Using a charity commission receipts and payments template helps ensure transparency and accuracy in financial reporting for your charity. It provides a clear structure to document all income and expenditure, making it easier to comply with regulatory requirements and build trust with donors.

The template should include categories for all sources of income, such as donations, grants, and fundraising events, along with all forms of expenditure, from operational costs to project funding. Keep the format simple and easy to update, as it will be reviewed periodically by both trustees and regulatory bodies.

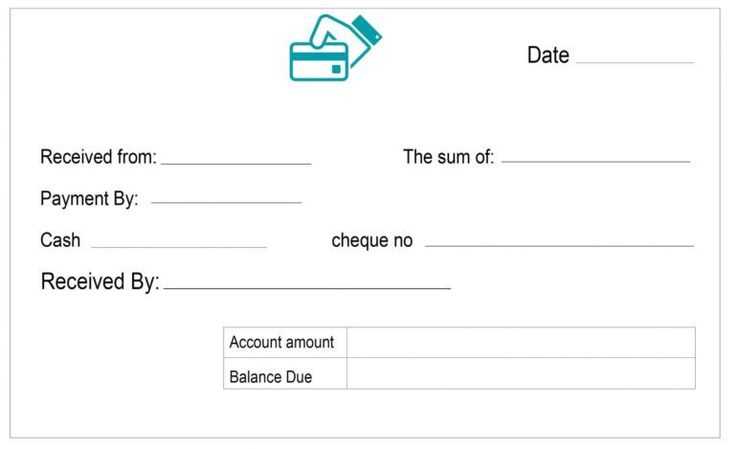

When filling out the template, be sure to record each transaction with specific details: the date, amount, and purpose. This ensures that your financial records remain organized and can be quickly accessed when needed for audits or reports.

Regular updates to the template are key to maintaining accurate records, especially if your charity receives multiple forms of income or has a range of expenses. Using an updated template also provides a clear picture of your charity’s financial health and supports long-term sustainability.

Always remember, a well-organized template not only helps meet legal requirements but also builds credibility with stakeholders by demonstrating transparency and proper stewardship of funds.

Here’s the revised version without unnecessary repetitions:

To ensure clarity and avoid redundancy, keep the format clean and concise. The Charity Commission receipts and payments template should reflect a straightforward structure. Focus on the key elements without over-explaining details that are already implied or covered elsewhere.

Key Sections to Include:

- Receipts: List all incoming funds with clear categories (e.g., donations, grants, fundraising events).

- Payments: Include all outgoing costs, categorized by their nature (e.g., operational costs, project expenses, staff salaries).

- Surplus or Deficit: Clearly indicate the balance between receipts and payments for transparency.

- Bank Statements: Attach supporting documentation for financial verification.

Practical Tips:

- Avoid using generic terms like ‘miscellaneous’ without explanation.

- Ensure that all entries are specific, listing precise dates and amounts.

- Be consistent with terminology across all sections to enhance clarity.

- Provide sufficient details to support audit trails, without overloading with irrelevant information.

By following this approach, you will present a clear, professional, and easy-to-understand financial report.

- Charity Commission Receipts and Payments Template

The Charity Commission Receipts and Payments Template is designed to help charities report their financial activity clearly and concisely. The template focuses on tracking income, expenditures, and overall financial status, ensuring compliance with charity regulations.

- Income Details: Begin by listing all sources of income, including donations, grants, fundraising events, and any other revenue streams. Each entry should include the amount received and the date of receipt.

- Expenditure Breakdown: Next, record all expenses. Categorize spending into relevant groups such as administration costs, program expenses, and fundraising costs. Be specific in describing each item and its cost.

- Balancing Funds: At the end of the period, the total income should be subtracted by the total expenses to determine the net balance. This balance is essential for transparency and ensuring proper financial management.

- Footnotes and Clarifications: Include any necessary footnotes to explain significant or unusual transactions. This helps avoid confusion and ensures transparency in your financial reporting.

