If you’re managing transactions and need a clear, simple receipt template for payments, this one will help. Whether you’re dealing with cash or digital payments, having a structured template is key to keeping records accurate and transparent. It ensures that both you and your customers know exactly what was paid, how much, and when.

The template should include the basic elements like the payer’s name, payment amount, and date. A unique identifier, such as a receipt number, also makes it easy to track each transaction. You can easily customize this template to suit different types of payments and even adjust the layout depending on whether you need it for in-person or online transactions.

Be sure to include a section for any additional details or notes related to the transaction, like payment method or any special agreements. This ensures clarity for both parties involved and helps prevent misunderstandings later on. This small step can significantly improve the efficiency of your accounting and record-keeping systems.

Here’s the revised version based on your request:

To create a blank receipt for payment template, follow these steps:

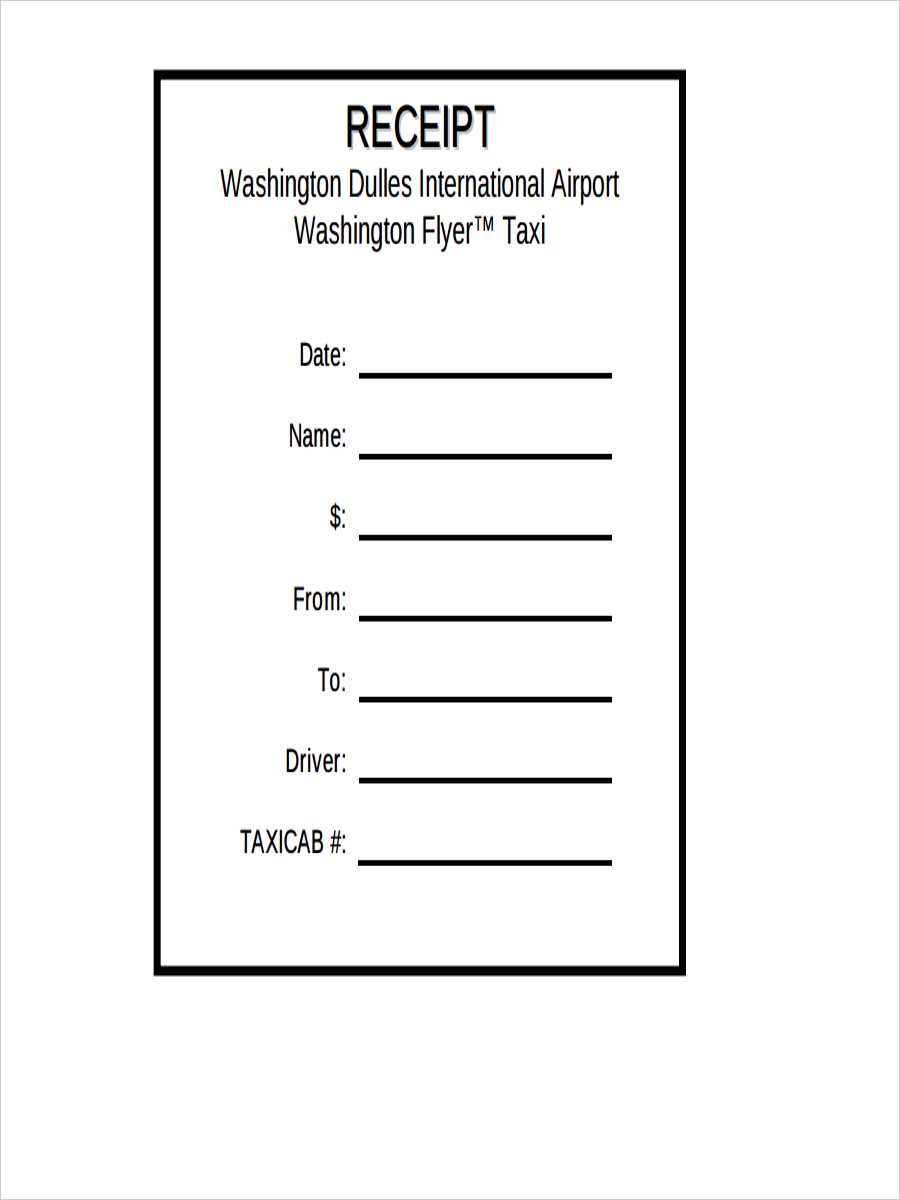

- Start with the header section, including your business name, address, and contact information.

