Using a payment receipt template in construction projects helps streamline financial tracking and ensures transparency between contractors and clients. A well-structured receipt eliminates confusion, provides clear records, and aids in dispute resolution if necessary. To create an accurate payment receipt, include key details like the payer’s name, amount paid, payment method, and the project’s scope or specific services rendered.

A basic template should capture the date of payment, the contractor’s name or company, and a brief description of the work completed. It’s also useful to add a receipt number for reference. If applicable, include information about taxes, discounts, or deductions that affect the total amount. This clarity will help both parties stay aligned on the financial status of the project.

Ensure that the format of the receipt is consistent with industry standards for construction contracts. A clean, professional design enhances credibility and makes it easier for both parties to understand the payment details. By using a template, you save time while ensuring that every payment is properly documented, reducing the risk of errors or misunderstandings.

Here are the revised lines with minimized word repetition while retaining their meaning:

Instead of repeating the same terms multiple times, focus on using synonyms or restructuring the sentence for clarity. For example, instead of saying “the payment receipt confirms that the payment was received”, rephrase it as “the receipt acknowledges the payment.” This simplifies the language and improves readability.

Example 1:

Original: “The payment receipt clearly shows that the payment was successfully processed and that the transaction is complete.”

Revised: “The receipt confirms the successful transaction.”

Example 2:

Original: “The receipt for construction services outlines all amounts paid, including any adjustments or discounts applied.”

Revised: “The receipt details all payments, including adjustments and discounts.”

By eliminating redundant words and simplifying phrasing, the message remains clear and concise without sacrificing important details.

