Creating a clear loan payment receipt is a straightforward way to document transactions between borrowers and lenders. A well-structured receipt confirms that the borrower has made a payment and provides both parties with a record of the amount, date, and loan details. This template helps to ensure that all necessary information is included and accurately recorded, avoiding misunderstandings later on.

Include the borrower’s name, loan account number, payment amount, and the method of payment in each receipt. Always state the payment date and ensure both the lender and borrower can easily verify the terms of the loan. A simple template with these fields can save time and protect both parties from disputes.

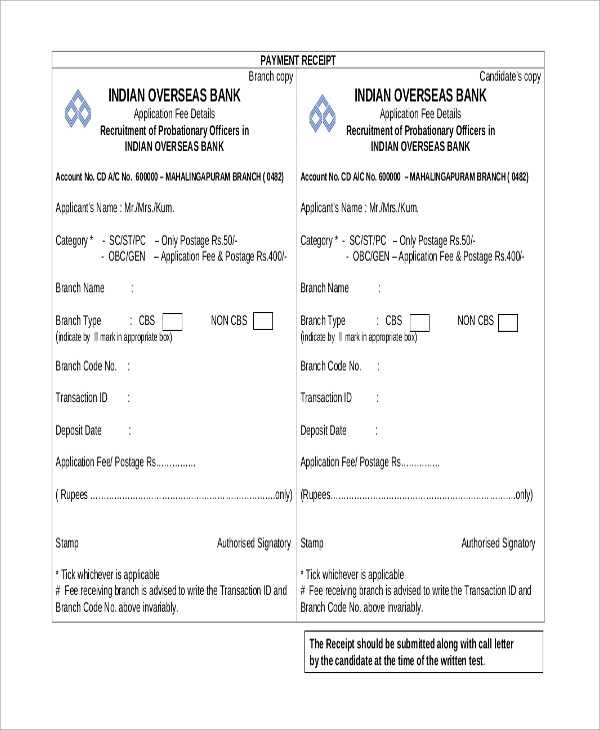

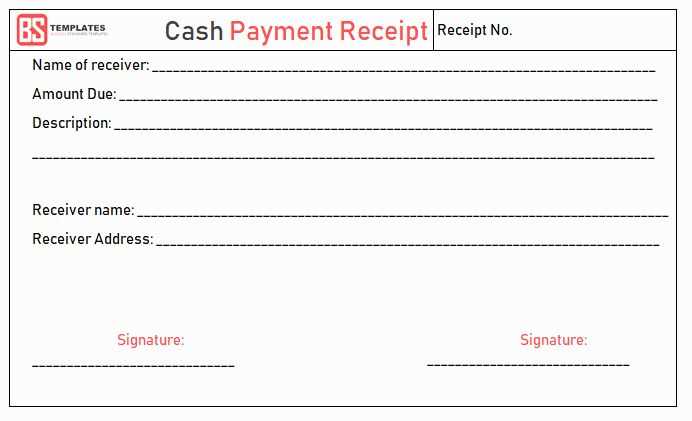

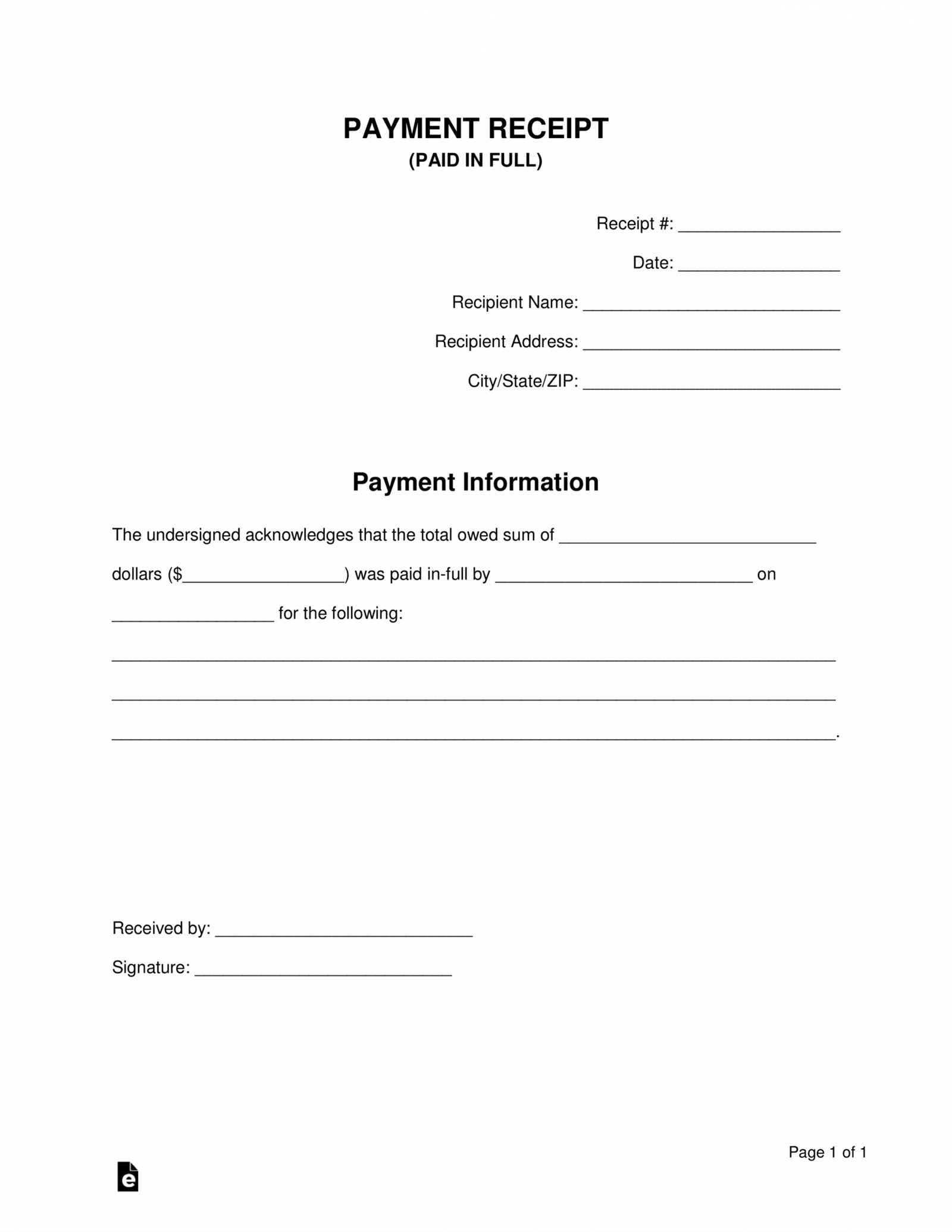

For consistency and ease of use, a basic loan payment receipt template should feature a title, payment details, and a space for signatures. This not only serves as proof of payment but also maintains transparency in the loan process. If you need a template, customize it to fit your specific needs or industry standards.

Key Details to Include:

- Borrower’s name and contact information

- Lender’s name and contact information

- Loan account number

- Amount paid

- Date of payment

- Payment method (cash, check, bank transfer, etc.)

- Signature of both parties

Here are the corrected lines, avoiding repetition:

