A layaway payment receipt serves as a clear record for both the buyer and the seller, confirming payment details and agreement terms. By utilizing a template, you can easily customize the receipt to fit your store’s policies and maintain consistency in transaction documentation.

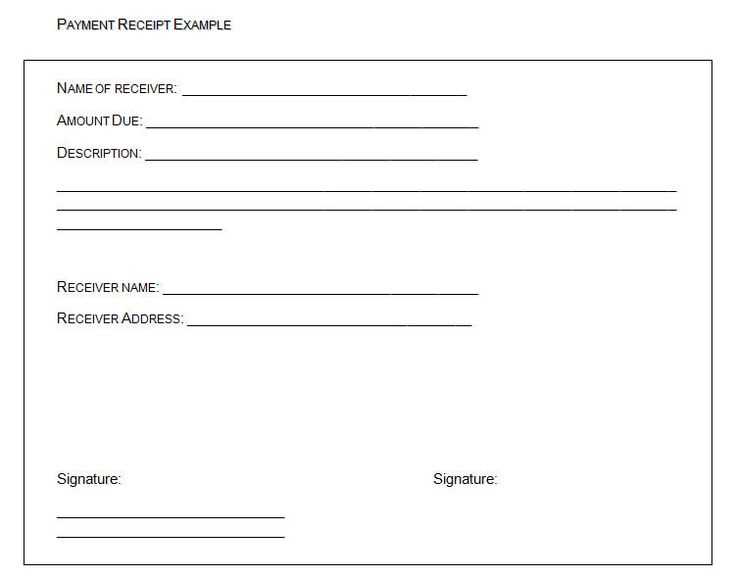

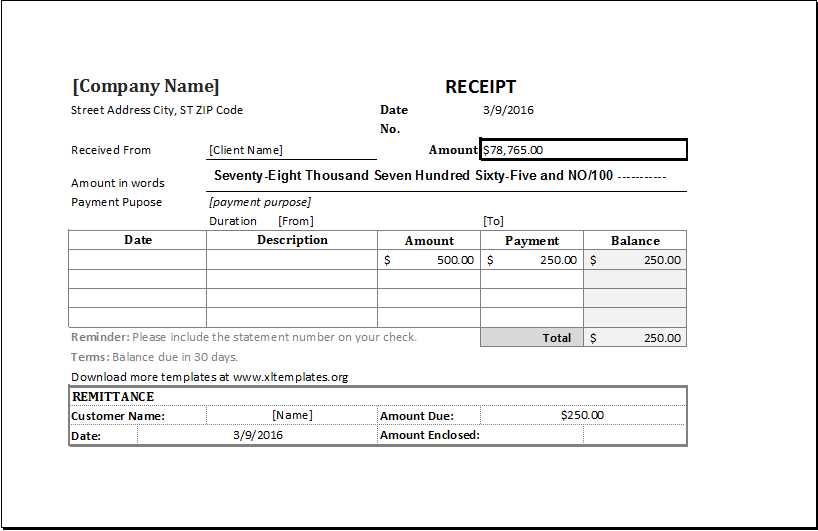

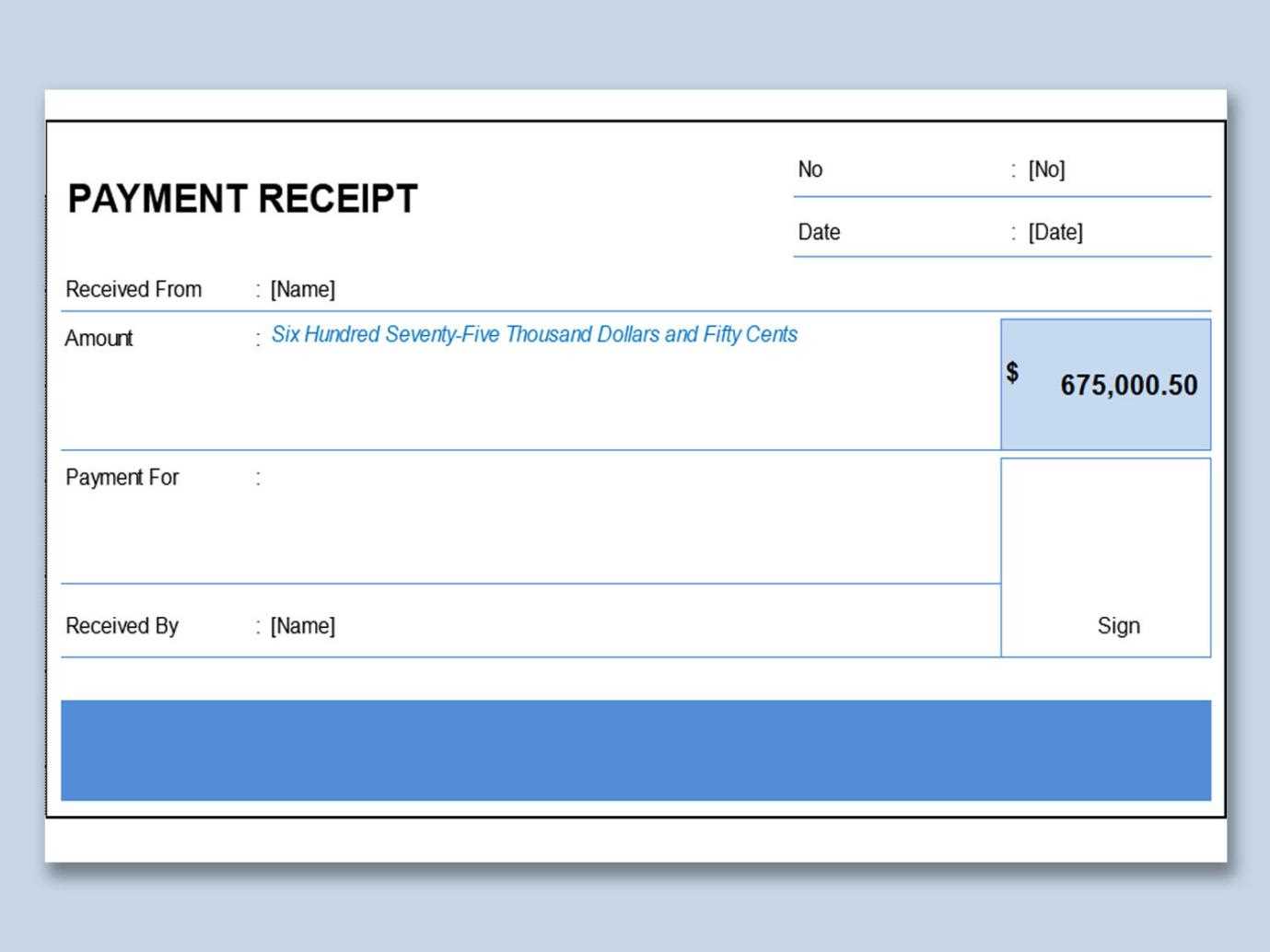

Each template should include the full name and contact information of both the buyer and seller, the item description, total cost, and the amount paid so far. Additionally, specify the payment schedule and due dates for remaining installments. This ensures clarity and helps both parties stay on track with the layaway plan.

Make sure to include a section for any penalties or fees that may apply if payments are missed. You can also add a signature line to confirm agreement from both sides. This small detail helps build trust and avoids confusion regarding payment terms.

By using a simple, well-organized layaway payment receipt template, you can improve the customer experience while streamlining your record-keeping process.

Here’s the corrected version:

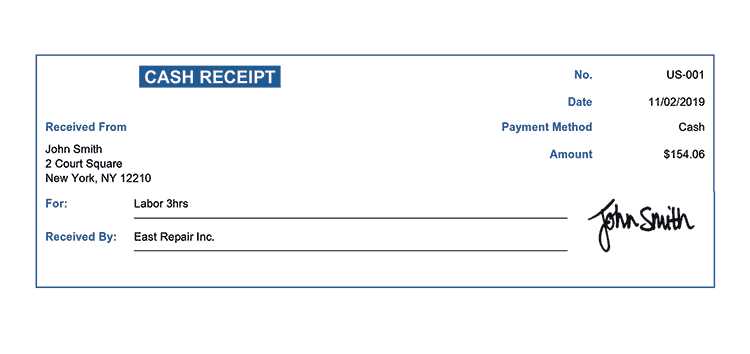

Make sure to clearly label the payment type in the receipt. This helps avoid confusion for both parties. Always specify if the payment is part of a layaway plan, and include any relevant dates such as the initial payment date and the final payment due date.

Key Information to Include

- Layaway Plan Details: Clearly state the total amount, the deposit made, and any future payments.

- Payment History: Include a list of all payments made, including the amounts and dates.

- Balance Remaining: Indicate the remaining balance after each payment.

- Product or Service Description: Describe what is being paid for, including any product codes or serial numbers.

- Terms and Conditions: List any relevant terms such as cancellation policies or late fees.

Additional Tips

- Make sure the receipt is easy to read and organized in a way that makes it clear which payments have been made and what is still owed.

- Ensure the receipt is signed by both the customer and the seller to confirm the transaction details.

- If possible, include a contact number or email for any queries regarding the layaway plan.

By following these guidelines, you can create clear, professional layaway receipts that help maintain transparency throughout the payment process.

