To confirm receipt of a payment from your customer, a clear and concise acknowledgment is necessary. This ensures both parties are aligned regarding the transaction details and provides a formal record for future reference. A payment acknowledgment template serves as a simple yet professional way to communicate the successful receipt of funds.

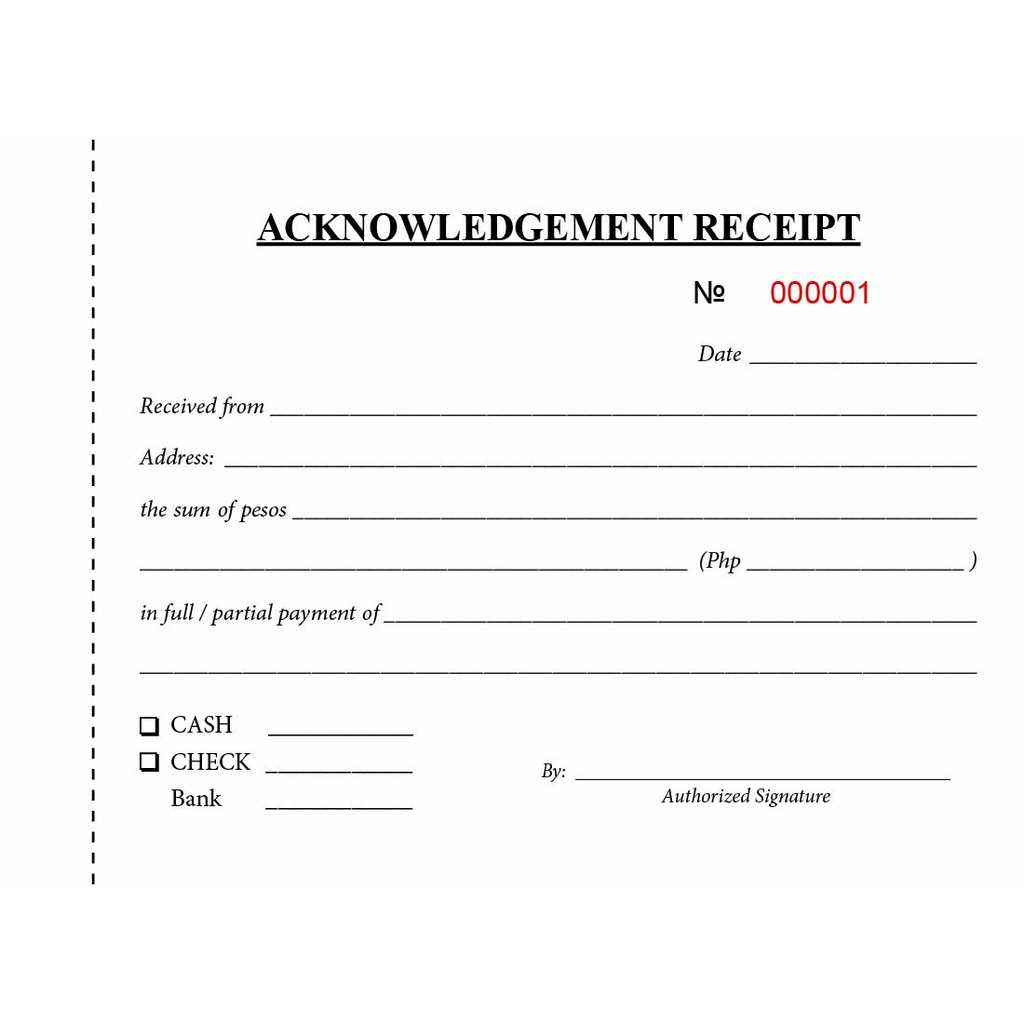

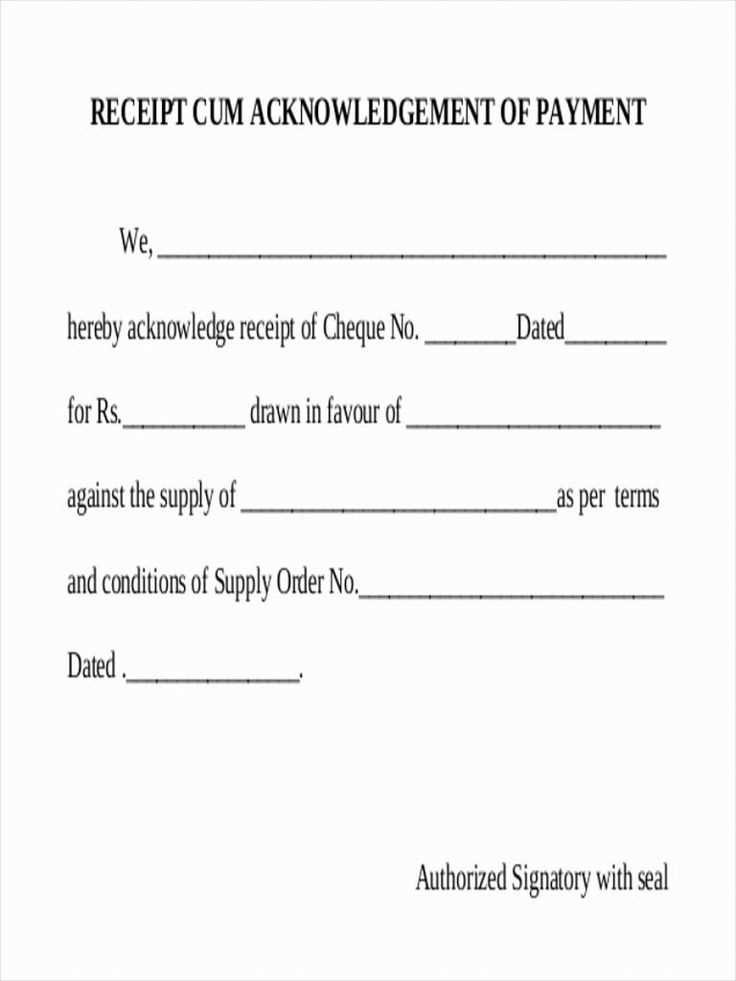

Crafting this acknowledgment requires specific elements to avoid any confusion. Begin with the payment amount, transaction date, and payment method used. Ensure you include a reference number for easy tracking, particularly in the case of online payments or large transactions. Mentioning the product or service paid for reinforces transparency.

Acknowledge the payment in a friendly yet formal tone. Express gratitude and confirm that the payment has been processed successfully. It is also helpful to offer contact information in case the recipient has any further questions regarding the transaction.

Here are the revised lines to avoid repetition, while maintaining the meaning and proper structure:

Remove unnecessary redundancies by simplifying the language. For example, instead of repeating the same idea in different ways, focus on clear, direct statements.

1. Avoid Unnecessary Redundancy

- Original: “We acknowledge the payment we have received from you.”

Revised: “We acknowledge receipt of your payment.” - Original: “Thank you for sending the payment, which we received.”

Revised: “Thank you for your payment.”

2. Keep It Concise

- Original: “Your payment has been received and is being processed now.”

Revised: “Your payment is being processed.” - Original: “We received the payment and will send the receipt as soon as possible.”

Revised: “A receipt will be sent shortly.”

By rephrasing these lines, we eliminate unnecessary wording while ensuring clarity and professionalism. Aim for simplicity and straightforward communication in payment acknowledgment templates.

- Acknowledge Receipt of Payment Template

Begin by confirming the receipt of payment with clarity. The message should include the amount paid, the method of payment, and the date it was received. Keep the tone positive and professional to maintain a strong relationship with the payer.

Payment Confirmation: Acknowledge the amount received in a direct manner, using phrases like “We have received your payment of $X.” This helps avoid any confusion regarding the transaction.

Transaction Details: Provide information about how the payment was made (e.g., via credit card, bank transfer). If possible, include transaction reference numbers to further authenticate the payment.

