Creating a clear and simple payment receipt is straightforward. Use a basic structure with all key details like the payment amount, date, payer’s name, and payment method. This ensures transparency and smooth communication between parties.

First, include the transaction details: Start with the payment amount, the date of the transaction, and the payer’s name. These pieces of information are crucial for verifying the payment. You can also add a unique receipt number for easier reference.

Next, specify the payment method: Indicate whether the payment was made by cash, card, or another method. This helps clarify how the transaction was processed, especially when reconciling accounts.

Don’t forget the seller’s information: Add the seller’s name, address, and contact information. This ensures that both parties know where to reach each other for any follow-up. Keep this section concise but complete.

Finally, consider adding a thank you note: A short expression of gratitude can enhance the receipt’s professionalism. Something simple like “Thank you for your business” will suffice.

Here is the corrected version:

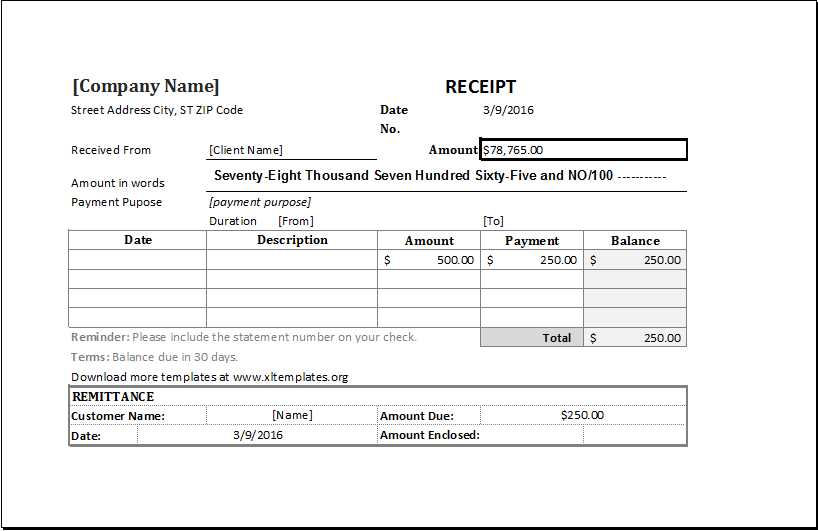

Ensure that the header of the receipt clearly displays your business name, address, and contact details. This creates immediate recognition for the customer. Right under the business information, list the transaction date, receipt number, and payment method used. Make this section easy to read for both the customer and any future reference needs.

Transaction Breakdown

Follow up with an itemized list of the purchased goods or services. Include a description, quantity, unit price, and total cost. Clearly separate each item for better clarity. Don’t forget to include any applicable taxes or discounts separately to maintain transparency.

Total Payment

At the bottom of the receipt, clearly state the total amount paid. This ensures that the customer can quickly verify the correct charge. If there are multiple payment methods used (e.g., credit card and cash), indicate the breakdown clearly, showing how the payment was divided.

- Easy Payment Receipt Template

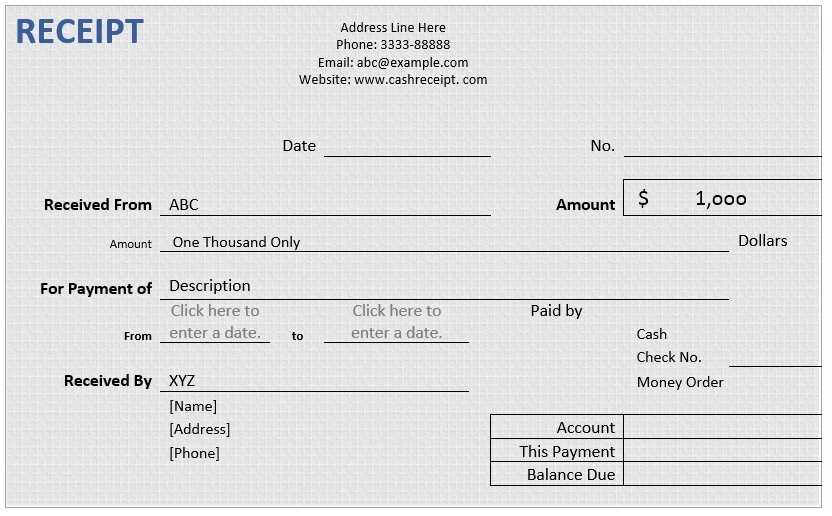

To create a simple payment receipt, start by including the key information that confirms the transaction. The most important elements to include are:

- Receipt Number – A unique identifier for easy reference.

- Seller’s Information – Name, address, and contact details of the person or business receiving payment.

- Buyer’s Information – Name and contact details of the person making the payment.

- Payment Date – The exact date the payment was made.

- Amount Paid – The total sum paid by the buyer, along with the currency used.

- Payment Method – Specify whether the payment was made by cash, credit card, bank transfer, etc.