Make sure to update the template regularly to reflect any changes in your charity’s financial activity. Proper use of this template not only meets the Charity Commission’s requirements but also builds trust with donors, trustees, and other stakeholders.

Begin by downloading the Charity Commission’s official template for receipts and payments. This document will ensure you follow the required structure and meet the reporting guidelines. The template includes sections for income, expenditure, and other essential details, providing clarity on financial activity.

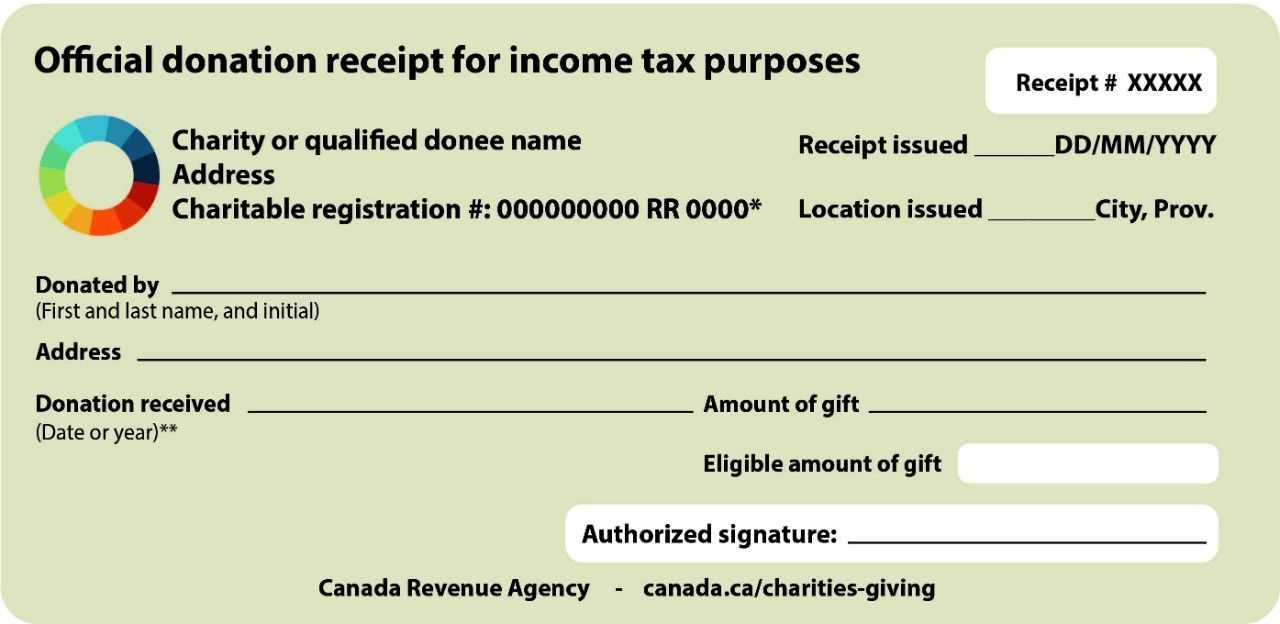

Fill in the charity’s name, registration number, and accounting period at the top of the template. These identifiers are necessary for compliance and proper tracking.