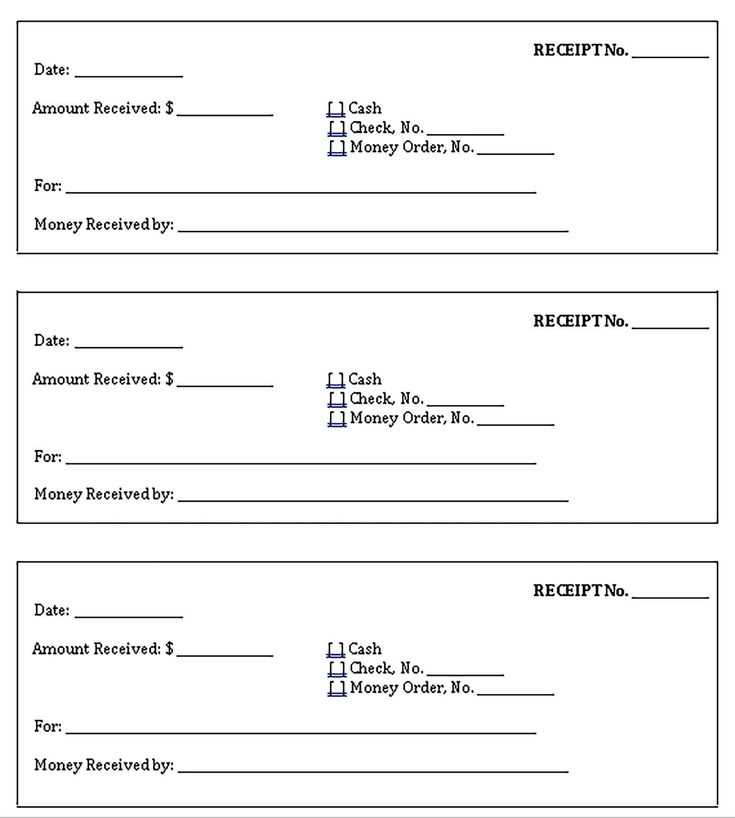

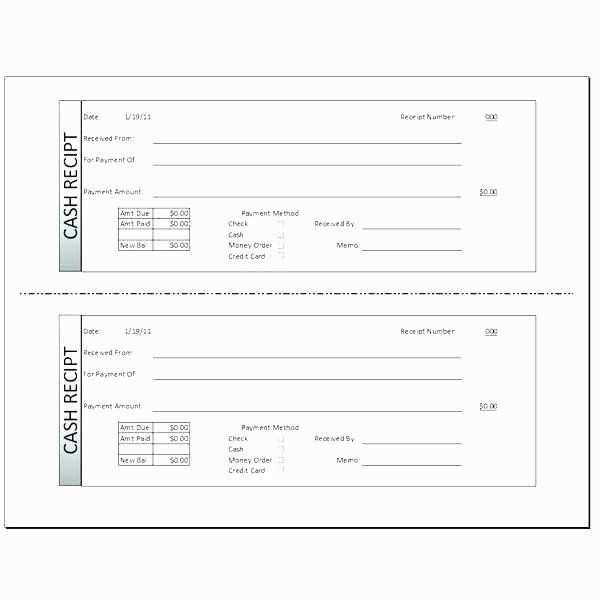

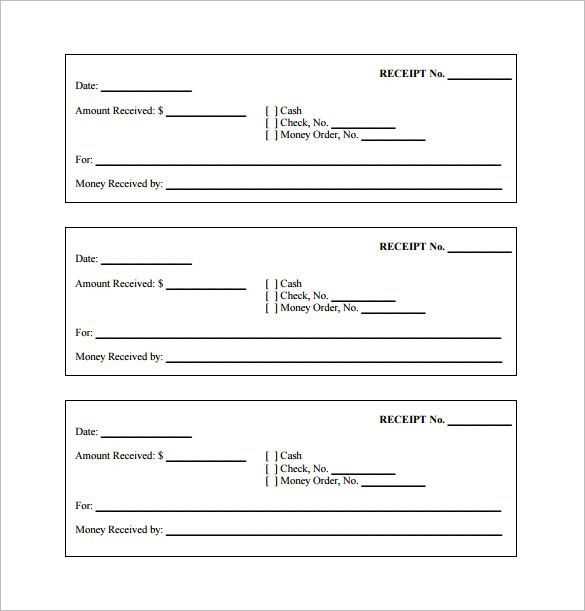

- Ensure the template includes a receipt number field, unique for each transaction.

