Creating a clear and professional receipt for landscaping services simplifies payment tracking and ensures both parties have an accurate record. This template includes sections for all necessary details, making it easy to document services rendered, costs, and payment confirmation.

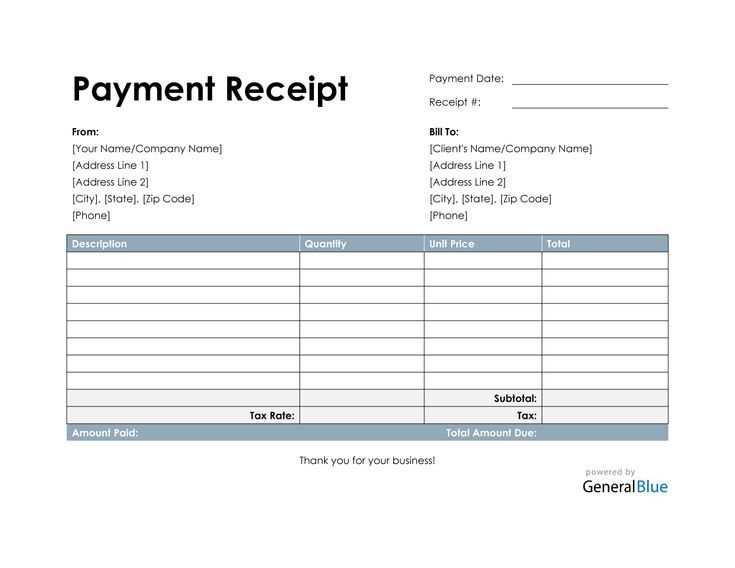

Start with a clear header containing the business name, contact information, and date of the transaction. Be sure to list the specific landscaping services provided, whether it’s lawn maintenance, tree trimming, or another task. Include the quantity, unit price, and total cost for each service to avoid confusion.

Next, add a section for the payment method used–whether by cash, credit card, or check–and any transaction numbers, if applicable. If applicable, provide details on taxes or discounts applied to the final amount. Finish with a section confirming receipt of payment and any relevant terms or follow-up notes for future work.

Here are the corrected lines with reduced repetition of words:

To improve the clarity of your payment receipt, focus on condensing repetitive phrases and eliminating redundancies. Simplifying the text not only makes it more professional but also enhances its readability.

Corrected Example 1:

Original: “The customer paid for the landscaping services provided. The payment was for the services rendered on the landscaping project.”

Corrected: “The customer paid for the services rendered on the project.”

Corrected Example 2:

Original: “The payment for the landscaping job was received on the date of the work completion. The full payment was made for the completed work.”

Corrected: “Payment was received upon completion of the work.”

Review your sentences for any phrases that repeat the same idea, such as “work” and “services,” which can often be combined. Aim for precision and conciseness to communicate the necessary details effectively.

- Identify duplicate information about the same transaction.

- Replace multiple mentions of the same item with a single reference.

- Focus on including key details without over-explaining.

- Landscaping Payment Receipt Template

To create a clean and clear landscaping payment receipt, ensure that all necessary details are included for both parties. Below is a simple and effective structure for your receipt template:

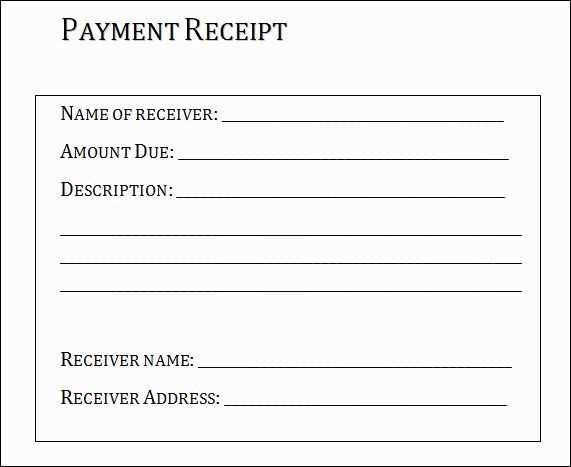

Key Components of the Receipt

- Service Provider Details: Include the company or individual’s full name, address, phone number, and email.

