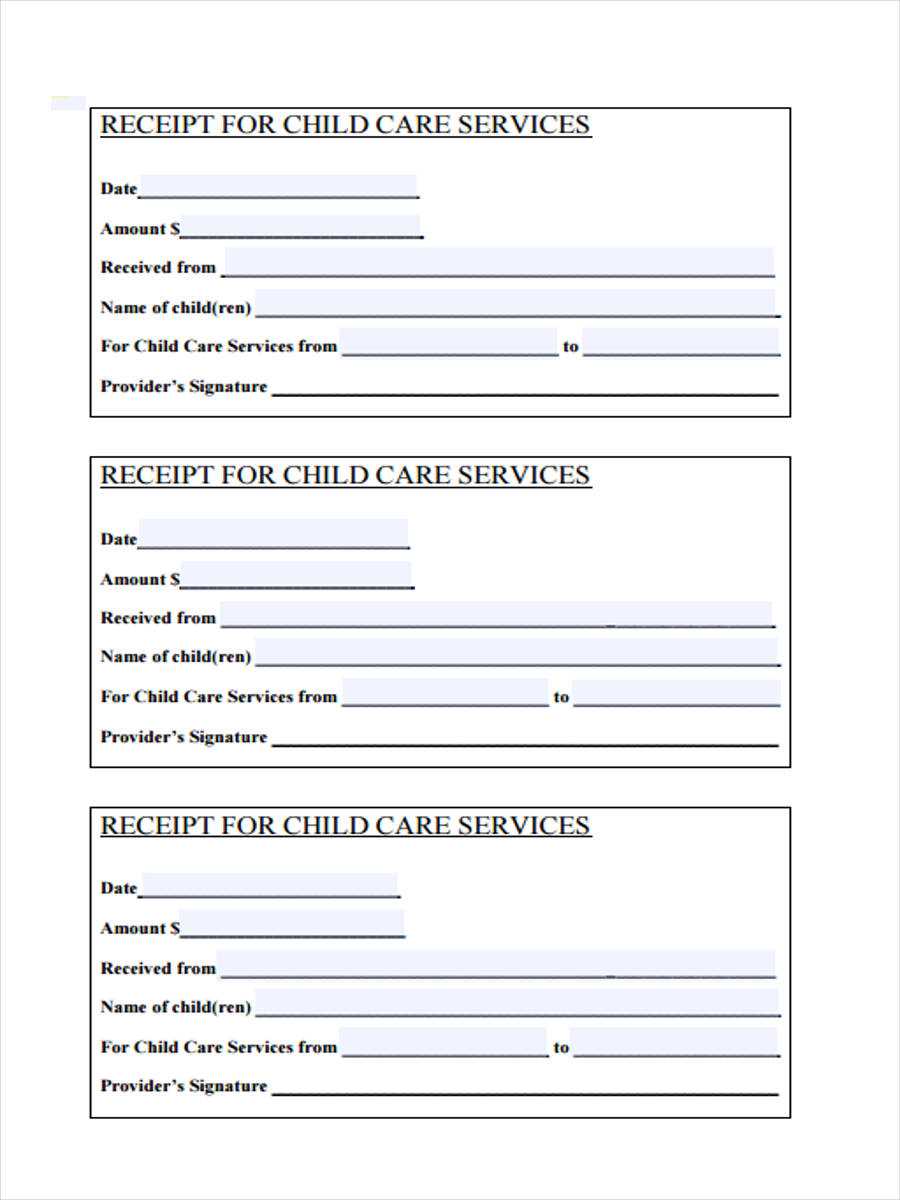

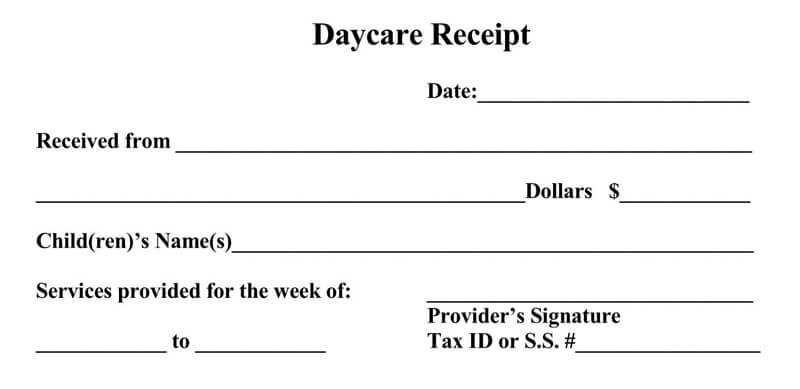

To streamline your year-end tax filing, create a clear and detailed child care receipt that includes the essential information. Start by listing the child’s name, the provider’s details, and the total amount paid for care services throughout the year. This ensures all necessary information is captured accurately.

Include the provider’s tax identification number (TIN) or Social Security number (SSN) to avoid delays when claiming deductions. Additionally, document the dates when services were provided and break down the amount paid per session, if possible. This helps clarify the full scope of services rendered.

Consider using a template that allows for easy updates, making the process smoother for the following year. A well-organized receipt can save you time and prevent potential issues with tax authorities down the road.

