Key Components of a Year-End Tax Receipt

A year-end tax receipt should include specific information that both the donor and the organization can use for tax purposes. Ensure the following details are included in the receipt:

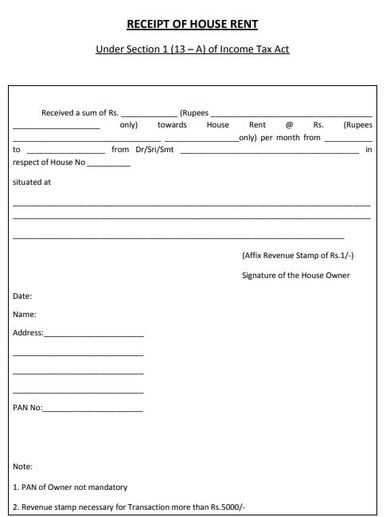

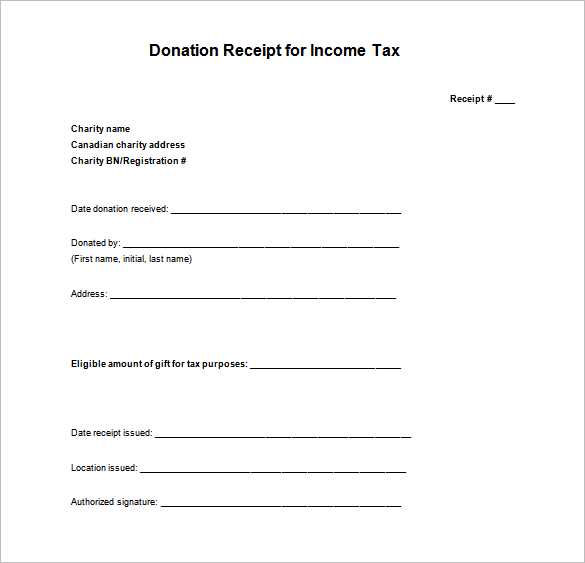

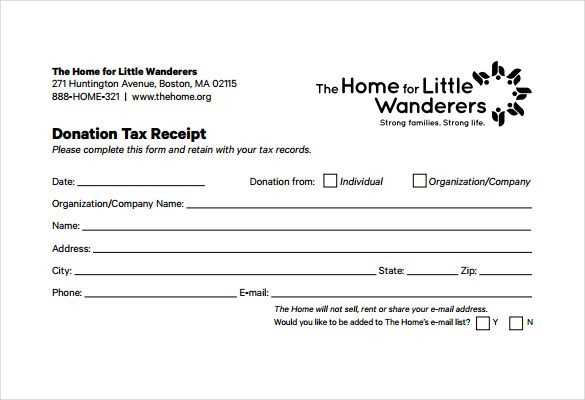

- Donor’s name – Clearly state the full name of the individual or entity making the donation.

- Organization’s name and contact details – Include the official name, address, and tax identification number (TIN) of your organization.

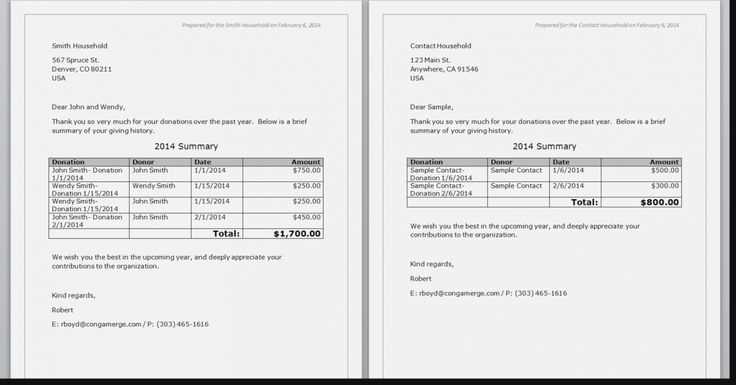

- Date of donation – Specify the exact date the donation was made, as this impacts the donor’s tax return for the relevant year.

- Amount of the donation – If it’s a monetary donation, include the exact amount given. For in-kind donations, describe the item and its estimated value.

- Confirmation of no goods or services received – If the donation was purely charitable, confirm that no goods or services were exchanged in return.

- Signature – A signature from an authorized individual within the organization can further authenticate the receipt.

