To confirm a payment, a well-structured acknowledgment letter provides both clarity and professionalism. This type of communication assures the payer that the transaction has been completed successfully, offering them peace of mind. Use a simple, clear format to avoid any confusion for the recipient.

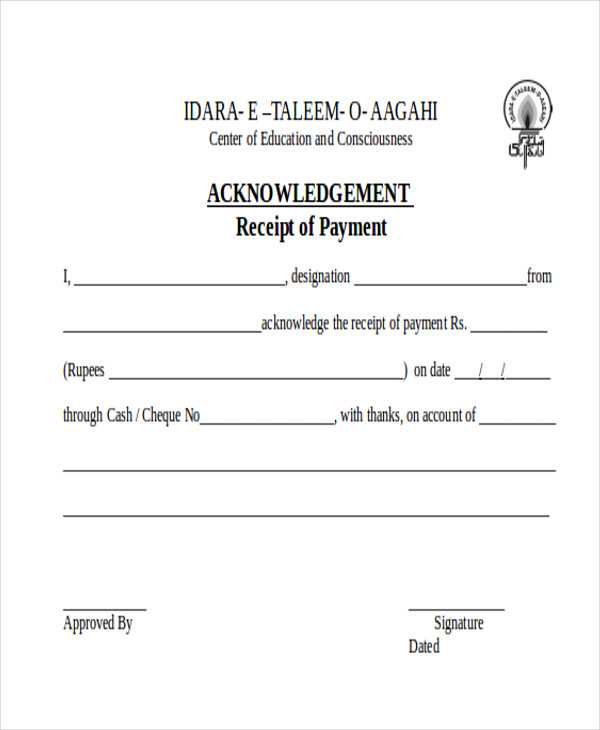

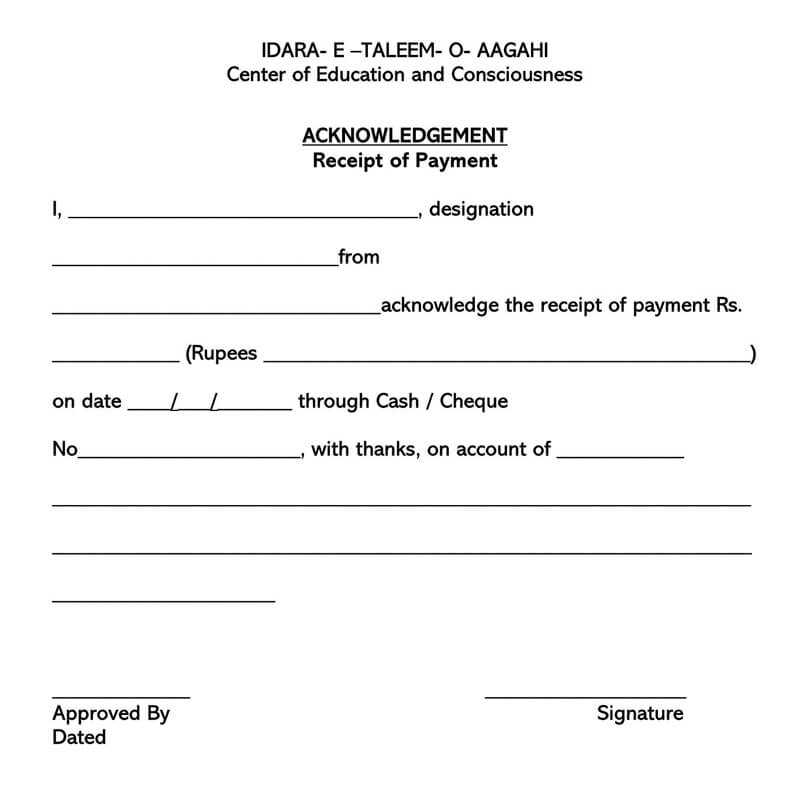

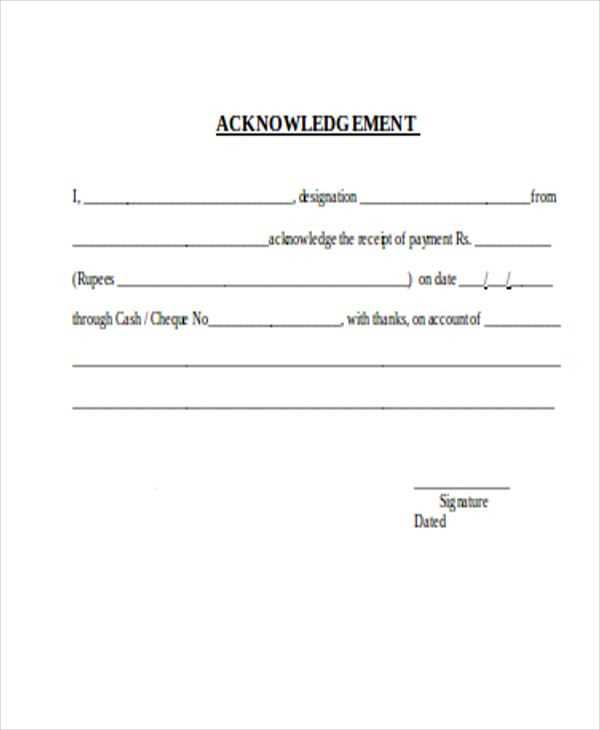

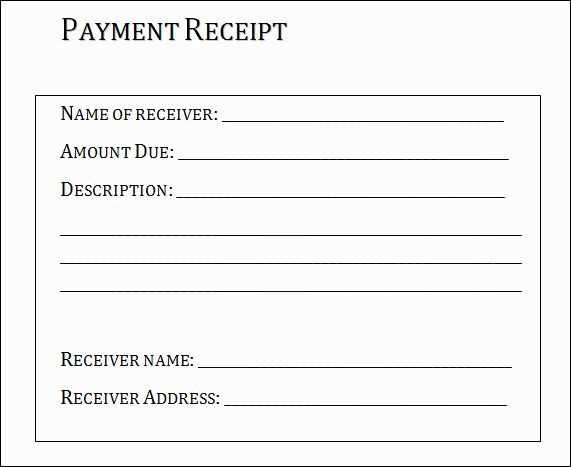

The template should begin with a direct acknowledgment of the payment. Include the payment amount, the date it was received, and the method used for the transaction. This specific information helps avoid any potential misunderstandings later. For example, reference the invoice number or order number to ensure the payment is correctly linked to the appropriate service or product.

Finish the template with a polite statement of appreciation. Thank the payer for their timely transaction, and offer any relevant details, such as the next steps or expected delivery dates. This keeps the communication transparent and ensures that both parties are aligned moving forward.

Here is the revised version of your list, with repetitions reduced:

Focus on providing a clear breakdown of each item without unnecessary redundancy. Below is the updated list that eliminates repeated elements:

Payment Acknowledgement Breakdown:

| Reference Number | Amount Paid | Payment Method | Payment Date |

|---|---|---|---|

| 001 | $100.00 | Credit Card | 02/03/2025 |

| 002 | $50.00 | Bank Transfer | 02/04/2025 |

| 003 | $150.00 | PayPal | 02/05/2025 |

By reducing repetition, your acknowledgment becomes clearer and more direct. This layout ensures a focused presentation of the necessary details, improving readability.

- Acknowledgement of Payment Receipt Template