To ensure clarity in your loan payment receipt, start by listing the borrower and lender information without redundancy. Use concise statements for the loan amount, interest rate, and payment terms. Instead of repeating similar phrases, focus on clear and precise wording.

Borrower and Lender Information

Always include the full name of the borrower and lender only once. If needed, refer to them by their roles (borrower or lender) in subsequent references.

Payment Details

State the loan amount, payment date, and method clearly. Avoid stating the same payment details multiple times. For example, mention the payment amount once and then refer to it simply as “the payment” in following sentences.

- Loan Payment Receipt Template

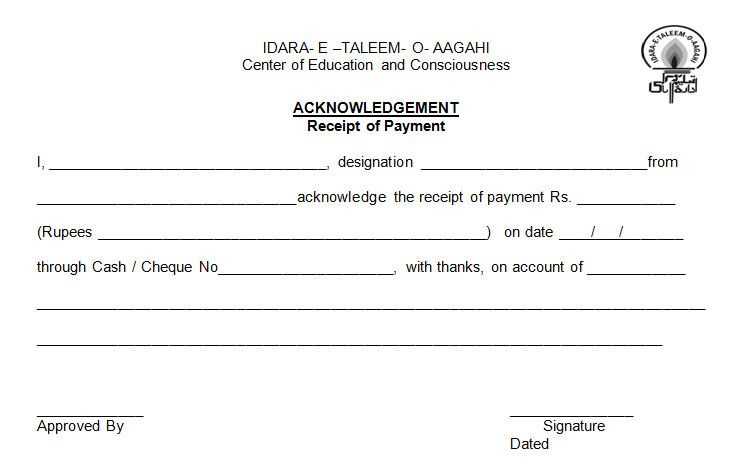

A loan payment receipt should be clear and concise, ensuring both parties have a written record of the transaction. Start by including key details like the loan agreement number, payment date, and amount received. Specify the payment method, such as cash, check, or bank transfer, along with any reference numbers or transaction IDs. This ensures transparency and clarity for both lender and borrower.

Be sure to include the names and contact details of both parties involved. This helps verify identities in case of any disputes. If the payment is a partial payment, note the remaining balance due to avoid confusion. For full transparency, you might also want to include any fees or charges applied to the loan account as part of the payment process.