- Client Details: List the name, address, and contact details of the client receiving the services.

- Invoice Number: Assign a unique identifier to the transaction for easy reference.

- Date of Service: Mention the specific date when the landscaping work was completed.

- Payment Details: Specify the amount paid and the method of payment (e.g., credit card, cash, check).

- Breakdown of Services: Include a brief description of the services performed, such as lawn mowing, planting, or hardscaping.

- Total Amount: Clearly state the total charge for services rendered.

- Terms and Conditions: Provide any additional details, such as payment due date or refund policies, if applicable.

Sample Template

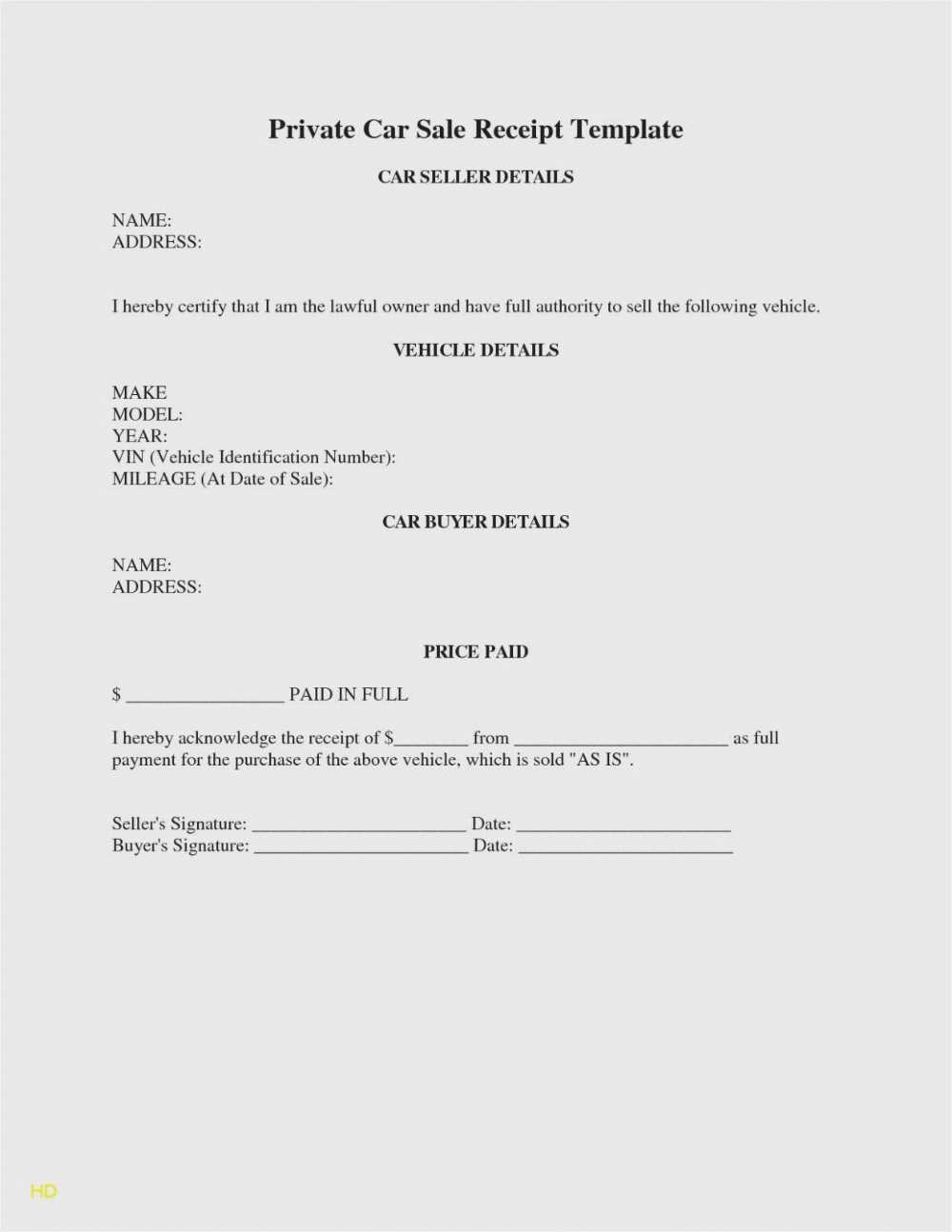

Landscaping Payment Receipt Service Provider: [Name / Company Name] Address: [Address] Phone: [Phone Number] Email: [Email Address] Client: [Client's Full Name] Address: [Client's Address] Phone: [Client's Phone Number] Email: [Client's Email Address] Invoice Number: [Invoice #] Date of Service: [Date] Services Provided: - [Service 1: Description] - [Service 2: Description] Payment Details: Amount Paid: [Total Amount] Payment Method: [Credit Card / Cash / Check] Payment Date: [Date of Payment] Total Amount: [Total Charge] Terms and Conditions: [Additional Notes / Refund Policy] Thank you for your business!

Customize this template to fit your specific needs. Clear and concise receipts protect both parties in any transaction, ensuring smooth communication and record-keeping.

To provide clarity in your payment receipt, list each service separately. Break down tasks such as “lawn mowing,” “tree trimming,” or “garden bed maintenance” to ensure the client understands exactly what they are paying for. Include a brief description of the task performed, the time spent, and the rate charged for each. This helps to build trust and avoid misunderstandings.

Use Clear Descriptions

Describe each service in simple, specific terms. Instead of writing “yard work,” specify “pruning of 3 bushes” or “installation of 5 new flower beds.” This level of detail ensures the client knows exactly what was done and why the service is priced as it is.

Include Quantities and Rates

For services charged based on quantity or time, like “mulching per cubic yard” or “hourly rate for labor,” include the exact amount of materials used or hours worked. For example, “Mulching: 3 cubic yards at $50 per cubic yard” or “Labor: 4 hours at $30 per hour.” This transparency helps clients understand the breakdown of charges and justifies the total cost.

By following these steps, you can ensure your service breakdown is clear, helping your clients feel confident in their payment and the work completed.

