When creating a blank receipt of payment template, it’s important to focus on clarity and simplicity. A well-organized template ensures both the payer and recipient can easily reference the transaction. Start by including key details such as the payer’s and recipient’s names, the date of payment, and the amount paid. These elements form the foundation of the receipt.

In addition to the basic information, include a space for a description of the goods or services provided. This can be essential for both parties to have a clear record of what the payment covered. Make sure to leave room for the method of payment, whether it’s cash, check, or digital transfer.

Lastly, consider adding a unique transaction number or receipt number for easy tracking. This small detail will help keep things organized, especially if the payment involves multiple transactions over time. With these key elements, the template will serve as an effective tool for documenting payments.

Here’s a revised version with fewer word repetitions while keeping the meaning intact:

To create a blank receipt of payment template, begin with essential fields such as the payer’s name, amount, date, and payment method. Include a section for a brief description or purpose of the payment. Ensure that the template is clear and uncluttered, with enough space for details to be filled in easily. Add fields for the payee’s contact information and the signature section at the bottom. Keep the design simple, focusing on legibility and convenience for both parties involved. This will allow for quick customization without unnecessary complexity.

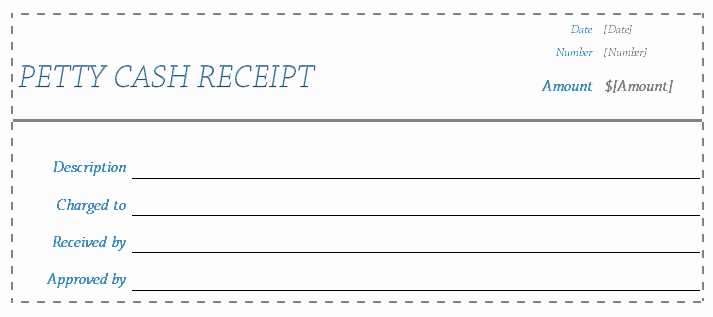

- Blank Payment Receipt Template

Creating a blank payment receipt template ensures clarity and accuracy in documenting financial transactions. Keep the following details on hand when drafting the template:

Key Information to Include

- Transaction Date – Clearly indicate the date of the payment.

- Payer Information – Include the name or business of the person making the payment.

- Amount Paid – Specify the exact payment amount in the appropriate currency.

- Payment Method – Indicate whether payment was made in cash, via check, bank transfer, or online platform.

- Receipt Number – Assign a unique identification number for easy reference.

- Recipient Information – List the individual or entity receiving the payment.

- Description of Goods/Services – Include a brief description of what the payment is for, if relevant.

Template Layout

Organize the template into clear sections. The header should list the word “Receipt” and a receipt number for easy identification. Ensure that all fields for payer and recipient details are visible, followed by a breakdown of the transaction. Provide space for the payer’s signature or acknowledgment, if applicable.

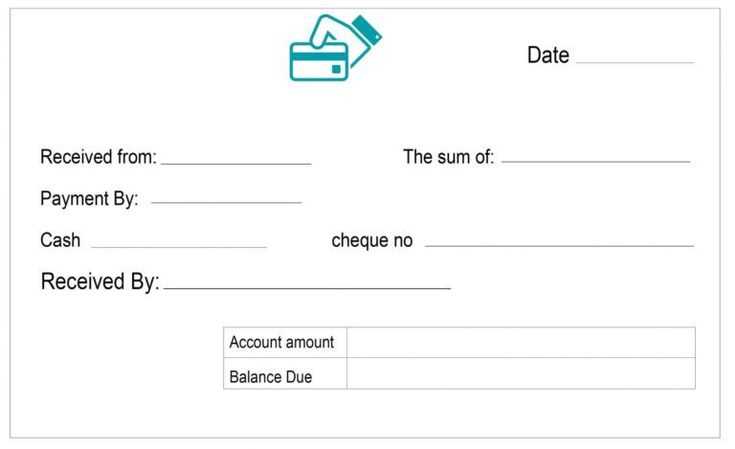

Begin by opening a word processor or a spreadsheet application. Create a document with the following key sections: “Receipt Number,” “Date,” “Amount Paid,” “Description of Goods or Services,” and “Payer’s Name.” Make sure the font is clear and legible. Use headings or bold text to separate each section for clarity.

Step 1: Organize the Layout

Start by setting up clear placeholders for each field. Align each section to ensure the template looks neat and professional. Add enough space for the details to be filled in, particularly for amounts and descriptions. Ensure that the layout remains simple and uncluttered.

Step 2: Customize and Save

Tailor the receipt template to your needs. You can add your business logo at the top, or leave it blank for personal use. Once completed, save the template in a format that suits your needs, such as PDF or DOCX, for easy printing or sharing.

