Use a structured customer payment plan receipt template to ensure transparency and accuracy in financial transactions. A well-designed template helps both businesses and customers track payments, due dates, and outstanding balances.

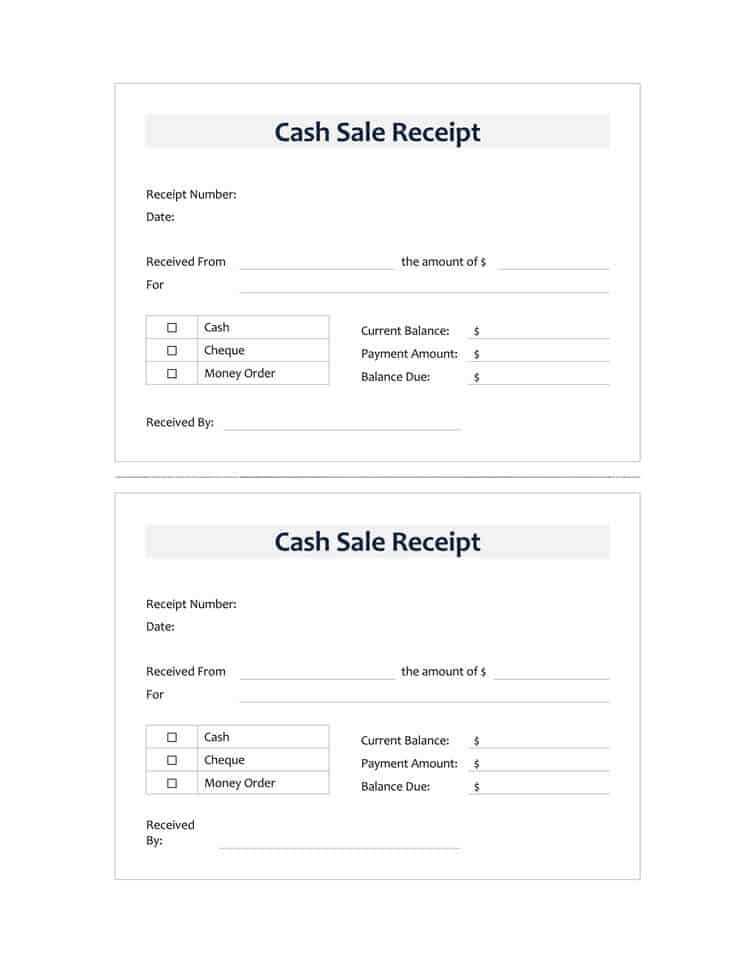

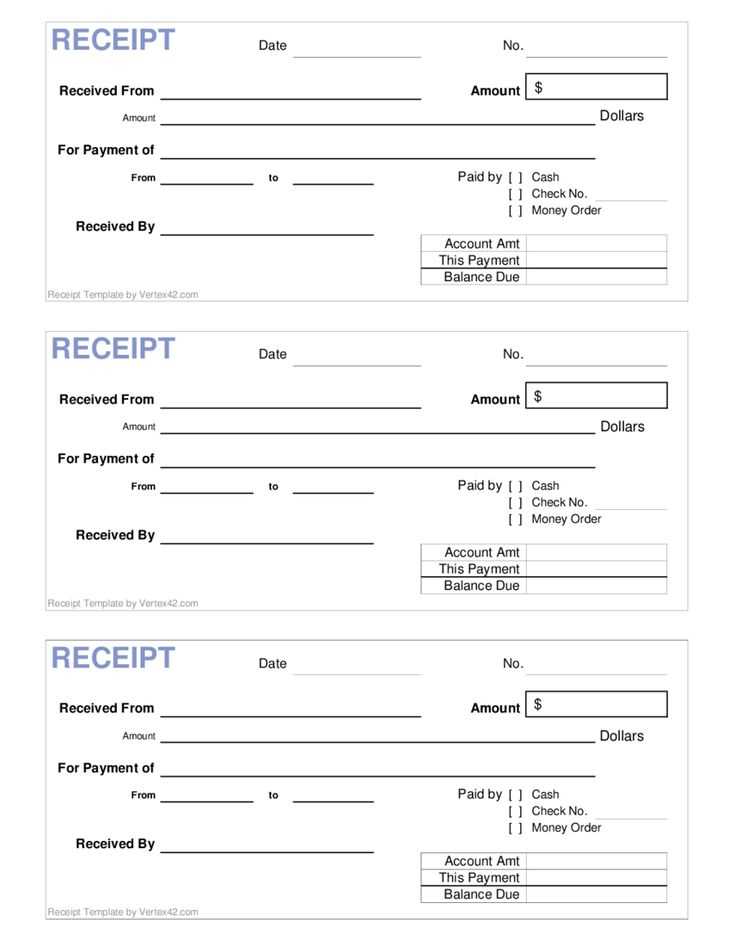

Include essential details such as the customer’s name, payment schedule, amount paid, remaining balance, and payment method. A unique receipt number ensures easy record-keeping, while clear terms prevent misunderstandings.

Format the receipt for readability. Use sections for key information, highlight due amounts in bold, and ensure dates follow a consistent format. Digital templates with automated calculations reduce errors and save time.

A professional receipt strengthens customer trust and simplifies financial tracking. Choose a template that fits your business needs and ensures compliance with legal and accounting standards.

Here’s the improved version without unnecessary repetition:

For a customer payment plan receipt template, follow these key points:

- Clear heading: Ensure the receipt has a clear title such as “Payment Plan Receipt” to immediately identify its purpose.

- Customer details: Include the customer’s full name, contact information, and account number for proper identification.

- Payment breakdown: List the amount paid, the due amount, and any applicable fees or discounts.

- Payment schedule: Specify the agreed-upon payment plan, including the dates and amounts of future payments.

- Receipt date: Mark the date when the payment was made to avoid confusion.

- Payment method: Indicate whether the payment was made by credit card, bank transfer, or another method.

- Signatures: Include a space for both the customer’s and the company’s representative’s signatures to confirm the agreement.

