Key Elements of a Receipt

A proper receipt should include all critical details to serve as clear proof of payment. Ensure it contains:

- Date: The exact date the payment was made.

- Receipt Number: A unique identifier for tracking.

- Payer and Payee Information: Names and contact details of both parties.

- Payment Amount: The total sum received.

- Payment Method: Cash, credit card, bank transfer, or another form.

- Description of Purchase: A brief note on what the payment covers.

- Signature: A confirmation from the receiver.

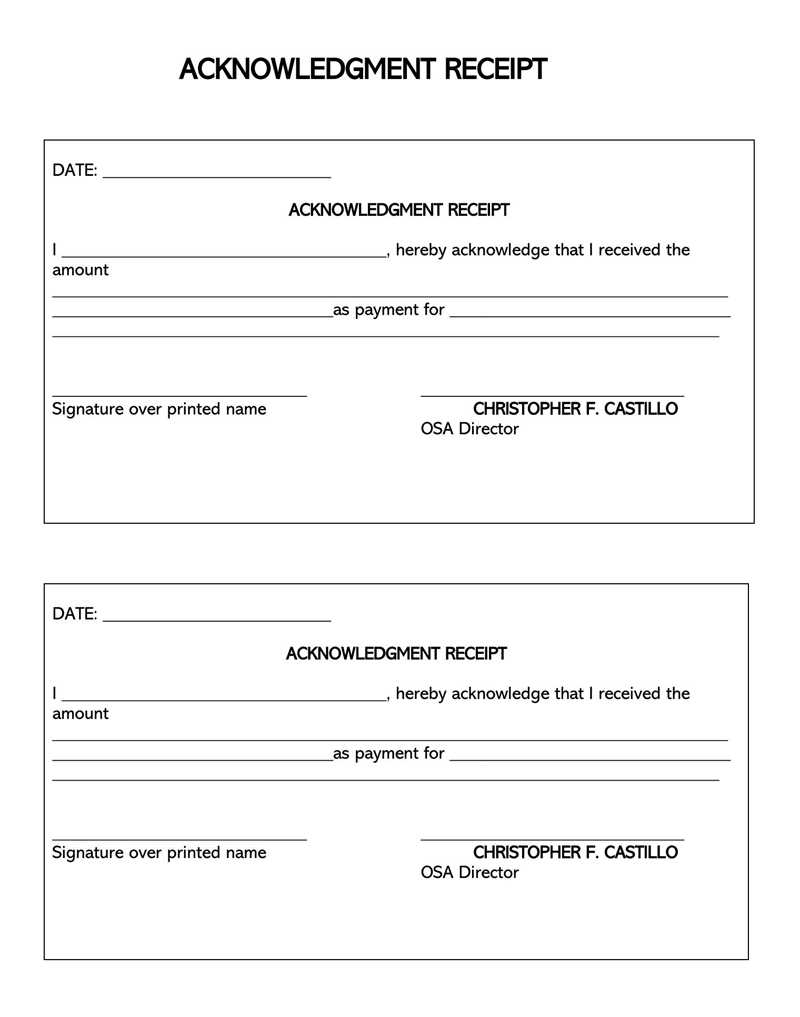

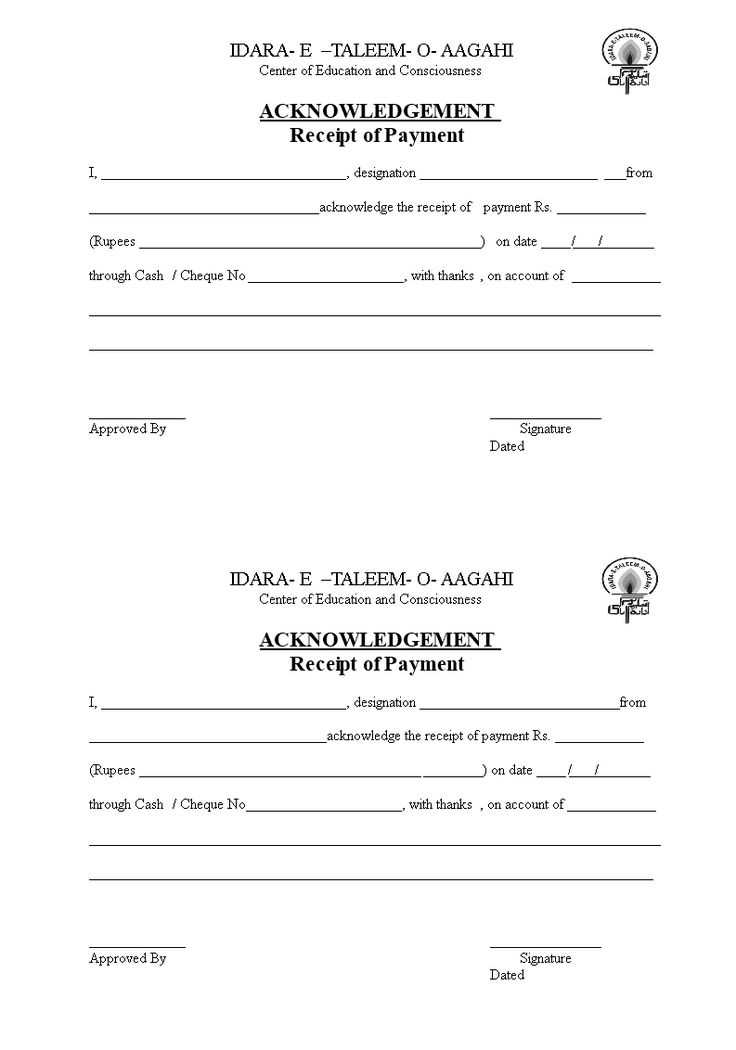

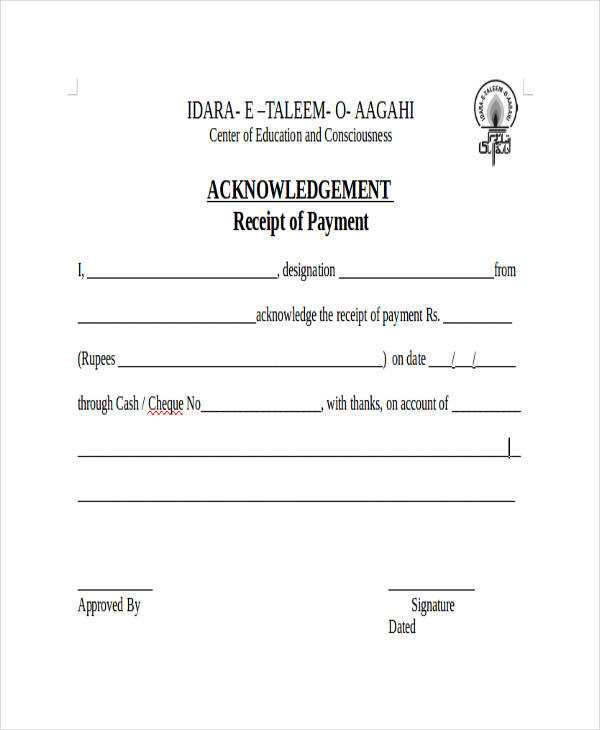

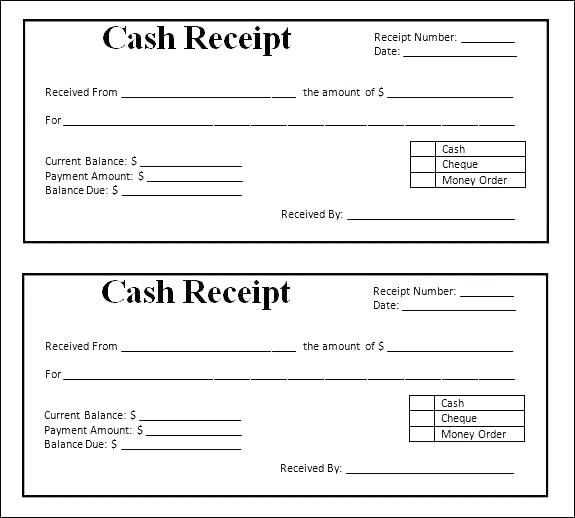

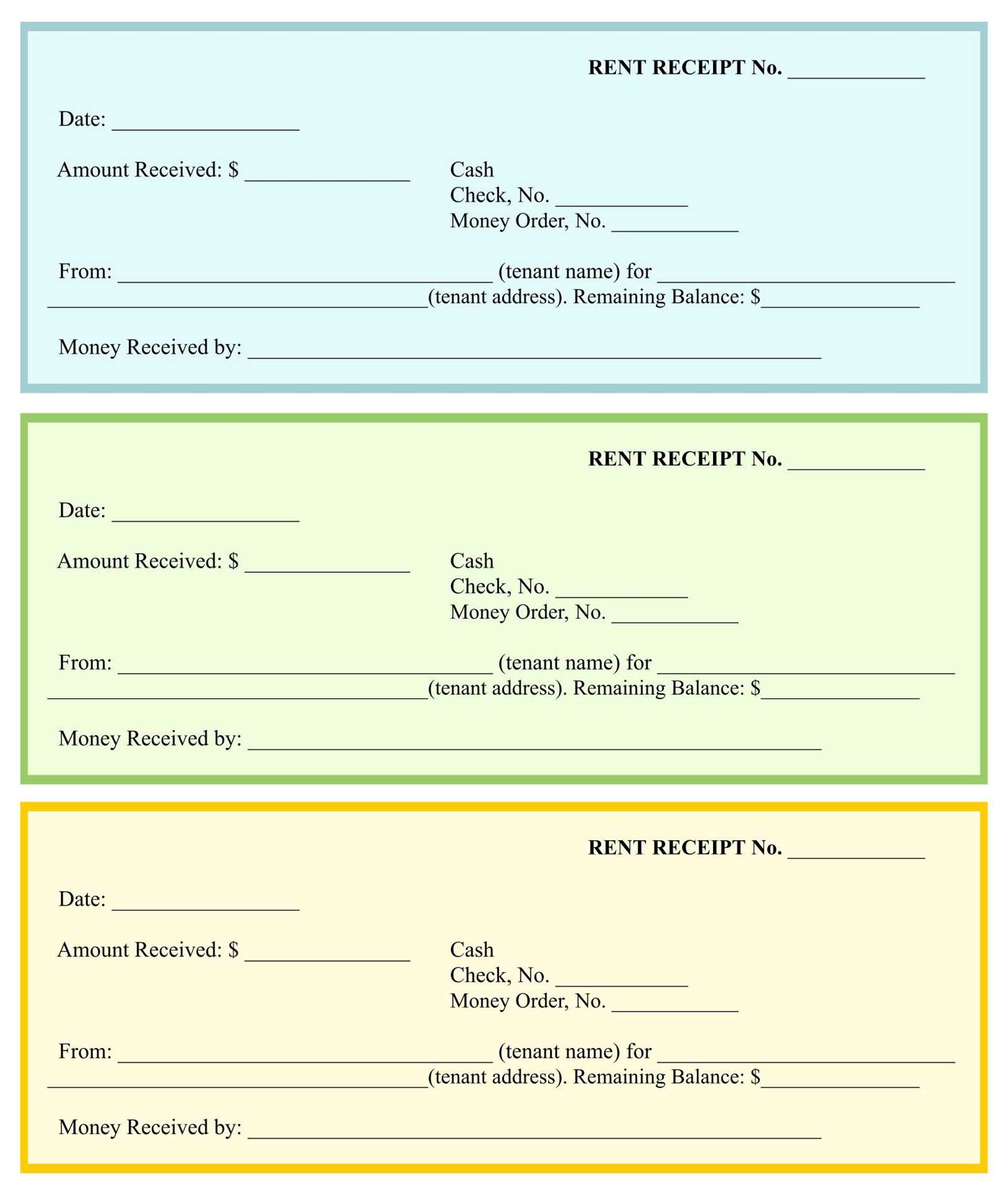

Sample Receipt of Payment Template

Use this structure as a foundation:

Receipt of Payment Date: [MM/DD/YYYY] Receipt No.: [#####] Received from: [Payer's Name] Address: [Payer's Address] Phone/Email: [Payer's Contact Info] Received by: [Payee's Name] Address: [Payee's Address] Phone/Email: [Payee's Contact