Use clear and concise language when confirming the payment. Include the payer’s details, the amount paid, and the payment method. This ensures the recipient understands the payment has been successfully received. Provide any additional details only if necessary to avoid confusion.

Example Template:

Dear [Payer’s Name],

We have received your payment of [Amount] on [Payment Date]. The payment was made via [Payment Method] for [Purpose].

Thank you for your prompt payment. If you need further assistance, feel free to contact us.

Best regards,

[Your Company Name]

Follow these steps to ensure your payment acknowledgment letter is clear and professional:

1. Include the Date and Contact Information

- Start by including the date at the top of the letter.

- Provide your name or business name, along with your address, phone number, and email. This will help the recipient easily contact you if needed.

2. Address the Recipient

- Clearly mention the recipient’s name and title.

- If the letter is being sent to a company, use the business name and include the contact person’s title or department.

3. Mention the Payment Details

- Specify the payment amount, date received, and method of payment (e.g., bank transfer, check, cash).

- If applicable, refer to an invoice or reference number for clarity.

4. Express Gratitude

- Acknowledge the payment with a polite thank you.

- This helps maintain a positive relationship with the customer or client.

5. Close Professionally

- Finish the letter with a respectful closing such as “Sincerely” or “Best regards.”

- Sign your name, or if it’s a business letter, include your company’s name and contact details.

Ensure the confirmation includes the payment amount and currency to avoid any confusion. State the exact date the payment was made and include the payment method used, whether it’s a credit card, bank transfer, or online payment system. This helps the recipient verify the transaction.