Ensure the layout is organized, with no extra information. Stick to the facts to keep the receipt professional and easy to understand.

- Customer Payment Plan Receipt Template

Start your receipt with clear information about the customer and the payment plan. Include their full name, address, and contact details, as well as the payment schedule, the total amount due, and the terms of the plan. Be specific with dates, amounts, and installment frequency to avoid confusion.

Key Elements to Include:

- Receipt Number: A unique identifier for easy reference.

- Customer Information: Name, address, phone number, and email.

- Payment Plan Details: Total amount, installment amount, frequency (weekly/monthly), and the payment start date.

- Payment History: List of payments made so far, including dates and amounts.

- Outstanding Balance: Remaining balance after each payment.

- Payment Method: Specify whether the payments are made via credit card, bank transfer, or other methods.

At the end of the receipt, provide a section for the customer’s signature and a note about the payment plan terms, including any late fees or penalties for missed payments.

Sample Template:

Receipt Number: 123456

Customer Name: John Doe

Address: 123 Main St, City, Country

Email: [email protected]

Total Amount Due: $500

Installment Amount: $50

Payment Frequency: Monthly

Start Date: February 1, 2025

Payment History:

- January 1, 2025 – $50

- February 1, 2025 – $50

Outstanding Balance: $400

Payment Method: Credit Card

Customer Signature: ______________________

A payment receipt should include specific details to ensure clarity and avoid confusion. Start with the receipt title. Clearly label the document as a “Payment Receipt” at the top. Next, include the following details:

1. Transaction Information

Each receipt should feature the transaction date and the payment reference number. This helps both the customer and the business track the transaction easily.

