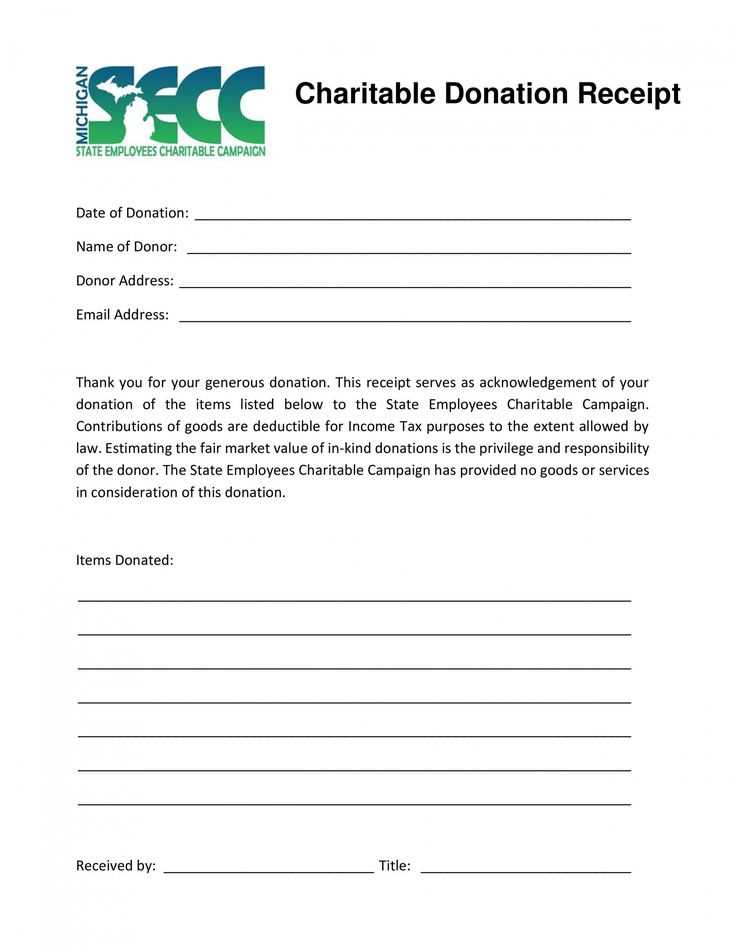

Use this template to maintain clear records of your charity’s financial transactions. Track all incoming donations and outgoing expenses in a structured way. Begin by listing receipts from donors, grants, and fundraising events. Make sure to note each contribution with the donor’s details and the date of receipt.

For payments, categorize expenses such as operational costs, event expenses, and any other financial commitments your charity incurs. It’s important to break down these costs for transparency and ease of reporting. Include the payee’s details, amount, and the purpose of the payment.

Ensure accuracy by reconciling these figures with bank statements regularly. This will help maintain trust with stakeholders and comply with accounting standards. Finally, regularly review and update your template to reflect any changes in your charity’s activities or funding sources.

Here’s an improved version with redundant words removed:

For accurate financial reporting, it’s crucial to use a clear and structured charity receipts and payments account. Start by listing all incoming funds in a well-organized table:

| Description | Amount (£) |

|---|---|

| Donations | 5,000 |

| Fundraising Events | 2,000 |

| Grants | 3,500 |

Next, track all outgoing payments, ensuring each expenditure is categorized for clarity:

| Expenditure Description | Amount (£) |

|---|---|

| Rent | 1,200 |

| Supplies | 800 |

| Event Costs | 1,000 |

By organizing the receipts and payments clearly, you enhance transparency and ensure compliance with reporting requirements.

- Charity Receipts and Payments Accounts Model

For charities, the receipts and payments accounts model provides a clear and transparent way to track financial activities. This template breaks down income and expenditures into simple categories to ensure clarity for both internal and external stakeholders.

Key Elements of the Model

- Income: This section should list all sources of funding such as donations, grants, and fundraising events. Clearly identify the amount and source for each category.

