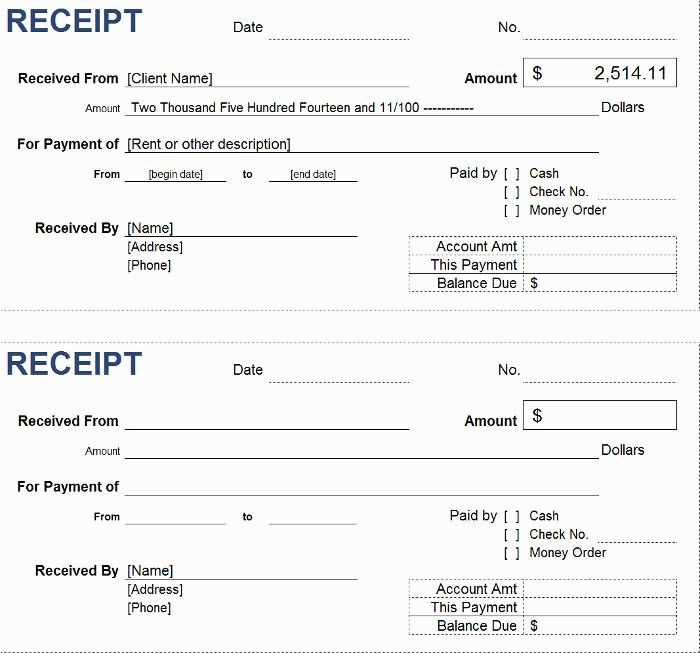

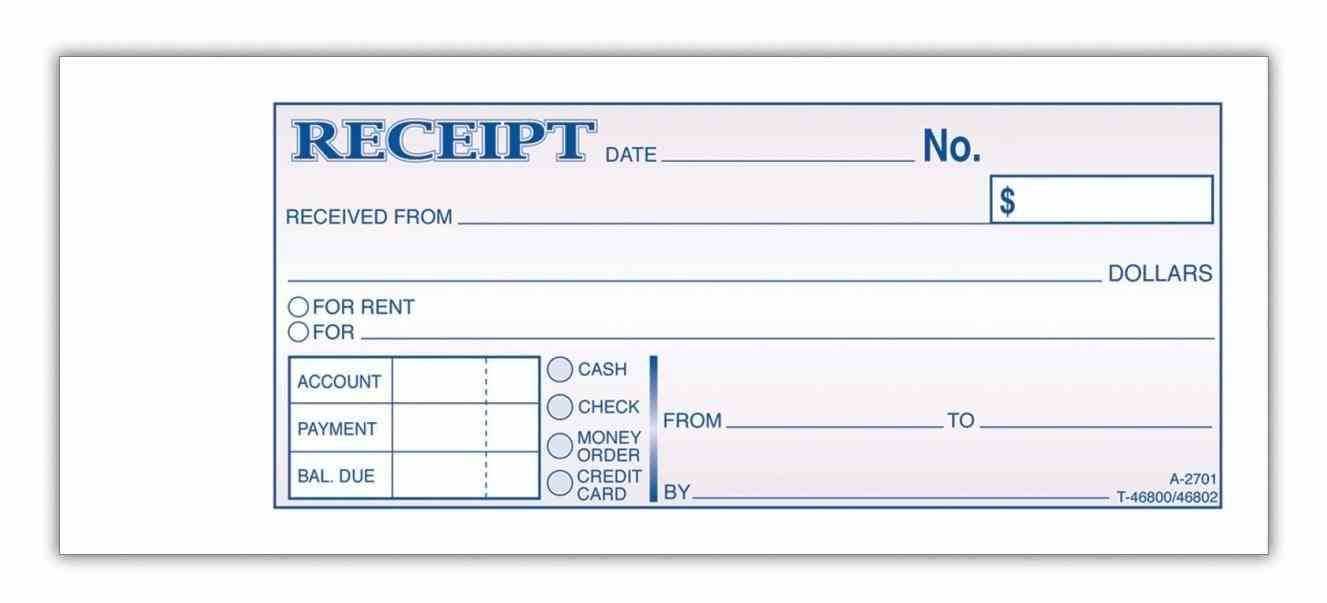

Create a clear and professional check payment receipt template to confirm payment transactions. Start with the date, payment amount, and check number to ensure both parties have a reference for the transaction. Be specific in detailing the purpose of the payment to avoid any confusion later. Make sure to include a section for both the payer’s and recipient’s names, and space for signatures to verify the agreement. This makes the transaction official and provides a formal record.

To avoid any issues, include payment method details, such as whether the check was paid in full or partially. This transparency helps keep both parties on the same page. Add a note for any related service or goods description, ensuring the purpose of the payment is clear and can be easily cross-referenced. A clean format will make it easier to update the template in the future for various payments.