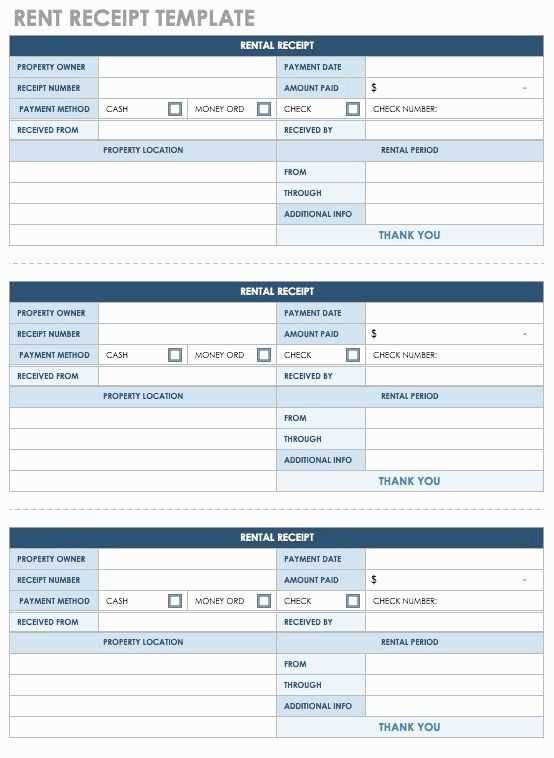

Next, populate the “Receipts” section with all sources of income. These may include donations, grants, fundraising activities, and any other income received by the charity. Each source should be listed separately, with totals recorded for each category.

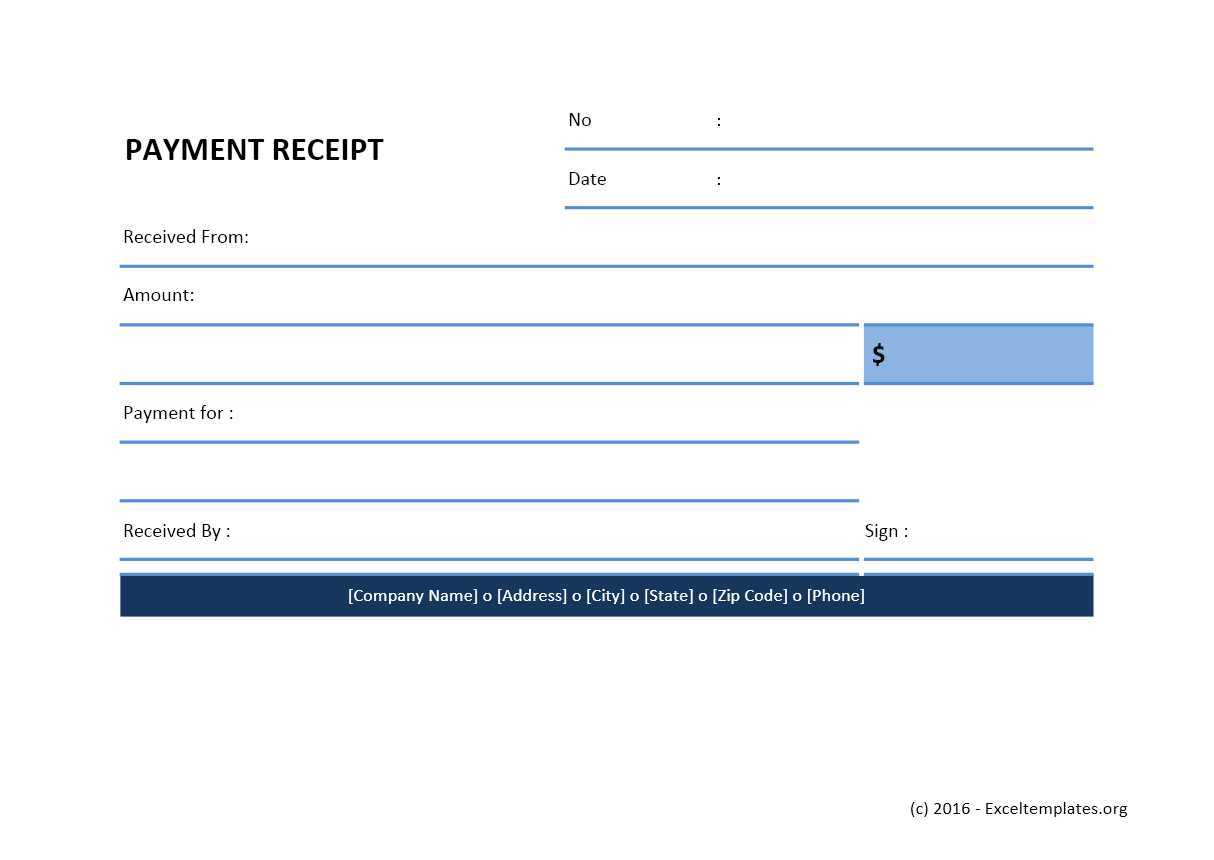

For “Payments,” list all outgoing payments, including expenses such as staff salaries, project costs, and overheads. Break down the payments into categories to make them easier to understand and track. Each payment should have a corresponding total to give a clear picture of the charity’s financial activity.