- Expenditure: Track all payments made by the charity, including program costs, administrative expenses, and fundraising costs. Categorize these expenses accordingly for ease of reference.

- Net Movement: Summarize the difference between income and expenditures, showing whether the charity has a surplus or deficit for the reporting period.

How to Fill Out the Template

- Start by recording all income sources first. Be as detailed as possible, listing the date and amount of each income entry.

- Next, document every payment made. Include the purpose of the payment, the date, and the amount. Make sure the information is well organized to allow easy verification.

- Finally, calculate the net change in funds. This helps clarify the charity’s financial health and can be useful for future planning.

Charity accounts provide a clear picture of a charity’s financial activities. These accounts ensure transparency, allowing stakeholders to assess how funds are managed. A charity’s receipts and payments account is crucial for tracking income and expenditures, offering a snapshot of financial health and aiding in decision-making processes.

Transparency and Trust

By maintaining accurate records, charities build trust with donors, regulators, and the public. Detailed accounts allow these parties to see how donations are spent and whether the charity is operating in line with its objectives. This transparency can help attract further funding and support.

Financial Management and Compliance

Well-organized charity accounts play a key role in managing finances. They help charities ensure they are adhering to legal requirements and fulfilling their obligations to regulators. Timely filing of accounts also helps prevent penalties and ensures that the charity remains in good standing with authorities.