Payment Date: Clearly state the exact date of the payment. This ensures both parties are aligned on when the payment was processed.

Next Steps: Indicate what the payer can expect next. Whether it’s processing the order, sending a receipt, or taking further actions, this creates a transparent flow of communication.

Gratitude: A brief thank you message can help strengthen the relationship with the payer. Something simple like, “Thank you for your prompt payment!” makes a positive impact.

Here’s a template you can follow:

Subject: Payment Received – [Invoice Number]

Dear [Customer Name],

We are writing to confirm that we have received your payment of $[amount] for invoice number [invoice number] on [payment date]. Your payment was made via [payment method].

Your payment is now processed, and we will proceed with [next steps].

If you have any questions or need further assistance, please feel free to contact us. Thank you for your prompt payment!

Best regards,

[Your Name]

[Your Company Name]

Begin with a polite and professional greeting, addressing the person or company that made the payment. Include the recipient’s name or company name to personalize the letter.

Next, clearly state that you have received the payment. Mention the exact amount and the date the payment was made. If necessary, include details such as the invoice number or any reference number to make the payment easy to identify.

Express gratitude for the payment. Acknowledge that the payment has been successfully processed and will be applied accordingly to the account or service. This will confirm to the sender that their payment is correctly recorded.

If applicable, mention the next steps or services that will be provided. This helps the recipient understand what to expect following the payment.

Finally, close the letter with a courteous statement, offering further assistance or support if needed, and sign off professionally.

| Section | Details |

|---|---|

| Greeting | Start with a polite greeting, addressing the sender. |

| Payment Confirmation | State the payment amount, date, and any reference numbers. |

| Gratitude | Thank the sender for their payment. |

| Next Steps | Explain what happens after the payment is received. |

| Closing | Offer assistance or provide contact information, then sign off. |

Clearly state the amount received and the date of payment. This ensures there’s no ambiguity about the transaction.

Include a description of the goods or services paid for. A simple reference to the invoice number or the specific items involved makes the acknowledgment more transparent.

