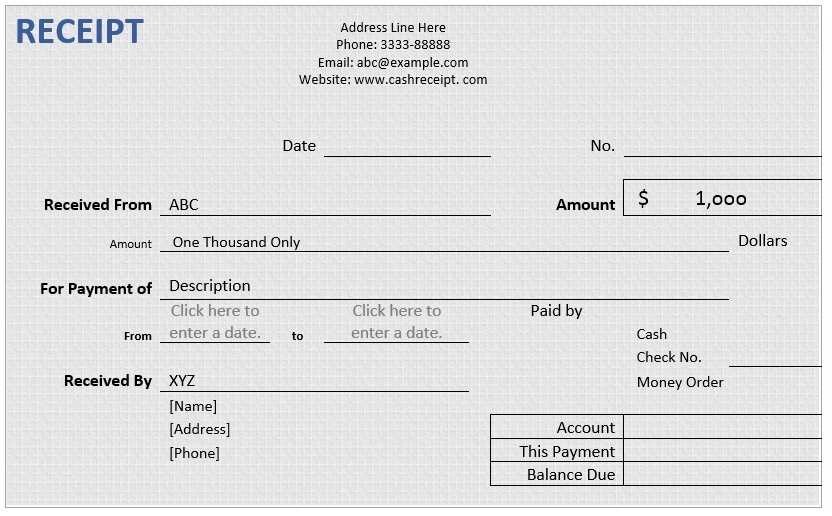

To ensure your receipt of payment complies with legal standards, it’s crucial to include specific details. A well-structured template helps protect both parties in a transaction and serves as a valid proof of payment. Always include the payer’s full name, the amount paid, and the date of payment. This ensures clarity and accountability for both sides.

Use a clear description of the service or product received. This can avoid future disputes and provide transparency. If applicable, add any relevant transaction or invoice numbers, especially for larger payments. You can also note the method of payment, such as cash, bank transfer, or card payment, to keep the record complete.

For greater legal assurance, always include a statement confirming that the payment has been received in full, leaving no ambiguity. A signature from both the payer and the payee can further strengthen the validity of the document.

Here’s the revised text, where words are not repeated more than two to three times, while maintaining meaning and correctness:

Always include the exact amount received in a payment receipt. Specify the payment method and include the date of transaction. Clearly state the purpose of the payment to avoid confusion. If there is any reference number or invoice associated with the payment, make sure to include it. Keep the format simple and professional, with relevant details easy to find for both the payer and recipient. It’s important to ensure that all information is accurate, as errors may lead to disputes or misunderstandings later on.

Details to Include

For clarity, your receipt should include: payer’s name, amount paid, and payment method (e.g., credit card, cash, bank transfer). Specify the service or product for which payment was made, along with the transaction date. If a balance remains, mention it as well as the due date for the next payment. Ensure all figures are clearly readable, and provide contact information for further inquiries.

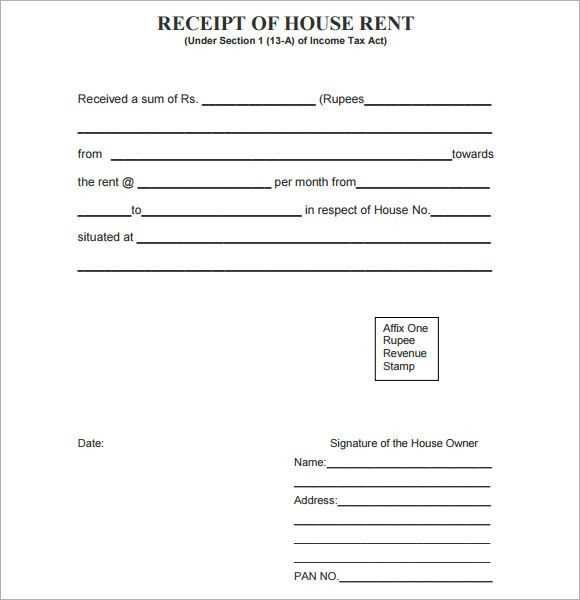

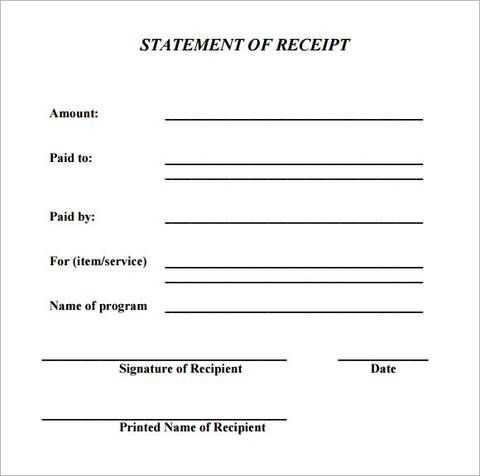

- Legal Payment Receipt Template

Ensure your payment receipts include all necessary details to comply with legal standards. A simple legal payment receipt template should contain the following key elements:

- Receipt Number: Unique identifier for tracking each transaction.

