Creating a clear and professional acknowledgement receipt for payment is a straightforward yet critical task for any business or individual handling transactions. A well-structured receipt ensures both parties–payer and payee–are aligned on the details of the payment made, reducing the risk of misunderstandings. The receipt should include key information such as the payer’s name, the amount paid, the payment method, and the transaction date.

Ensure your template includes a unique reference number for each payment. This helps in tracking payments and resolving any potential disputes. Clearly state the payment details, including a breakdown if relevant, to avoid confusion in the future. You can also consider adding a thank you note or a brief message that acknowledges the transaction, which adds a professional touch and helps build trust with your customers.

By using a template, you streamline your process while maintaining consistency across transactions. It’s simple to customize, allowing for quick adjustments depending on your business needs. Make sure that the receipt is easily readable, well-organized, and free of errors–these small details reflect positively on your professionalism.

Here’s the corrected version with minimal repetition:

When crafting an acknowledgement receipt for payment, make sure the document clearly states the transaction details without unnecessary repetition. Begin with a simple header such as “Acknowledgement Receipt for Payment,” followed by the payment amount, date, and method used. This ensures all critical information is conveyed upfront.

Key Components

First, include the payer’s and payee’s names and contact information. Then, specify the exact amount received and the currency. Mention the payment method–whether cash, check, or electronic transfer. If relevant, reference the invoice or agreement number that corresponds to the payment.

Clarity and Accuracy

Ensure that the receipt is clear and concise. Avoid repeating the same information more than once. Each section should contain only the necessary details for reference. A simple statement confirming that payment has been received is often sufficient.

- Acknowledgement Receipt for Payment Template

An Acknowledgement Receipt for Payment serves as a formal record confirming that a payment has been received for goods or services. It should include clear, accurate details to avoid any disputes in the future.

Key Components of the Acknowledgement Receipt

The receipt must contain the following information:

- Receipt Number: Unique identifier for the transaction.

- Date of Payment: The exact date the payment was received.

- Payer’s Name: Full name of the person or company making the payment.

- Amount Received: The exact sum paid, including any applicable taxes or fees.

- Payment Method: Cash, check, credit card, or any other method used.

- Transaction Description: Brief description of the goods or services paid for.

- Received By: The name of the person or organization that accepted the payment.

- Signature: The authorized signature confirming the transaction.

