Receipts

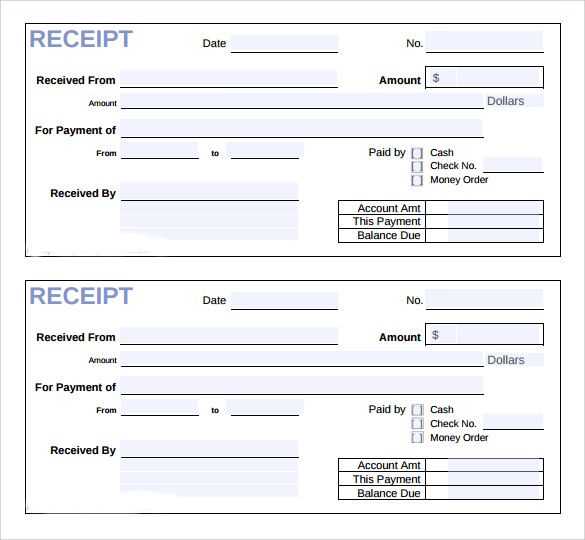

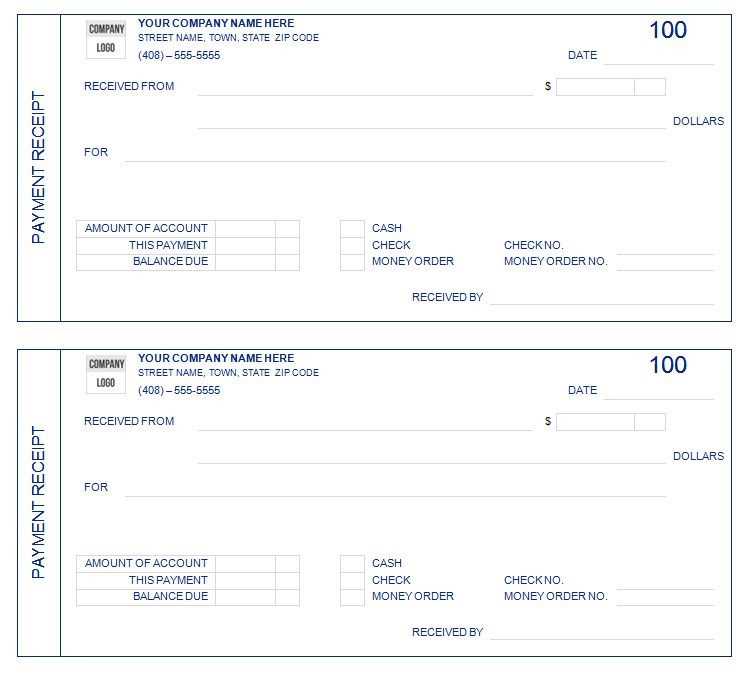

When documenting charity receipts, include the date, donor details, amount, and purpose. Each receipt should be clearly labeled with “Receipt” and provide a unique reference number for traceability. For each donation, ensure the source is mentioned, such as individual donors, grants, or fundraising events. Grouping receipts by type or event helps maintain organization. For instance:

- Individual Donation: Include the donor’s name and amount received.

- Fundraising Event: List the total raised, specifying ticket sales or direct contributions.

- Grant: Include the name of the grant provider, amount, and any conditions attached to the funds.