Here’s the corrected version where each word repeats no more than 2-3 times:

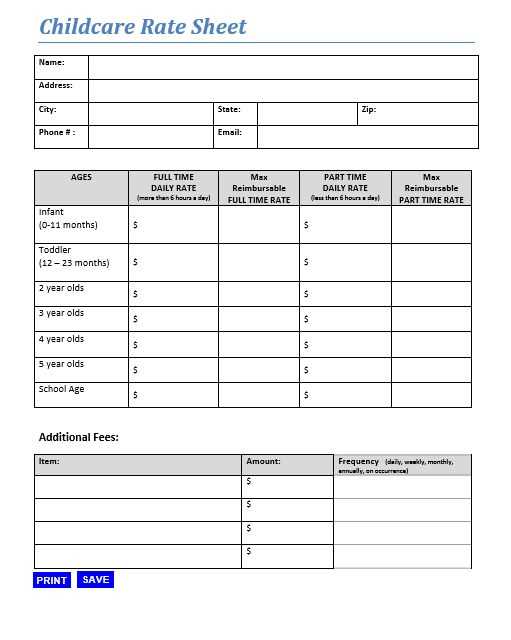

To create a child care receipt template, start by including key details: provider’s name, address, phone number, and tax identification number. Clearly list the child’s name, the care period, and hourly or total cost. Avoid vague terms and ensure amounts are easily readable.

- Include the total cost for services rendered.

- Specify the dates for which the services were provided.

- Ensure clear contact details for both the provider and the person receiving the service.

- Consider adding a brief note about payment terms, if applicable.

Ensure all figures are accurate. The receipt should reflect exact times and fees charged. If the provider works at different rates for various hours, specify this clearly for transparency. Providing a receipt that aligns with the care provided helps avoid misunderstandings.

If the receipt is being used for tax purposes, confirm the provider includes their tax ID or Social Security number as required. This helps validate the receipt and comply with legal standards.

- Year-End Child Care Receipt Template

For tax purposes, a well-organized year-end receipt for child care is crucial. Ensure that the template you use includes specific details such as the child care provider’s name, address, contact information, and the taxpayer’s information. Clearly list the dates of care, the total amount paid, and any applicable tax identification numbers.

Include a breakdown of services rendered. For example, if care was provided for multiple children, itemize the costs separately for each child. This will make it easier for you to track payments and also for any audits or claims you may need to make later.

The total amount paid should match the sum of all payments made throughout the year, and it’s important that the document is signed by the care provider. This signature serves as proof that the provider acknowledges the payments made.

Don’t forget to add a statement that confirms the care provider did not receive any other form of compensation beyond the amount listed. This helps clarify that no additional payments, including under-the-table arrangements, were made. Having this transparency can be helpful in the event of a dispute.

Finally, make sure that the receipt template you use complies with local tax guidelines. Some jurisdictions may have specific requirements for information that must be included, so it’s always a good idea to check with your local tax authority to ensure your template is up to date.

Include the care provider’s name, address, and contact information. Also, add their tax identification number (TIN) or Employer Identification Number (EIN), which is required for tax purposes.

List the child’s full name and the dates on which care was provided. Specify the number of hours or days for each care session. If applicable, indicate the hourly rate or the total amount for each session or period.

Clearly outline the total amount paid throughout the year. Break down payments by date and method (e.g., check, cash, or credit card). Keep the format straightforward for easy reference.

Include a statement indicating that the receipt is for tax purposes, and provide any necessary details, such as whether the care was eligible for tax credits or deductions.

Include the caregiver’s full name and address to ensure clarity about who provided the service. This information is necessary for tax purposes and verification.

Clearly state the date(s) the child care was provided, including the start and end times. This ensures an accurate record of services rendered.

List the child’s name, as well as the total hours of care provided. This helps differentiate between different children if multiple families use the same caregiver.

Specify the hourly or flat rate charged for the care. Provide a breakdown of the total payment, especially if any discounts or additional charges (like late fees) apply.

Include a unique receipt number to track payments and easily reference past transactions for tax or accounting purposes.

State the total amount paid for the services. This helps ensure that both parties have a clear understanding of the financial transaction.

If applicable, add a statement indicating whether the receipt is for tax-deductible purposes. This can help parents during tax filing.

Sign and date the receipt. This serves as confirmation that both parties agree on the services rendered and the amount paid.

Customize your year-end receipt template by updating the basic details for each child care service provided. Fill in the dates, total payments, and other key fields with accurate data. This ensures the receipt reflects the services correctly.

1. Update Service Information

Modify the template to include accurate descriptions of the services you provided during the year. Include the type of care (e.g., full-time, part-time), the total number of hours, and any special services (e.g., evening care or holidays). These details help parents understand what they are being charged for.

2. Include Parent Information

Make sure the template includes the parent’s name, address, and contact details. Add a section for the child’s name and age to confirm who the care was provided to. This personalizes the receipt and ensures its relevance for tax purposes.

3. Input Payment Details

Update the payment section with the total amount paid during the year. Break down payments by individual months or services if needed. This can be displayed in a table for clarity.

| Month | Amount Paid | Service Type |

|---|---|---|

| January | $400 | Full-time care |

| February | $350 | Part-time care |

4. Verify Tax Information

Double-check that all relevant tax details are included, such as your provider tax ID or Social Security number (if applicable). This makes the receipt useful for parents when filing their taxes.

5. Add a Receipt Number

Generate a unique receipt number for each year-end receipt. This helps keep records organized and easily accessible in case of any disputes or questions.

6. Review and Save the Template

After customizing all fields, review the template for accuracy. Ensure no fields are missing and that the total payment amounts match what was charged. Save the final version in a format that is easy to print or email to parents.

Provide Accurate Itemization in the Receipt

Ensure each charge is clearly listed, including dates, hours worked, and the specific service provided. This helps parents and guardians track child care expenses throughout the year. Each entry should detail the child’s name, the care provider’s name, and any additional costs such as transportation or materials.

Include Payment Method Details

List the payment method used for each transaction, whether it’s check, credit card, or other forms. This adds clarity and supports accounting purposes, both for parents and for tax filing purposes.

Summarize Total Amounts

At the end of the receipt, sum up the total charges for the year. Provide an easily understandable breakdown of any discounts or adjustments that were made. This helps avoid confusion and offers a complete financial summary.