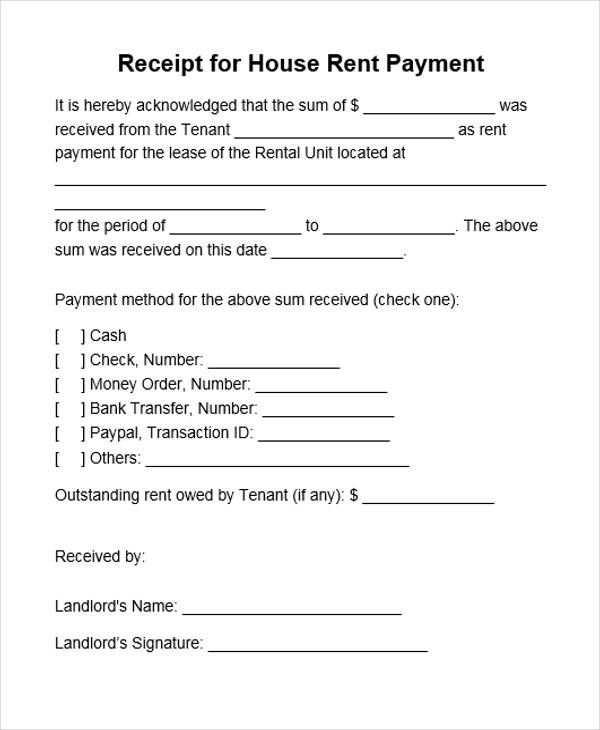

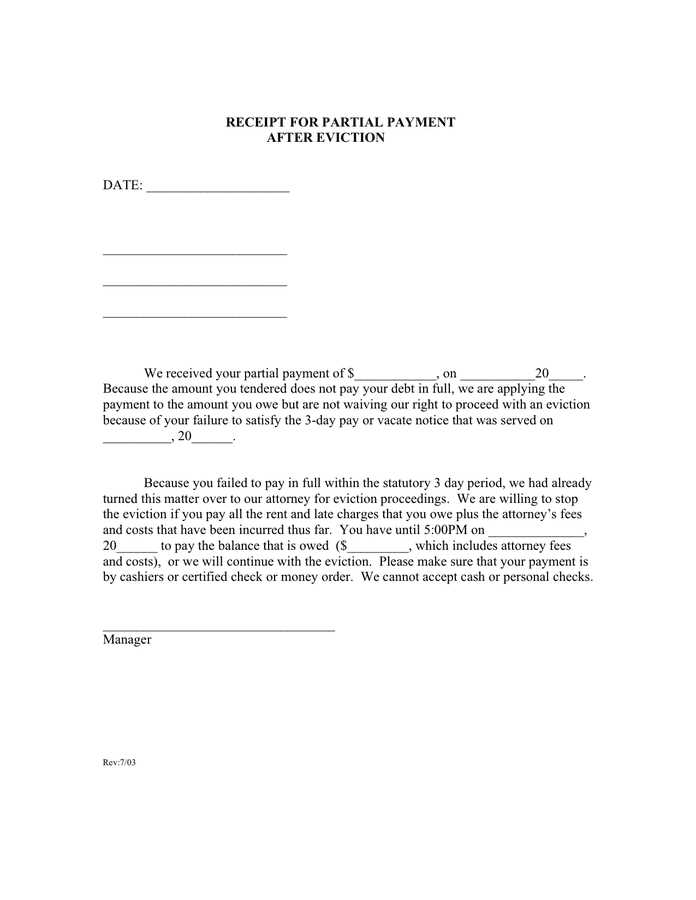

To create a debt payment receipt, ensure it includes key details: the payer’s name, the amount paid, the date of payment, and the balance remaining. This will provide a clear record for both parties and help avoid any future disputes. Make sure the receipt is signed by both the payer and the payee to confirm the transaction.