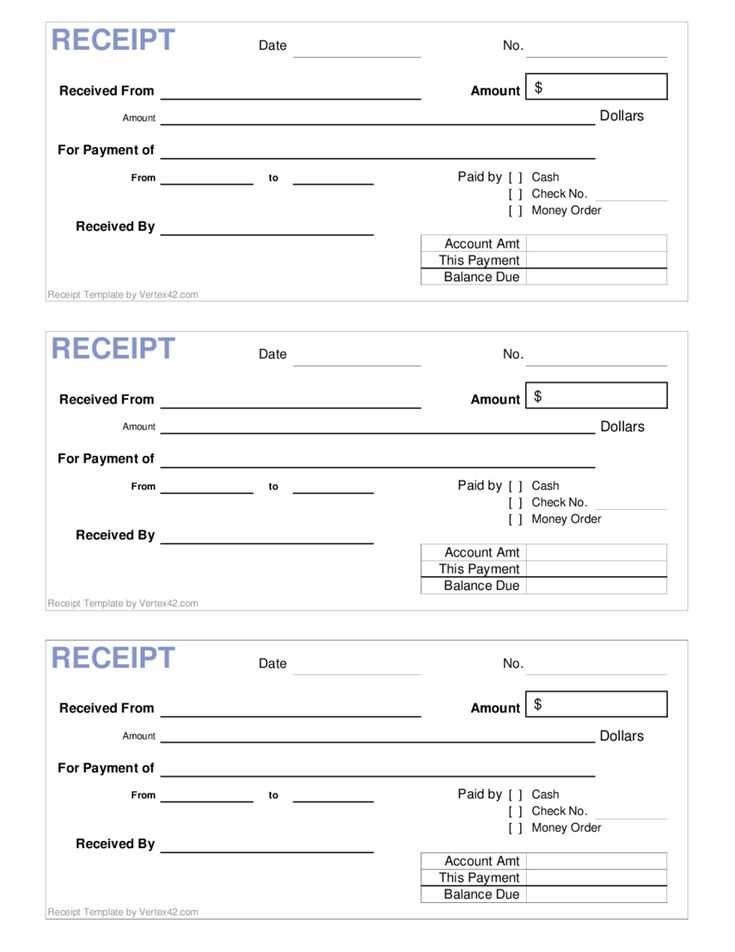

Lastly, use a simple and organized layout for the receipt. Clear headings and ample space for necessary details ensure the document is easy to read and understand. Avoid unnecessary elements and focus on making the template as straightforward as possible. This approach saves time and helps prevent errors when creating or issuing receipts in the future.

Here’s the revised version without repetitions:

To create a clear and accurate check payment receipt template, focus on structuring the document for easy understanding. Include the following details:

Key Information to Include

Start with the recipient’s name, the date, and the payment amount. Follow with the check number, bank details, and the payer’s contact information. If applicable, specify the reason for the payment. Make sure to use a clean, readable font for clarity.

Final Tips

Always double-check the details for accuracy. Avoid including unnecessary information, keeping the template straightforward. Ensure proper alignment of text and numerical values for consistency. Finally, make the template easy to modify for future use.