Double-check that all amounts are accurate and match the supporting documentation, such as bank statements or receipts. This will prevent errors and ensure the data aligns with the charity’s financial records.

If applicable, include any balances at the start and end of the reporting period to show the charity’s financial position. This helps to provide a full view of the charity’s financial health.

| Receipts | Payments |

|---|---|

| Donations | Staff Salaries |

| Grants | Office Rent |

| Fundraising Income | Project Expenses |

Review the completed template for accuracy. After filling in all required sections, save the document and upload it to the Charity Commission’s online system. This will ensure that your charity remains compliant and transparent in its financial reporting.

Each receipt and payment category on the charity commission template serves a specific purpose, helping ensure transparency in financial reporting. Organizing receipts and payments into clear sections not only enhances accuracy but also complies with reporting standards. Below is a breakdown of the most common categories:

Receipts: These are incoming funds that the charity receives, often categorized by their source. Examples include donations from individuals, grants from institutions, and income from fundraising activities. Each receipt should be recorded with specific details like donor names, grant providers, and purpose, as this aids in understanding the flow of funds.

Payments: Payments represent outgoing funds that the charity spends on various expenses. Categories within this section often include administrative costs, program expenses, and staff salaries. Ensure that each payment is detailed with vendor names, service descriptions, and amounts to maintain clarity in the records.

Restricted and Unrestricted Funds: Donations may be allocated to either restricted or unrestricted funds. Restricted funds are earmarked for specific projects or purposes as defined by the donor. Unrestricted funds can be used for any charitable purpose, offering more flexibility. Clearly differentiate between these fund types to avoid confusion in future reports.

Grants and Contracts: If the charity receives grants or enters into contracts, it’s important to distinguish these from other receipts. Specify the amount, funding source, and terms of the grant or contract. This ensures proper management and reporting of externally sourced funds.

Investments and Income: If the charity generates income from investments or other assets, it must be categorized separately. This includes interest, dividends, and any returns on investments held by the charity. Accurate tracking ensures that the financial statements reflect all sources of income.

Expenditure on Activities: This includes costs directly associated with running the charity’s programs and services. It’s essential to break down expenses by activity to demonstrate how funds are allocated to the charity’s mission. Categories here might include event costs, outreach programs, and community services.

Administrative Costs: Expenses related to the charity’s general operations should be tracked separately. This includes office supplies, rent, utilities, and salaries for administrative staff. Providing transparency here ensures that donors and auditors can evaluate how efficiently the charity uses its resources.

Capital Expenditure: Some expenses may be capital in nature, such as the purchase of land, buildings, or long-term equipment. These costs should be recorded in their own category to distinguish them from operational expenses. This makes it easier to track the charity’s long-term investments.

By organizing receipts and payments into these specific categories, the charity can maintain clarity, improve financial management, and ensure adherence to regulations. Clear categorization also aids in preparing accurate financial statements and helps establish trust with donors and stakeholders.

To accurately categorize income and expenditure, first review the template’s predefined categories. Identify which category each transaction belongs to, and be consistent throughout. For income, typical categories might include “Donations,” “Grants,” or “Fundraising Events.” For expenditure, common sections could be “Program Costs,” “Administration,” or “Fundraising Expenses.” Make sure to place every transaction into its corresponding section to ensure transparency and clarity.

Be specific when categorizing each transaction. If a donation is made for a particular project, record it under “Project-Specific Donations” to track its usage. For any staff-related costs, place them under “Staff Salaries” or “Employee Benefits,” depending on the type of expense. If expenses don’t fit neatly into a category, create an additional section, but avoid too many miscellaneous categories to maintain clarity.