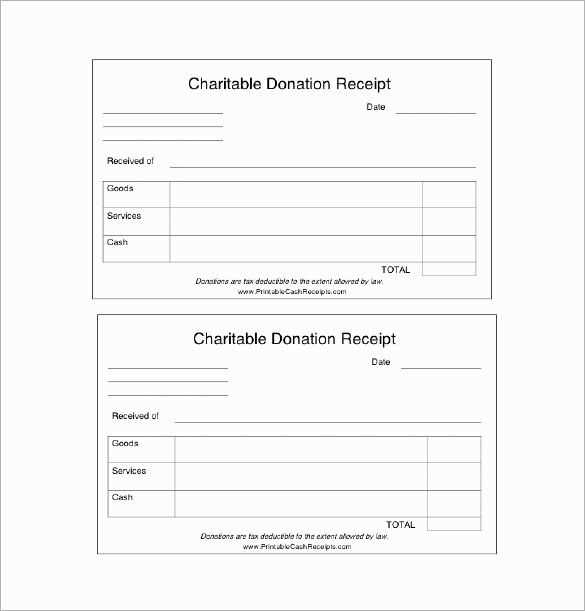

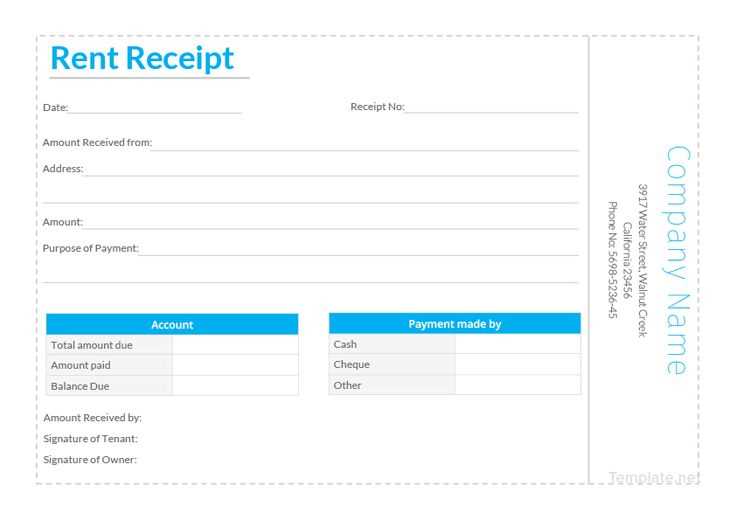

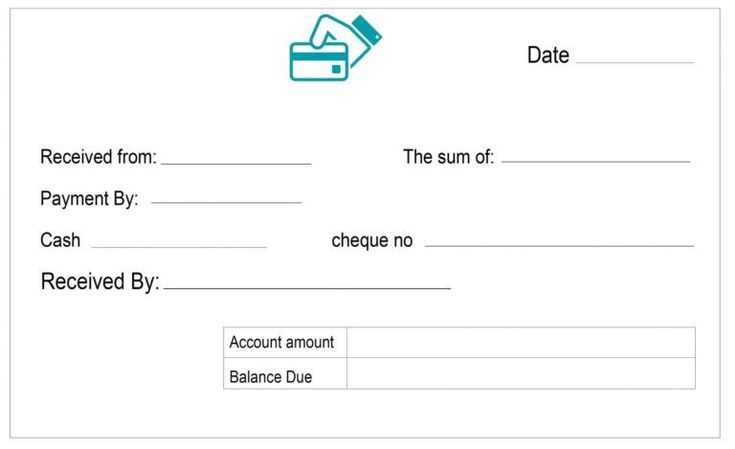

To create a practical template for tracking donations and expenses, structure it in clear sections. Begin with a Date column to record when each transaction occurs. Then, create distinct columns for Donor Information and Donation Amount. In the case of expenses, add a column for Expense Type and another for Amount Spent. This makes it easy to track where funds are coming from and how they are being spent.

For each donation, include space for the Method of Payment (cash, cheque, online transfer, etc.), which helps with categorizing payments. Be sure to leave a Remarks section for additional notes or details about each transaction. On the expense side, adding a column for Vendor and Purpose of Expense offers clarity when reviewing financial statements.

Lastly, include Running Totals for both donations and expenses. This will allow quick assessment of the balance and make reporting simpler. Keep the template flexible, ensuring it can be updated or adjusted as your needs evolve.

Charities typically organize their financial records into clear categories for both income and expenses. This helps maintain transparency and accountability. Below are the key categories charities should consider for revenue and spending tracking.

Revenue Categories

Common revenue streams for charities include:

- Donations: Voluntary financial contributions from individuals or organizations.

- Grants: Funding received from government bodies or foundations for specific projects.

- Fundraising Events: Proceeds from events like galas, auctions, or fun runs.

- Investment Income: Earnings from investments made by the charity.

- Sales of Goods or Services: Revenue from selling merchandise or providing services related to the charity’s cause.

Expenditure Categories

Typical spending areas include:

- Program Costs: Expenses directly related to the charity’s activities, such as running educational programs or providing support services.

- Staff Salaries: Wages for employees working on the charity’s projects.

- Administration: General costs related to managing the charity, such as office supplies and utilities.

- Fundraising Costs: Expenses for organizing and running fundraising events and campaigns.

- Marketing and Outreach: Expenses for promoting the charity’s mission and events through advertising or public relations.

Summary Table

| Category | Examples |

|---|---|

| Revenue | Donations, Grants, Fundraising Events, Investment Income, Sales of Goods |

| Expenditure | Program Costs, Staff Salaries, Administration, Fundraising Costs, Marketing |

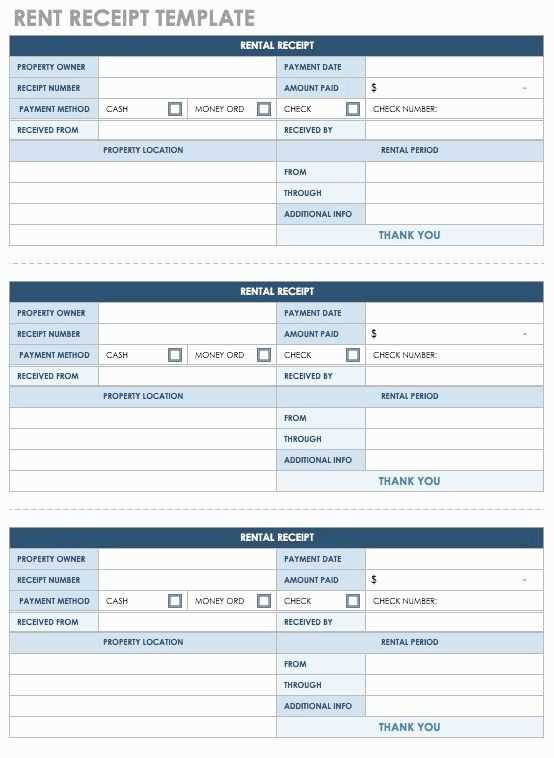

Begin with a clear heading indicating the financial period covered. Organize the report into key sections: income, expenditure, assets, and liabilities. Ensure that each section is clearly labeled and detailed to show all transactions. Use a table format for easier navigation, listing each source of income and category of expense separately.

