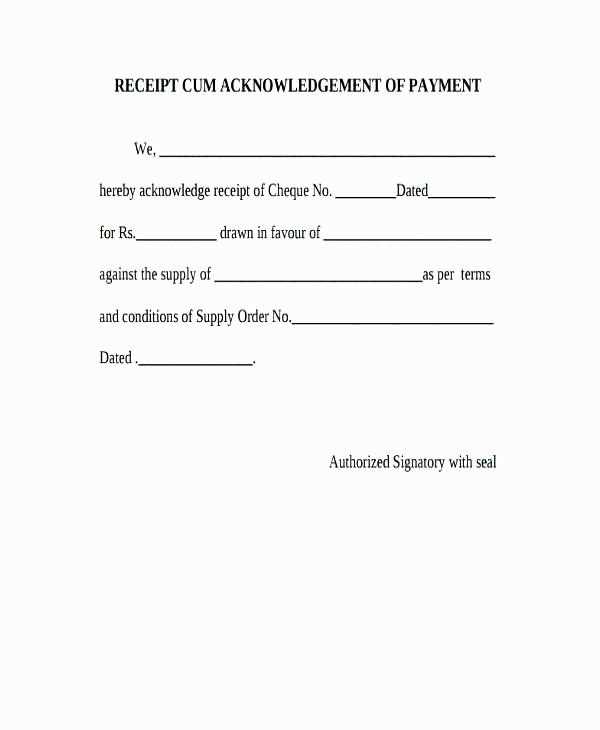

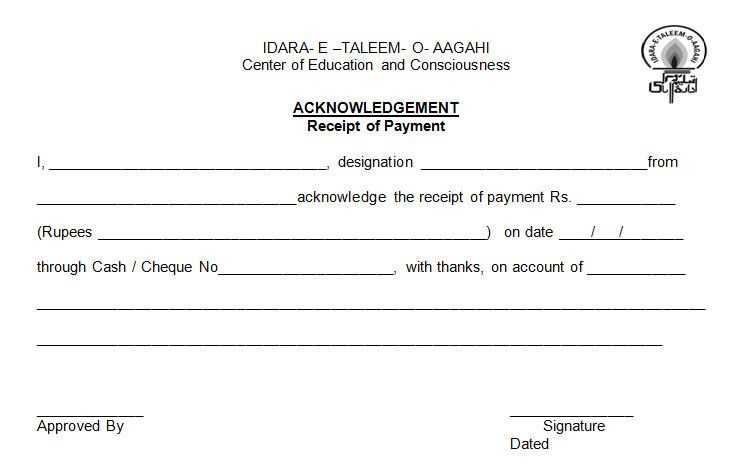

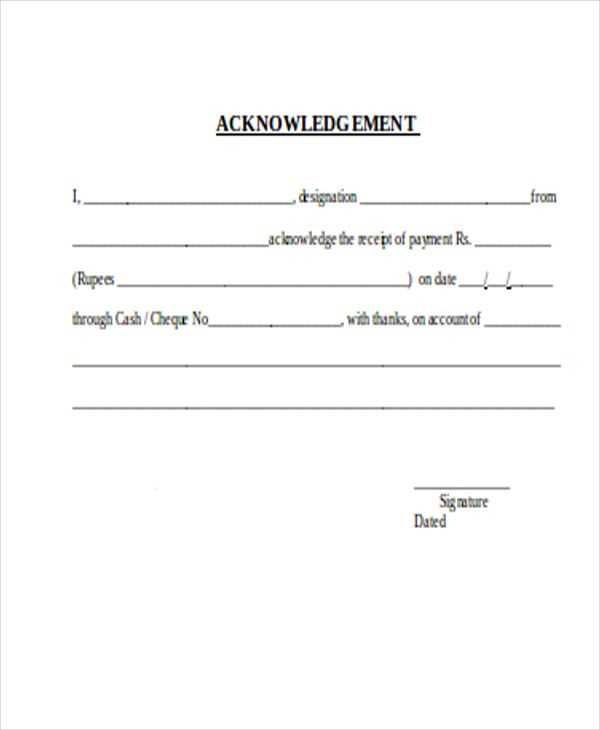

When receiving payment, documenting the transaction with an acknowledgment receipt is a key step. This template serves as a formal confirmation of payment, protecting both the payer and the payee by clearly stating the details of the transaction.