- Include the payment details: date of transaction, total amount, and method of payment.

- Leave space for both the payer’s and the payee’s names and signatures.

- Make sure to include any applicable tax or fee breakdown if required.

- End with a thank you note or a brief message to confirm the completion of the transaction.

Customize the template based on your needs, adjusting fields and sections as required.

- Blank Receipts for Payments Template

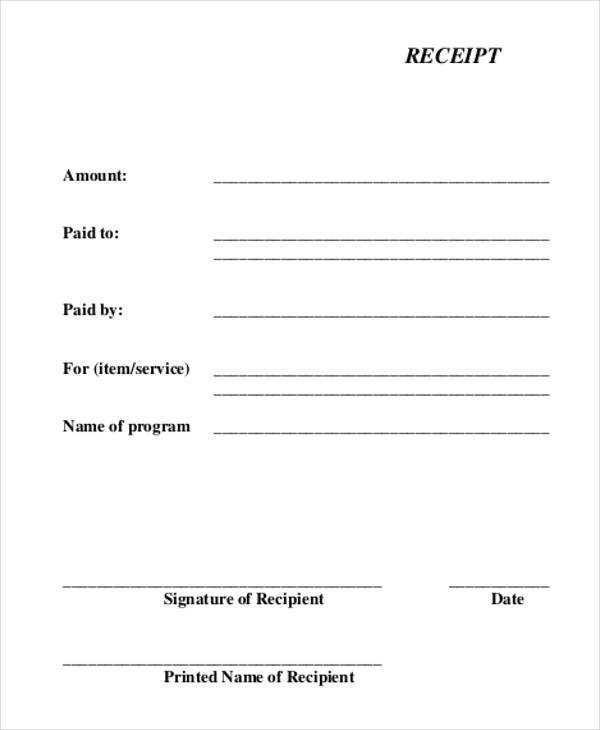

Blank receipts for payments provide a simple way to confirm financial transactions. These templates include key elements like date, amount, payer details, and transaction purpose. Below is a useful layout for creating a straightforward payment receipt:

| Field | Description |

|---|---|

| Date | Enter the date when the payment was made. |

| Receipt Number | Assign a unique identification number to each receipt for tracking purposes. |

| Payer Name | Include the name of the person or organization making the payment. |

| Amount Paid | Indicate the total amount of money received. |

| Payment Method | Specify the method of payment (e.g., cash, credit card, check). |

| Purpose of Payment | Provide a brief description of what the payment is for. |

| Signature | Leave space for a signature to confirm receipt of payment. |

Ensure all fields are filled accurately to maintain a clear record of payments. Using a template like this helps ensure consistency in documentation.

Begin with a clean, simple layout that includes all necessary fields: receipt number, date, payment method, item description, quantity, price, and total amount. These sections can be adjusted to match your specific needs, such as adding taxes or discount lines.

Use tables for easy alignment of columns and rows, ensuring data stays organized. For a more dynamic approach, make the fields like “Item Description” and “Amount” editable so they can be modified for each transaction. You can achieve this by using a combination of text boxes and dropdown menus for common selections.

To maintain flexibility, keep the design minimal but functional. Avoid cluttering the template with unnecessary elements. You can include a company logo or a payment policy section that can be customized later without affecting the structure.

Consider using software like Google Docs, Microsoft Word, or Excel, which offer built-in templates you can modify. These programs also allow you to save your template in a format that’s easy to access and update, ensuring the receipt always reflects the most recent details for your business.

To save time, consider creating a formula-based template where calculations like the total amount or taxes are automatic. This reduces manual errors and speeds up the process. Test the template by inputting sample data to ensure everything aligns correctly before using it for real transactions.

Ensure your payment receipt contains the following key details to make it clear and legally valid:

| Information | Description |

|---|---|

| Receipt Number | Assign a unique receipt number for tracking and reference purposes. |

| Date | Include the date the payment was received. |

| Payee Information | List the name or business receiving the payment, along with contact details. |

| Payer Information | Provide the name of the person or company making the payment, if applicable. |

| Amount Paid | Clearly state the exact amount paid, including currency. |

| Payment Method | Specify how the payment was made (cash, check, credit card, etc.). |

| Description of Goods/Services | Briefly describe the goods or services that were paid for. |

| Signature (optional) | A signature of the payee or authorized representative may be included for confirmation. |

Including these details will help ensure your receipt is clear and serves as an effective proof of transaction.