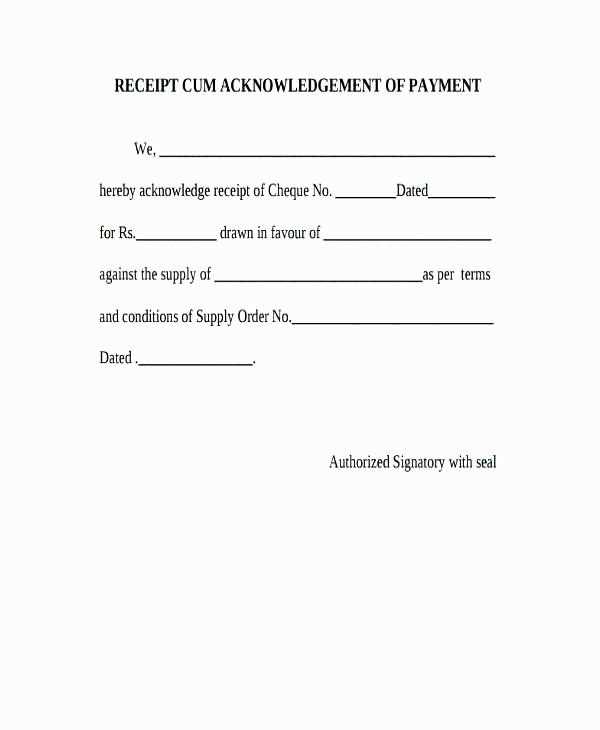

Template Example

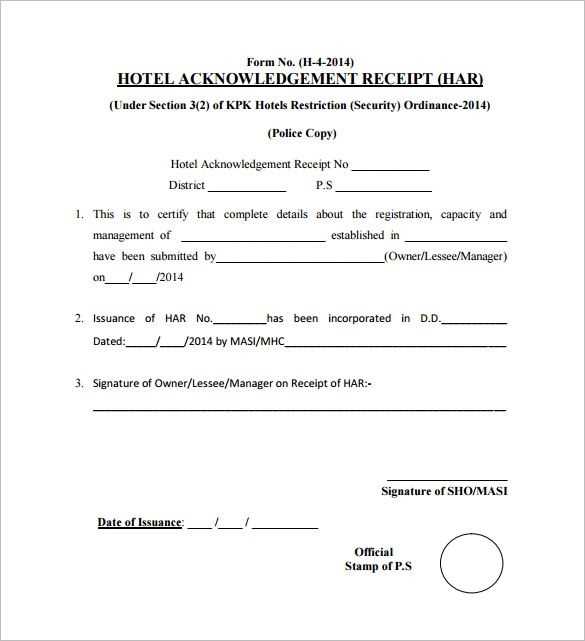

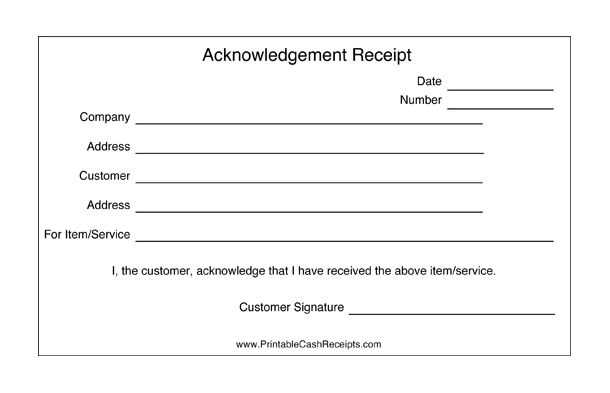

Below is a simple template for creating an Acknowledgement Receipt for Payment:

Receipt Number: [Receipt Number] Date of Payment: [Date] Payer’s Name: [Payer’s Name] Amount Received: [Amount] Payment Method: [Payment Method] Description of Goods/Services: [Transaction Description] Received By: [Receiver’s Name] Signature: ___________________________

This template can be adapted to suit specific needs, whether for personal or business transactions. Ensure all details are correctly filled in to maintain transparency.

To create a clear and straightforward acknowledgement receipt, include the following key details:

1. Receipt Title

Start with a clear heading, such as “Acknowledgement Receipt” or “Payment Receipt.” This makes it immediately recognizable for what it is.

2. Payment Information

Specify the amount received, the payment method (e.g., cash, check, online transfer), and the date of the transaction. If applicable, include the invoice or transaction number for easy reference.

3. Payer and Payee Details

Identify both the payer and the payee by including their names and contact information. This ensures both parties are clearly outlined in the receipt.

4. Acknowledgement Statement

State that the payment has been received. A simple sentence like “This receipt acknowledges payment of [amount] from [payer name] for [service/product]” is enough.

5. Signature or Initials

Include a space for the payee’s signature or initials, confirming the transaction has been completed and the document is valid.

By keeping these elements in mind, you can quickly draft an effective receipt that serves its purpose without unnecessary complexity.

Key Elements to Include in Your Receipt

Each payment receipt should contain the following core details to be both clear and legally binding.

- Receipt Title – Clearly label the document as a “Receipt” to distinguish it from other documents.

- Receipt Number – Assign a unique number to every receipt. This helps with record-keeping and tracking.

- Date of Payment – Record the exact date the payment was made, ensuring there’s no ambiguity about when the transaction occurred.

- Amount Paid – Clearly state the total payment amount, along with the currency used. This ensures transparency.

- Payment Method – Specify how the payment was made (cash, credit card, bank transfer, etc.) for proper documentation.

- Details of Goods or Services – Include a brief description of what the payment was for. This helps avoid any confusion about the transaction.

- Receiver’s Information – Provide the name or business name of the entity receiving the payment. Include contact details, such as address or phone number, if relevant.

- Issuer’s Signature or Stamp – A signature or stamp adds authenticity and confirms the receipt’s validity.

- Tax Information – If applicable, list any taxes paid or tax identification numbers to comply with local regulations.

Bonus Tips

- Ensure the font is clear and legible for easy reading.

- If the receipt is for a service, make a note about the time or duration of service rendered.

- Double-check for accuracy to avoid disputes down the line.

