When creating a general receipt of payment, accuracy and clarity are key. Ensure that the template includes all necessary details: the buyer and seller information, the transaction date, a description of the product or service, and the amount paid. These elements form the backbone of the receipt and provide both parties with a clear record of the transaction.

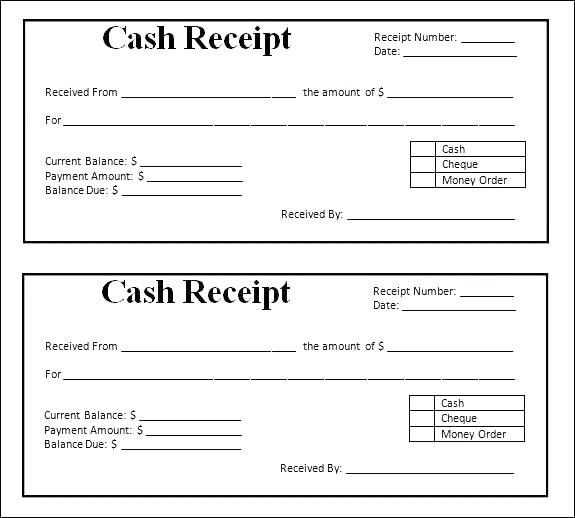

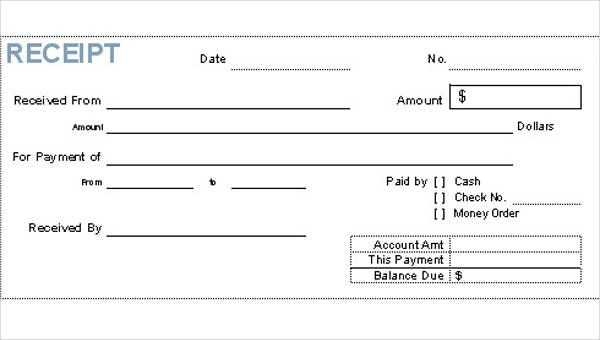

In addition to the basic transaction information, it’s helpful to add a unique receipt number for tracking purposes. This allows easy reference in case of disputes or further communications. Incorporate payment method details, such as cash, credit card, or bank transfer, to confirm the payment method used and avoid confusion later.

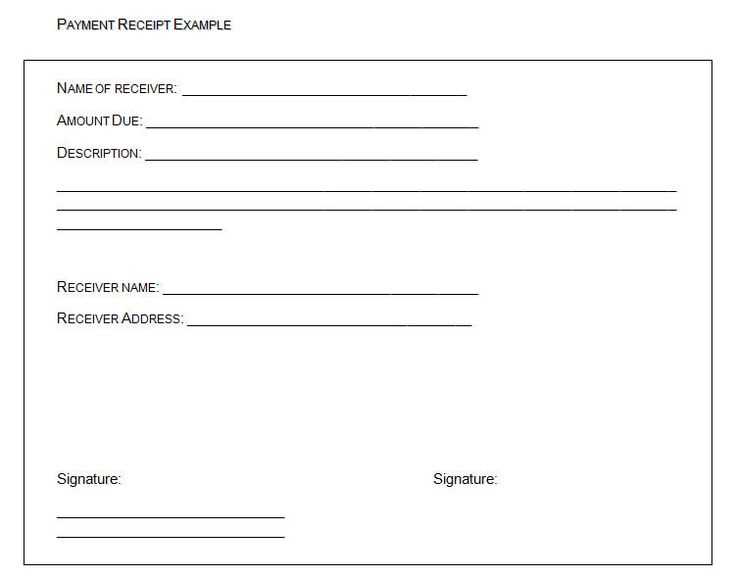

Be consistent with the layout and structure of your template. This makes it easier for both parties to read and understand the receipt. If possible, include a signature line for the seller or an electronic version to increase trust in the authenticity of the receipt.

Here are the revised lines with minimized repetition:

Use clear, concise language to communicate payment details. Replace repetitive phrases with more straightforward terms to avoid redundancy. For example, instead of saying “payment has been made successfully,” simply use “payment confirmed.” This simplifies the message and reduces unnecessary complexity.