Include a transaction reference number or receipt number for easy tracking. If applicable, mention the invoice number or other identifiers related to the payment. This information is critical for record-keeping and matching payments to orders.

For clarity, state whether the payment is partial or full. If it’s a partial payment, outline the remaining balance and any deadlines for further payments. Provide contact details or a direct link for any follow-up questions regarding the payment.

If there are any relevant notes about the payment–such as a special discount applied, taxes included, or any other relevant terms–mention them in a concise manner. This helps the recipient understand the complete details of the transaction.

Adjust the template based on the payment method used. Each method requires specific details for clarity and proper record-keeping.

For Bank Transfers

Include the transaction number, bank name, account details, and any reference codes. Clearly state the payment amount, date, and any additional charges or fees. Ensure that all bank-specific requirements are met, such as SWIFT codes or IBAN numbers if applicable.

For Online Payment Services (e.g., PayPal, Stripe)

For online payments, highlight the payment service provider and transaction ID. Specify the payment date, amount, and any processing fees. Some providers offer receipts that can be attached directly, so it’s helpful to mention that in the template.

By tailoring the template to these methods, you create clarity and avoid confusion during the payment confirmation process. Keep the information concise and relevant to each specific transaction type.

Always include clear details regarding the payment in your acknowledgment, such as the date, amount, and method used. This prevents ambiguity in case of disputes. An official receipt or written acknowledgment serves as evidence of a completed transaction, protecting both parties legally. Make sure your language is precise to avoid any misinterpretation.

Include Clear Terms

Specify payment terms in your acknowledgment, including any penalties or interest charges for late payments. This helps establish the boundaries for both parties, reducing the potential for legal issues. Having an agreement in writing strengthens the enforceability of these terms should a dispute arise.

Comply With Tax Requirements

Ensure that your acknowledgment complies with applicable tax regulations. For businesses, this means providing proper invoicing and keeping accurate records. Failure to comply with tax laws can lead to legal trouble. Check the local tax authority guidelines to ensure compliance with any necessary reporting or documentation requirements.

Always keep a record of the acknowledgment for reference in case of a future audit or legal challenge. The receipt must be issued in a timely manner, according to the terms of the agreement.

One of the most common errors is failing to provide the correct payment details. Ensure that the payment amount, date, and method are clearly mentioned to avoid any confusion. Misrepresentation of payment information can lead to disputes.

Incorrect Formatting or Missing Information

Another mistake is neglecting to format the letter properly. Payment acknowledgement letters should have a clear, professional structure, including a greeting, payment details, and a closing. Omitting important details like the transaction reference number can complicate future verification.

Vague Language

Avoid vague language. Clearly state what the payment was for, and confirm the amount received. For example, saying “We received your payment” without specifying the amount or invoice number leaves room for ambiguity. Clear and specific wording ensures both parties are on the same page.

Lastly, failing to express gratitude or acknowledgment for the payment can make the letter seem impersonal. A simple, friendly acknowledgment strengthens the relationship and maintains positive communication.

Respond as soon as you receive a payment. Aim to send an acknowledgment letter within 24 to 48 hours of receipt. Delayed responses can cause uncertainty and strain relationships with your clients or customers.

- Use automated systems to streamline the process, especially if dealing with high volumes of transactions. This ensures no payment goes unacknowledged.

- Personalize each letter. Include relevant payment details such as the date, amount, and method of payment to show that the transaction is accurately processed.

- Send the acknowledgment via the same communication channel used for the payment (email, postal mail, etc.). This maintains consistency and increases the likelihood that the recipient will read it promptly.

- Ensure that the tone of the letter is warm and professional. Acknowledge the customer’s contribution to building a positive ongoing relationship.

By following these steps, you can enhance customer satisfaction and avoid potential confusion or frustration regarding payments.

To effectively acknowledge a payment receipt, always include clear details: the transaction date, the amount received, the payment method, and the payer’s name. This ensures both parties have a precise record of the transaction.

Key Elements of a Payment Acknowledgment

Start with a personalized greeting, followed by a confirmation of the payment amount and method. Include the payment’s unique reference number if available. This provides transparency and avoids any confusion in case of future inquiries.

What to Avoid

Refrain from using ambiguous language or leaving out important transaction details. Missing information can lead to miscommunication. Instead, focus on being direct and clear in confirming the payment.