includes the following legal elements to stay compliant with relevant regulations:

- Company Information: Include the full legal name, business address, and contact details of your company. This ensures transparency and provides a point of contact in case of disputes.

- Employee or Client Details: Clearly identify the individual or entity receiving the work. Include their name, address, and relevant identification numbers, such as employee or customer ID.

- Date and Time: The receipt must specify the date and time the work was completed or services were provided. This is crucial for record-keeping and legal reference.

- Detailed Description of Work: Provide a breakdown of the tasks completed or services rendered. This should be specific, including quantities, hours worked, and rates, if applicable.

- Payment Terms: Specify the amount due, payment method, and payment schedule. Include details of any taxes, discounts, or fees that apply to the transaction.

- Signatures: Include spaces for the signatures of both parties to confirm the agreement. This may be necessary in some jurisdictions to validate the receipt.

- Terms and Conditions: Add any relevant terms of service, warranties, or disclaimers. Ensure these terms comply with local consumer protection laws.

Adhering to these legal requirements helps minimize the risk of disputes and ensures your receipts are legally valid.

Understand how to integrate necessary legal clauses and requirements into your receipt templates to stay compliant.

Ensure your receipt templates include the correct legal elements, such as business registration details, tax identification numbers, and return policies. Specify refund conditions clearly to protect both the business and the customer. If your transactions involve specific regulations, such as consumer protection laws or industry standards, incorporate those stipulations into your template.

Clearly state the price breakdown, including taxes, service fees, or any other applicable charges. In some regions, receipts must list taxes separately to comply with tax reporting requirements. If your business offers warranties or guarantees, include this information to meet legal obligations and enhance transparency.

Always review the receipt against your local regulations, as some jurisdictions may require specific language or disclosures. Keep templates updated as laws change to prevent compliance issues.

Streamlining Work Receipt Generation with Digital Tools

Using digital tools for work receipt generation eliminates manual errors and speeds up the process. Switch to software solutions that allow quick input and automatic formatting to create consistent, professional receipts. Tools like receipt generators let you customize templates with fields for work details, payments, and signatures.

Automating data entry reduces the chance of mistakes and saves time. With integrated systems, receipts can pull data directly from invoicing or CRM platforms, ensuring accuracy across all business documents. This minimizes the need for re-entry and streamlines the workflow.

Cloud-based options offer the benefit of access from anywhere, enabling quick updates and real-time collaboration. You can also store receipts securely in the cloud for easy retrieval, keeping them organized and safe from physical damage.

For businesses with high transaction volumes, batch processing can generate multiple receipts at once, further reducing administrative workload. Choose tools that offer export options to popular formats like PDF or Excel to facilitate easy sharing and archiving.

Adopting digital receipt generation not only speeds up operations but also enhances professionalism and reliability, helping businesses maintain organized records and a positive reputation with clients.

Explore digital solutions that can simplify and speed up the creation of work receipts, from software to automation options.

Start using receipt creation software that allows users to quickly input details and generate professional-looking receipts. Many solutions offer templates and customization options to ensure the receipt fits specific needs. Look for software with features like auto-fill for frequent clients, batch processing for multiple receipts, and cloud storage for easy access.

Software for Receipt Creation

Popular software tools such as QuickBooks, FreshBooks, and Zoho Invoice can help streamline the receipt process. These platforms allow users to create receipts instantly by entering the necessary information and applying predefined templates. Integration with payment systems can automate the process further, reducing manual input.

Automation Features

Automation tools can minimize the time spent on repetitive tasks. Use software that can automatically generate receipts after each transaction, send them to clients, and store them securely. Consider integrating invoicing and receipt generation with your business’s point-of-sale (POS) or payment system. This can automatically trigger receipt creation when payments are made.

| Feature | Benefit |

|---|---|

| Templates | Speeds up receipt creation with predefined layouts |

| Auto-fill | Reduces time spent entering customer details |

| Cloud Integration | Provides easy access to receipts from anywhere |

| Batch Processing | Creates multiple receipts at once for increased productivity |

For businesses looking to go further, consider integrating automated workflow tools like Zapier or Integromat. These tools can trigger receipt creation and even send follow-up emails to customers without manual intervention, making the process faster and more efficient.