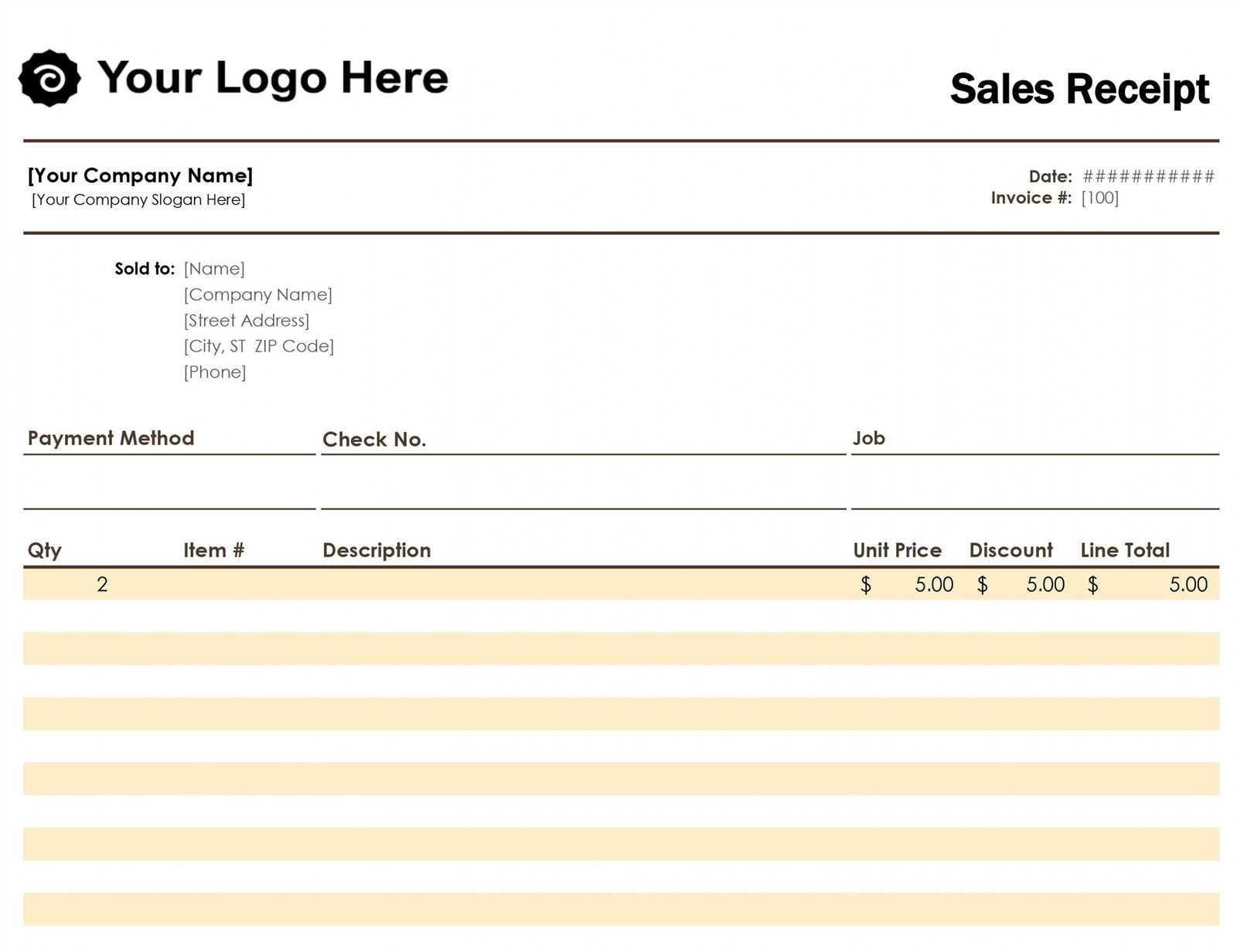

2. Buyer and Seller Details

Include the name and contact information of both the buyer and the seller. This ensures both parties can be identified and reached if necessary.

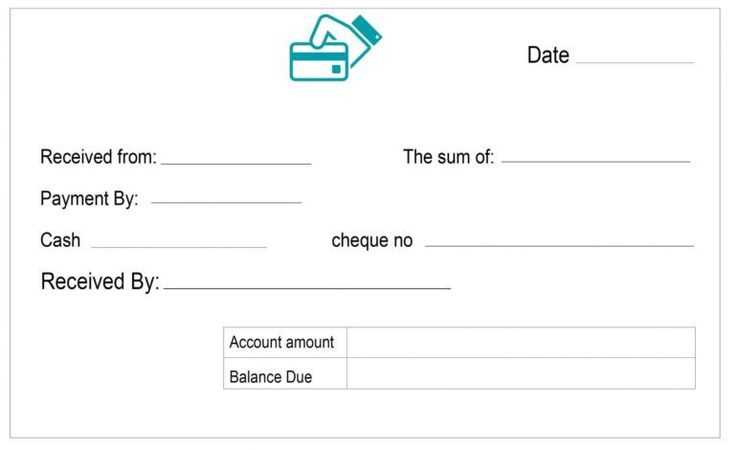

3. Payment Method

Specify how the payment was made. Whether it’s by cash, credit card, bank transfer, or another method, including this detail adds transparency to the receipt.