- Description of Goods/Services – A brief summary of the items or services purchased.

- Tax and Discount Information – If applicable, mention any tax applied or discounts given during the transaction.

- Signature – A space for the seller’s signature or an electronic equivalent to verify the payment.

Structure the receipt clearly to ensure readability, separating each section with space or borders. This layout makes it easy for both the buyer and the seller to keep track of payments and any future inquiries.

If using an online template, ensure it is customizable to match the details of each transaction. Include options to add a logo or any specific branding that represents your business, creating a professional touch for customers.

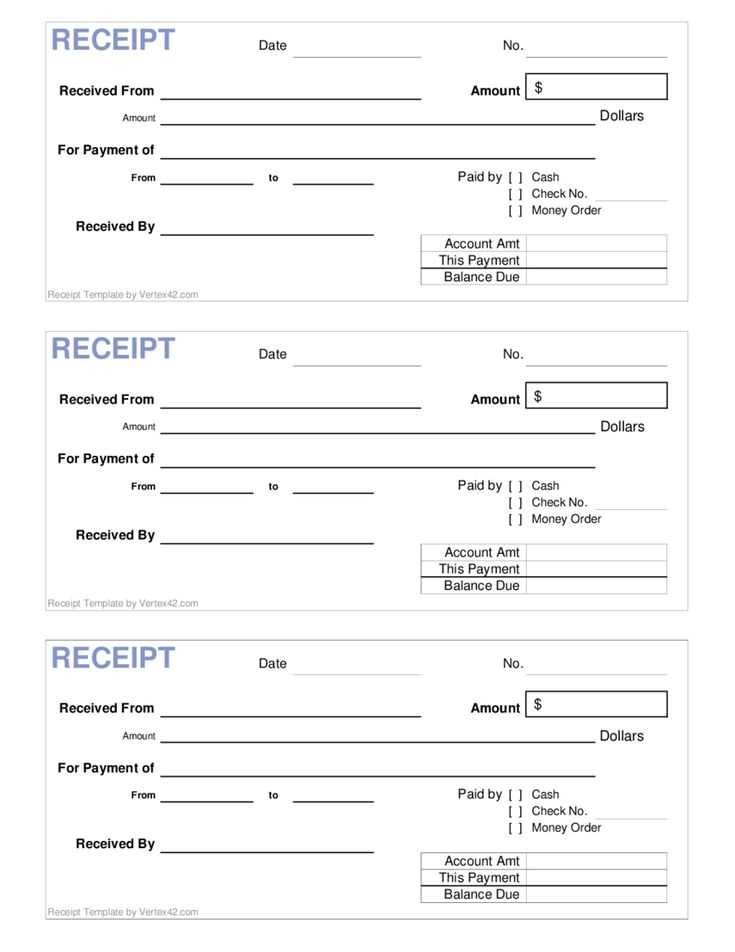

Begin with the transaction date and a unique receipt number for tracking purposes. This helps to easily reference the transaction in the future. Then, include both the buyer’s and seller’s information, such as name, address, and contact details.

Next, list each purchased item or service with a brief description. Include the quantity and price of each item. Afterward, calculate the subtotal and add any applicable taxes. Ensure that the total amount is clearly stated at the bottom.

Indicate the payment method (cash, credit card, etc.) and include any relevant transaction or reference number if applicable. This allows for easy verification of the payment.

Finish with a thank-you note or message, such as “Thank you for your purchase!” Keep the layout clean and easy to read for future reference or potential disputes.

Adjust your template based on the transaction type to ensure clarity and proper information delivery. For retail purchases, include the total price, payment method, and itemized list of purchased items. In service-based transactions, detail the services rendered, hourly rates (if applicable), and any discounts or taxes that apply. Always leave room for the transaction ID or reference number, particularly for online payments or larger orders.

For recurring payments, consider adding fields for billing cycles, payment due dates, and payment method confirmations. This makes tracking easier for both the customer and the service provider. You can also create separate sections for payment history or notes about subscription renewals or upcoming charges.

Use columns to differentiate different pieces of information clearly. Below is a sample table layout that can be customized based on the transaction type:

| Item/Service | Description | Amount | Tax | Total |

|---|---|---|---|---|

| Product A | High-quality product | $50.00 | $5.00 | $55.00 |

| Service B | Consultation | $100.00 | $10.00 | $110.00 |

For each transaction type, make sure the layout visually emphasizes the most important details like totals and due dates. Customizing sections based on transaction types ensures all necessary information is visible and easy to read, fostering transparency in every interaction.

To save time, make sure your receipt template is stored in a format that’s easy to access and edit later. The most common formats are Word, Excel, or PDF. Here’s how to manage them effectively:

1. Store Your Template in Cloud Storage

- Upload your template to a cloud service like Google Drive, Dropbox, or OneDrive.

- This ensures your template is available on any device and can be easily updated.

- With cloud storage, you can access, edit, and share your template from anywhere.