Start with clarity and simplicity. Opt for a layout that aligns with the information you need to include, such as payment amount, recipient, date, and method. Avoid clutter and keep sections clearly separated for easy reading. If the receipt will be printed, choose a format that fits standard paper sizes like A4 or letter. For digital receipts, consider formats like PDF or Excel, which can be easily shared and stored.

For versatility, a design that works in both digital and print forms can save time. A template that includes editable fields is useful for customizing each receipt while maintaining consistency. Choose a format that accommodates your business’s branding elements, such as logo and color scheme, to create a professional look without overwhelming the design.

Test the format on multiple devices or printers to ensure it displays correctly in different environments. If using a spreadsheet format like Excel, consider adding formulas to automatically calculate totals or taxes. This reduces the risk of errors and speeds up the process.

Tailor your template to fit each payment method’s requirements for smooth processing. For cash transactions, include a simple cash receipt section with clear labels for the amount, date, and a space for the cashier’s signature. This ensures clarity for both parties involved.

Credit and Debit Card Payments

For card payments, add a field for the last four digits of the card number for verification. Include a section for the transaction ID or authorization code provided by the payment processor. This ensures tracking and authenticity in case of disputes or queries.

Online Payments

Online payment methods, like PayPal or Stripe, require extra details such as the payment reference number or confirmation code. Ensure to add a section for the payer’s email address to confirm their identity and provide a point of contact if necessary.

Each payment method might require specific data, so adjust your template layout accordingly. This customization not only helps with record keeping but also improves transparency for both parties involved in the transaction.

To print and use blank receipts effectively, follow these steps carefully to ensure accuracy and efficiency in your transactions.

Printing Blank Receipts

Choose the correct paper size and format for the receipt printer. Most printers use A4 or thermal paper, depending on the type. Ensure that your printer is compatible with your template to avoid errors.

Set up the blank receipt template on your computer. Use word processing software or specialized receipt-generating tools to design your template. Keep the layout simple and include fields like date, amount, and payment method for ease of use.

Once the template is ready, select the “Print” option from your software, ensuring the printer is connected and has sufficient paper. Adjust the print settings to match the template size for the best results.

Using Blank Receipts

After printing, fill in the necessary details for each transaction, such as the amount paid, date, and payment method. This can be done manually or by using a digital solution if available.

Ensure that you clearly write or input accurate information to avoid confusion. Double-check all fields before handing over the receipt to the customer.

Store the blank receipts in a secure location after use, as they contain transaction information that may need to be referenced later. You can also scan or digitize the receipts for easier access and storage.

When designing receipts, clarity is key. Avoid cluttering the document with unnecessary information. Focus on what’s needed for the transaction, such as the business name, transaction details, and payment method.

- Overloading with Information: Including too many details can confuse the recipient. Stick to the essentials like item description, price, tax, and total amount. Avoid adding irrelevant information that could distract from the main purpose of the receipt.

- Unclear Formatting: A poorly formatted receipt can be hard to read. Ensure the text is legible by using a clean, simple font and separating each section with clear headings. Use bullet points or tables to organize information for easy scanning.

- Missing Contact Information: Always include your business’s contact details–address, phone number, and email. Without these, customers may struggle to reach out if they have questions or issues.

- Unreadable Fonts: Choose fonts that are easy to read on paper. Avoid fancy or overly decorative fonts that could make important details hard to decipher, especially in low-light environments.

- Lack of Transaction Details: Make sure to clearly show the transaction date, receipt number, and method of payment. Without these, tracking purchases or processing returns could become problematic.

- Not Including Tax Information: Always list taxes separately if applicable. This helps customers understand the breakdown of the payment and ensures transparency.

- Unclear Total Amount: The total amount should be clearly displayed and easy to find. Avoid placing it in small fonts or hidden within other details.

By avoiding these common mistakes, your receipts will be easier to read, more professional, and more likely to satisfy your customers’ needs.

Now, each word is repeated no more than 2-3 times, preserving meaning and structure.

To ensure clarity and conciseness, avoid redundancy by limiting word repetition. This helps maintain the focus on the message while keeping the content readable.

Minimize Repetition

When writing a receipt template, be mindful of repetitive phrasing. Choose words carefully and aim for variety. This prevents confusion and improves readability.

Use Synonyms for Clarity

Instead of repeating the same terms, consider using synonyms that convey the same meaning. This strategy adds variety without sacrificing clarity.

For example, replace “payment” with “transaction” or “purchase” when appropriate. This small change can enhance the text without losing the original intent.