4. Amount Paid

The exact amount paid should be listed, along with any applicable taxes, discounts, or adjustments that affect the total price.

5. Description of Goods or Services

Briefly describe what was purchased or the service rendered. This helps the customer understand what they are paying for and provides documentation for returns or disputes.

6. Seller’s Terms and Conditions

If relevant, include any applicable terms related to refunds, exchanges, or warranties. These can help resolve potential issues post-purchase.

| Element | Description |

|---|---|

| Title | “Payment Receipt” clearly marked at the top. |

| Transaction Date & Reference Number | Date of payment and unique transaction reference. |

| Buyer & Seller Details | Name and contact information of both parties. |

| Payment Method | Details of how payment was made (e.g., credit card, cash). |

| Amount Paid | The total amount paid, including taxes or discounts. |

| Description of Goods/Services | A brief list or description of what was purchased. |

| Terms & Conditions | Seller’s terms for returns, warranties, or disputes. |

A well-structured receipt is key to maintaining clear and accurate records. The receipt should be organized in a way that ensures every detail is easy to track and verify. Here’s how to structure it effectively:

Include Basic Information

Start with the date of the transaction, the customer’s name, and the payment method used. This sets the foundation for any future reference. For clarity, add the payment plan terms (e.g., total amount, installments, due dates). A concise breakdown of what was purchased should follow, with the respective amounts clearly stated.

Provide Payment Details

Clearly list the amounts paid, and if applicable, the remaining balance. Use a table or bulleted list to make this section easy to follow. Ensure the amount is broken down by each installment, with the due date and amount left to pay. This will help keep both parties informed and avoid confusion.

Ensure Legibility: Use a clean and readable font, ensuring all figures and words are legible. A receipt that is hard to read creates unnecessary confusion.

Tip: Always double-check the totals, especially if payments are part of an ongoing plan. Clear, mistake-free records help maintain trust and transparency between you and your customer.

Tailor your receipt template based on the specific needs of your business. Focus on elements that will help your customers easily understand their payment details and reinforce your brand identity. Adjust the layout and content to suit your industry, whether it’s retail, services, or subscription-based business.

Retail Businesses

For retail businesses, include detailed product descriptions, itemized pricing, discounts, and any promotional codes used. A section for returns or exchanges can also be useful. Customize the receipt header with your business name, logo, and contact information for clear customer identification.

Service-Based Businesses

Service-based businesses should list the services provided with the date and time. Include hourly rates, service duration, and any applicable taxes or tips. Adding a section for payment terms and conditions clarifies how clients can proceed with future payments or installments.

For subscription-based businesses, highlight the billing cycle, next payment date, and any account balance remaining. This makes it easier for customers to track ongoing charges and understand their payment history. Incorporating a clear breakdown of the service period helps avoid confusion.

Customer Payment Plan Receipt Template

Use a clear structure for your payment plan receipt to ensure all details are easy to follow. Include the following elements:

1. Customer Details

Start with the customer’s full name, address, and contact information. These details should be prominently displayed at the top of the receipt. This helps quickly identify the transaction details and avoid any confusion.

2. Payment Breakdown

Clearly list each payment, including the amount due, the due date, and the payment method. Specify the balance after each payment. This makes it easy for both the customer and your team to track the remaining balance.

Always include the payment schedule, showing the frequency of payments, whether it’s monthly, bi-weekly, or otherwise. If there are any late fees or discounts applied, include these in the breakdown as well.

3. Terms and Conditions

Be transparent about the terms of the payment plan. Include information about penalties for late payments, early repayment options, and any other relevant conditions. This reduces any confusion and ensures the customer understands their obligations.

4. Signature Section

End the receipt with a section for both the customer and company representative to sign. This confirms that both parties agree to the terms outlined in the payment plan.

Having these components will help keep both parties aligned on the payment plan terms, making future reference simpler and less prone to disputes.