- Layaway Payment Receipt Templates: A Practical Guide

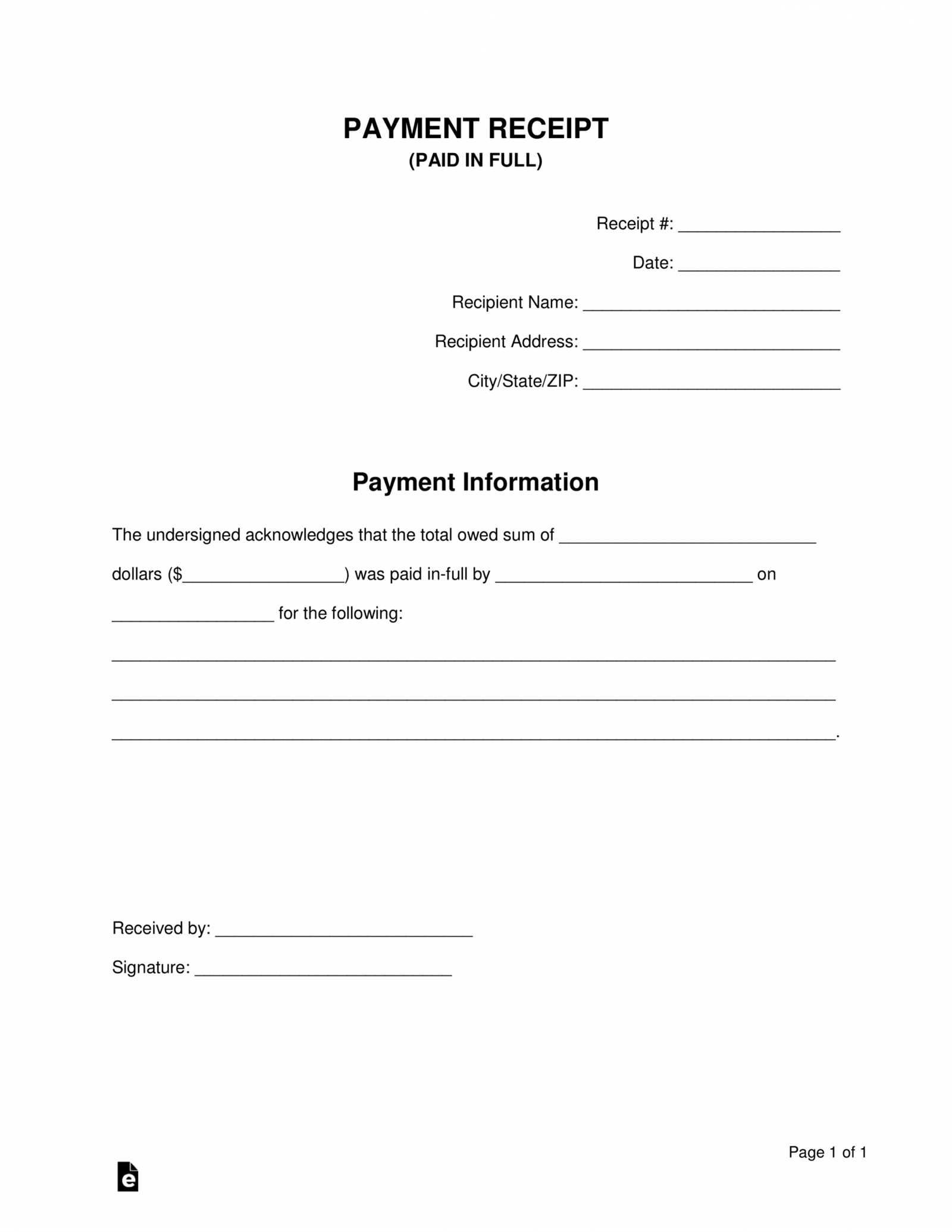

A well-structured layaway payment receipt template simplifies tracking customer payments, ensuring clarity for both businesses and clients. The receipt should include key details like the date, customer’s name, payment amount, item description, balance due, and payment schedule. Customize the template to suit your business model, whether you’re offering weekly or monthly payment plans. Ensure the receipt has space for multiple entries if payments are made in installments.

When designing the template, consider including the following fields:

| Field | Description |

|---|---|

| Date | Indicate the date of the payment transaction. |

| Customer’s Name | Full name of the person making the payment. |

| Item(s) Description | Provide a brief description of the item(s) being held on layaway. |

| Payment Amount | The amount paid by the customer on that particular date. |

| Remaining Balance | Current outstanding balance after the payment. |

| Payment Due Date | The next due date for the next installment or final payment. |

This layout ensures all vital information is clearly displayed and easy to understand. Additionally, make sure to include a section for your business name, contact information, and a note confirming the layaway terms, such as the total number of payments or final payment deadline.

By using a template tailored to your layaway policy, you maintain a professional approach while offering customers transparency and reassurance about their purchases. A consistent format allows for easier tracking and reduces misunderstandings, keeping customer satisfaction high.

