Creating a lease payment receipt is straightforward and essential for keeping accurate records of transactions. It ensures both landlords and tenants have proof of payment, which can be referenced for future agreements or disputes. A well-structured receipt should include key details such as the tenant’s name, payment date, amount paid, and the rental property address.

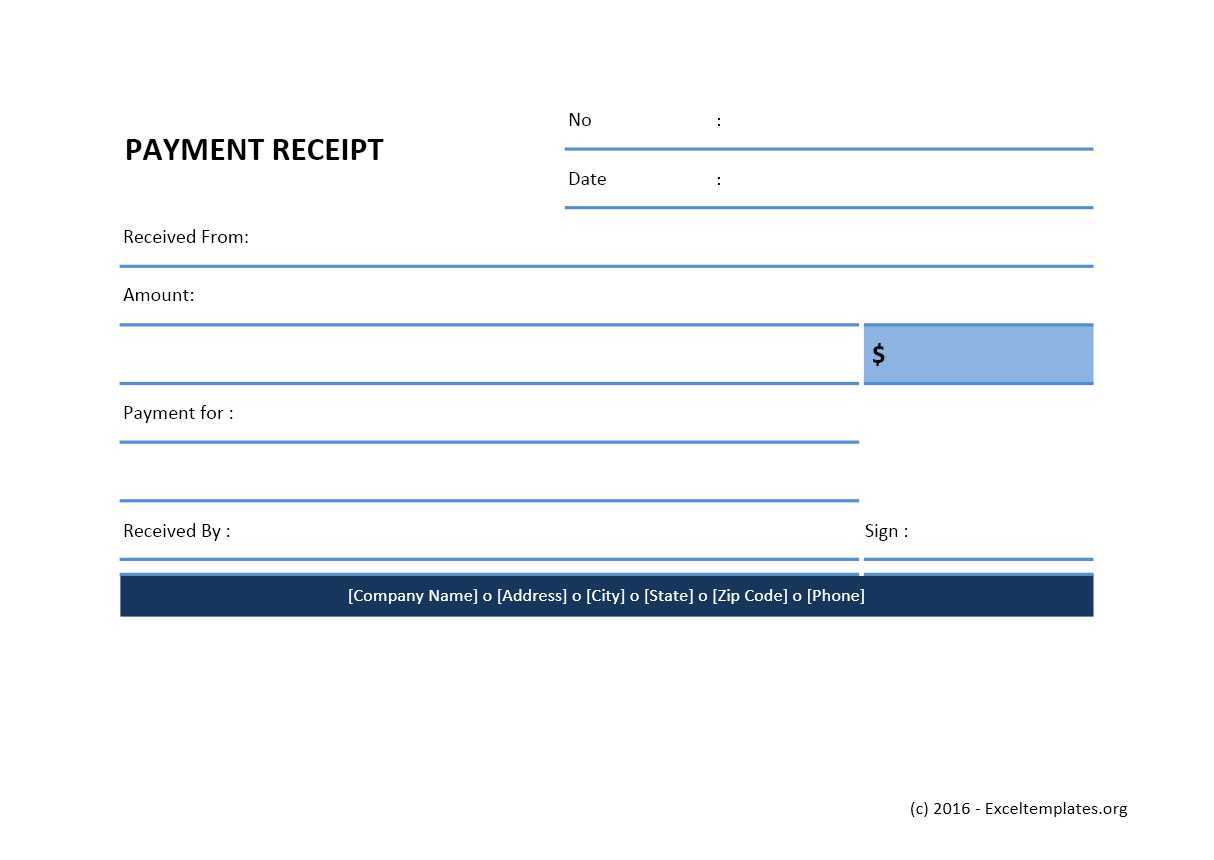

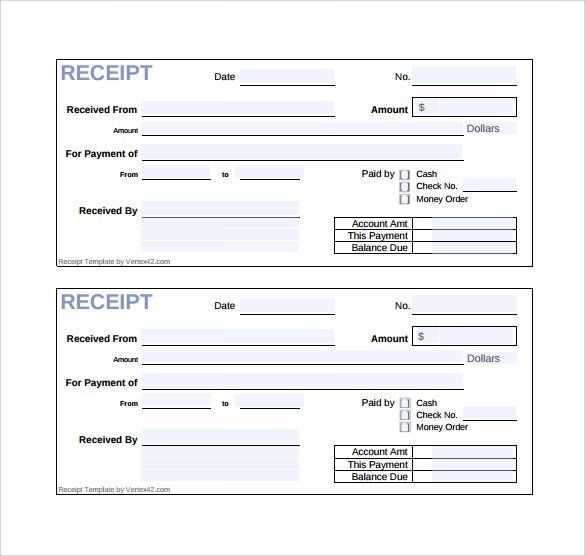

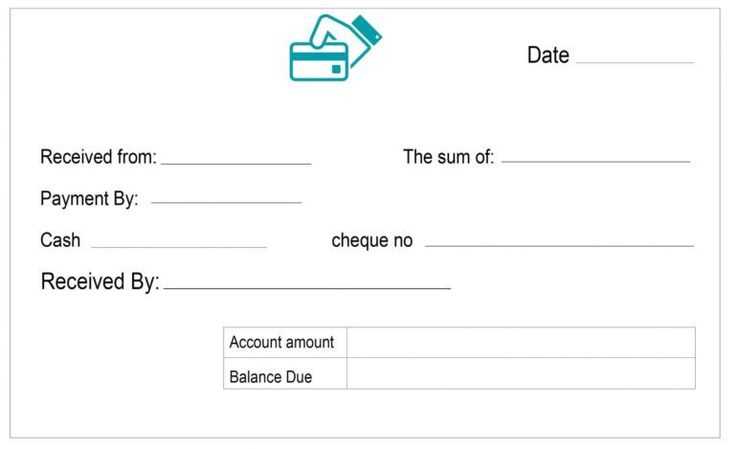

Use a clear format to list the transaction details. Start with the tenant’s full name and the property address to ensure no confusion. Clearly state the rental period the payment covers, as well as any late fees or adjustments, if applicable. Include the payment method–whether it’s cash, check, or electronic transfer–to provide a full record of the transaction.

A lease payment receipt should be easy to read and free from unnecessary jargon. By including only the most relevant information, it helps maintain clarity and transparency between both parties. Make sure both the landlord and tenant have a copy of the receipt for their records, ensuring smooth future transactions and avoiding potential misunderstandings.

Here’s a revised version with minimal repetition:

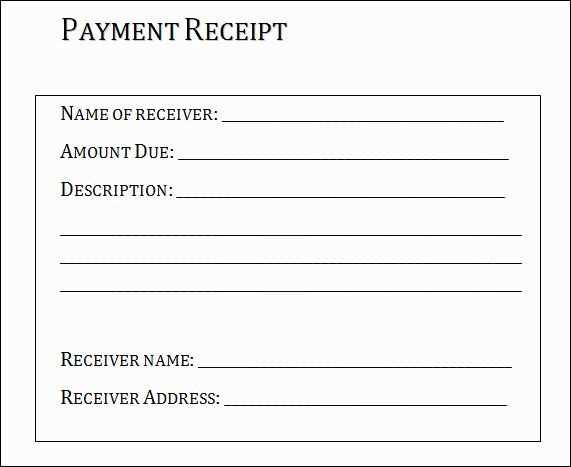

For an accurate and professional lease payment receipt, ensure that the document includes all necessary details. Start with the tenant’s name, address, and contact information. Next, list the landlord’s details, followed by the property address. Clearly indicate the payment date, amount, and the payment method used. If applicable, mention any late fees or adjustments made to the rent amount.

Payment Breakdown

Include a breakdown of the rent, specifying the rent period (monthly, quarterly, etc.), the base rent, and any additional charges such as utilities or maintenance fees. Ensure that each component is itemized separately for transparency. This helps both the tenant and the landlord verify the payment details easily.

Legal Considerations

If the receipt is related to a lease agreement, add a brief note confirming that the payment has been made according to the lease terms. This could be as simple as stating, “This payment covers the rent for the period of [date range].” Also, include the receipt number for tracking purposes and any other terms relevant to the lease.

Lastly, ensure that the receipt is signed by the landlord or their authorized representative, confirming its authenticity. Keep a copy for future reference and provide one to the tenant as proof of payment.