Avoid using the same terms multiple times in close proximity. For example, if you’ve already mentioned the amount in the first sentence, there’s no need to repeat it later. Instead, focus on the context and refer to the transaction without restating details unnecessarily.

Opt for phrases that directly state the action or status. For example, “payment received” is more effective than “payment has been successfully received and is now in our records.” Streamline the sentence to improve clarity and reduce redundancy.

- General Payment Receipt Template

Provide the following details to create a clear and accurate payment receipt:

Key Elements to Include

- Receipt Number: Each receipt must have a unique identifier for tracking.

- Date: Record the exact date of the transaction.

- Payer’s Information: Include the name or business name of the person or company making the payment.

- Amount Paid: Clearly state the total amount paid and the currency.

- Payment Method: Specify whether the payment was made via cash, credit card, bank transfer, etc.

- Reason for Payment: Include a brief description of the purpose for the payment, such as services rendered or products purchased.

- Recipient’s Information: Include the name or business name of the entity receiving the payment.

Template Example

Payment Receipt

Receipt Number: [Enter Receipt Number]

Date: [Enter Payment Date]

Paid By: [Enter Payer’s Name]

Amount Paid: [Enter Amount] [Currency]

Payment Method: [Cash/Card/Transfer]

Reason for Payment: [Enter Purpose of Payment]

Received By: [Enter Recipient’s Name]

This template ensures both parties have a clear, formal record of the payment transaction.

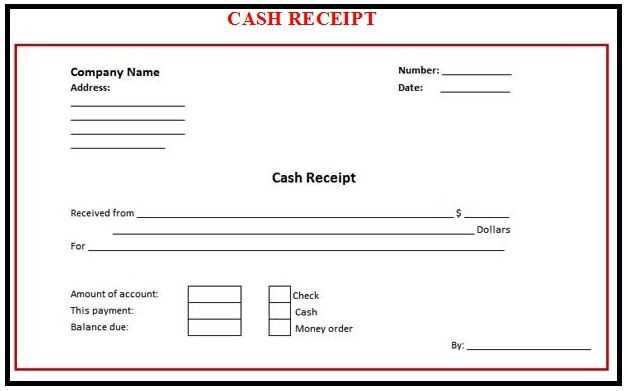

Begin by outlining the key elements your receipt needs: the company name, date, receipt number, items or services purchased, total amount, and payment method. Keep it clear and concise.

Use a simple structure that includes a header with your business name, contact details, and a unique receipt number for reference. Below this, include the transaction date and the customer’s information if necessary.

List each item or service with a description, quantity, unit price, and total cost. Use a table format to make the information easy to follow. Include a subtotal, tax, and the final total at the bottom.

End with the payment method used (cash, credit card, etc.) and any other important notes, such as refund policies or terms. Be sure the design is clear and readable, with enough space between sections.

Start with the payment amount and method to ensure clarity. Clearly state the total amount paid and specify whether the payment was made via cash, credit card, bank transfer, or any other method.

Payment Information

- Payment Amount: Specify the exact amount paid, including any taxes or additional fees.

- Payment Method: List the method used for payment (e.g., credit card, bank transfer, cash, etc.).

- Transaction ID: Include the unique reference number for the transaction, especially for digital payments or bank transfers.

Sender and Recipient Details

- Sender’s Information: Include the full name and contact information of the person making the payment.

- Recipient’s Information: Mention the business or individual receiving the payment, along with their contact details.

Don’t forget to add the date of payment and a brief description of what the payment covers, ensuring that both parties understand the purpose of the transaction.

Additional Information

- Date of Payment: State the exact date the payment was received.

- Invoice Number: Include the invoice number to link the payment to a specific transaction or order.

- Description: Provide a short description of the goods or services paid for, if applicable.

Customize your receipt template to match the specific payment method used for the transaction. Each payment method has distinct details that need to be included for accuracy and clarity.

Credit and Debit Cards

- Include the last four digits of the card number for reference.

- Provide the card type (e.g., Visa, MasterCard) and the cardholder’s name.

- Make space for authorization codes or transaction ID, if applicable.

Bank Transfers

- Show the bank account number or reference number for the transaction.