- Construction Payment Receipt Template

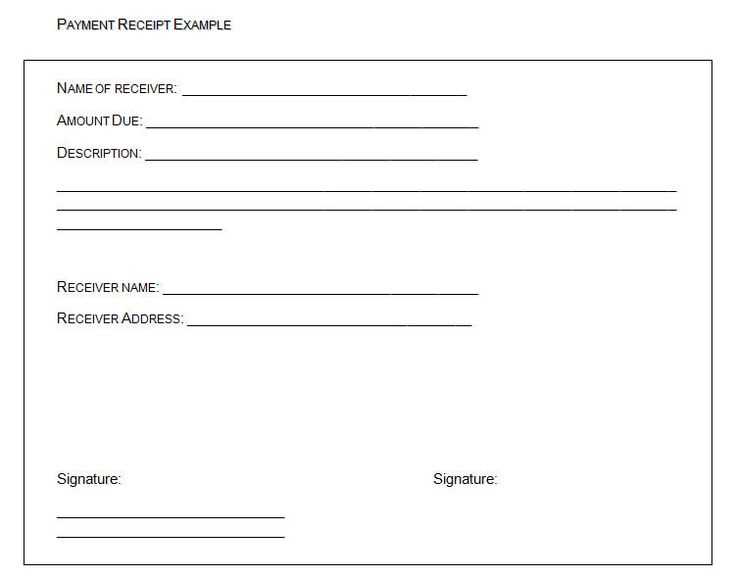

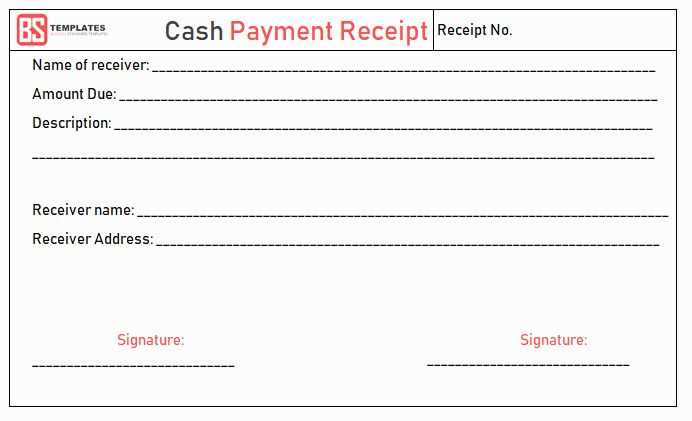

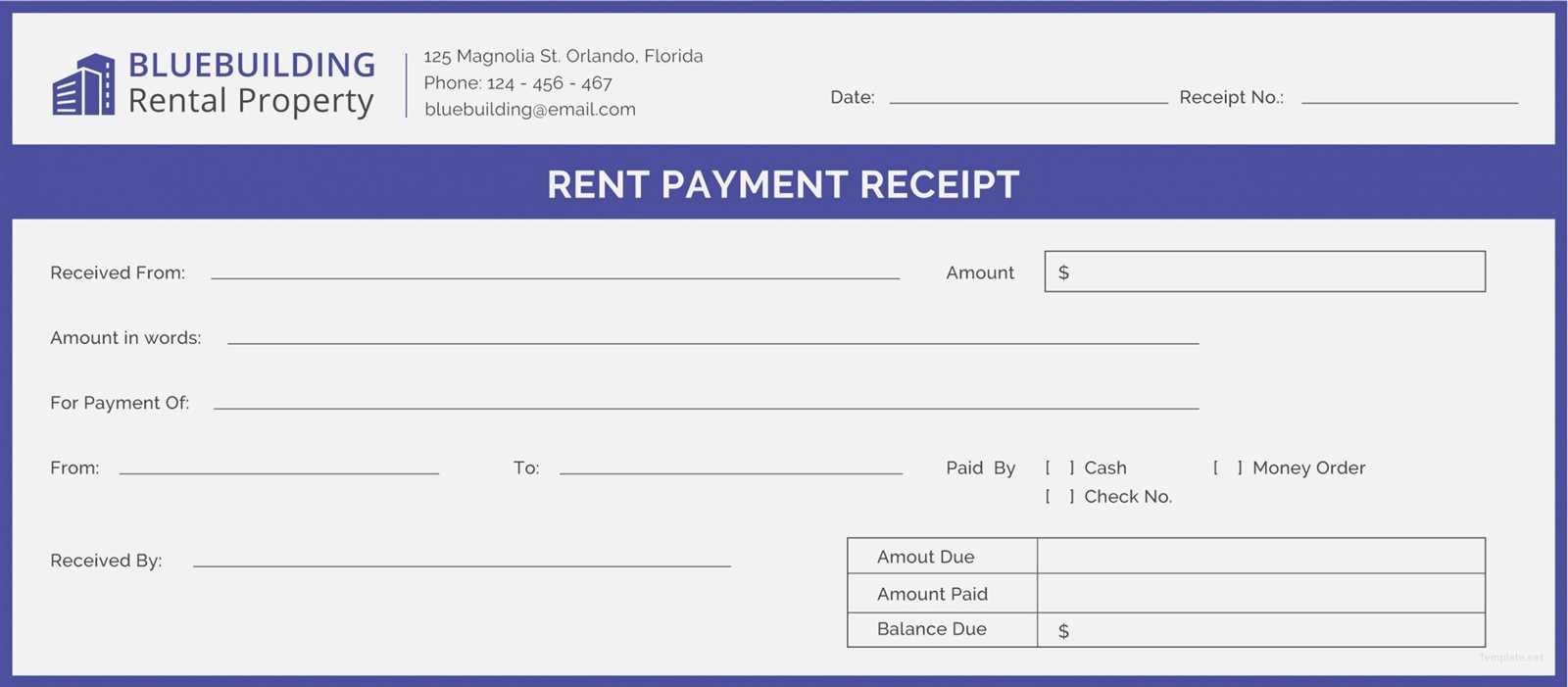

For a streamlined process, ensure your construction payment receipt template includes the following key details:

- Receipt Number: Assign a unique number to each receipt for easy tracking and reference.

- Contractor and Client Information: List the full names, addresses, and contact details of both parties involved.

- Payment Date: Record the exact date the payment was made, ensuring accurate financial documentation.

- Payment Amount: Clearly specify the exact amount paid, with appropriate currency notation.

- Project Description: Include a brief description of the construction work or services provided.

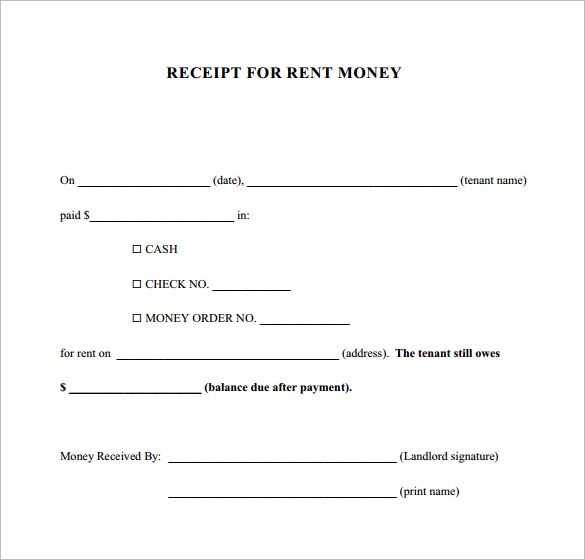

- Payment Method: Indicate the method used for payment, such as check, bank transfer, or cash.