To make the receipt more formal, include a space for signatures from both the lender and borrower. This serves as mutual acknowledgment of the transaction. Additionally, consider adding a disclaimer stating that the payment has been received in full (if applicable), or outline any ongoing obligations if it’s a partial payment.

Lastly, ensure the receipt is easy to read with a professional layout, using bold headers and clear sections. This will provide a useful document for both parties to reference in the future, particularly if there are questions regarding the loan agreement or payment history.

To create a loan payment receipt template, focus on clarity and easy-to-understand details. Include all necessary components to ensure both parties are fully informed. Here are key elements to consider when designing your template:

1. Title and Header Information

Start with a clear heading at the top of the receipt, such as “Loan Payment Receipt”. This identifies the purpose of the document at first glance. Include the lender’s name and contact information below the title for easy reference.

2. Loan Payment Details

Include the following details to make the receipt clear and complete:

| Payment Date | Amount Paid | Remaining Balance | Loan Number |

|---|---|---|---|

| [Date of Payment] | [Amount Paid] | [Remaining Balance] | [Loan ID or Reference Number] |

This table ensures that the transaction is clear and easily verifiable. Make sure the amounts and loan number are accurate to avoid confusion.

Additionally, include a brief description of the payment method (e.g., cash, check, or bank transfer). This confirms the payment method and can be useful for record-keeping.

3. Acknowledgement Section

At the bottom of the receipt, provide a space for both parties to acknowledge the transaction. A simple statement such as “This payment has been received in full for the specified loan” with a space for signatures helps formalize the process.

Clearly identify the borrower and lender with full names and contact details. Specify the loan’s reference number or account number for easy tracking. Include the exact amount of the payment made, as well as the method of payment, whether by check, bank transfer, or another form. Mention the date the payment was received and the payment period it covers. If applicable, provide details about any remaining balance, including the next due date for repayment.

Indicate any late fees or interest charges that might have been applied. If the payment affects the total outstanding balance, clearly state the new amount due. Keep the tone professional but straightforward, ensuring all important details are easily identifiable. If the payment was partial, note the total amount due and the breakdown of the remaining balance.

Finally, include a section for both parties to acknowledge the receipt, with a space for signatures or digital confirmation. This confirms the transaction’s validity and serves as a record for future reference.

Start by ensuring all payment details are accurately recorded. Missing information, such as incorrect payment amounts or dates, can create confusion for both you and the borrower.

1. Incorrect Payment Amounts

Double-check the amount recorded on the receipt. Even small discrepancies can lead to disputes later. Always match the payment amount with the agreed-upon terms to avoid mistakes.

2. Failing to Include Relevant Loan Details

Include the loan number, payment date, and balance remaining on the loan. Without these key details, the receipt may lack clarity, making it hard to track the payment history.

3. Not Recording Partial Payments Properly

If a borrower makes a partial payment, record it accurately on the receipt. A simple “partial payment” note helps clarify the loan status and ensures both parties understand the remaining balance.

4. Missing Borrower’s Signature

Always have the borrower sign the receipt, especially if it’s a physical document. A missing signature can complicate proof of payment in the future.

5. Ignoring Payment Method

Specify how the payment was made, whether by check, bank transfer, or cash. This adds an extra layer of detail that helps clarify any potential questions regarding the payment.

6. Not Providing Copies

Always give a copy of the receipt to the borrower. Both parties should have a record for reference. Failing to provide a copy can lead to misunderstandings about the payment status.

7. Leaving Out Payment Dates

Include both the payment date and the date the receipt was issued. This will avoid confusion about when the payment was made and when the receipt was generated.

By keeping these points in mind, you’ll avoid common mistakes and ensure payment receipts serve their intended purpose clearly and accurately.

Creating a Clear Loan Payment Receipt Template

Use precise language to ensure clarity and avoid confusion. Every word should contribute to the document’s purpose. For instance, make sure the loan amount, payment dates, and borrower details are clear and correctly formatted. Repeating terms like “payment” or “loan” should be minimized, keeping the focus on important details.

Maintain a simple structure. Include essential information only: borrower’s name, lender’s name, loan amount, and payment method. A table can help present figures neatly, ensuring everything is easily readable. Avoid unnecessary paragraphs or long sentences that distract from the purpose of the document.

Make sure to use active voice to keep the message direct. For example, instead of “The payment was made by the borrower,” write “The borrower made the payment.” This makes the receipt clearer and more straightforward.

Limit redundant phrasing. For example, don’t say “The borrower has made the payment today, and the payment was confirmed.” Instead, simply state, “The borrower made the payment on [date],” keeping the language concise and clear.