How to Create the Template

When crafting your year-end tax receipt template, keep the format simple and professional. You can use a word processor or spreadsheet software to create a template. Here’s an easy-to-follow structure:

- Start with the name of your organization at the top, followed by the organization’s contact details.

- List the donor’s information, including name and address.

- Include the donation amount or description of in-kind gifts.

- Specify the donation date.

- Confirm that no goods or services were exchanged.

- Close with a formal thank you and the signature of an authorized person.

Format Example

Here’s an example of a basic year-end tax receipt template:

[Organization Name] [Organization Address] [City, State, ZIP] [Organization’s Tax Identification Number] Receipt for Tax-Deductible Donation Date: [Donation Date] Donor’s Name: [Donor’s Full Name] Donor’s Address: [Donor’s Address] Amount of Donation: $[Amount] or Item Description: [Item Name/Value] No goods or services were provided in exchange for this donation. Thank you for your generous contribution! Authorized Signature: _________________________

Year-End Tax Receipt Template

Creating a Basic Template for Tax Receipts

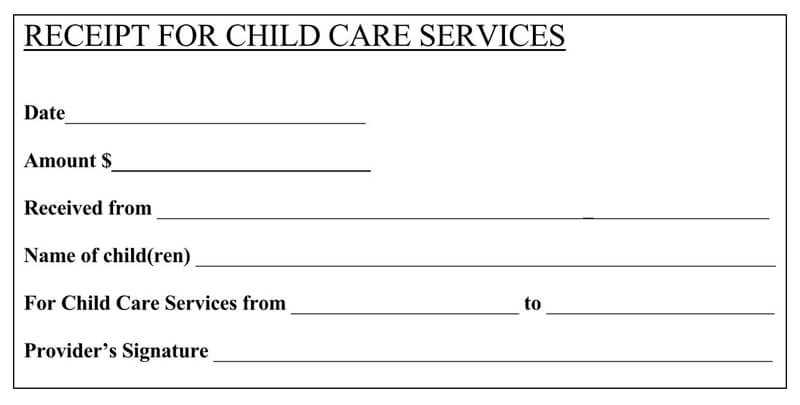

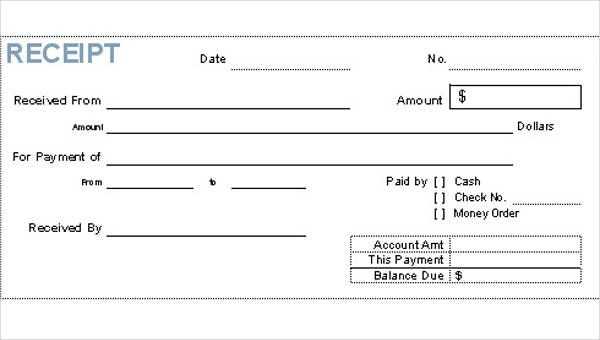

Key Information to Include on a Receipt

Customizing Your Template for Various Scenarios

Legal Requirements for Year-End Receipts

Common Mistakes to Avoid When Generating Receipts

How to Distribute Year-End Tax Receipts to Clients or Employees

Start with a simple and clear structure for your year-end tax receipt. Ensure the template includes the following key details: the name and contact information of your business, the recipient’s name, the date of the transaction, the amount donated or paid, and a description of the service or goods provided. If applicable, include a tax identification number (TIN) or business registration number.

Customizing Your Template for Various Scenarios

Adjust your template based on the specific type of receipt. For charitable donations, ensure to add the charity’s name, tax-exempt status, and a statement confirming no goods or services were provided in exchange. For employee or client receipts, add relevant job titles or service descriptions, and consider adding a section for notes if needed.

Legal Requirements for Year-End Receipts

Each jurisdiction may have specific legal requirements for what must appear on year-end receipts. Research the rules relevant to your region, particularly for tax-exempt organizations or employee reimbursements. Many regions require that receipts for donations over a certain amount include additional details, like a value estimate of any goods or services provided.

Avoid common mistakes such as missing essential details like dates or amounts. Double-check the accuracy of names and tax numbers. Also, ensure that the template is simple and user-friendly to minimize errors. Distribute your receipts promptly, ensuring clients or employees receive them in a timely manner, either electronically or via mail, depending on your company’s practices.