Using a clear and concise invoice template with “payment due upon receipt” helps streamline your payment process. This straightforward payment term ensures that clients know they need to settle the invoice immediately, which can speed up cash flow and reduce the time spent on follow-ups.

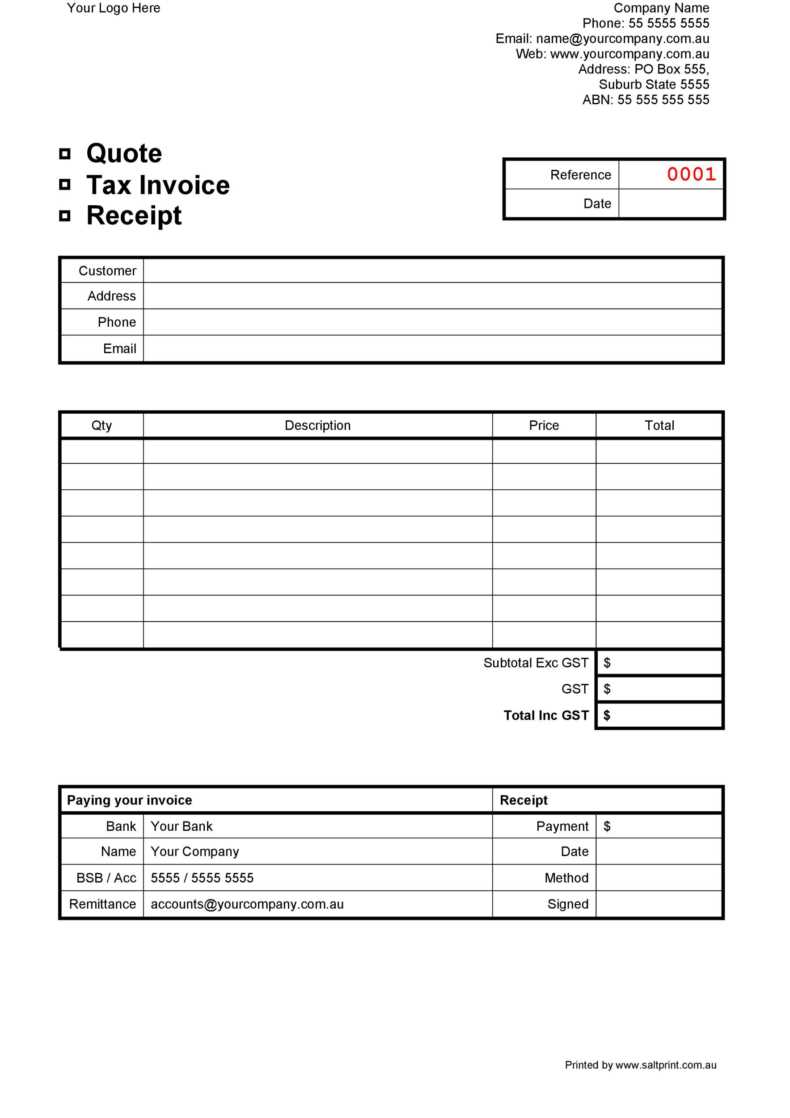

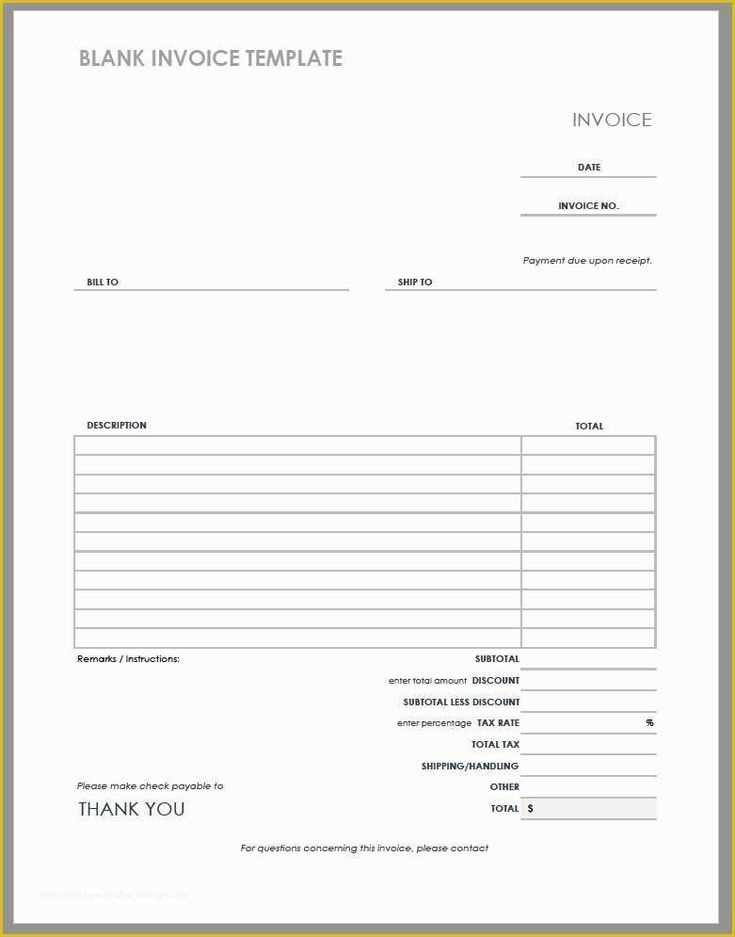

When designing your invoice template, make sure the due date is clearly stated at the top. Use bold fonts or a distinctive color to highlight the term “payment due upon receipt” to make it stand out. This clarity reduces misunderstandings and sets clear expectations for both you and your client.

