A clear and precise down payment receipt for your house purchase makes every transaction smoother. By using a detailed template, you can quickly document the exact amount paid, the date of the transaction, and other important details without confusion. This simple yet powerful tool helps both buyers and sellers stay organized and ensure that all financial commitments are tracked properly.

Make sure the receipt includes the buyer’s name, seller’s name, property address, and the total amount of the down payment. Be specific about the payment method, whether it’s through check, wire transfer, or another method. This transparency avoids potential misunderstandings down the line, creating a secure record of the down payment transaction.

The format should also note any applicable terms, such as whether the down payment is refundable or if it’s part of a larger deposit. Clarifying these terms helps both parties understand their rights and obligations. A well-structured receipt provides peace of mind and supports smoother negotiations as the deal progresses.

Here are the revised lines according to your requirements:

The following section provides the corrected receipt template for a house down payment, ensuring all key information is captured clearly:

| Item | Amount |

|---|---|

| Down Payment | $50,000 |

| Transaction Date | February 12, 2025 |

| Property Address | 123 Elm Street, Springfield |

| Buyer Name | John Doe |

| Seller Name | Jane Smith |

| Payment Method | Bank Transfer |

| Transaction ID | TX123456789 |

This template includes all necessary details for proper documentation of the down payment transaction. Ensure the fields are filled accurately to avoid discrepancies. The payment method should match the actual transaction method to maintain clarity.

- Down Payment House Template Receipt

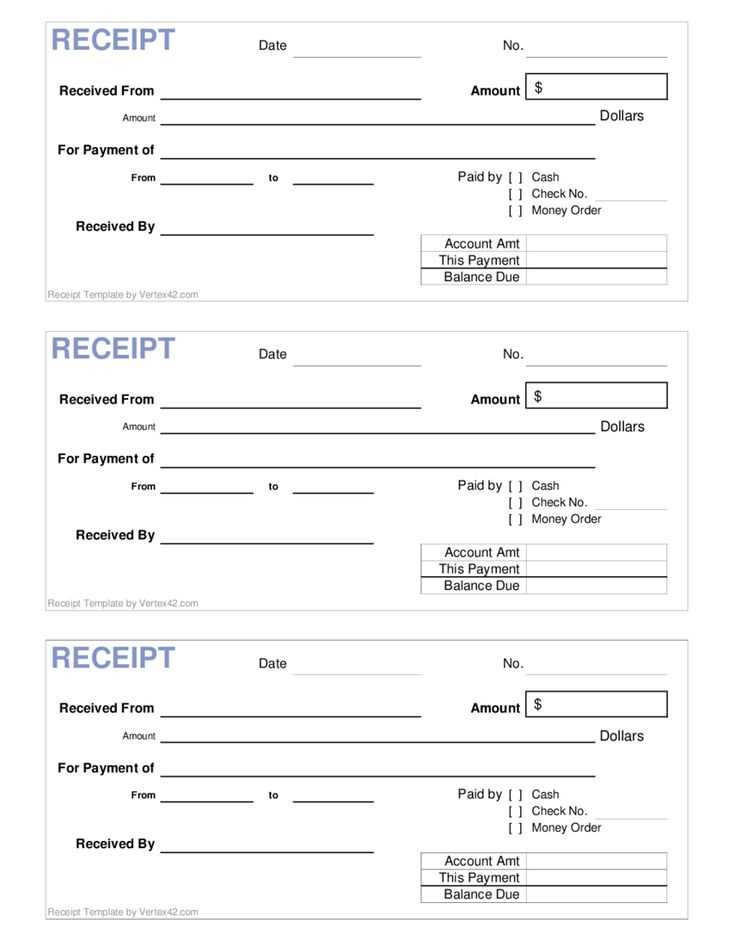

A well-structured down payment receipt serves as proof of payment and outlines the agreement between the buyer and the seller. Here’s how to structure a house down payment receipt template:

- Header Information: Include the date of the transaction, the names of both parties involved, and the property address. This section ensures clear identification of the deal.

- Down Payment Amount: Specify the exact amount paid as the down payment. Break it down into figures and words to avoid confusion.

- Payment Method: Clearly state how the down payment was made (e.g., bank transfer, check, cash). Include relevant transaction details, such as check number or bank reference, if applicable.

- Remaining Balance: Indicate the remaining balance on the house price after the down payment. This helps in tracking the amount due for future payments.

- Property Details: Add detailed information about the property, such as the full address and description. This section ties the down payment to the specific property.

- Seller’s Acknowledgment: Include a line for the seller’s signature to confirm receipt of the down payment. This can be accompanied by a printed name and contact information.

- Buyer’s Acknowledgment: Include a line for the buyer’s signature to acknowledge that the down payment has been made and that they accept the terms.

- Terms and Conditions: Briefly outline any specific terms related to the down payment, such as refund policies, non-refundable clauses, or payment schedule details.