For income, list donations, grants, and fundraising efforts with specific amounts and dates. In the expenditure section, group costs by type–salaries, office expenses, and program-related costs. This helps readers easily understand where funds are being allocated.

Include a summary of net income or deficit at the end of the report. Make sure the document is concise, with a summary table or a financial statement that consolidates all figures, showing totals for each section.

Finally, provide a balance sheet with assets and liabilities, ensuring the accounting equation is balanced. Double-check that all numbers are accurate and that every expense and income is accounted for in the appropriate section.

Charities must adhere to various legal requirements to maintain their status and ensure transparency in operations. First, ensure that all financial transactions are properly documented and easily traceable, including donations, grants, and expenses.

1. Transparent Financial Reporting

Accurate and timely financial reports are a legal requirement. Make sure to document all receipts and payments, reflecting how funds are used. This helps build trust with both donors and regulatory bodies.

2. Compliance with Local Tax Laws

Understand the specific tax regulations that apply to charities. Some regions offer tax exemptions, but these must be applied for and maintained regularly through the appropriate paperwork.

3. Clear Governance Structure

Charities must have a defined governance structure. This includes a board of trustees or directors responsible for overseeing the charity’s activities. Regular meetings should be held to discuss financial status and organizational objectives.

4. Reporting Requirements

- Submit annual financial statements to regulatory authorities.

- Ensure that all charity-related income is accounted for in line with legal standards.

5. Regular Audits

Charities are required to undergo regular audits to confirm that financial statements align with actual spending. These audits can be done internally or by external auditors, depending on the charity’s size and the regulatory requirements of the jurisdiction.

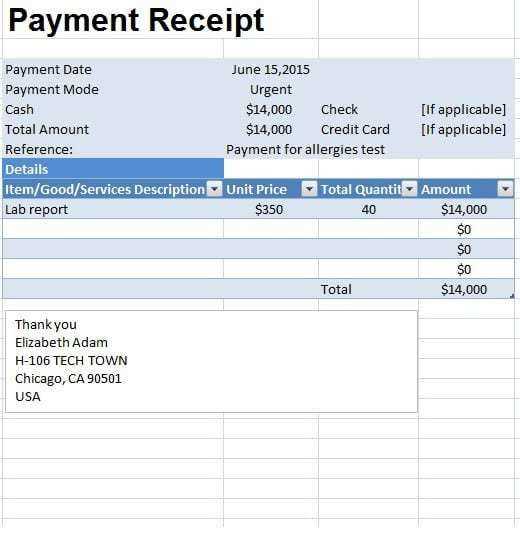

Income:

- Donations: $15,000

- Fundraising Events: $5,000

- Grants: $10,000

- Other Income: $1,500

Expenditure:

- Program Costs: $12,000

- Administrative Costs: $3,000

- Fundraising Costs: $2,000

- Other Expenses: $500

Net Balance: $13,000

This template shows clear income and expenditure categories with corresponding amounts, providing transparency and simplicity for stakeholders to review the financial performance of the nonprofit. The format highlights the different sources of income and expenses, offering a comprehensive snapshot of the organization’s finances.

Ensure clarity by organizing charity receipts and payments clearly. Here’s how:

- List all receipts first, detailing the date, amount, and source.

- Separate payments with the same structure: date, amount, and purpose.

- For each item, use consistent categories, such as donations, grants, and other sources.

- Be transparent about any restricted funds or special allocations.

- Include a clear statement of the balance at the end of each period.

Keep everything well-documented and categorized to ensure transparency and accountability. This approach is straightforward and effective for both internal records and external reviews.