Construction Payment TemplateAnswer in chat instead

Construction Payment Schedule Receipt Template

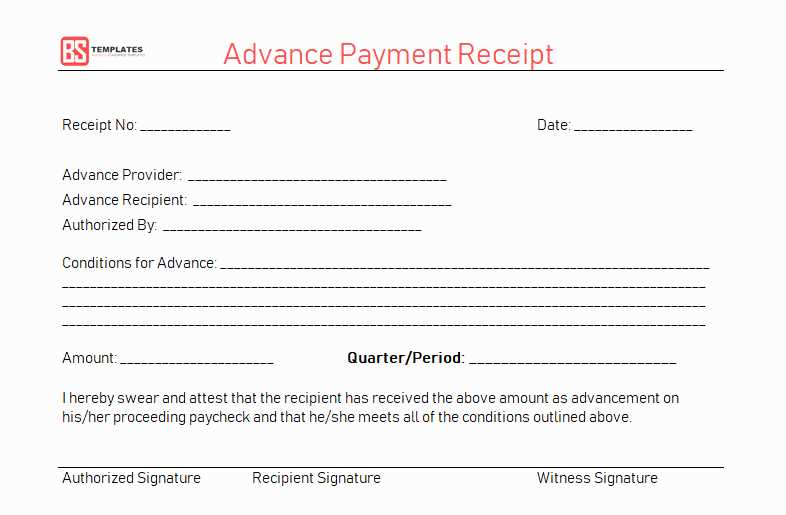

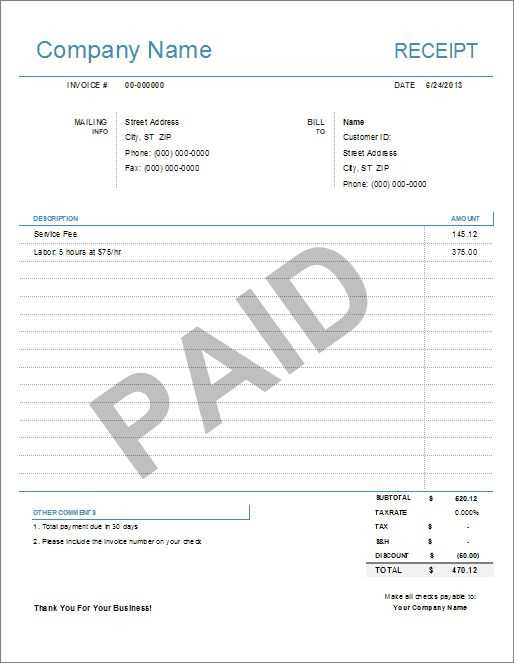

Key Components of a Payment Schedule Receipt

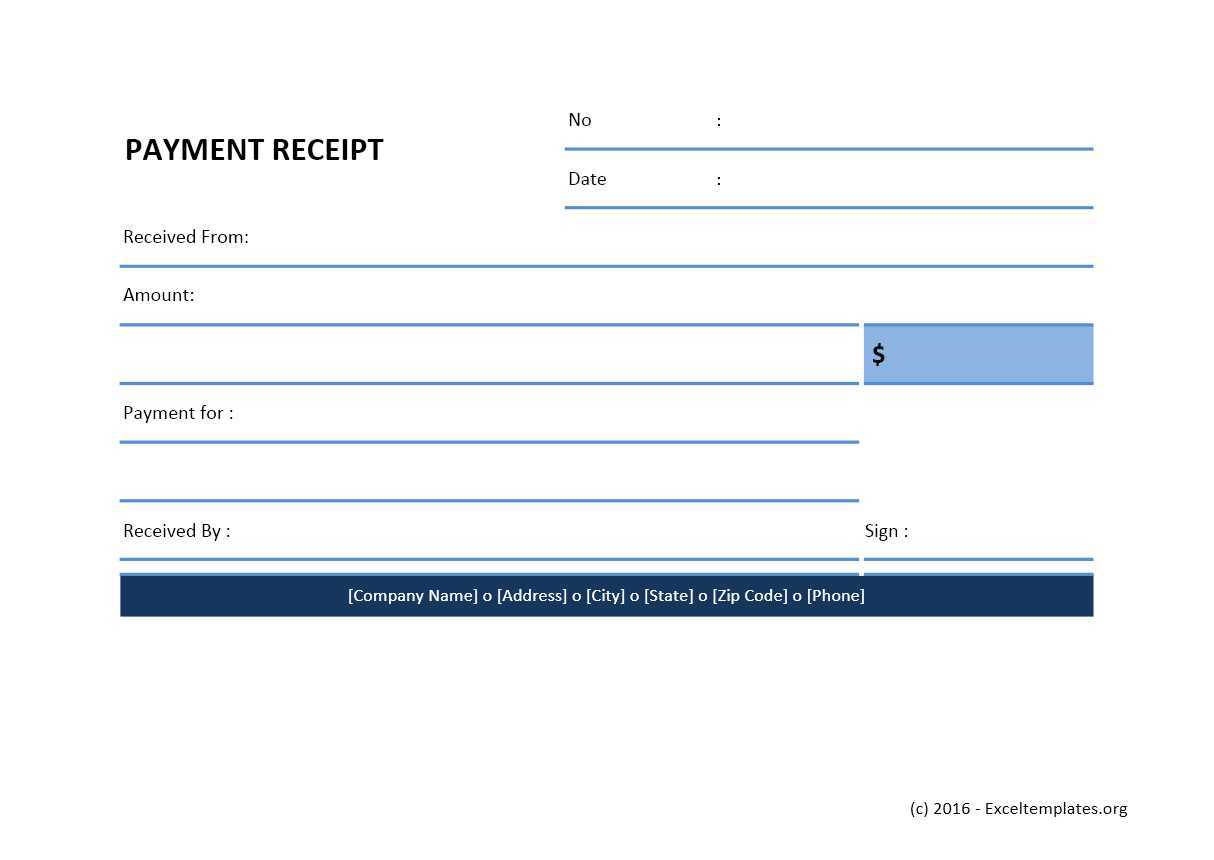

A well-structured payment schedule receipt includes essential details to avoid disputes. Ensure each receipt contains:

- Invoice Number: A unique identifier for tracking.

- Payment Date: The exact date the payment was received.

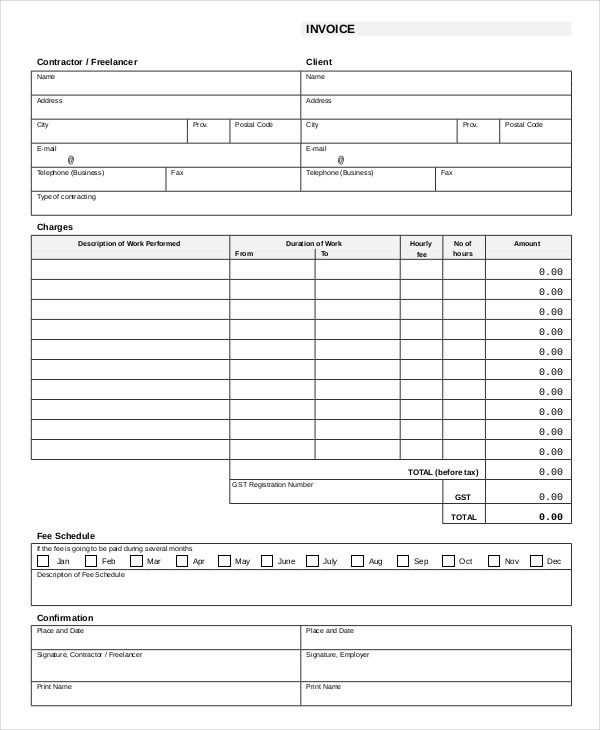

- Client and Contractor Details: Full names, addresses, and contact information.

- Project Description: A concise summary of the construction project.

- Milestone Description: Clearly define the work completed for the payment.