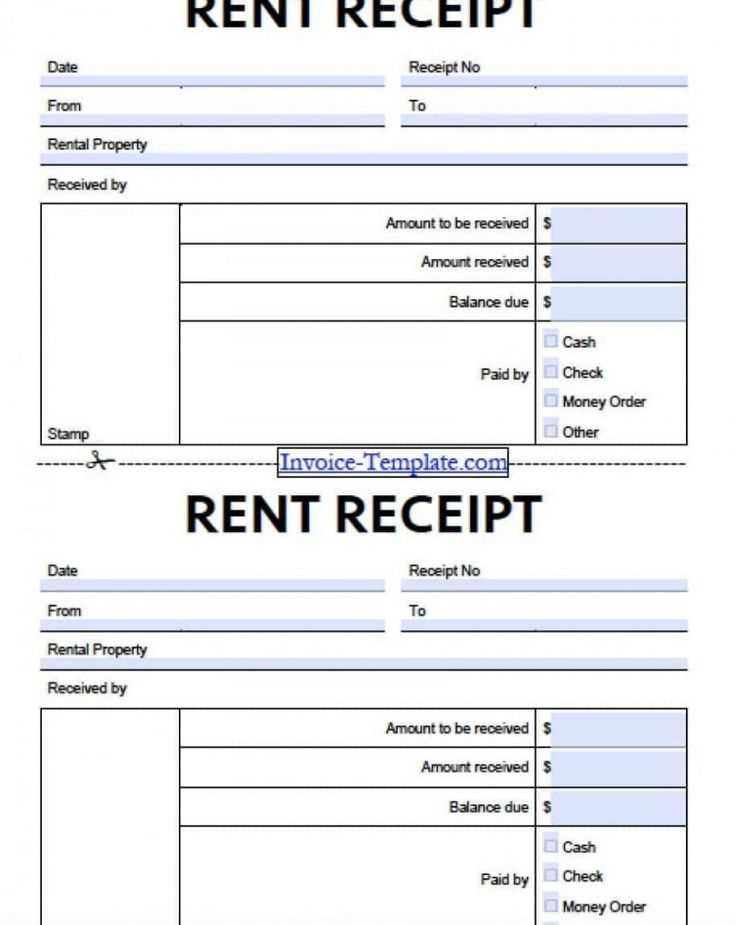

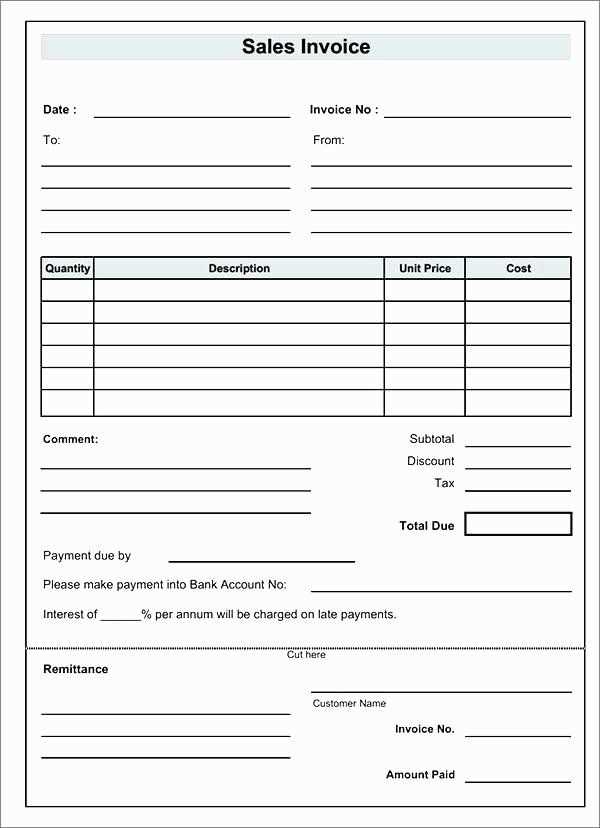

Additionally, include essential details such as payment methods, instructions, and any late fee policies. The more transparent and professional your invoice looks, the easier it will be for your clients to process the payment on time.

By adopting this payment term and following best practices, you can encourage faster payments and maintain a smooth cash flow for your business.

Invoice Template Payment Due Upon Receipt

Set clear payment expectations with a straightforward “Payment Due Upon Receipt” clause in your invoice template. This ensures that your clients understand payment is expected as soon as they receive the invoice, streamlining your cash flow. Make sure the language is direct and unambiguous, such as: “Payment due immediately upon receipt of this invoice.” This eliminates confusion and sets a firm deadline.

Ensure your template includes the payment terms near the top, so clients are immediately aware of the expectations. Include your preferred payment methods and details to make it as simple as possible for them to pay right away. Avoid cluttering the invoice with excessive information; focus on the essentials: the total amount due, the due date, and payment instructions.

To further reinforce your terms, it may be helpful to add a polite reminder, such as: “Thank you for your prompt payment.” This keeps the tone professional while reiterating the importance of timely payment. Regularly using this template will help clients become accustomed to your expectations, leading to faster payments over time.

How to Set the Payment Due Upon Receipt in Your Invoice Template

To set the payment due upon receipt in your invoice template, simply adjust the payment terms section. Instead of using common terms like “net 30” or “net 15,” write “Due upon receipt” to clearly state that payment is expected immediately after the customer receives the invoice.

Steps to Update Your Template

Locate the “Payment Terms” section in your template. Remove any preset due dates or time frames, and replace them with “Due upon receipt.” This ensures that your client knows the payment is expected right away, without waiting for a set number of days.

Additional Considerations

Be clear about the expectation to avoid misunderstandings. You can also specify the accepted methods of payment, such as bank transfer, PayPal, or credit card. Including a reminder for the customer to process payment immediately upon receiving the invoice can help reinforce the message.

Customizing Invoice Templates for Different Business Types with Immediate Payment Terms