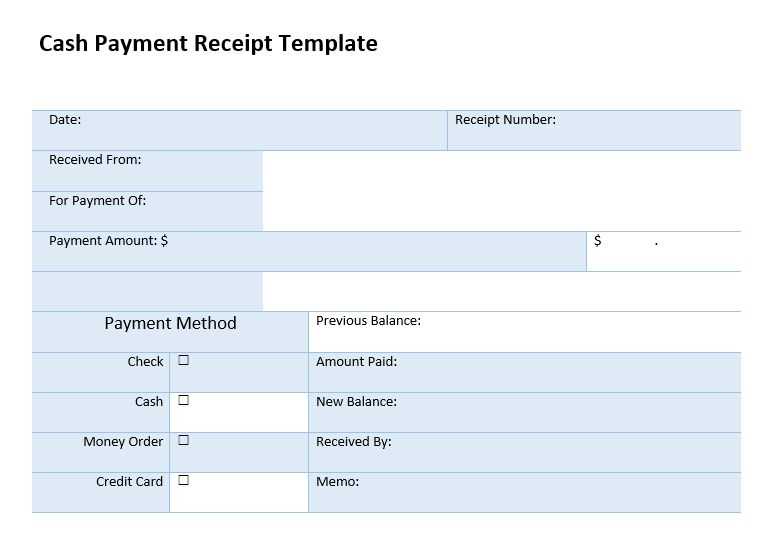

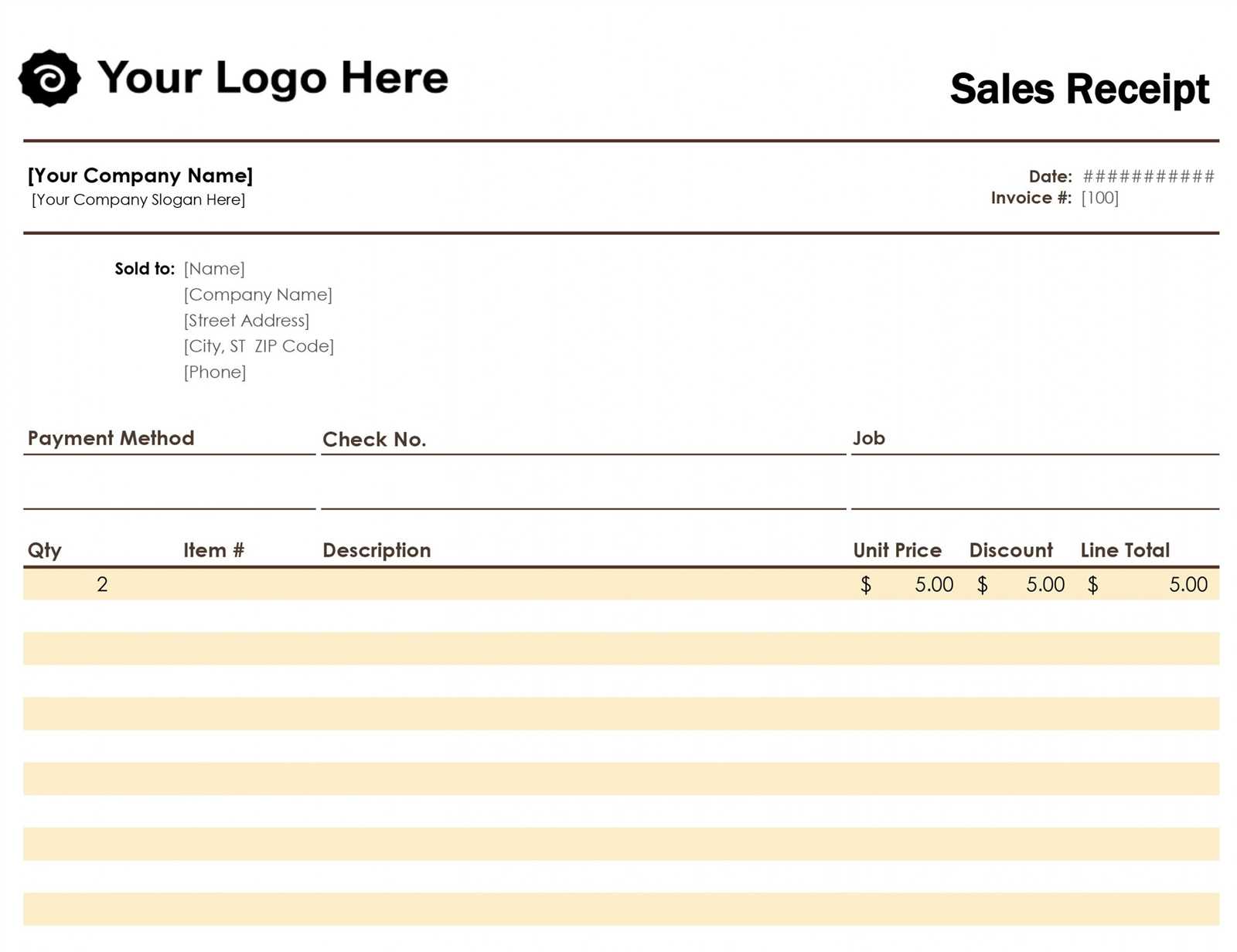

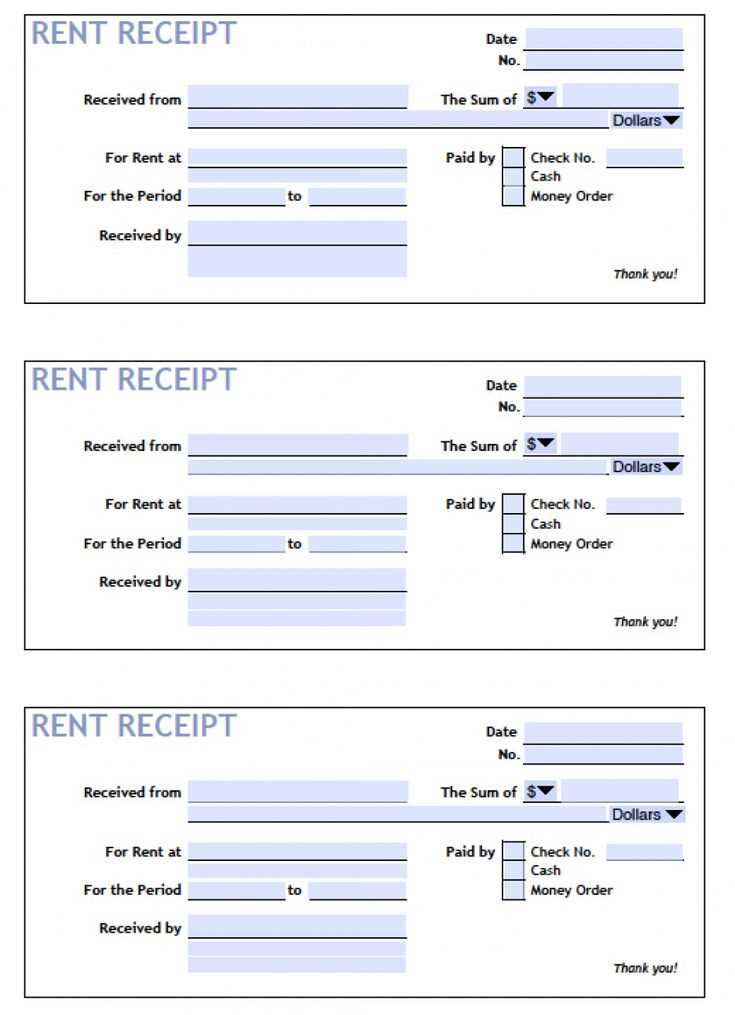

Begin with a clear heading at the top stating “Debt Payment Receipt” followed by a section for the payer’s information, including their name, address, and contact details. Next, include the specifics of the payment: the amount, method of payment (cash, cheque, bank transfer), and the payment date.

Conclude with a section for the balance remaining (if any), and a statement confirming that the payment has been received in full or partial settlement. A receipt like this will serve as proof for both parties that the transaction has taken place, helping avoid misunderstandings down the line.

