Key Elements of an Acknowledgement Receipt

An acknowledgement receipt serves as proof that a payment has been received. It is crucial for keeping accurate records of transactions and ensuring both parties are on the same page. The receipt should include the following elements:

- Recipient’s Name and Contact Information: Clearly state the person or company receiving the payment.

- Amount Paid: Specify the exact sum received in both numbers and words.

- Payment Method: Indicate whether the payment was made via cash, cheque, credit card, or another method.

- Date of Payment: Include the specific date when the payment was made.

- Purpose of Payment: Briefly explain what the payment is for (e.g., goods, services, or rent).

- Signature: Ensure both parties, the payer and the recipient, sign the receipt.

Payment Agreement Guidelines

A payment agreement outlines the terms of payment between two parties. It provides clarity and avoids misunderstandings. Ensure the following details are included in the agreement:

- Parties Involved: Clearly identify the payer and payee, including their legal names and addresses.

- Payment Amount and Schedule: Specify the exact amount to be paid and the dates or conditions under which payments will be made.

- Interest or Late Fees: Include any applicable interest rates or fees for late payments.

- Consequences of Non-Payment: Define the steps to be taken if payment is not received as agreed.

- Signatures: Both parties must sign the agreement to make it legally binding.

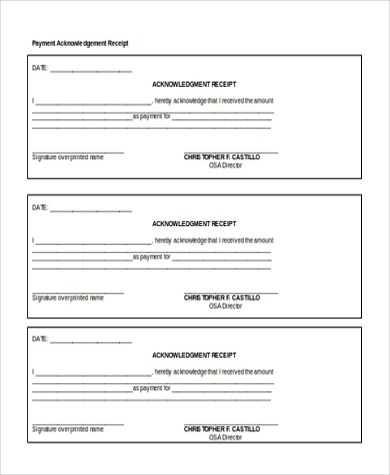

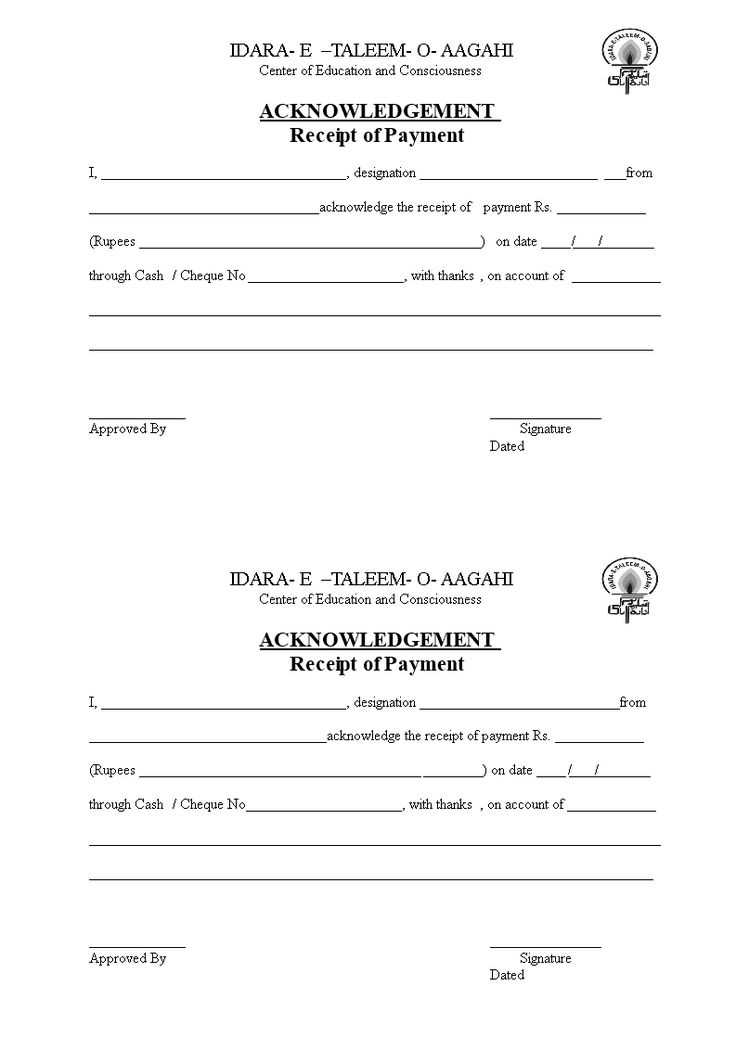

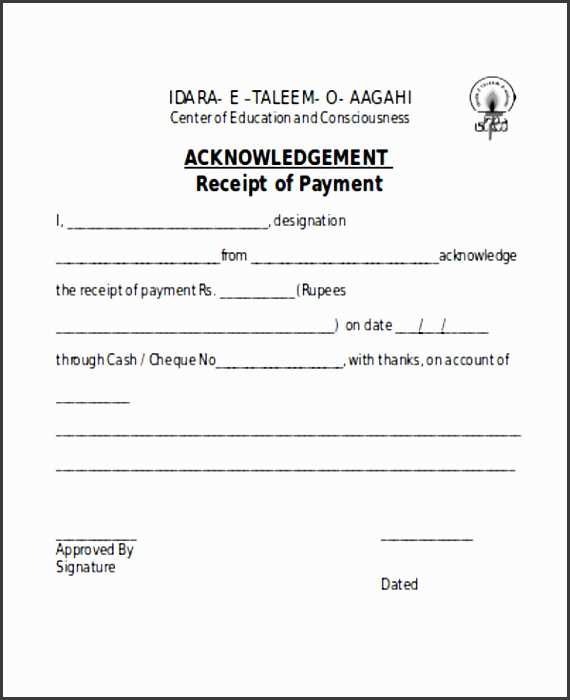

Example Template for Acknowledgement Receipt and Payment Agreement

Below is a simple template that can be customized for your needs:

Acknowledgement Receipt

Date: ________________

Received from: ______________________________

Amount: ______________________________

Payment Method: ______________________________

Purpose of Payment: ______________________________

Signature of Recipient: ______________________________

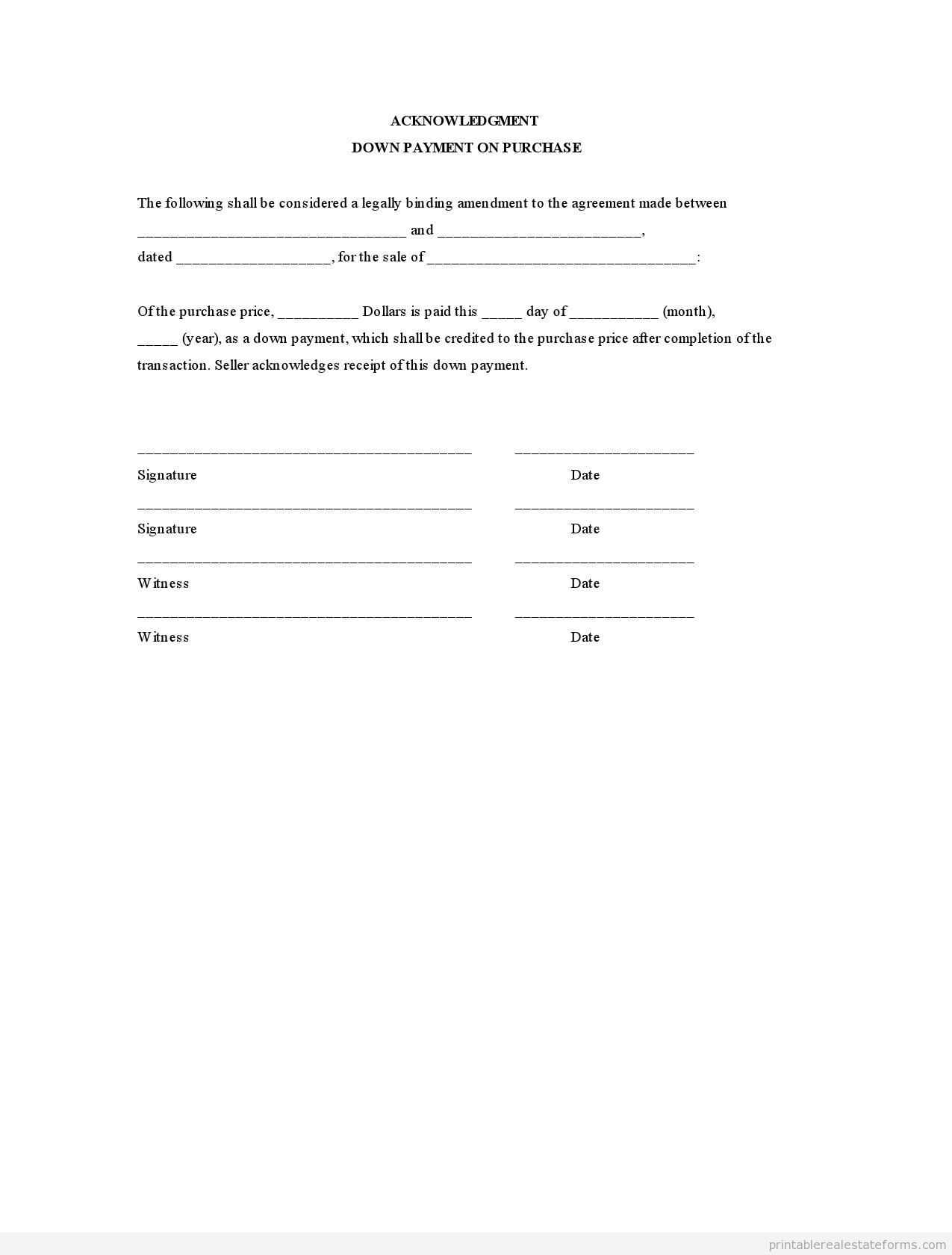

Payment Agreement

This Agreement is made between [Payer Name] and [Payee Name] on this date, ________________. The parties agree to the following terms:

- Payment Amount: ______________________________

- Payment Schedule: ______________________________

- Late Fees: ______________________________

- Consequences of Non-Payment: ______________________________

Signature of Payer: ______________________________

Signature of Payee: ______________________________

Using this template ensures a clear, straightforward transaction and protects both parties involved in the payment process.

Detailed Guide to Acknowledgement Receipt and Payment Agreement

Begin by recognizing the importance of an acknowledgement receipt. This document serves as proof that a payment or transaction has been made and received. It provides clarity for both parties and can be referred to in case of disputes.

The core components of a payment agreement include the payment amount, terms of payment, dates, and any conditions or penalties for late payment. It should clearly outline the responsibilities of both parties, ensuring no misunderstandings later.

Follow a clear process when drafting a template. First, include basic information like the names of the parties involved, the transaction amount, and payment methods. Then, specify deadlines and any applicable penalties or interest charges for late payments. Make sure to add a section that allows both parties to sign and date the agreement.

Legal aspects of a payment agreement include ensuring compliance with local laws and regulations. It’s essential that both parties understand the terms they are agreeing to. Including a clause for dispute resolution can help prevent legal complications down the road.

To customize the template for specific transactions, adjust the payment terms based on the nature of the deal. For example, installment plans may require adjustments to reflect the timing and amount of each payment. Always align the terms with what is realistic and fair for both parties.

Avoid common mistakes like leaving out key details such as payment deadlines or failing to clarify the consequences of missed payments. Another mistake is not keeping a copy of the signed agreement for reference. Ensuring that both parties review and understand the document will help prevent issues in the future.