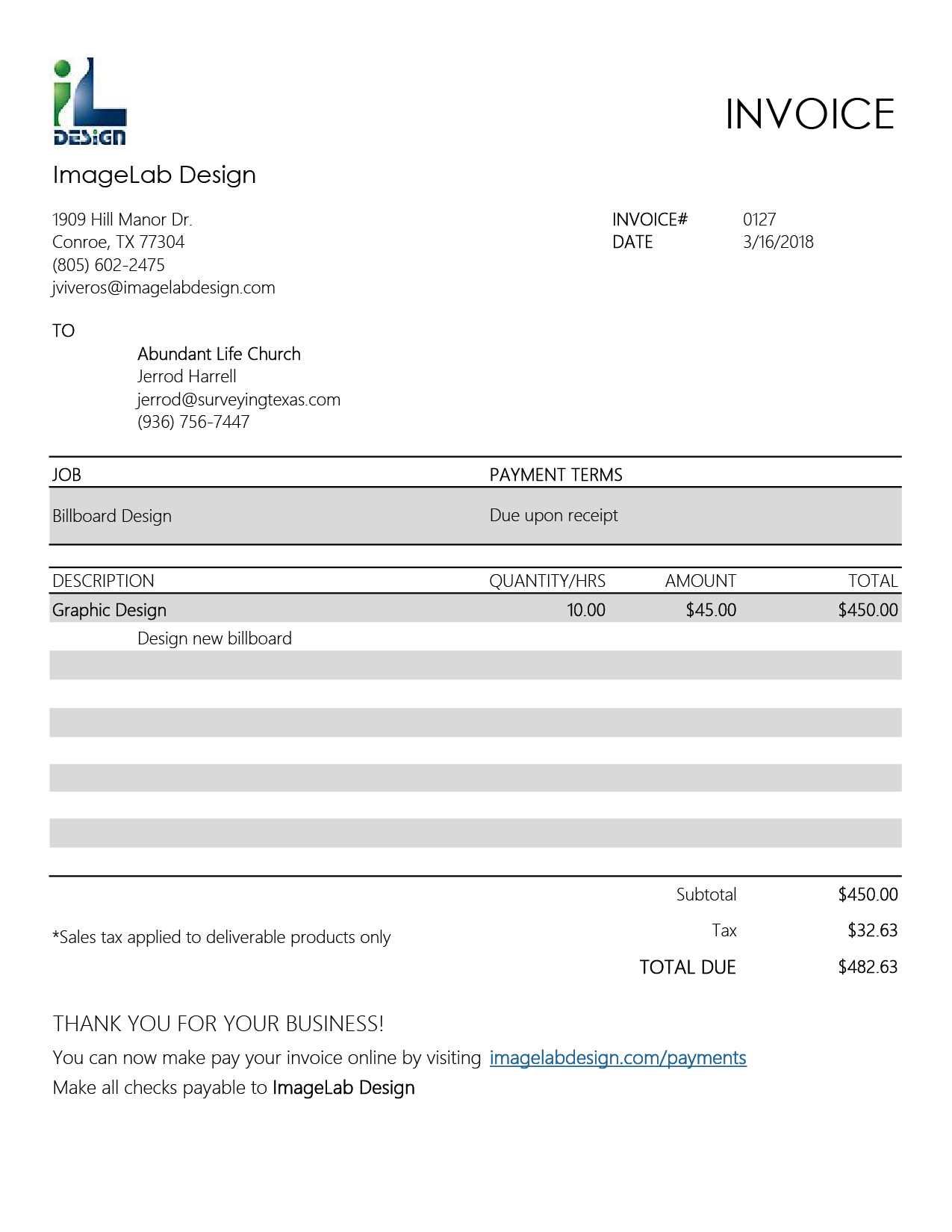

Tailoring invoice templates to suit specific business types helps ensure that payment terms are clear and that the process is streamlined. For businesses with immediate payment terms, customization is key to communicating urgency while maintaining a professional appearance.

Service-Based Businesses

For service-based businesses like consulting or freelancing, highlight the scope of work or services provided. Ensure the payment terms, “Due Upon Receipt,” are displayed prominently in both the invoice header and payment instructions. Add a section for work hours or deliverables, and include a note specifying that the invoice is payable immediately upon submission.

- Clearly outline services rendered with brief descriptions.

- Place payment terms near the total amount due for visibility.

- Include a payment method section that lists options like bank transfer, PayPal, or credit card.

Product-Based Businesses

For businesses that sell physical products, ensure that each item’s description, price, and quantity are clearly listed. For immediate payment terms, include a bold payment notice near the total amount or at the top of the invoice. Indicate whether sales tax is included and include clear instructions on where to send payments and accepted payment methods.

- List product names, quantities, and prices with detailed breakdowns.

- Incorporate a statement like “Payment Due Immediately Upon Receipt” to prevent delays.

- Consider adding a discount for prompt payment as an incentive for faster transactions.

For both types of businesses, adjust the layout to reflect your brand’s tone–whether it’s formal or casual–while keeping the design clean and easy to read. Use a simple, straightforward template without clutter to ensure clients can quickly process the information and make a timely payment.