Debt Payment Receipt Template: A Practical Guide

To create a clear and effective debt payment receipt, include these key elements:

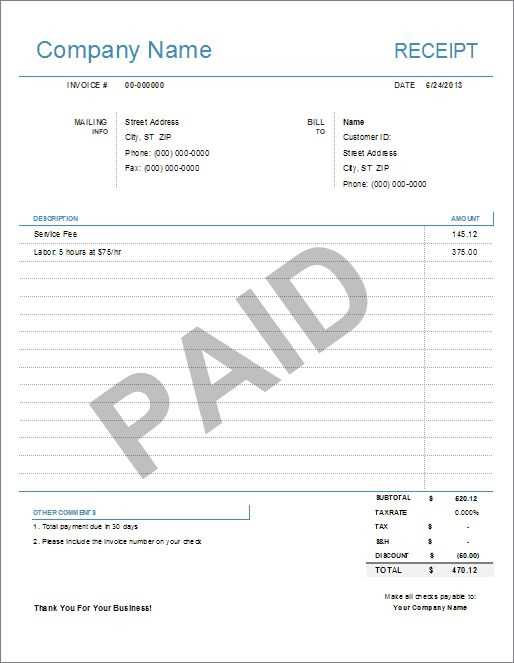

- Receipt Number: Each receipt should have a unique identification number for tracking purposes.

- Debtor’s Information: Include the name and contact details of the individual or company that owes the debt.

- Creditor’s Information: Provide the name and contact details of the party receiving the payment.

- Amount Paid: Specify the exact amount of money that was paid to clear the debt.

- Payment Date: Clearly indicate the date when the payment was made.

- Remaining Balance: If applicable, show any remaining balance that needs to be paid.

- Payment Method: Specify the method used for the payment, such as cash, check, or bank transfer.

- Signatures: Include signatures from both parties involved to confirm the payment has been made and received.

Template Example

Here’s a simple debt payment receipt template:

Receipt Number: 00123 Date: 13th February 2025 Debtor: John Doe Creditor: XYZ Corporation Amount Paid: $500.00 Payment Method: Bank Transfer Remaining Balance: $0.00 Signature of Debtor: _______________________ Signature of Creditor: _______________________

Ensure that both parties retain a copy of the receipt for their records. This documentation helps avoid confusion and provides proof of the transaction.

Creating a Clear and Concise Debt Payment Receipt

Make sure the debt payment receipt includes key details to avoid confusion. The document should start with the name of the person or entity making the payment, followed by the recipient’s details. Include the date of the transaction and the amount paid in both numbers and words for clarity.

Basic Elements to Include

Clearly state the purpose of the payment, such as the loan or debt being settled. If applicable, reference any agreement number or contract details that apply to the transaction. This allows both parties to link the payment to the specific debt.

Providing Proof of Payment

Ensure the receipt includes a unique receipt number and a confirmation statement that the payment has been fully received. This serves as a proof of settlement and can prevent misunderstandings in the future.

Customizing Your Template for Different Payment Methods

Adjust your template to clearly reflect the payment method used, ensuring accuracy and transparency. For bank transfers, include specific bank details such as account number, sort code, and transaction reference. If the payment was made by credit card, add relevant card information, such as the last four digits of the card number, along with the payment processor used.

For cash payments, note the exact amount received and any reference numbers or receipts associated with the transaction. PayPal payments can be tracked using the transaction ID, which should be included along with the date and payment details from the service provider.

Tailor the receipt layout to fit the payment method by adding sections for any relevant payment fees, taxes, or discounts that apply to each transaction type. This will help the recipient easily understand the breakdown of their payment and avoid confusion.

Ensuring Legal Validity and Record Keeping

To ensure the legal validity of a debt payment receipt, include key details such as the debtor’s full name, the exact amount paid, the date of payment, and a clear statement confirming that the debt has been settled. This clarity helps avoid future disputes or misunderstandings. Both parties should sign the document to indicate agreement. Additionally, the creditor should provide the debtor with a copy of the signed receipt as proof of the transaction.

Record Keeping Practices

Store the original debt payment receipts in a secure location. Both physical and digital copies should be kept for at least 5 years to comply with most legal requirements. Digital copies must be easily accessible, preferably backed up in multiple locations. Proper organization and labeling of records can help quickly resolve any future queries related to the payment.