To create an effective layaway payment receipt, focus on accuracy and clarity. Each receipt should reflect the transaction details, ensuring both the customer and the store are on the same page. This is crucial for avoiding disputes or misunderstandings later on.

Key Information to Include

The receipt should clearly display the following elements:

- Store Information: Include the business name, address, and contact details. If applicable, provide a store logo for brand consistency.

- Customer Information: List the customer’s name and contact information. This helps identify the purchaser easily.

- Layaway Details: Specify the items being held under layaway, including item descriptions, quantities, and individual prices.

- Total Layaway Amount: Display the total price for the items before any payments are made.

- Payment Breakdown: Include the amount paid, any remaining balance, and the due date for the next payment. If there are multiple payments, outline each installment and its due date.

- Receipt Date: Indicate the exact date the payment was made. This helps both the customer and store track the transaction timeline.

- Transaction ID or Reference Number: This serves as a unique identifier for the transaction and is useful for future reference.

Additional Tips

Ensure all calculations are precise and that the receipt is easy to read. Consider adding a section for customer signatures to confirm agreement to the terms of the layaway plan. For digital receipts, providing an option for the customer to print or save the receipt can improve convenience and accessibility.

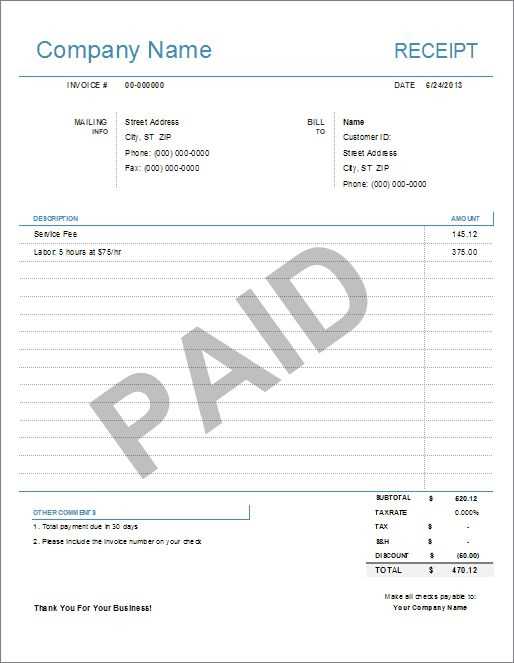

Tailor your layaway receipt template based on the specific terms of each plan. For weekly layaway payments, include fields for the payment amount, next due date, and remaining balance. This helps customers track their progress without confusion.

If offering a longer-term layaway plan, ensure your template reflects installment milestones. A clear breakdown of each payment and its due date can prevent misunderstandings. Include a “total paid” section and a “balance remaining” section for clarity.

For flexible layaway plans, where customers can adjust payment amounts, consider adding an “adjustment” field. This allows you to note any changes made to the original payment schedule, ensuring both parties are on the same page.

If your layaway plan involves specific items, incorporate a section for listing the items and their prices. Include a “deposit paid” field at the top so customers can easily see the amount they’ve already contributed towards the total cost.

Lastly, make sure your template includes clear terms and conditions that apply to the specific plan. If certain plans have penalties for missed payments or early payment incentives, outline these in simple, easy-to-understand language.

Ensure that your layaway payment receipt includes all necessary details to meet legal requirements. At a minimum, include the full names of the buyer and seller, the total purchase amount, and a breakdown of the payments made. This ensures clarity in the transaction and prevents disputes later on.

Refund and Cancellation Policies

Clearly outline the store’s refund and cancellation policies on the receipt. Specify whether the buyer is entitled to a refund if they cancel the layaway agreement or if there are restocking fees. The policies should comply with local consumer protection laws, ensuring transparency and fairness for both parties.

Payment Timeline and Due Dates

Include payment deadlines and the frequency of installments. This helps both the buyer and seller track progress and avoid misunderstandings. State the final due date for full payment and any consequences of missing payments, such as cancellation of the layaway agreement or forfeiture of the item.

Make sure that the receipt complies with relevant state or national regulations on layaway transactions. These regulations vary, so always check the local laws to confirm that your receipts meet the required standards.

Layaway Payment Receipt Template: Tips for Clear Communication

Ensure your receipt clearly lists the layaway terms, including total price, deposit amount, and payment schedule. This removes ambiguity and ensures both parties are on the same page.

Include the due dates for each installment. Make sure the customer knows when payments are expected and how much is remaining to be paid. This helps prevent confusion down the line.

Provide clear instructions on how to make payments. Whether it’s online, in-store, or through another method, give precise details to avoid any miscommunication.

Make your return policy clear on the receipt. Specify whether the layaway item can be refunded or exchanged, and outline any fees or penalties associated with cancellations.

Always confirm the customer’s information, such as their name and contact details. This allows for easy follow-up if needed and confirms the accuracy of the layaway agreement.