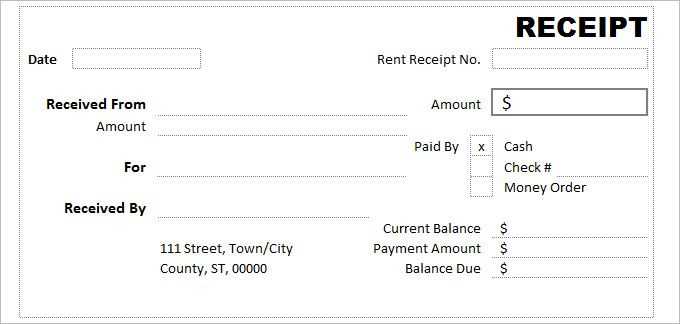

For smooth financial operations, creating a clear and concise payment receipt is key. A well-structured receipt ensures both parties involved in the transaction have accurate records. Use this template to confirm the details of each payment and maintain professionalism in your dealings.

Start by clearly listing the payment date, the amount received, and the method of payment. This eliminates confusion and helps track payments with ease. It’s also recommended to include your business details, such as name, address, and contact information, so your client can easily reach you if needed.

Always ensure to include a reference number or invoice number. This is useful for both you and your client to match the receipt to the correct transaction. Additionally, provide a brief description of the goods or services rendered to give a complete record of the payment.

Finally, don’t forget to include a thank-you note at the end. A simple “Thank you for your business” adds a personal touch and reinforces customer relations.

Business Payment Receipt Template Guide

For clarity and professionalism, every business payment receipt should include key details that confirm the transaction. Make sure your template includes the following elements:

1. Payment Details

Clearly state the payment amount, currency, and method. Specify whether the payment was made via credit card, bank transfer, or cash. This helps both parties track and verify the payment.

2. Buyer and Seller Information

Include the names, addresses, and contact details of both the buyer and the seller. This ensures both parties can easily reach each other for any future references or issues regarding the payment.

Additionally, it’s a good practice to include a receipt number for easy identification of the transaction. Make sure the template is easy to customize, allowing you to adjust the style and layout according to your business needs.

Finally, always add a section for the transaction date and a brief description of the goods or services provided, so that both parties have a clear record of what was paid for.

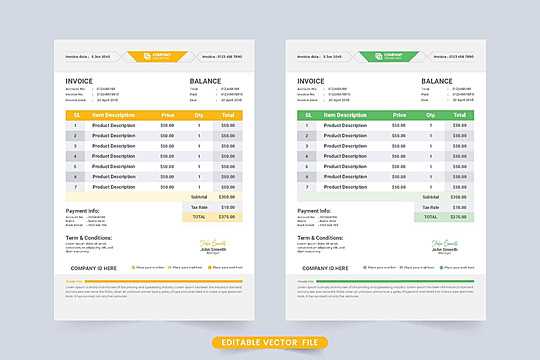

Customizing Your Payment Receipt Template

Adjusting your payment receipt template can help ensure it meets your business’s specific needs. Begin by adding your business logo at the top. This makes your receipts more professional and recognizable. Position your business name, address, and contact details clearly so customers can easily reach you if necessary.

Incorporating Key Payment Information

Include the payment method used, transaction ID, and payment date for clarity. This helps both you and your customer keep track of their payment. Specify the amount paid and list any taxes or discounts applied. Providing this transparency builds trust and reduces confusion.

Personalizing Receipt Details

For an extra touch, personalize each receipt with customer names or order numbers. This can be automated in many receipt software programs. Consider adding a section for thank-you notes or promotional offers. This small gesture can encourage customer loyalty and make the receipt feel less transactional.

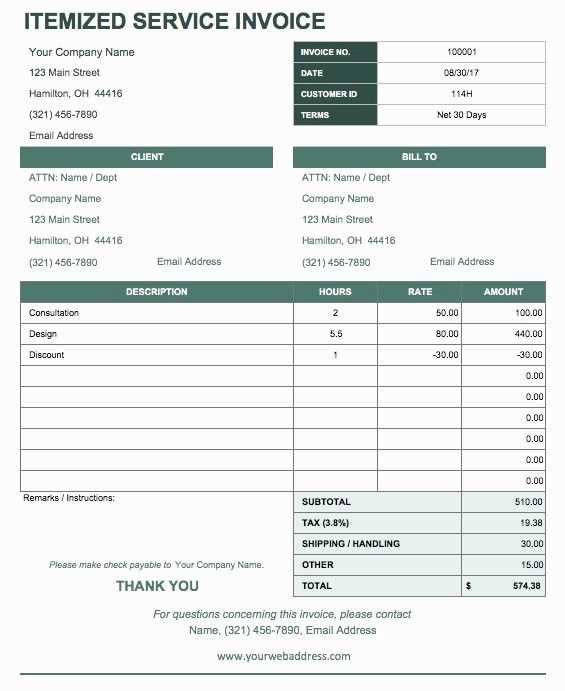

Key Elements to Include in a Receipt

Ensure each receipt clearly displays the following key elements for a smooth transaction record:

1. Business Information

Include your business name, address, phone number, and email. If applicable, add the business registration number or tax identification number for verification. This establishes your credibility and enables the customer to contact you if needed.

2. Transaction Details

Record the date and time of the transaction. List the items or services purchased, including descriptions and quantities. The price for each item and the total amount paid must be clearly visible. Add any discounts, taxes, or additional fees to provide full transparency.

Finally, include the payment method (e.g., cash, credit card, online payment) to clarify how the transaction was completed.

Legal Considerations for Payment Receipts

Ensure payment receipts comply with local laws and regulations. Include key information like the date, transaction amount, and names of both parties involved. These details provide clarity and protect both the payer and the receiver in case of any disputes.

Keep in mind that tax authorities may require you to include additional details on the receipt, such as tax identification numbers or VAT. Verify the specific requirements for your location to avoid penalties.

- Include a clear description of the goods or services provided.

- Indicate the method of payment (cash, credit card, bank transfer, etc.).

- Ensure the receipt is signed if required by local regulations.

- Record both the gross and net amounts, especially if taxes are involved.

Also, verify the validity of the payment method used, especially for larger transactions. For example, ensure that checks or electronic transfers have cleared before issuing a receipt. This helps in preventing fraudulent claims or reversals.

To avoid complications, always issue receipts in a timely manner. Delaying a receipt can lead to confusion and may not hold up in legal situations. Make sure to keep copies for your records as well.