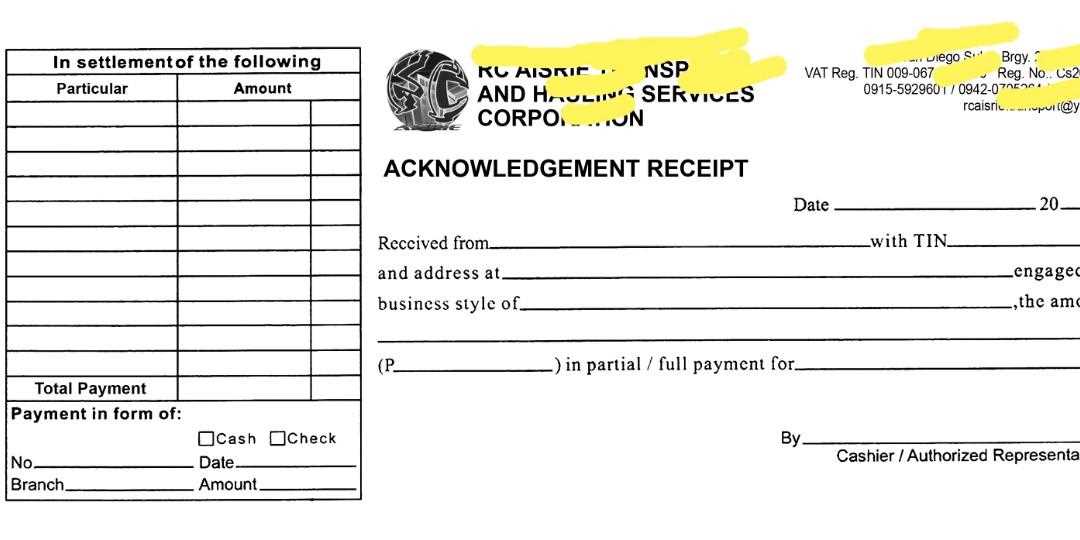

Adjust your acknowledgement receipt template to reflect the specific details related to each payment method. Each method has its own set of requirements that can enhance clarity for both parties involved.

1. Credit/Debit Card Payments

For card payments, include the last four digits of the card number to verify the transaction. You can also specify the payment processor or gateway used, such as PayPal, Stripe, or others, depending on the system in place. Be sure to mention any transaction fees, if applicable.

- Card type (Visa, MasterCard, etc.)

- Last 4 digits of the card number

- Transaction date and amount

- Payment gateway or processor

2. Bank Transfers

For bank transfers, include the bank name, account number (last few digits), and transaction reference number. This helps verify the payment and makes it easier to track. You might also want to include the payment date and the amount transferred.

- Bank name

- Account number (last 4 digits)

- Transaction reference

- Amount and transfer date

3. Cash Payments

For cash payments, note the amount received and the date. It’s helpful to add a reference or receipt number if multiple cash payments are processed for transparency. Since no bank or card details are involved, focus on the transaction date, amount, and the name of the payer.

- Amount received

- Date of payment

- Receipt/reference number (optional)

- Payee name

4. Online Payment Platforms (e.g., PayPal, Venmo)

For payments made through platforms like PayPal or Venmo, include the transaction ID, payer’s email or username, and the platform used. Make sure to include the transaction date and payment amount for completeness.

- Transaction ID

- Platform name (PayPal, Venmo, etc.)

- Payer’s email or username

- Amount and transaction date

By tailoring your template for each payment method, you ensure that both the payer and the recipient have all the necessary details for future reference.

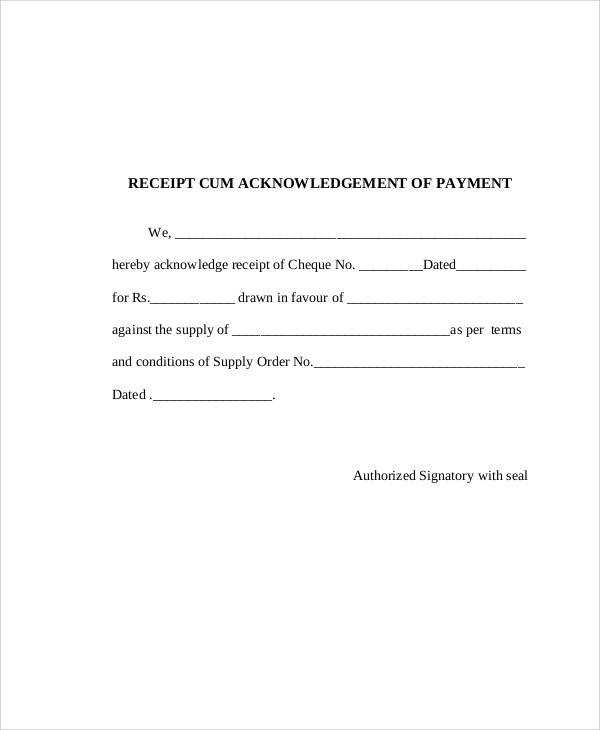

Issuing a receipt carries several legal obligations and consequences. When you provide a receipt, you confirm the completion of a transaction, and this document serves as proof of payment. The receipt is often treated as a legally binding document in disputes or claims over payments.