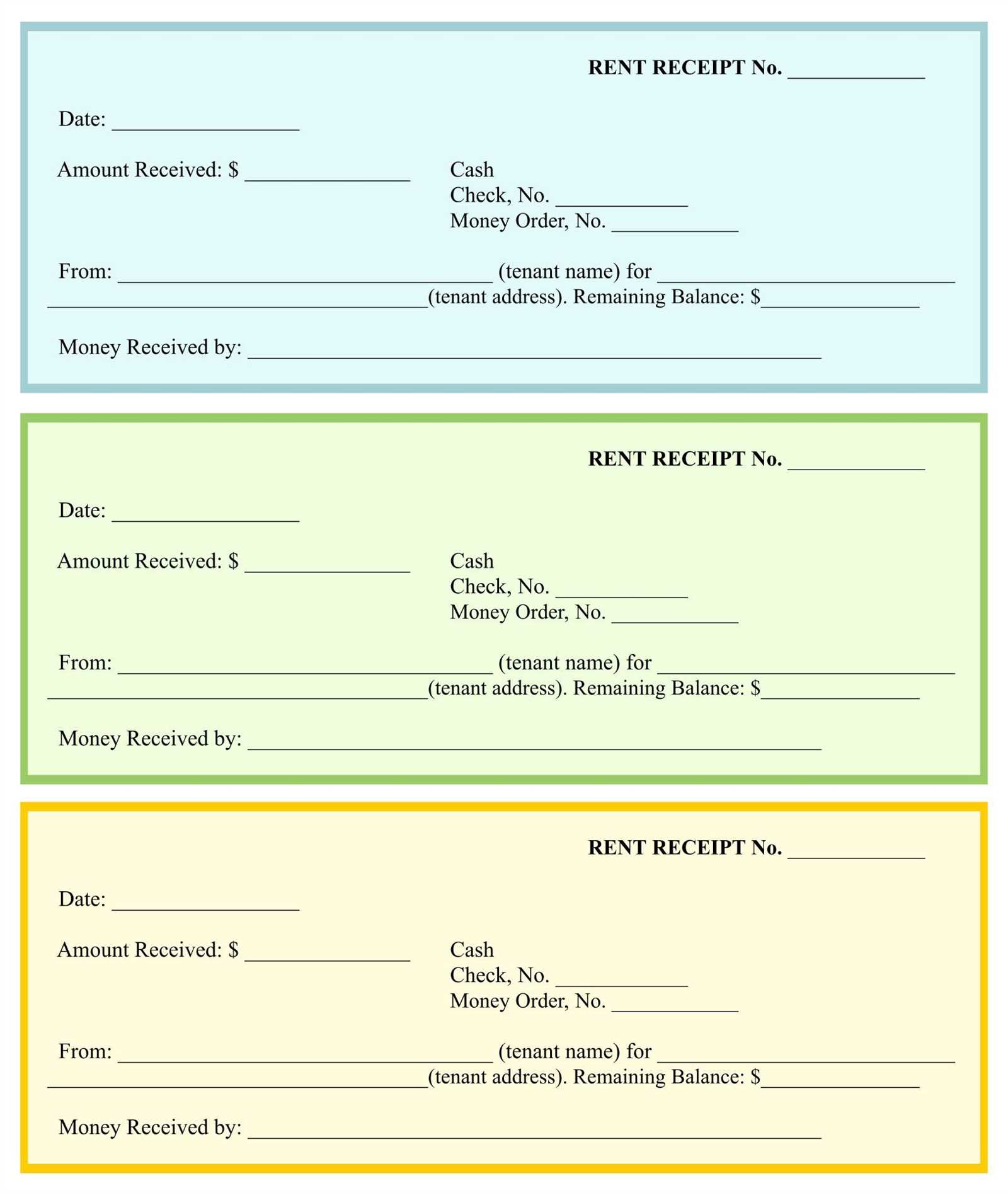

- Amount Paid: Specify the sum and payment method.

- Remaining Balance: If applicable, state the amount left to be paid.

- Authorized Signature: A signature from both parties to confirm agreement.

How to Structure Milestones and Due Dates

Milestones should align with project phases to maintain cash flow and accountability. Use these steps for accuracy:

- Set Clear Phases: Divide the project into measurable stages (e.g., foundation, framing, roofing).

- Define Completion Criteria: Attach specific deliverables to each milestone.

- Assign Due Dates: Establish realistic deadlines based on project timelines.

- Use Percentage-Based Payments: Link payments to work completed (e.g., 30% at contract signing, 40% at framing completion).

- Include Contingencies: Account for potential delays or changes.

Legal and Accounting Documentation

Maintain compliance by keeping thorough records. Ensure all receipts align with legal and tax requirements:

- State-Specific Regulations: Check local laws on contractor payment terms.

- Tax Documentation: Record all transactions for tax reporting and audits.

- Digital and Physical Copies: Store receipts securely to prevent loss.

- Contract Alignment: Ensure receipts reflect the agreed payment terms.

- Dispute Resolution: Keep a clear paper trail to resolve discrepancies efficiently.

By structuring your payment schedule receipt correctly, you reduce misunderstandings and keep financial records organized.