Regularly update the template with new income and expenditure items to keep it accurate. This practice ensures that you always have an up-to-date overview of the financial health of your charity.

Double-check the totals for receipts and payments. A common mistake is miscalculating the amounts or forgetting to update the figures after adding or removing transactions. This can lead to discrepancies between your template and the actual financial records.

Ensure you enter all income and expenditure in the correct sections. Mixing up “income” with “payments” or “capital” with “income” can cause confusion and misinterpretation of the financial situation.

Be precise with date entries. Sometimes, the date of a transaction may be incorrectly entered or omitted entirely. This can affect your template’s accuracy, especially if transactions span across different financial periods.

Include sufficient descriptions for each entry. Vague labels like “donation” or “miscellaneous” should be avoided. Clear descriptions help maintain transparency and make it easier to understand the source and purpose of funds.

Don’t forget to round off your figures correctly. Whether it’s income or payments, ensure numbers are rounded appropriately to match the format expected by the charity commission guidelines.

Remember to review the template after filling it out. Missing or incomplete fields are frequent errors, so double-check each section before submission to avoid unnecessary delays or follow-up requests from the charity commission.

Submit the Charity Commission receipts and payments template annually, no later than 10 months after the end of your charity’s financial year. For example, if your financial year ends on December 31st, the submission is due by October 31st of the following year.

Ensure that the template is completed with accurate data, reflecting all income and expenditure for the reporting period. It’s required for any charity with an income over £25,000, even if you are not legally required to file audited accounts. If your charity’s income is below this threshold, you may still be required to submit a simplified version of the template, depending on your governance structure.

File your template online via the Charity Commission’s website, using the designated portal for annual returns. You will need to log in with your charity’s registration number and password to access and submit the form. Submitting by post is no longer an option, so ensure internet access for the filing process.

If the deadline passes without submission, your charity will be marked as “not up to date” in the Charity Commission’s public register, which may impact trust and funding. Keep track of deadlines using your charity’s accounting system to avoid delays and penalties.

To ensure financial transparency, enter each transaction in the appropriate section of the template. Start by clearly recording income sources, specifying the donor or grant provider’s name and the amount received. This eliminates ambiguity, providing a clear financial trail for anyone reviewing the records.

Record Regularly

Update the template consistently, ideally after each transaction. Delays in entry can lead to discrepancies or omissions, affecting the accuracy of the report. Use a system that ensures data is captured immediately, maintaining accuracy and preventing errors.

Use Categories for Clarity

Organize your payments and receipts into specific categories, such as administrative expenses, program costs, or fundraising income. This helps anyone reviewing the document to quickly understand how funds are being allocated. The more detailed the categorization, the clearer the financial picture becomes.

Make sure that each entry includes clear dates and descriptions. This way, auditors or other stakeholders can track the financial flow over time and identify any irregularities or inconsistencies in the records. A transparent and up-to-date template makes financial audits smoother and more straightforward.

Finally, ensure that your template is structured in a way that complies with local or regulatory standards for charity financial reporting. This not only fosters trust but also assures funders and donors that the charity adheres to best practices in financial management.

Receipts and Payments Template: Structure and Key Elements

In charity financial reporting, the structure of receipts and payments remains consistent across templates, with a focus on clarity and accuracy. The format outlines income, expenses, and balance, while minimizing redundant terms to ensure straightforward comprehension.

Income and Expenditure

Clearly categorize all incoming funds and outgoing payments. Income sources include donations, grants, and fundraising activities. Payments are broken down into categories such as operating costs, program expenses, and administrative fees. Each item is listed separately to avoid confusion and provide transparency for stakeholders.

Balance and Year-End Adjustments

The balance section reflects the total funds available at the end of the reporting period. Make adjustments for any outstanding transactions or accrued expenses, ensuring the final balance accurately reflects the charity’s financial status.

To maintain consistency, ensure the template follows a simple, easily understandable format. Each section should be clear, precise, and reflect the charity’s financial activities without unnecessary repetition.