Contractual Evidence

A receipt can act as proof of the agreed-upon terms in a transaction. It may be used in legal disputes to demonstrate that a sale took place, including the specific amount paid, the parties involved, and the transaction’s date. This is particularly relevant in cases of payment disputes or allegations of fraud.

Tax and Reporting Obligations

Receipts play a role in tax reporting and auditing. Both individuals and businesses are required to maintain accurate financial records. Failure to provide or properly issue receipts could lead to complications during tax audits or when filing for deductions and credits. It’s critical to issue a receipt that meets regulatory standards for reporting purposes.

| Element of Receipt | Legal Implication |

|---|---|

| Date of Payment | Establishes the timing of the transaction, important for tax and contractual deadlines. |

| Amount Paid | Provides confirmation of payment and can serve as evidence in case of a dispute. |

| Parties Involved | Identifies the buyer and seller, helping to resolve any potential claims or misunderstandings. |

While a receipt doesn’t guarantee immunity from legal challenges, its presence can simplify the process of resolving disputes. Be sure that all necessary details are included and that the receipt complies with legal requirements to avoid complications later.

Keep an organised record of all payments received by using acknowledgement receipts. These documents serve as proof that a transaction has taken place and provide a clear record of the amount paid, the date, and the involved parties. It’s helpful to create a system for storing these receipts, whether electronically or physically, to ensure that every transaction is easy to track when needed.

By filing receipts systematically, you can quickly access historical payment data, which is crucial for both tax reporting and internal audits. Consider categorizing receipts by client, date, or payment type, depending on your business needs. This approach makes it easier to reconcile accounts and verify payment histories without confusion.

Make sure each receipt includes the relevant payment details such as the payer’s name, amount paid, method of payment, and a description of the service or goods provided. This level of detail makes it easier to confirm payment status and resolve any disputes that may arise.

As you manage receipts, regularly back up your records, especially if stored digitally. Use cloud storage or a secure database system to ensure that all documentation remains accessible and protected over time.

Failing to include all necessary details can create confusion or disputes. Always list the full name of the payer and recipient, the exact amount paid, the date of payment, and a clear description of the service or product provided.

Using vague language or abbreviations can lead to misunderstandings. Ensure all terms and descriptions are straightforward and universally understood, especially if the receipt will be used for tax or legal purposes.

Forgetting to assign a unique receipt number can make record-keeping a nightmare. Always include a sequential or unique identifier for each receipt to simplify tracking and verification.

Neglecting to specify the payment method is another common oversight. Whether it’s cash, credit card, bank transfer, or check, clearly state how the payment was made for accountability.

Skipping an authorized signature or electronic stamp can diminish the document’s credibility. Ensure that every receipt is signed or digitally authenticated to confirm its validity.

Avoid errors by proofreading all details before issuing the receipt. Typos in names, amounts, or dates can result in disputes or complications when reconciling records later.

Thus, the lines retain their meaning while reducing the repetition of words.

When creating an acknowledgment receipt for payment, focus on clarity and brevity. Ensure the main details, such as the payer’s name, payment amount, and date, are clearly outlined without redundancy. Remove unnecessary adjectives or phrases that don’t add value. For example, instead of stating “full payment has been received in total,” simply say “payment received.” This keeps the message direct and professional.

By reducing word repetition, you make the document easier to read and more to the point. Avoid using the same word multiple times in a short space. Instead, rephrase where possible, or use synonyms to convey the same idea. For example, use “amount” instead of repeatedly saying “payment.” This not only makes the text more concise but also keeps the focus on the key information.

Incorporating this approach helps maintain professionalism while delivering all the necessary details efficiently. Clarity will ensure that the recipient understands the transaction fully, without being overwhelmed by unnecessary language.