Legal and Financial Implications of Using “Payment Due Upon Receipt” in Invoices

Using “Payment Due Upon Receipt” on invoices can lead to immediate legal and financial obligations for both the business issuing the invoice and the client. Legally, the term sets a clear expectation that payment is required as soon as the invoice is received. This helps to avoid misunderstandings and potential disputes. However, businesses must ensure that their payment terms are clearly communicated and agreed upon prior to issuing the invoice to avoid any legal complications.

Legal Considerations

The key legal aspect of “Payment Due Upon Receipt” is that it creates a contractual obligation for the client to settle the invoice immediately. If the client fails to pay within a reasonable time after receiving the invoice, the business may take legal action, such as pursuing a late fee or filing a lawsuit for breach of contract. To enforce this, businesses should have clear contracts that specify payment terms and conditions. Some jurisdictions may also require businesses to provide a grace period before taking legal action, so understanding local laws is crucial.

Financial Impact

From a financial standpoint, setting “Payment Due Upon Receipt” helps improve cash flow by reducing the time between invoicing and payment. This is especially beneficial for small businesses that rely on quick payment cycles to maintain operations. However, it may also strain relationships with clients who are accustomed to longer payment terms. Some clients may consider the immediate payment expectation unreasonable, which could lead to lost business or delays in future deals. Balancing prompt payments with client satisfaction is key.