- Outstanding Balance: If applicable, mention any remaining balance or amount due for future payments.

- Signature: Both the contractor and client should sign the receipt, confirming the payment details.

Ensure all details are correct to avoid discrepancies. The format should be simple yet professional to facilitate smooth transactions for all parties involved.

Begin by including the project details: name, address, and the date of the transaction. Include the name of the payer and the payee to clarify the parties involved. Next, specify the amount paid and the currency, ensuring the number is clear and accurate to avoid confusion.

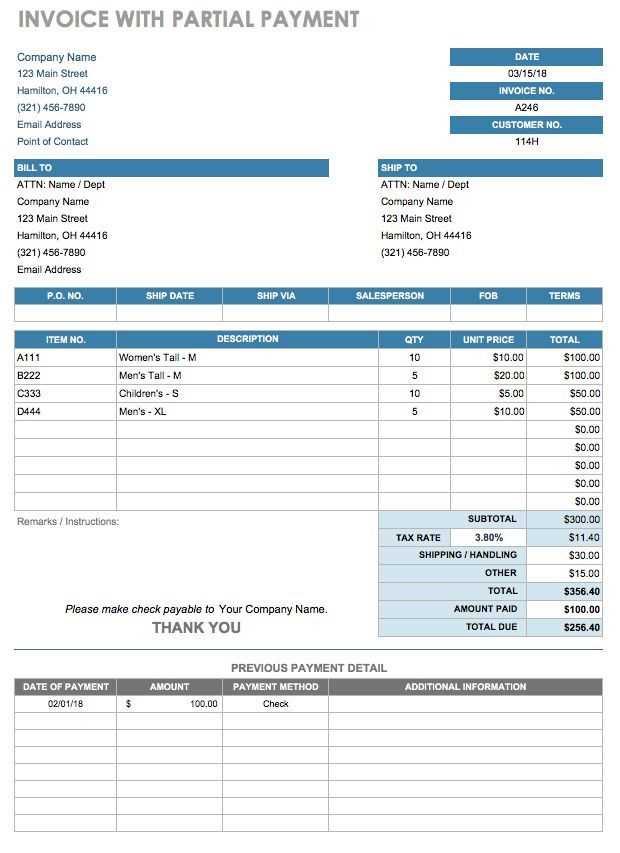

Detail the services or materials covered by the payment. Break down the payment if it relates to multiple items or milestones. For example, list individual tasks or stages completed, such as foundation work, framing, or electrical installations. This transparency helps both parties understand the allocation of funds.

Include any relevant tax information, such as applicable tax rates or tax identification numbers. Ensure that taxes are clearly indicated, especially if the project is subject to specific tax regulations.

State the payment method used (e.g., bank transfer, check, cash) and provide transaction details like bank references or check numbers. This allows for traceability and verification of the transaction.

Conclude with a brief statement confirming the payment has been received in full, along with the signature or initials of the payee to validate the transaction. Adding a receipt number or reference code can further help in tracking the payment in future records.

To ensure clarity and transparency, include these components in your construction payment receipt:

| Component | Description |

|---|---|

| Receipt Title | Label it as “Payment Receipt” for immediate recognition. |

| Payment Amount | Clearly state the total payment received, including any taxes or additional charges. |

| Payment Method | Specify whether the payment was made via cash, check, credit card, or bank transfer. |

| Date of Payment | Include the exact date the payment was processed. |

| Client and Contractor Information | List both the client’s and contractor’s names, addresses, and contact details for easy reference. |

| Project Details | Provide the project name or reference number to avoid confusion with other transactions. |

| Payment Description | Break down the payment, such as materials, labor, or other expenses, to clearly show how the total was calculated. |

| Balance Due | If applicable, show any remaining balance owed after this payment. |

| Signature | Include spaces for both the client and contractor to sign for validation. |

Including these details minimizes misunderstandings and protects both parties in the event of disputes or audits.