2. Create a Template Folder

- Organize your receipt templates by creating specific folders for different types of receipts (e.g., payments, refunds, invoices).

- Label each file clearly to avoid confusion when looking for a specific template.

3. Use File Versioning

- Enable version history in your cloud storage to track any changes made to your template.

- If you need to revert to a previous version, simply restore it from the version history.

4. Automate Template Filling

- If you frequently use the same information (e.g., company name, address), create placeholders in your template.

- Use tools or scripts to auto-fill these placeholders, saving you time when preparing new receipts.

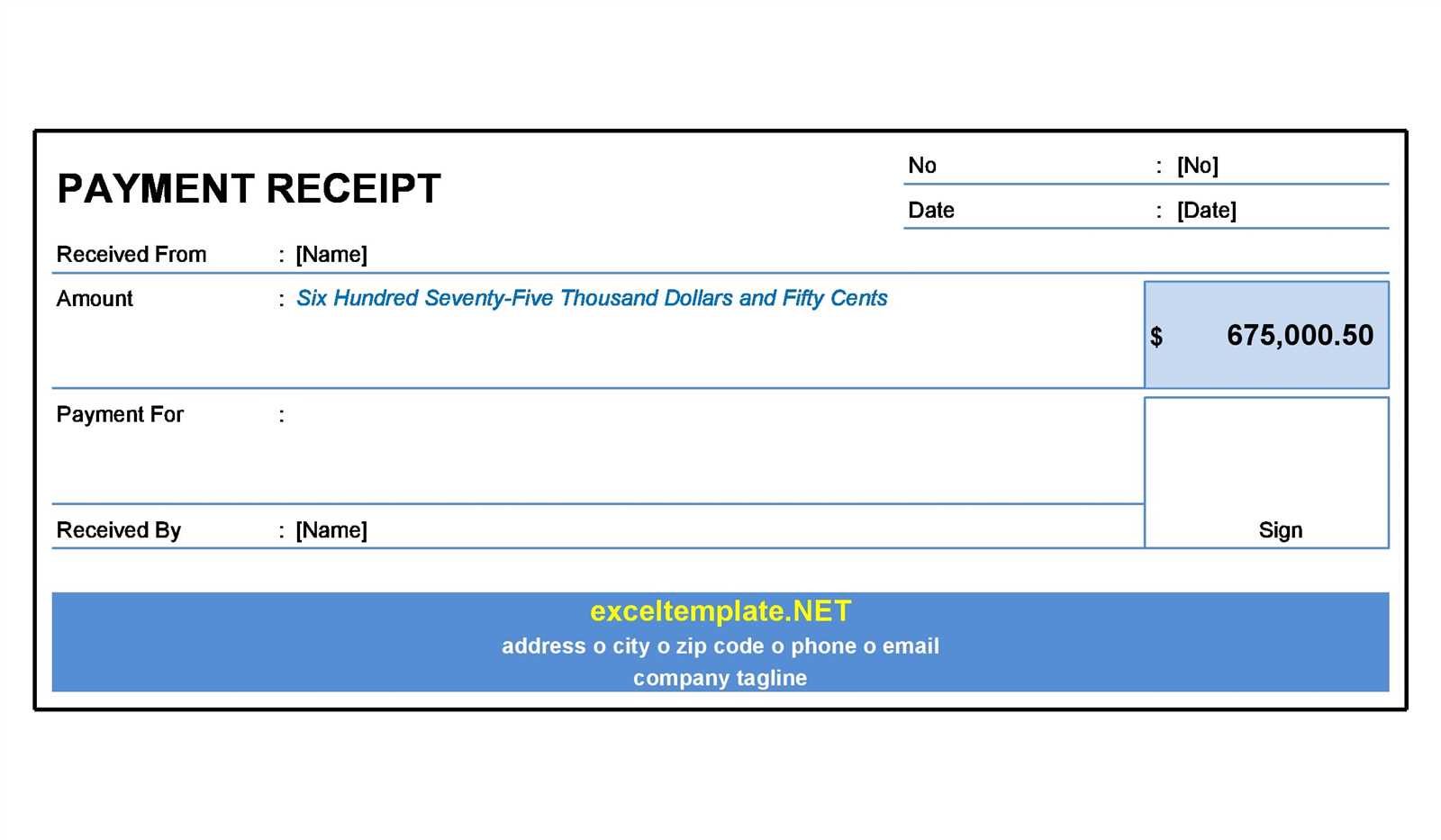

For a clean and simple payment receipt template, ensure it contains the transaction details clearly. Start by listing the payment date followed by the payer’s name and amount paid. Next, add the payment method used. This could be credit card, PayPal, or cash.

Provide a unique receipt number for each transaction to help with future reference or audits. Make sure to include a brief description of the goods or services purchased. If applicable, add taxes or discounts applied to the total.

Conclude with a thank you note or a simple “Thank you for your payment” statement to leave a positive impression. Keeping this layout simple but clear will help both parties track their transactions effortlessly.