Info] Amount Received: $[Amount] Payment Method: [Cash/Credit/Bank Transfer] Purpose of Payment: [Product/Service Description] Signature: _____________________ (Payee)

Best Practices

- Use consistent formatting to maintain clarity.

- Issue receipts immediately after payment.

- Keep a copy for record-keeping.

- Include company branding if applicable.

A well-structured receipt not only serves as proof of payment but also helps in financial tracking and dispute resolution.

How to Write a Payment Receipt Template

Key Elements to Include in a Payment Receipt

How to Format a Receipt for Clarity and Accuracy

Choosing the Right Wording for Legal and Financial Compliance

Best Practices for Numbering and Tracking

Customizing a Template for Different Payment Methods

Printable vs. Digital Receipts: Pros, Cons, and Use Cases

Include the essential details: A payment receipt must specify the transaction date, receipt number, payer’s name, payee’s details, amount paid, payment method, and a brief description of the transaction. Clearly stating these elements ensures accuracy and legal compliance.

Format for clarity: Align text properly, use readable fonts, and separate sections with spacing. List numerical values in bold to make them stand out. Consistency in formatting prevents misinterpretation.

Use precise wording: Avoid vague terms. Instead of “Paid in full,” specify “$500 received for January rent.” This removes ambiguity and provides a clear record of what the payment covers.

Implement an efficient numbering system: Use sequential numbers or include prefixes based on transaction types (e.g., INV-1001 for invoices, REC-2001 for receipts). This simplifies tracking and prevents duplication.

Adapt for different payment methods: If accepting card payments, include transaction IDs. For bank transfers, note reference numbers. For cash payments, require signatures to confirm receipt.

Consider digital vs. printed receipts: Digital receipts allow easy storage and retrieval, while printed ones suit in-person transactions. Choose based on your business needs and customer preferences.