The receipt should include specific information such as the payment amount, the date of payment, the method of payment, and a brief description of what the payment is for. Make sure to include the names of both parties involved, as well as any reference numbers or invoice details that might be relevant to the transaction.

A well-structured acknowledgment receipt helps to maintain transparency, reducing the chances of misunderstandings in the future. It serves as a reference for both parties, making record-keeping simpler and more reliable. This template is a practical tool to ensure clear communication and avoid disputes later on.

Here are the corrected lines:

Ensure that the payment amount is clearly stated. If the amount is in a foreign currency, include the conversion rate used at the time of payment.

State the date of payment accurately to avoid confusion. If the payment was made in installments, break down each payment clearly with corresponding dates and amounts.

Include the payment method used (e.g., bank transfer, credit card) to confirm the transaction details.

Double-check that the recipient’s name and address are correctly entered to avoid issues with the payment process.

Verify that the payment receipt includes a reference number or transaction ID, making it easier for both parties to track the payment history.

- Acknowledgement Receipt Template for Payment

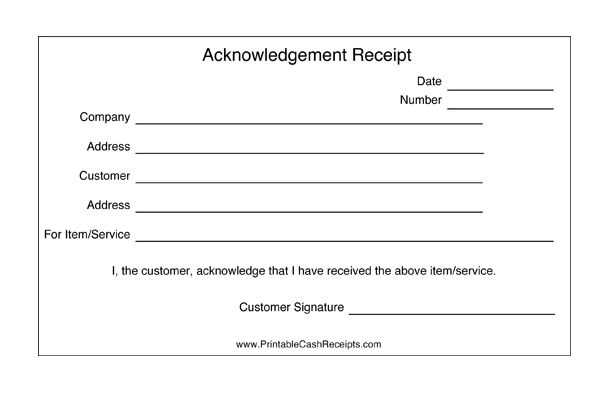

When creating an acknowledgment receipt for a payment, ensure it includes the payment amount, method, and the date it was received. Clearly state the payer’s name and the recipient’s information, such as the business or individual receiving the payment. It’s also helpful to reference the invoice or service provided for easy tracking. This template should reflect a professional and clear structure to avoid confusion and ensure both parties are aligned on the transaction details.

The receipt should include a line for the signature of the payer and a space for the recipient’s signature as well. This confirms that both parties agree to the terms of the transaction. A short, concise statement such as “Received the amount of [amount] for [goods/services]” works well to document the payment transaction accurately.

Make sure to include your contact details or a customer support number for future inquiries. This adds clarity and provides an easy point of reference in case any issues arise after the payment has been made. Always keep a copy for your records and provide the payer with their own copy for future reference.

Use a format that aligns with the nature of the transaction and the recipient’s preferences. If the payment is personal, a simple, concise format with clear details may be sufficient. For business transactions, include your company’s name, address, and contact information for professionalism. A receipt should clearly specify the payment amount, date, method of payment, and what the payment covers.

For printed receipts: Stick to a layout that is easy to read and includes all necessary details. Consider including a barcode or QR code if the transaction is part of a larger system that tracks payments.

For digital receipts: Use a clear, easy-to-navigate PDF or email format. Ensure that the text is legible, and avoid using excessive colors or fonts that could distract from the key information. Attach any relevant transaction numbers or links that might be helpful for follow-up.

Make sure the format you choose provides all the information needed without overwhelming the recipient with unnecessary details. This will help ensure that the receipt is not only practical but also professional and user-friendly.

Include the date of the transaction to ensure clarity regarding the payment timeline. This helps avoid confusion about the payment’s timing and status.

Clearly state the amount paid. Be specific about the currency and avoid ambiguity in the total sum.

Include the payment method, such as credit card, bank transfer, or cash, so that both parties can easily reference how the payment was made.

Provide a brief description of the goods or services for which the payment was made. This helps maintain transparency and eliminates any potential misunderstandings.

List the receipt number or transaction ID. This unique identifier allows both parties to track the payment and confirms that it has been processed.

Note the payee’s and payer’s details. Make sure to include names and contact information for easy reference in case of any follow-up or dispute resolution.

Include the name of the business or individual receiving the payment, along with any relevant tax identification numbers if necessary. This ensures accountability and provides necessary legal information.