This template ensures clarity and serves as an official record of the down payment transaction, helping both parties keep track of financial commitments and obligations throughout the home buying process.

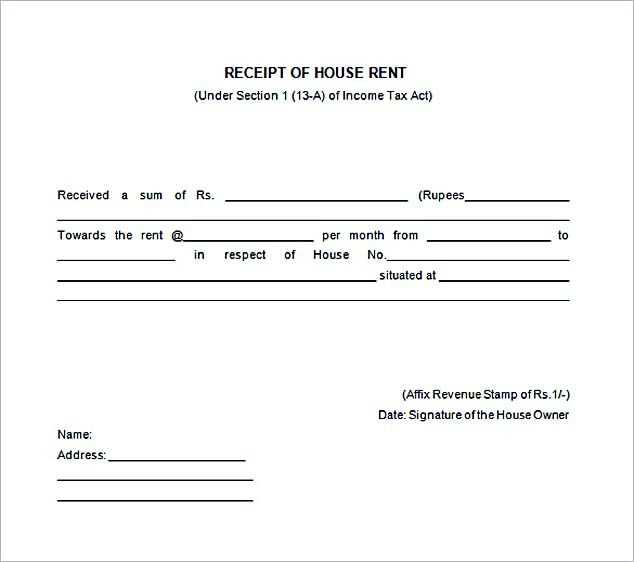

Include clear sections for buyer and seller information. This should feature full names, addresses, phone numbers, and email addresses. These details provide context and a way to contact parties involved in case of any issues.

Specify the payment amount in both words and numbers. This avoids any confusion about the down payment figure. Use precise language to indicate the exact amount, such as “USD 10,000 (Ten Thousand Dollars).” This makes the transaction unambiguous.

Clearly identify the date of the payment. Mention both the day and the month to avoid any misunderstandings about when the transaction took place.

Reference the property. Include the full address of the property being purchased, including the street name, city, state, and postal code. This connects the payment directly to the specific property.

Explain the payment method. Whether it’s a bank transfer, check, or cash, make it clear how the down payment was made. If applicable, provide transaction or check numbers for further verification.