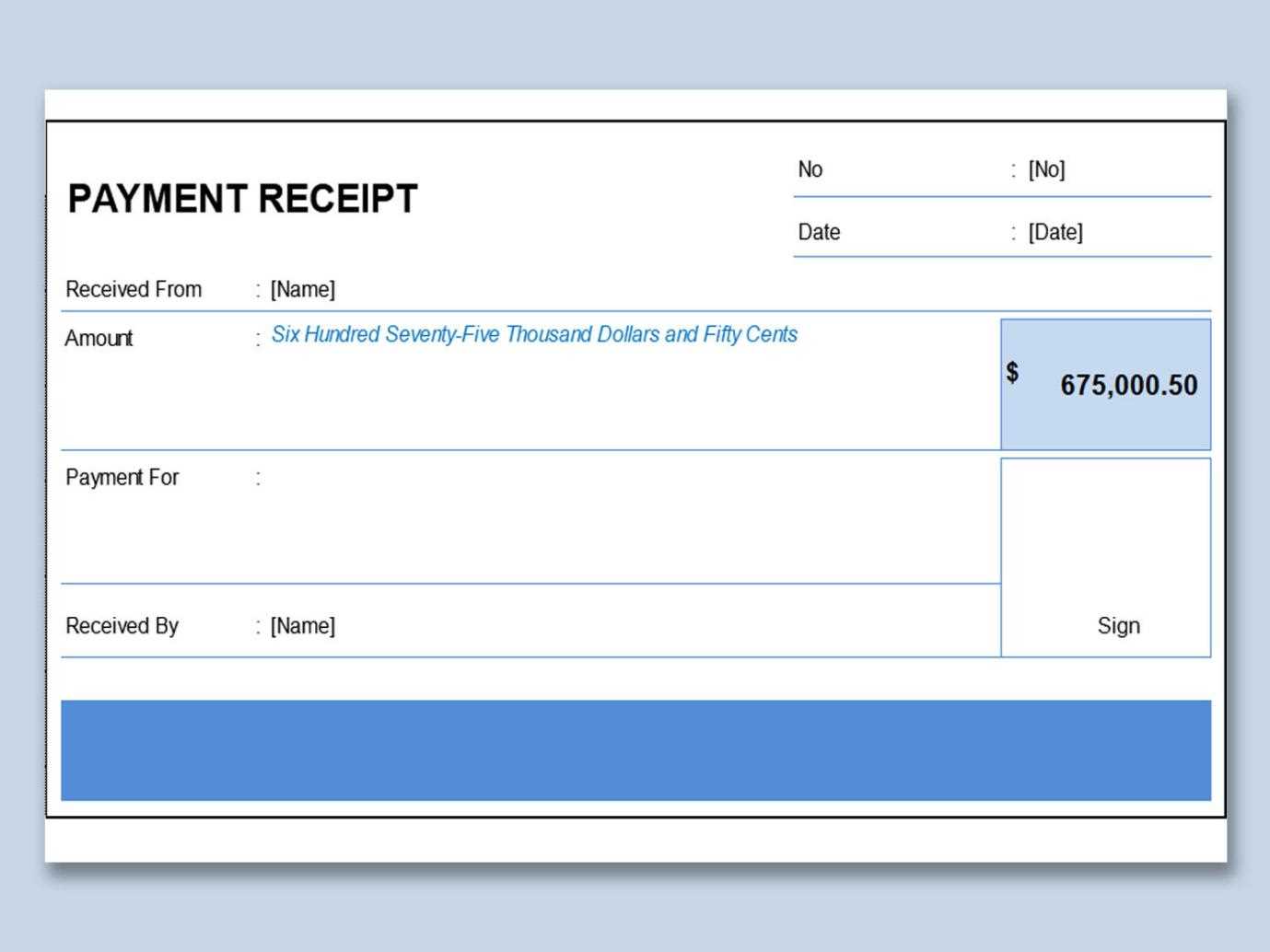

Example of a receipt entry:

Receipt #001 | Date: 12/02/2025 Donor: John Doe | Amount: $500 | Purpose: General Donation

Payments

Document all charity payments with the same level of clarity. Each payment should list the payee, amount, and purpose. Include transaction references or invoice numbers for full accountability. Grouping payments based on categories like operating costs, event expenses, or grants paid out ensures clarity. For instance:

- Operating Costs: Payments related to rent, utilities, and office supplies.

- Event Expenses: Costs related to venue rental, catering, and other logistical needs.

- Grants Paid: Payments made to other organizations or individuals.

Example of a payment entry:

Payment #045 | Date: 15/02/2025 Payee: ABC Catering | Amount: $1,200 | Purpose: Fundraising Event Catering

Tracking and Reconciliation

Regularly reconcile receipts and payments to ensure all funds are accounted for. For transparency, maintain a spreadsheet or accounting software that categorizes all incoming and outgoing funds. This will simplify financial reporting and assist in auditing. Ensure that every entry matches corresponding bank statements, and reconcile at least monthly to identify discrepancies early.

Charity Accounts Template: Receipts & Payments

For a clear and accurate charity account, use a simple template to record receipts and payments. A straightforward layout helps avoid confusion and ensures transparency. Begin by categorizing income sources such as donations, grants, and fundraising. Include details like the donor’s name, the date, and the amount received. A clear breakdown makes it easier to track donations and maintain proper records for future reference.

When recording payments, list every expense, specifying the date, payee, and the amount paid. Ensure that each entry matches the charity’s purpose. Keep track of both one-time and recurring payments for operational costs, project expenses, and other liabilities. This prevents discrepancies and facilitates better cash flow management.

To comply with accounting standards, maintain a well-organized structure that aligns with legal requirements. Double-check that all receipts and payments are documented and reconciled. Avoid vague descriptions in the records and ensure all transactions are substantiated with receipts or invoices. Regular audits and updates on the account will help maintain accuracy and meet regulatory requirements.