Here’s a detailed article plan for the topic “Lease Payment Receipt Template” in HTML format:

Creating a clear and accurate lease payment receipt is straightforward. Make sure to include the following details for both record-keeping and transparency.

Receipt Header

- Title: Use “Lease Payment Receipt” as the document header.

- Receipt Number: Assign a unique number to each receipt for reference.

- Payment Date: Indicate the exact date of the payment.

Tenant and Landlord Information

- Tenant’s Information: Full name and address of the tenant.

- Landlord’s Information: Include the full name and address of the landlord.

Payment Details

- Amount Paid: Clearly specify the amount paid by the tenant.

- Payment Method: Indicate how the payment was made (e.g., cash, check, wire transfer).

- Rental Period Covered: State the period the payment covers (e.g., for rent from January 1st to January 31st).

Other Information

- Late Fees: Include any additional charges for late payment if applicable.

- Remaining Balance: If there’s an outstanding balance, note it down clearly.

By following this structure, the receipt will provide all necessary details for both the landlord and tenant, ensuring proper documentation and transparency in the payment process.

- How to Create a Lease Payment Receipt

To create a lease payment receipt, start by including the basic information: the tenant’s name, the landlord’s name, and the property address. Specify the payment date and the amount received. If applicable, mention any specific lease terms tied to the payment, such as rent period or due date.

Next, list the payment method (e.g., check, credit card, bank transfer) and provide transaction details, such as check number or reference number, for clarity. If there’s a security deposit or late fees involved, include those as separate line items on the receipt.

Ensure that the receipt includes a clear statement confirming that the payment has been received in full and for the specified period. Add a note of gratitude or acknowledgment to maintain a positive landlord-tenant relationship.

Conclude with a signature or an authorized representative’s name and title if necessary, and include a receipt number for record-keeping purposes. Keep a copy for both the landlord and the tenant for future reference.

Adjust the lease payment receipt template to fit different types of lease agreements by focusing on key details specific to each contract. For residential leases, include the tenant’s name, property address, and the lease term. For commercial leases, provide the business name, the leased space’s details, and any applicable clauses related to rent escalation or maintenance responsibilities.

Make sure to specify the due dates for payments in a way that aligns with the agreement, whether it’s monthly, quarterly, or annually. For agreements with varying amounts, such as those with variable rent or added service charges, include separate lines for each charge to clarify the breakdown of payments.

Adjust the template’s layout to accommodate specific payment methods, whether through checks, bank transfers, or online platforms. If the lease agreement includes penalties for late payments, make space to list the penalty amount and due date. Add sections for the signature of both parties if required, ensuring it reflects the legal requirements of your jurisdiction.

Consider adding a notes section at the bottom for any special terms or conditions, such as security deposit deductions or early termination fees. This customization makes the template more versatile and adaptable to various types of lease agreements, ensuring clarity for both landlords and tenants.

Double-check the payment amount before issuing the receipt. A minor error here can cause confusion and disputes later on. Always verify that the amount matches the payment received.

Missing or Incorrect Information

Ensure all required fields are completed accurately. This includes the payer’s name, transaction date, and detailed payment breakdown. Leaving any of this information out can make the receipt invalid or unclear for future reference.

Unclear Payment Descriptions

Be specific when describing what the payment covers. Vague terms like “services” or “goods” don’t provide enough detail. Instead, use clear descriptions that align with the agreement.

Avoid using outdated templates. Always update your receipt templates to reflect any changes in your business, legal requirements, or payment methods. Using old formats may confuse your clients or lead to incorrect documentation.

This keeps the structure and meaning intact, without overusing the same words.

Include the full name of the tenant and landlord at the top of the receipt. Specify the rental property address and the date of payment. Clearly state the total payment amount and method used, whether by check, cash, or online transfer.

Break Down Payment Information

Detail each charge included in the payment. Mention rent, late fees, or any other adjustments. Indicate the specific rental period that the payment covers. This ensures both parties are on the same page about what has been paid.

Record Receipt Number and Contact Information

Assign a unique receipt number to each payment. Provide the landlord’s contact information for any follow-up questions. This helps both parties keep accurate records and resolves any potential disputes smoothly.