Check Payment Receipt Template

How to Create a Simple Payment Receipt Template

Key Components to Include in a Payment Receipt

Customizing a Receipt for Specific Transactions

Formatting Tips for a Professional Payment Receipt

How to Automate the Generation of Payment Receipts

Common Mistakes to Avoid When Creating a Payment Receipt Template

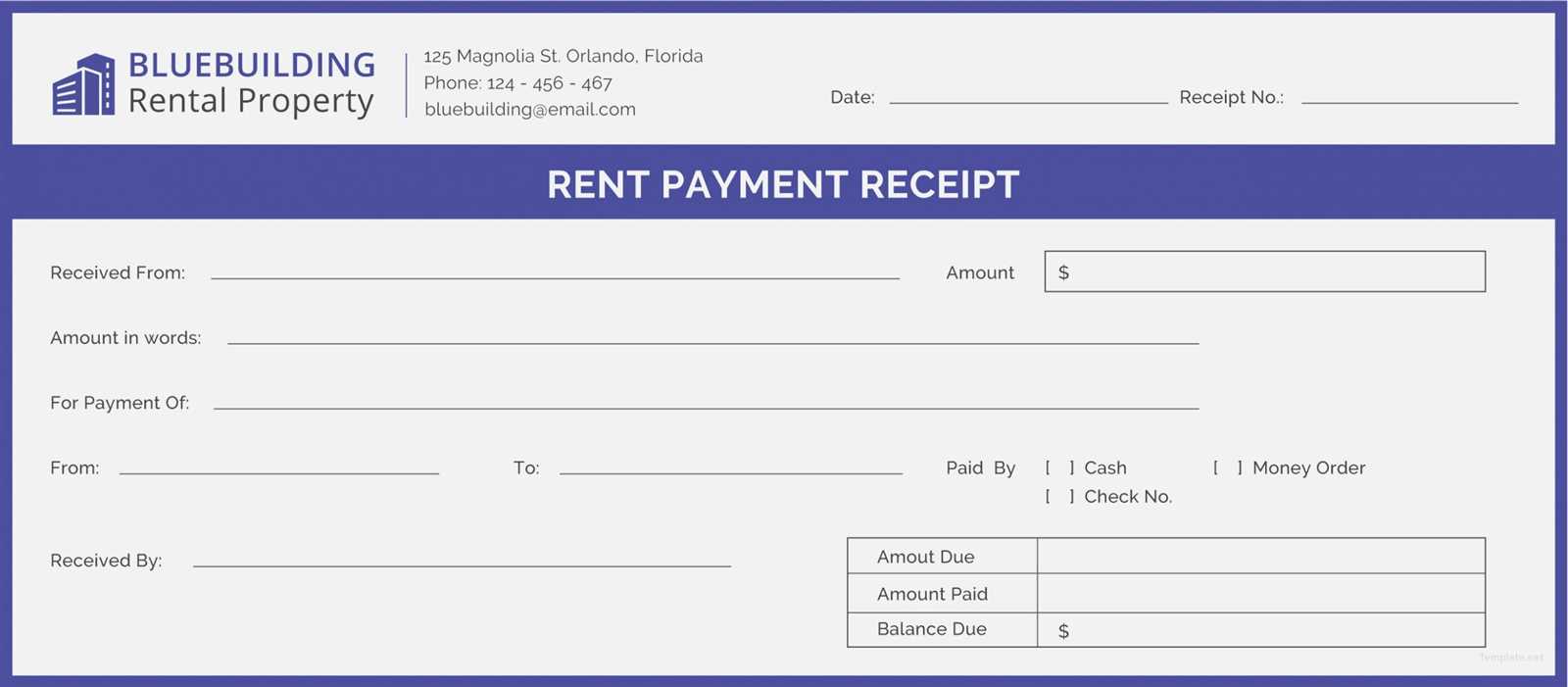

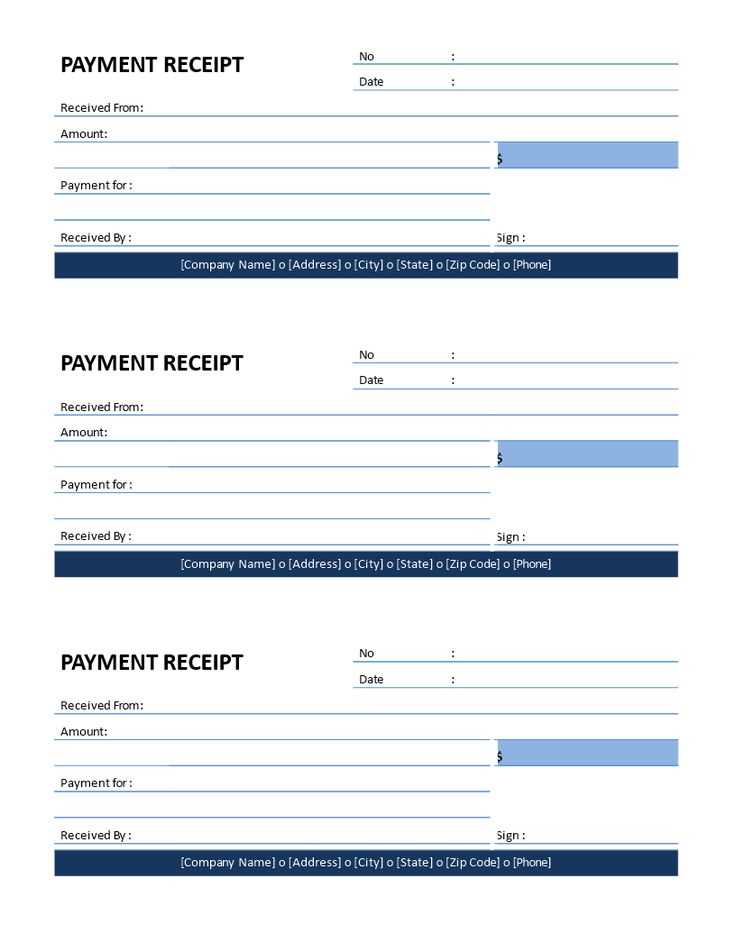

Start with a clear and concise header stating the receipt’s purpose, such as “Payment Receipt” followed by the transaction date. Include the payer’s and payee’s information, such as name, address, and contact details. Specify the payment amount, currency, and any reference numbers for tracking purposes.

Key Components to Include in a Payment Receipt

Include the following details in each receipt:

1. Transaction date and time

2. Payer’s full name and address

3. Payee’s full name and contact information

4. Payment amount and currency

5. Payment method (e.g., check, bank transfer)

6. Transaction reference or invoice number

7. Signature or authorization (optional)

Customizing a Receipt for Specific Transactions

Modify the template based on transaction type. For example, for services, include details like service descriptions, hours worked, or milestones reached. For product sales, list item names, quantities, and individual prices. Adjust the receipt format based on the complexity of the transaction.

Ensure clarity by using sections and bullet points. If applicable, add taxes or discounts separately. The format should align with your business or industry standards.

To automate receipt generation, use tools that integrate with accounting software or payment platforms. These tools can pull transaction data and generate customized receipts automatically after each payment is processed.

Avoid common errors such as leaving out transaction references, unclear formatting, or incorrect payment amounts. Double-check each field for accuracy before finalizing the receipt.