- Date of Payment: The exact date when the payment was received.

- Payer’s Information: Full name, address, and contact details of the payer.

- Recipient’s Information: Name, address, and contact details of the business or individual receiving payment.

- Payment Amount: Total amount paid, including currency.

- Payment Method: Indicate whether the payment was made via cash, credit card, bank transfer, or any other method.

- Purpose of Payment: Brief description of the service or product for which payment was made.

- Signature: Space for the recipient’s signature to validate the receipt.

Keep the format clear and concise, and always provide a copy of the receipt to the payer for their records. A legally valid receipt helps protect both parties in case of disputes or audits. Always consult local laws to ensure your template aligns with regional requirements.

Structuring the Template for Compliance

Ensure your payment receipt template complies with local laws by including these key elements:

- Business Information: Display your full business name, address, and contact details. This ensures transparency and provides clear identification for legal purposes.

- Transaction Details: Include the transaction date, amount paid, and method of payment. Specify whether it was cash, check, or digital payment.

- Recipient’s Information: Add the name and contact details of the person or entity receiving the payment. This verifies the receiver’s identity.

- Invoice Reference Number: Incorporate an invoice number or a unique transaction ID to allow for easy tracking and reference in case of disputes.

- Tax Information: If applicable, include tax amounts and rates, ensuring alignment with local tax laws.

- Legal Disclaimers: If required by local regulations, add any disclaimers or terms that explain the scope and nature of the transaction.

Structure your template in a clear, legible format. Include sections that are easy to locate and review, ensuring both parties understand the payment details. Regularly review and update the template in accordance with changes in legal requirements.

A payment confirmation must contain precise details to ensure both parties are clear on the transaction. The following elements should always be included:

| Information | Description |

|---|---|

| Transaction Date | Specify the exact date the payment was received to avoid confusion. |

| Payment Amount | Clearly state the total amount paid, including any applicable taxes or fees. |

| Payment Method | Indicate how the payment was made (e.g., credit card, bank transfer, PayPal). |

| Invoice or Reference Number | Include the corresponding invoice or reference number to link the payment to the service or product. |

| Sender’s Details | Provide the name or company that made the payment. |

| Recipient’s Details | Include the name or company receiving the payment. |

| Confirmation Number | Offer a unique confirmation number for tracking and reference purposes. |

| Additional Notes | Any special instructions or comments regarding the payment (optional but helpful). |

Ensure this information is accurate and easy to locate. It provides transparency and confirms that both parties are on the same page regarding the payment.

Ensure dates are clear and unambiguous. Use the standard format MM/DD/YYYY for U.S. transactions or DD/MM/YYYY for others. Avoid abbreviations like “Jan” or “Mar” to prevent confusion.

For amounts, use commas to separate thousands and a period for decimals. For example, write 1,500.00 instead of 1500.00. This standard ensures amounts are easily readable across different systems.

Always indicate the currency. Use ISO currency codes (e.g., USD, EUR) before or after the amount for consistency. For instance, $1,500.00 or 1,500.00 USD.

Consistency matters. Apply these formats consistently throughout the document to avoid errors and ensure the recipient can quickly understand the data provided.

In legal documentation for receipts, certain terms are critical to ensure clarity and legal protection. One of the most commonly used terms is “paid in full”, indicating that the recipient has received the total amount owed, and no further payment is required.

“Receipt acknowledged” serves as confirmation from the receiver that the payment has been accepted. This phrase holds particular importance in legal disputes or audits.

The term “consideration” often appears in the context of contracts or agreements, referring to the payment or exchange made in return for services or goods. It’s essential to define the nature of the consideration in the receipt for it to be legally binding.

“Subject to terms and conditions” is another important phrase, indicating that the payment is accepted with the stipulation that the buyer agrees to the pre-established terms. This phrase helps limit liability and ensures both parties understand the rules governing the transaction.

Finally, “non-refundable” is frequently included in receipts where a refund policy is not allowed. This phrase removes ambiguity, ensuring that the buyer acknowledges they cannot reverse the transaction once payment has been made.