Create a payment receipt template that reflects your business’s branding and provides all necessary transaction details. Focus on clear sections that organize information logically for easy reading. Begin with a prominent header that includes your business name, logo, and contact information for quick reference. This helps clients immediately identify your company.

Include Key Transaction Information

Ensure the template contains essential transaction details: the receipt number, payment date, payer’s name, amount paid, and the method of payment. Specify the items or services purchased, along with their respective prices. Clearly label each section to avoid confusion. Make sure the total amount paid stands out for quick verification.

Design Considerations

Use a clean, easy-to-read font and maintain consistent alignment throughout the document. Organize the receipt into distinct sections, such as a payment summary, service details, and a thank-you note. Incorporate any necessary tax or discount information in dedicated fields. A simple layout ensures your customers can review and understand their receipt at a glance.

Always include all relevant transaction details in payment receipts to meet legal and tax requirements. Each receipt must specify the amount paid, date of payment, payer’s and payee’s information, and the reason for the payment. This ensures the document serves as both proof of transaction and an official record for financial reporting.

Tax Documentation Requirements

For businesses, payment receipts are crucial for tax filings. They help track income and expenses for tax purposes. Always keep a copy of the receipt to comply with local tax regulations. Receipts should clearly indicate if VAT (Value Added Tax) or sales tax was included in the transaction. It’s recommended to use a standardized template that includes tax numbers and other mandatory details based on the jurisdiction.

Legal Validity of Receipts

Payment receipts are legally binding documents when properly issued. Ensure the receipt contains a signature (either digital or handwritten) to verify its authenticity. In some jurisdictions, a receipt without a signature may not hold up in court. If dealing with large transactions, both parties may want to keep additional evidence such as bank statements or signed contracts to support the receipt in case of future disputes.

- Verify the transaction information for completeness before issuing a receipt.

- Keep receipts for a specified period, often between 3-7 years depending on local regulations.

- Ensure the receipt aligns with the local tax laws regarding what information must be included.

Always double-check the payment amount before finalizing the receipt. Mistakes in the total can lead to misunderstandings and disputes later on. Ensure that all charges, taxes, and discounts are clearly listed and accurate.

Incorrect Payment Details

Be cautious when entering the method of payment. If the customer paid by credit card, note that clearly on the receipt. Avoid ambiguous terms like “paid” without specifying the exact payment type. This clarity prevents confusion in case of refunds or disputes.

Missing Information

Ensure that all required fields are completed, including the transaction date, company details, and receipt number. A receipt without this basic information may be deemed invalid. Missing signatures or terms of service can also invalidate a receipt.

Always use legible fonts and maintain consistent formatting throughout. Poor readability can make it hard for both you and the customer to interpret important details. Ensure that all text is clear and well-spaced for ease of reading.

To resolve payment disputes efficiently, always ensure that the acknowledgement receipt clearly states the payment details. This document confirms that the payment has been made and can be a valuable piece of evidence in case of discrepancies.

Key Elements of an Effective Acknowledgement Receipt

- Date of transaction

- Amount paid

- Payment method used (cash, check, bank transfer, etc.)

- Name of the payer

- Details of the transaction, including the reason for the payment

Steps to Handle Disputes Using Acknowledgement Receipts

- Verify the payment details on the receipt against your records.

- Contact the payer to clarify any misunderstandings.

- If the payer contests the receipt, request additional supporting documents, such as bank statements or transaction confirmations.

- Consult legal assistance if the dispute remains unresolved after verifying the payment and communication.

By maintaining a clear record through acknowledgement receipts, you establish a straightforward method to address disputes and protect both parties’ interests.

When drafting an acknowledgment receipt for a payment, make sure to clearly state the transaction details in a simple format. This not only ensures transparency but also helps both parties keep track of financial exchanges effectively.

Key Components to Include

| Section | Description |

|---|---|

| Payment Amount | Specify the exact sum received, in both numerals and words, for clarity. |

| Date of Payment | Include the exact date on which the payment was received. |

| Sender’s Information | List the name and contact details of the person making the payment. |

| Receiver’s Information | Provide details of the person or business receiving the payment. |

| Payment Method | Note how the payment was made (e.g., credit card, bank transfer, cash). |

Best Practices for Clarity

Ensure that the receipt is concise, free of jargon, and structured logically. Avoid unnecessary details that may confuse the reader. Provide space for signatures or confirmation from both parties to verify the transaction.