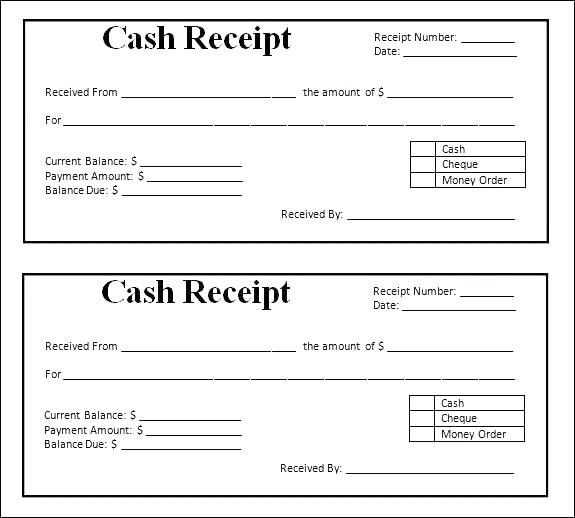

Make sure to include the following details in any receipt to ensure clarity and completeness:

Transaction Information

Specify the date and time of the transaction. This helps both parties track purchases accurately. Additionally, include the receipt number, which serves as a unique identifier for future reference.

Payment Details

List the total amount paid and the payment method used, whether it’s cash, card, or another form. If applicable, include the last four digits of the credit card number to further clarify the payment method.

Seller Information

Provide the name and contact information of the seller or business. This allows for easy follow-up or customer inquiries about the transaction.

Itemized List of Products or Services

Include the names, quantities, and individual prices of the purchased items or services. Break down any applicable taxes or discounts, so the total can be easily understood.

Return or Exchange Policy

If applicable, mention the business’s policy on returns or exchanges. This sets clear expectations for customers if they need to address any issues with their purchase.

For clarity and legal compliance, opt for a format that clearly outlines transaction details. A digital receipt works best for online purchases, while printed receipts are suitable for in-person sales. Both should include the same essential elements: transaction date, itemized list, total amount, and payment method.

Digital Receipts

Digital receipts provide a streamlined approach. They are easily stored and can be emailed directly to the customer. This format is ideal for online transactions, especially when you need to send a copy immediately after purchase. Choose a format that is easily readable across devices–PDFs or HTML-based receipts are widely compatible.

Printed Receipts

For in-store transactions, printed receipts are a standard choice. Ensure they are legible and include all necessary transaction details. Consider a format that supports both small businesses and large-scale retailers, making it scalable for different printing methods such as thermal or inkjet printers.