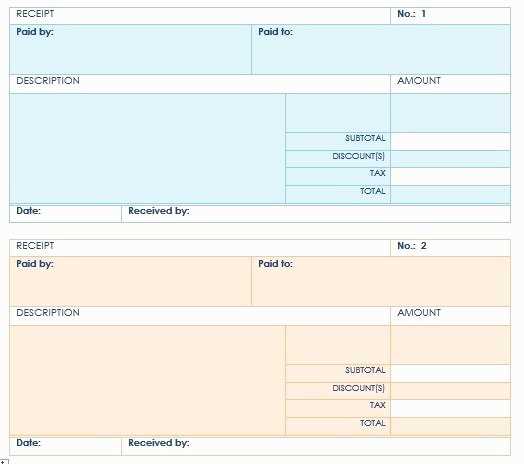

Tailor your receipt template to match the specific requirements of different transactions. Start by adjusting the payment method section to reflect whether it’s a cash, credit card, or digital payment. Each method may require additional details, such as card type or transaction ID for electronic payments. These small adjustments provide clarity and help avoid misunderstandings.

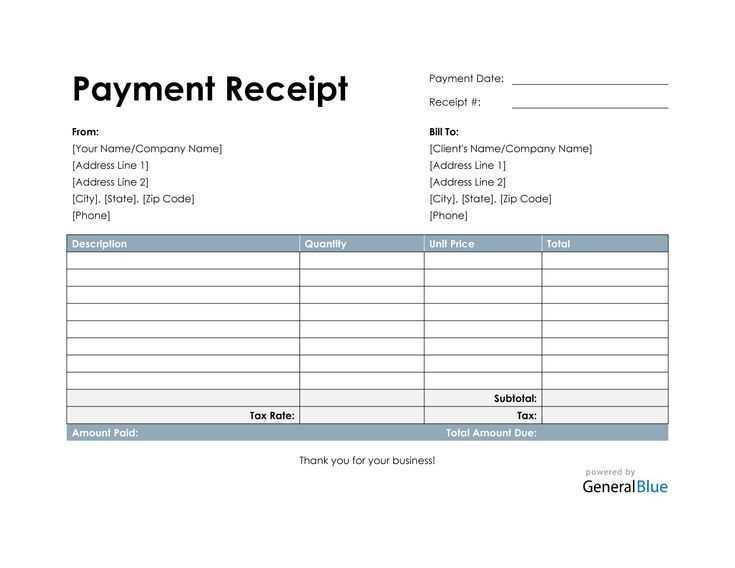

Invoice-Specific Modifications

For invoices, include itemized lists with quantities and prices. You can also add tax breakdowns if applicable. Make sure to adjust the “amount paid” field to reflect any deposits or partial payments made before the receipt is finalized. This keeps the transaction history accurate and transparent.

Adjustments for Services

In service-based transactions, note the type of service provided, along with the service duration, if applicable. A section for terms and conditions may also be necessary, especially for long-term agreements or customized services. This adds a layer of professionalism and ensures both parties are clear on expectations.

By updating your template for each type of transaction, you reduce errors and create a more professional, organized receipt for both parties involved.

Both digital and paper receipts are legally valid as long as they meet the necessary criteria, such as clear identification of the buyer, seller, transaction amount, and date. The choice of format depends largely on the needs of the business and legal requirements in the relevant jurisdiction.

Digital Receipts

Digital receipts hold up in court as long as they are backed by a secure system that verifies their authenticity. Using electronic signatures or timestamping can make digital receipts even more reliable. Ensure the system generates consistent and accurate data that can be easily accessed by the involved parties. Storing receipts in a secure cloud service or database enhances their validity, especially if they are time-stamped and encrypted.

Paper Receipts

Paper receipts are traditionally accepted as valid records of transaction. The main challenge with paper receipts is maintaining their legibility and condition over time. Storing receipts in a safe, organized manner helps preserve their legal standing. Paper receipts are commonly accepted in audits or disputes, as long as they include necessary transaction details, such as signatures or company information.

For both formats, ensure that the receipt complies with local tax laws and record-keeping regulations. If your business operates internationally, understanding the specific legal requirements of each region is crucial for maintaining receipt validity.

Ensure that your receipt includes the payer’s full name, address, and contact details. Include the payment amount, date of transaction, and a clear description of the product or service provided. Provide both the payer’s and receiver’s signatures for verification. Be specific with the payment method (e.g., cash, check, bank transfer) and transaction reference number. If applicable, mention any taxes or additional fees. Keep a copy for your records and send the original receipt to the payer promptly to confirm the transaction.