Confirm the payment method used, whether it’s through credit card, bank transfer, cash, or another option. This provides clarity on how the payment was processed.

If applicable, mention any outstanding balance or remaining payments. This keeps the recipient informed about the status of their payment schedule.

Provide contact details for any questions or concerns regarding the payment. Offering a direct point of communication builds trust and ensures smooth follow-up if needed.

A payment acknowledgment serves as a clear confirmation between parties that a transaction has been completed. By issuing an acknowledgment, businesses reduce the risk of misunderstandings and disputes, ensuring that both the buyer and seller are on the same page. This helps maintain trust and transparency in the relationship.

It also provides a legal safeguard, offering proof of the transaction for both parties. In case of future disputes, having a record of payment acknowledgment can be invaluable for resolving issues efficiently. It supports accurate accounting and provides a clear trail for financial records, which can be critical for auditing or tax purposes.

Moreover, sending an acknowledgment demonstrates professionalism, showing the customer that their payment has been properly received and processed. This simple gesture can enhance customer satisfaction and encourage repeat business, as it reinforces reliability and attention to detail.

By incorporating a payment acknowledgment system, businesses streamline their financial operations, making it easier to track payments and avoid errors in billing. This can be especially helpful when managing large volumes of transactions or dealing with recurring payments.

Make payment confirmations clear and easy to understand. Include specific details about the transaction, such as the payment amount, date, and method. This transparency prevents confusion and ensures both parties are aligned.

- Use a Professional Tone: Maintain a formal and polite tone throughout the message. This builds trust and reflects well on your business.

- Provide Detailed Information: Include the invoice number, reference number, or transaction ID for easy tracking. This helps recipients verify the payment quickly.

- Specify the Payment Method: Clarify how the payment was made (credit card, PayPal, bank transfer, etc.). This can assist recipients in cross-checking their records.

- Confirm the Amount Paid: Restate the amount paid and any outstanding balance, if applicable. This ensures there is no misunderstanding regarding the payment.

- Set Clear Expectations: If the payment triggers a service, delivery, or future communication, explain what happens next. Let the recipient know the next steps and when they can expect to receive the product or service.

Always proofread your confirmation emails for accuracy. Typos or incorrect details can cause unnecessary follow-up questions and lead to confusion.

- Make Contact Information Easy to Find: Always include a way for the recipient to reach out in case of questions, such as a customer service email or phone number.

- Use a Template for Consistency: Having a payment confirmation template can ensure consistency in your communication and save time for future transactions.

- Keep It Brief: Avoid overloading the recipient with unnecessary information. Stick to the essentials to ensure the message is easy to read and understand.

These practices ensure a smooth experience for your customers, leaving them confident in their payment and the transaction process.

Common Mistakes to Avoid When Writing a Payment Confirmation

Be clear and concise. Avoid using vague language like “We have received your payment,” which can lead to confusion. Always specify the exact amount and the date of the payment to prevent any misunderstanding. For example, instead of just stating “Payment received,” write, “We received your payment of $200 on February 5, 2025.”

1. Missing Payment Details

Failing to include all relevant payment details is a common mistake. It’s important to list the payment method, reference number, and the date. This provides the recipient with everything they need for record-keeping and helps avoid disputes later on.

2. Lack of Personalization

A generic payment confirmation can make the process feel impersonal. Address the recipient by name and make the message feel specific to their transaction. This shows attention to detail and builds trust with the client.

Finally, always double-check that the information is accurate before sending. A single typo could lead to confusion and potentially damage the relationship with your client.

If there is a dispute or error in payment confirmation, address the issue quickly to maintain clear communication with the customer. First, review the payment records to confirm whether the issue is related to transaction processing or an internal error. If the payment was not processed correctly, contact your payment processor for assistance and provide the necessary documentation. If an error was made on your end, issue a prompt acknowledgment and offer a resolution, such as a refund or a correction in the payment amount.

Always respond professionally and transparently. Let the customer know you are investigating the issue and will provide an update within a set timeframe. Keep the conversation focused on facts, avoiding emotional language. After resolving the dispute, confirm with the customer that the issue has been handled to their satisfaction. Document the incident thoroughly for future reference and to help improve payment systems and procedures.

Ensure that your acknowledgment of payment is clear and concise. Always confirm the amount, payment method, and date. Mention any transaction reference number for easy identification. It’s helpful to include a sentence thanking the sender, reinforcing the receipt of their payment.

Be precise with the payment status: mark whether it was processed successfully or if there were any discrepancies. If a payment requires additional verification, state what steps are needed next.

Make the acknowledgment friendly yet professional. Avoid unnecessary jargon, and focus on the key details. Keep the tone positive to maintain a solid relationship with the payer.

Use bullet points or numbered lists to break down the information for easy readability. This makes the message less overwhelming and more actionable for the reader.

Lastly, always provide a contact option for any follow-up questions or concerns regarding the payment.