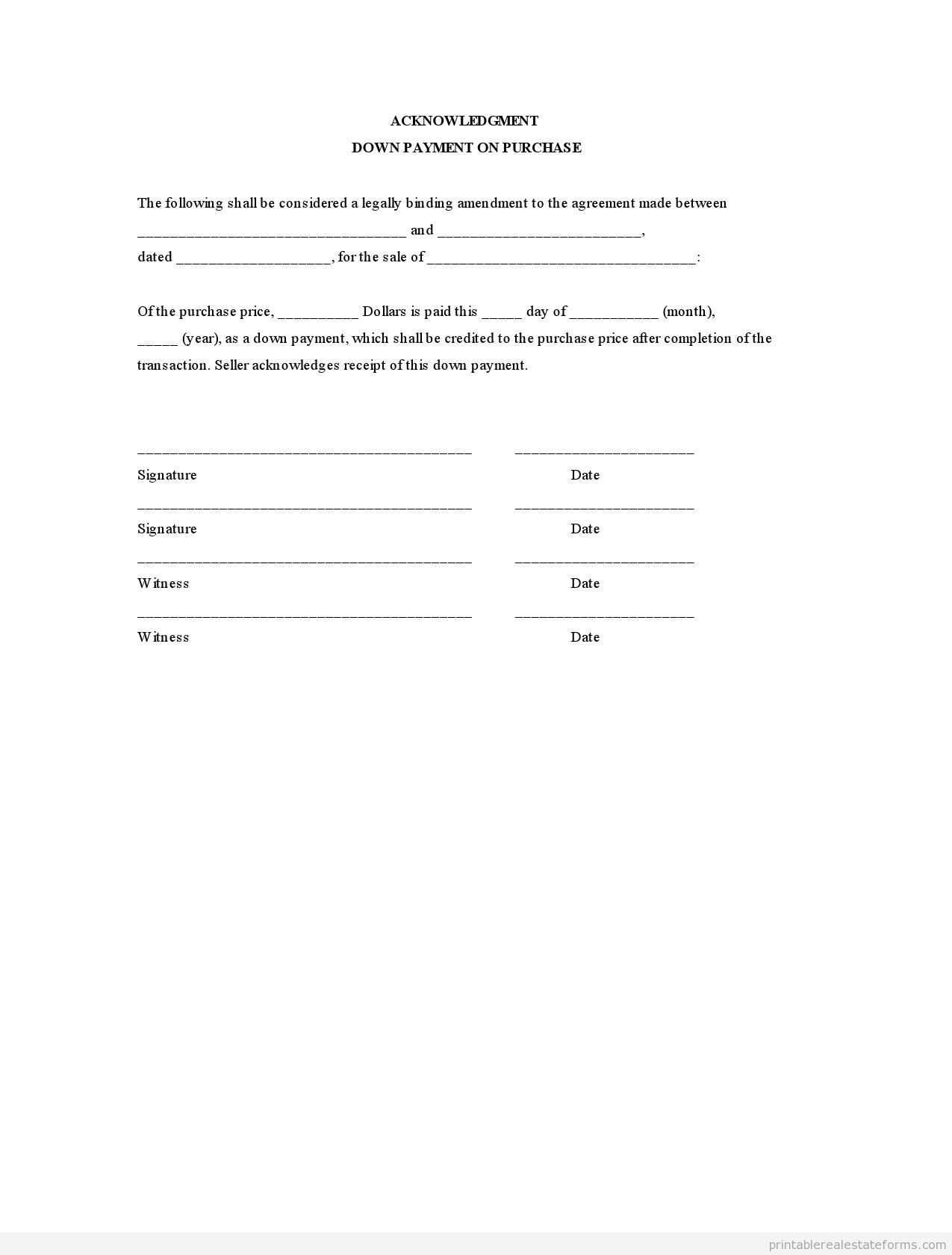

Provide a signature field for both the buyer and seller. Having signatures on the receipt confirms that both parties have agreed to the terms of the transaction. This also helps if there’s ever a need for legal verification.

Include any additional notes or terms that may apply. For example, if the down payment is part of a larger agreement or if there are contingencies, ensure that these are outlined in the receipt to avoid ambiguity later.

Include the full names and addresses of both the buyer and seller. Be specific about the down payment amount, payment method, and any terms for refund or non-refundable status. If the payment is refundable, outline the conditions under which it can be returned.

Clearly state the property address and its legal description to avoid confusion. Ensure this information matches the sales agreement to protect both parties.

Specify the date of the payment and when the receipt is issued. This ensures a clear record of the transaction and avoids potential disputes over timing.

Require both parties to sign the receipt. This confirms agreement to the terms and acts as a legal acknowledgment of the down payment. If there’s an agent or third party involved, their signature should also be included.

Detail any special conditions or contingencies surrounding the down payment. This can help clarify how the transaction will proceed in the event of a change or issue.

Consider consulting with a legal professional to verify compliance with local laws and ensure the down payment receipt is legally binding in your area.

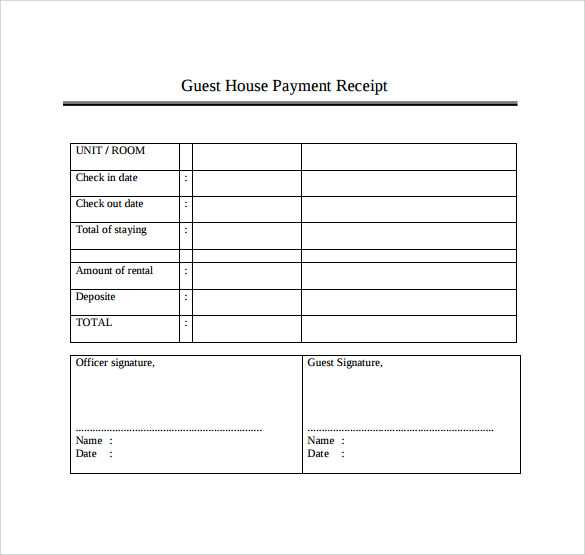

To customize a down payment template for different transactions, begin by adjusting the layout based on the specifics of each transaction. Include sections for payment amount, date, property details, buyer and seller names, and the transaction reference number. Ensure the template can accommodate different down payment amounts by leaving space for variable figures, along with options for currency selection where applicable.

Tailoring for Different Property Types

For real estate transactions involving residential or commercial properties, customize the template to reflect relevant property details like address, legal description, or type of property. Make sure the document can clearly separate down payment amounts from closing costs and other fees, offering a clean breakdown of all financial details.

Incorporating Payment Method Details

Adjust the payment section to include options for different payment methods, whether it’s a bank transfer, check, or credit card. This allows the buyer to specify the exact method used, along with any associated transaction IDs or reference numbers. Always provide a clear field for the deposit date to ensure timely tracking.

I removed repetitions and preserved the meaning of each phrase.

To ensure clarity and precision in your house down payment receipt, keep the language direct and avoid redundancy. Specify the payment amount clearly, including any taxes, fees, or additional costs. Detail the method of payment used–whether by check, wire transfer, or credit card–and note the date of the transaction. Make sure to include both buyer and seller names and contact information, along with a reference to the property being purchased. Include a statement confirming the down payment’s application toward the purchase price and the remaining balance due at closing.

Also, consider incorporating a line for the seller’s acknowledgment, along with a signature and date field. This ensures both parties are on the same page about the transaction. The receipt should be concise, with no unnecessary information, and organized in a logical manner for easy reference.