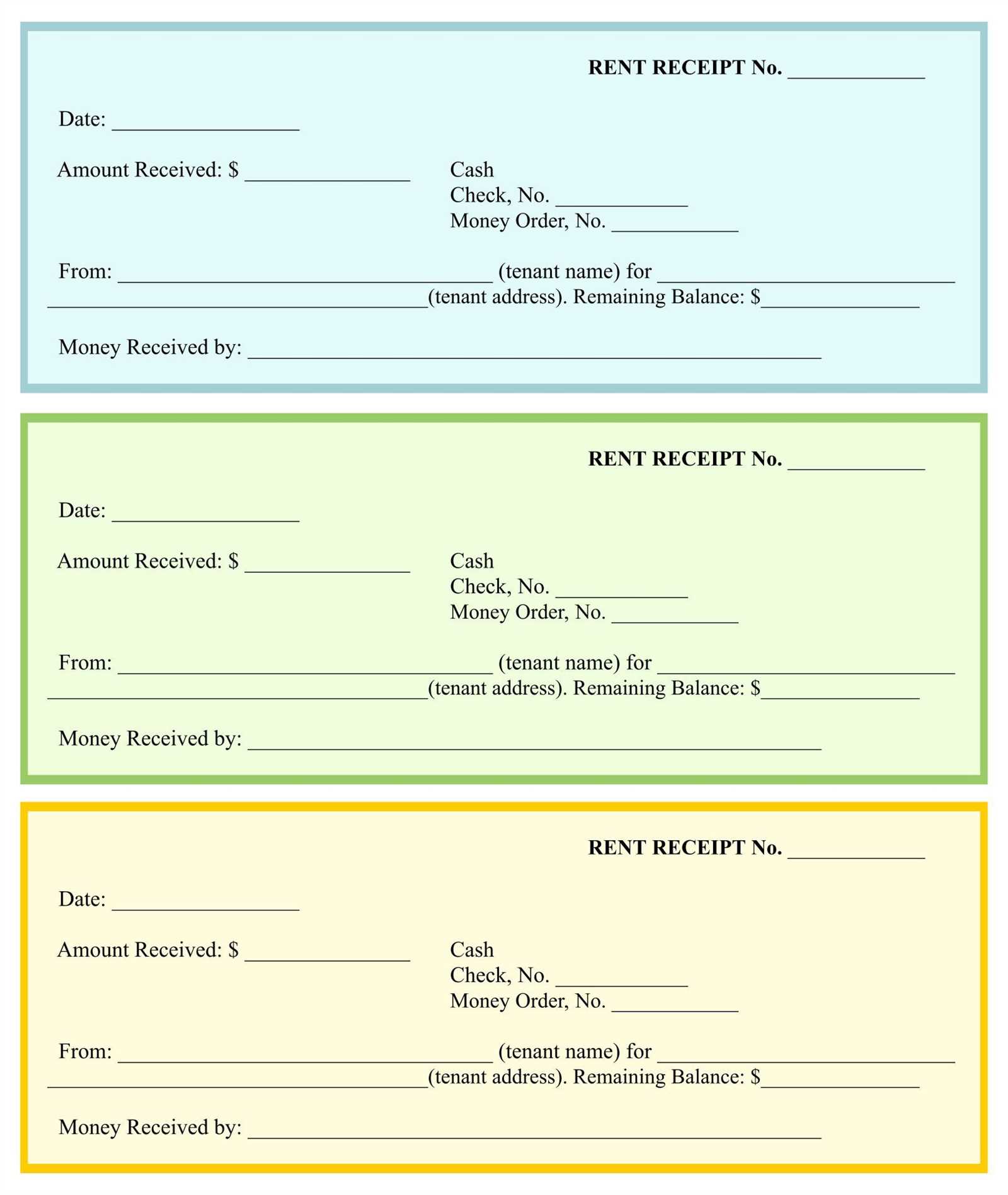

Adjusting your payment receipt template for different transaction types ensures clarity and meets all the necessary requirements. First, tailor the header to reflect the type of payment, such as “Credit Card Payment,” “Cash Payment,” or “Bank Transfer.” This immediately informs the recipient of the payment method used.

Include Specific Payment Details

Each payment type has distinct details that should be highlighted. For credit card payments, include the last four digits of the card number and the transaction approval code. For cash payments, indicate the amount received and specify any change given. Bank transfers require the transaction reference number and bank details to be clearly stated.

Adding Payment Terms and Notes

If relevant, add payment terms or instructions specific to the transaction. For example, “Payment due within 30 days” or “Thank you for your prompt payment” can be helpful. This reinforces the expectations and provides the recipient with a clear understanding of the terms linked to the payment.

By customizing these elements, you ensure that each payment receipt serves its purpose while maintaining professionalism and transparency.

Payment receipts serve as a legal proof of transaction and have specific requirements depending on jurisdiction. They typically outline the amount paid, the payment method, and the identity of both parties. In most cases, receipts must be issued for all transactions to avoid disputes and ensure compliance with tax laws.

Make sure to include the following key elements in a payment receipt:

- Date and time of the transaction

- Details of the product or service purchased

- The total amount paid, including applicable taxes

- Payment method (credit card, cash, etc.)

- Names or identification numbers of both the buyer and the seller

Failure to provide accurate receipts can lead to legal consequences, including fines or difficulties during audits. It’s also important to store these receipts for a specified period, often ranging from 3 to 7 years, depending on local regulations.

For businesses, maintaining a record of receipts helps in proving compliance with tax laws and reducing the risk of fraud. It’s recommended to keep a digital or physical copy accessible in case of disputes.

Double-check the accuracy of the receipt before accepting or issuing it. Small mistakes such as incorrect dates, amounts, or buyer details can lead to confusion or disputes. Verify that the receipt matches the transaction in every aspect.

1. Incorrect Information

Always ensure that the receipt contains accurate information about the transaction. Check for errors in names, addresses, item descriptions, or amounts. Double-check the date and time to prevent any inconsistencies.

2. Forgetting to Include Necessary Details

Every receipt should include vital transaction details. If you’re issuing a receipt, make sure it contains the payment method, purchase description, and any applicable taxes. Missing information can make the receipt less reliable in case of refunds or audits.

| Common Mistake | How to Avoid It |

|---|---|

| Omitting the payment method | Always include how the transaction was paid (e.g., credit card, cash, or bank transfer). |

| Unclear item descriptions | Provide specific details about the purchased items or services to avoid confusion. |

| Incorrect amounts | Double-check all amounts to ensure the total is accurate and matches the transaction. |

Another mistake is failing to store receipts properly. Keep both digital and physical copies in a safe place for future reference. If a receipt is lost, retrieving necessary information may be difficult.

For creating a blank receipt of payment template, follow these steps to ensure clarity and completeness:

- Include the date of payment at the top of the receipt. This helps both parties keep track of transactions.

- Clearly state the name and contact information of both the payer and the recipient. This ensures identification and facilitates future reference.

- Provide a unique transaction or receipt number. This prevents confusion and aids in record-keeping.

- List the items or services for which payment is made. Specify the amount for each item along with any taxes or discounts applied.

- Clearly show the total amount paid at the bottom. This ensures transparency.

- Leave space for the payment method used (e.g., cash, credit card, check). This ensures that all payment details are recorded.

Key Fields to Include

- Date of payment

- Receipt number

- Payer’s and recipient’s information

- Itemized list of goods/services and amounts

- Payment method

- Total amount paid

Formatting Tips

- Keep the layout simple and organized. This improves readability.

- Use bold or underline to highlight key sections like the total amount and transaction number.

- Leave enough space for manual additions, such as signatures or notes if necessary.