- Include the bank’s name and branch if necessary.

- Note the payment date and the amount transferred.

Adjust your template to accommodate these details while maintaining a professional appearance, ensuring that customers have all the necessary information for their records. Each payment method will have unique fields, so stay consistent with formatting to avoid confusion.

Each region has its own set of tax laws and financial regulations that businesses must adhere to when issuing receipts. It’s important to consult local authorities or legal experts to ensure the receipt template aligns with these standards.

Tax Information to Include

Receipts should clearly outline the tax rate applied to the transaction. This helps in proving compliance during audits or inspections. Include the applicable tax number, the amount of tax charged, and a breakdown of how the tax was calculated.

Adhering to Legal Formats

Some jurisdictions have mandatory formats for receipts. Ensure that your template meets all required legal specifications, such as the inclusion of business registration numbers or specific wording. Failure to comply may result in fines or legal disputes.

| Region | Required Information | Tax Rate Format |

|---|---|---|

| United States | Tax ID, Itemized prices, State tax | Tax rate as percentage |

| European Union | VAT number, Net price, Gross price | VAT rate listed separately |

| Canada | GST/HST number, Itemized breakdown | GST/HST rate displayed |

Regularly review local regulations to ensure your receipt template remains up-to-date and legally compliant. This prevents potential legal issues and builds trust with customers.

Ensure that the text is legible by using a clean and readable font, such as Arial or Helvetica. Keep the font size consistent throughout, but make the total amount bold and slightly larger for emphasis. Use contrasting colors for important sections like the company name, transaction date, and total amount to make them stand out clearly.

Layout matters: Organize the receipt with logical spacing. Place the company logo, contact details, and transaction information in distinct sections to avoid clutter. Align text consistently for easy scanning, and ensure there is enough white space between the sections for better readability.

Use clear labels: Clearly label each line item with descriptors like “Item,” “Price,” and “Quantity” for easy comprehension. Use consistent formatting for these labels across all receipts to avoid confusion.

Provide itemized details: Breakdown of services or products with clear descriptions makes it easy for the customer to verify their purchases. Include the unit price, quantity, and any applicable taxes or discounts. Ensure all details are accurate to prevent disputes.

Include payment methods: Clearly state whether the payment was made via cash, credit card, or any other method. This helps the customer keep track of their finances and provides clarity for any future reference.

Use professional language: Ensure the language used on the receipt is straightforward, polite, and formal. Avoid slang and overly casual phrases that may reduce the professional tone of your business.

To share receipts securely, avoid sending them via unsecured email or unencrypted messaging platforms. Instead, use encrypted email services or secure file-sharing tools. Popular options like Dropbox or Google Drive offer encryption, but always ensure you enable two-factor authentication to add an extra layer of protection. If you need to share receipts on the go, consider using apps that offer end-to-end encryption, such as Signal or WhatsApp.

Storing Receipts Digitally

When storing receipts digitally, organize them into encrypted cloud storage or a secure digital vault. Make sure your passwords are strong and unique, and enable multi-factor authentication to prevent unauthorized access. Scanning receipts with your phone’s camera can provide a digital version, but use apps that store files in an encrypted format for added security. Regularly backup your files to ensure nothing is lost due to technical issues.

Physical Receipt Storage

If you prefer physical receipts, store them in a safe or locked drawer to prevent unauthorized access. Use fireproof containers for additional protection. Digitizing physical receipts can help you maintain a backup in case the physical copies get damaged or lost.

When designing a receipt template for payments, focus on clarity and simplicity. Start with a clear heading indicating the document type, such as “Payment Receipt.” Include essential details like the payment amount, date, and the payment method used.

Details to Include

Include the name of the payer and payee, along with their contact information. This helps verify the transaction and establishes transparency. Be sure to list the service or product purchased and the corresponding price, if applicable.

Formatting Recommendations

Ensure that the font is legible, and the sections are neatly separated. A well-organized receipt allows recipients to quickly identify important details. Utilize bold text for headings and key figures like the total amount.

Finish with a clear statement of payment confirmation, such as “Paid in Full” or “Transaction Complete.” This provides reassurance to the payer that the transaction has been processed successfully.