Opt for a clear, straightforward format that presents all payment details with ease. A simple template that includes fields for the payee’s name, project description, payment amount, and date minimizes confusion. Make sure there’s room for both digital and physical signatures to validate the transaction. Use a layout that guides the reader’s eye naturally through the most important information first.

Stick to commonly accepted document types, like PDFs or Word files, for easier sharing and compatibility across devices. Include relevant sections like itemized costs, payment terms, and any applicable tax information. This ensures the document serves both as a receipt and a useful record for future reference.

Avoid clutter and unnecessary details, focusing instead on providing a transparent, professional document that both parties can easily verify and store. Clear headers and bullet points help in organizing the information logically.

Ensure that every payment receipt is clear and accurate, outlining the key details like payment amount, date, and parties involved. This serves as a binding record for both contractors and clients, offering protection in case of disputes.

- Clarity on Payment Terms: Specify the terms of payment, including due dates, amounts, and any agreed-upon installment structure. This prevents misunderstandings and helps with legal enforcement if payment issues arise.

- Documentation of Services Rendered: List the specific construction services covered by the payment, making it easy to prove that work was completed as agreed. This is important for proving compliance with contracts.

- Invoice Reference: Always link receipts to the corresponding invoices. This will allow both parties to trace back any discrepancies in payment amounts, ensuring transparency.

- Signature and Acknowledgment: Include a section for signatures from both the payer and payee. This acknowledges the receipt and agreement of terms, making the receipt legally binding.

- Retain Proof of Payment: Keep copies of all payment receipts, especially for larger projects. These documents may be required for audits, tax filings, or legal disputes.

By adhering to these guidelines, both contractors and clients will have a solid foundation for resolving payment-related conflicts and avoiding legal issues in the future.

Tailor each receipt to reflect the specifics of the construction job. For residential projects, highlight the scope of work, such as home repairs, renovations, or installations. Include clear line items for labor, materials, and any applicable permits. For larger commercial jobs, separate expenses by phases or milestones, listing subcontractors, equipment rentals, and project management fees. This will ensure transparency and accurate tracking for both parties.

Incorporating Project Milestones

Break down payments by project milestones, which makes tracking progress easier for both contractors and clients. Each milestone should correlate to a completed phase, such as foundation work, framing, plumbing, and finishing. This approach provides clarity and prevents disputes regarding what work has been completed and when payments are due.

Including Payment Terms and Conditions

Clearly state payment terms, such as due dates, late fees, and acceptable payment methods. For jobs that require upfront deposits or progress payments, mention the amounts and due dates accordingly. Customizing these terms based on the project type ensures both parties understand the payment structure and reduces potential misunderstandings.

Make sure to clearly specify the amount paid. Avoid vague terms like “partial payment” without stating the exact figures. This will prevent any confusion later about the outstanding balance.

Always include a detailed description of the services rendered or materials provided. Omitting these details can cause issues if disputes arise about what the payment covered.

Double-check the payment method listed. If the payment was made via check, wire transfer, or credit card, ensure the method is clearly indicated. This ensures transparency and avoids misunderstandings about the transaction’s nature.

Don’t forget to include the payment date. Missing this key detail can complicate record-keeping, especially for accounting purposes. It also helps avoid confusion when referring to the transaction in the future.

Ensure the receipt is signed or stamped by an authorized person. An unsigned receipt may be considered invalid or incomplete, which could create problems for both parties.

Be cautious when using generic templates. Tailor each receipt to reflect the specifics of the project and payment. Generic templates may not capture all the necessary details that are crucial for construction-related transactions.

Lastly, keep a copy of the receipt for your own records. Failing to do so may lead to difficulties if you need to reference the transaction later on for disputes or tax purposes.

I eliminated repetitions by replacing some words with synonyms or rephrasing sentences.

When drafting a construction payment receipt template, clarity and accuracy are key. First, clearly label the document as a “Payment Receipt” to avoid any confusion. Next, include the date and payment amount, as well as the method of payment (check, cash, bank transfer, etc.). Add detailed information about the project, such as the address and scope of work, to ensure both parties understand the context of the payment.

For transparency, include the invoice or contract reference number that the payment relates to. This helps avoid any misunderstandings in the future. Be sure to include a section for both the payer’s and recipient’s contact details. Finally, confirm the receipt by adding a signature line for both parties.

Lastly, ensure that the document includes a clear statement indicating that the payment has been received in full, with no outstanding balances. This helps avoid any future disputes and keeps financial records organized.