Clearly outline the project scope and expectations in your contract to prevent misunderstandings. Specify the tasks, deadlines, and any materials required for the project. For example, list whether the contractor will be responsible for soil preparation, plant installation, or lawn care. Clearly defining these elements allows both parties to know what is expected and prevents unexpected costs or delays.

Use precise language when agreeing on payment terms. Decide if payments will be made in installments or as a lump sum upon project completion. Set clear milestones and link them to specific deliverables, such as the completion of hardscaping or planting. Avoid vague phrases like “upon completion”–instead, attach specific dates to each payment or stage of work.

Agree on terms for project modifications. If unexpected issues arise, define how changes will be handled in advance. Will the pricing be adjusted based on time and materials, or will it follow a predefined hourly rate? This ensures flexibility while maintaining financial clarity.

Address warranties and guarantees within the contract. Specify the duration of any warranties for plants, materials, or work completed. Include any conditions under which these warranties apply and the process for addressing potential issues after the project is finished.

Break down each cost clearly. List materials with their quantities, unit prices, and total cost. For labor, detail the hours worked and the hourly rate. Include any specialized services or equipment used, with corresponding fees. For example, if soil or gravel was purchased, specify the type, amount, and cost per unit. If equipment rentals were necessary, list the item and its rental price. Ensure each charge is easy to understand by the client to avoid confusion.

Use simple calculations for transparency. For instance, if you used 10 bags of mulch at $5 each, write: “10 bags of mulch at $5 each = $50.” This clarity prevents misunderstandings and shows professionalism. For labor, make sure to specify the total hours worked, like “8 hours of labor at $25 per hour = $200.” Always include a subtotal before taxes to allow the client to check your math.

Include a separate section for taxes if applicable. Provide the tax rate and calculate the tax amount clearly. This helps the client understand how the final total was derived. For example, if your state tax rate is 8%, then apply it to the subtotal before taxes. Transparency in this part of the receipt fosters trust and ensures the client knows exactly what they’re paying for.

To ensure transparency and compliance, always include tax details in your landscaping receipt. Clearly list the sales tax rate applied and the total amount charged. This helps your customers understand how much they are paying beyond the service cost. Be sure to break down the tax calculation so it’s easy to follow. For example, if you are charging a service fee of $200 and the tax rate is 7%, show the tax amount as $14, and the final total as $214.

Include your business’s tax identification number (TIN) or VAT number if required by local regulations. This helps verify that the transaction is legitimate and ensures you’re following tax laws. Also, specify the type of tax applied (sales tax, VAT, etc.) to avoid confusion. If you provide multiple services, list the tax applied to each item separately for clarity.

If applicable, mention any exemptions or special tax rates that apply to your services. For example, certain landscaping services might be exempt from tax in specific regions. Make sure to stay updated on local tax laws to keep your receipts accurate and compliant.

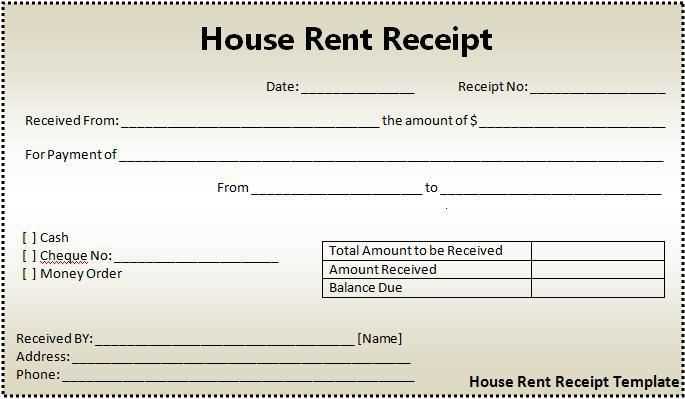

Clearly outline payment methods, such as bank transfers, checks, or online payment systems, in your template. Specify the details required for each option, like account numbers or payment links, ensuring there’s no ambiguity.

State the total amount due, including any taxes or additional charges, and mention whether deposits are required before starting work. Set clear due dates for the full payment, whether it’s upon completion of the project or within a certain number of days post-service. This helps avoid confusion or delays.

Break the payment process into clear stages if the project is large, and specify when partial payments are due. Include terms for late payments, such as any penalties or interest rates, and be transparent about how and when those fees apply.

Finally, give clients a straightforward point of contact for payment questions, such as an email or phone number, so they can reach out easily if needed.

Always include a clear breakdown of services provided and their associated costs. This helps avoid ambiguity and disputes. Specify if any taxes, permits, or other fees apply, and show how they are calculated. This transparency builds trust and ensures you are in line with local regulations.

Use proper terminology and formats required by your jurisdiction. Some regions may have specific rules about the inclusion of certain items or language on invoices. Verify your template complies with local tax codes and invoicing standards.

Make sure your billing includes the terms of payment and any penalties for late payments. Specify accepted payment methods and provide clear instructions on how to remit payment.

| Billing Element | Description | Legal Requirement |

|---|---|---|

| Itemized Services | Clear listing of all tasks performed | Required by law for transparency in most areas |

| Taxes & Fees | Breakdown of applicable taxes and other fees | Must reflect local tax laws |

| Payment Terms | Clear payment due date, late fees, and accepted methods | Enforced by contract law |

Consider including a clause addressing liability, especially for damage during work or post-service issues. This protects both the client and the service provider. Always check with a legal professional to ensure your contract terms align with current regulations.

Detailed Payment Breakdown

Break down the payment clearly by listing each service or item provided, along with the corresponding cost. This way, the customer understands exactly what they are paying for. Include labor, materials, and any additional fees, ensuring transparency in the transaction.

Payment Terms

Specify when the payment is due, whether it’s on receipt or after a certain period. Include any applicable late fees or discounts for early payments to help manage expectations and keep the process smooth.

Payment Methods Accepted

Clearly list all accepted payment methods–cash, check, credit card, or bank transfer. If applicable, mention any fees associated with specific payment methods.

Contact Information

Include the contact details of the service provider, such as a phone number or email address, to ensure the client can reach out for any questions or concerns related to the payment.

Invoice Number and Date

Provide a unique invoice number and the date of issuance for easy tracking. This also helps both parties keep records of the transaction for future reference.

Refund or Cancellation Policy

Include clear terms regarding refunds or cancellations, if any. Specify the conditions under which the client can cancel or request a refund and any potential charges for doing so.