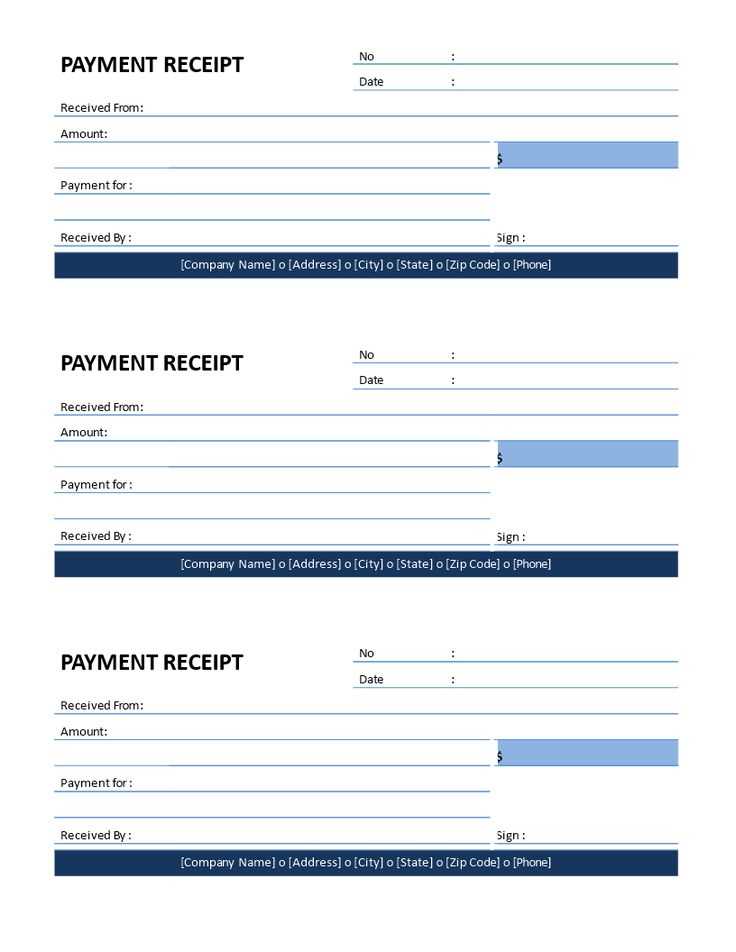

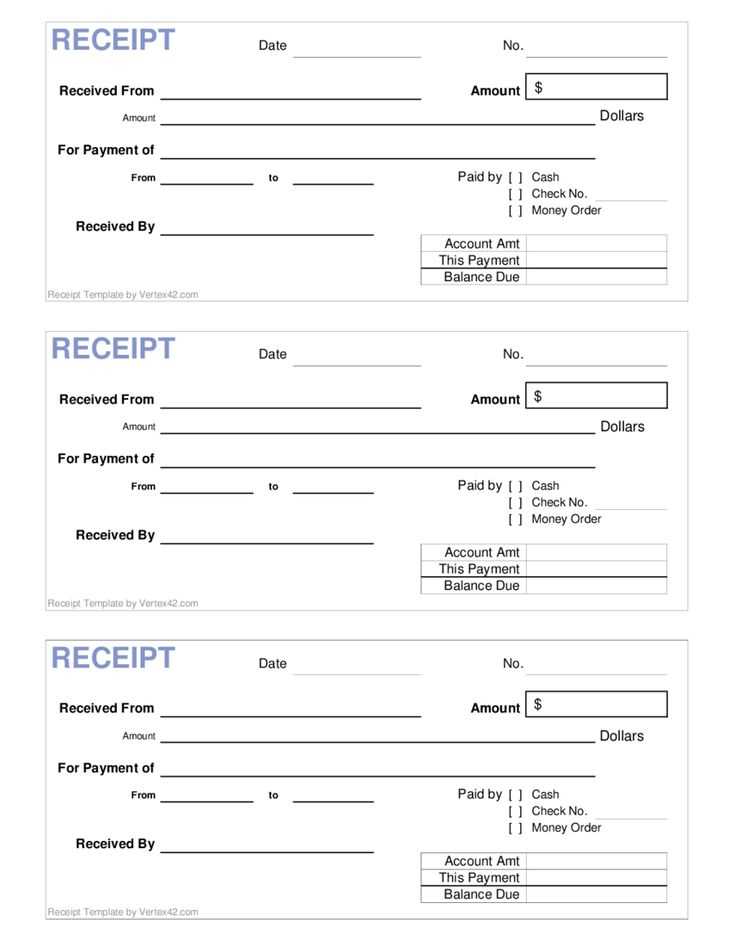

A structured receipt for partial payments prevents misunderstandings and keeps financial records in order. Whether handling deposits, milestone payments, or installment plans, a well-designed template ensures clarity for both payer and recipient.

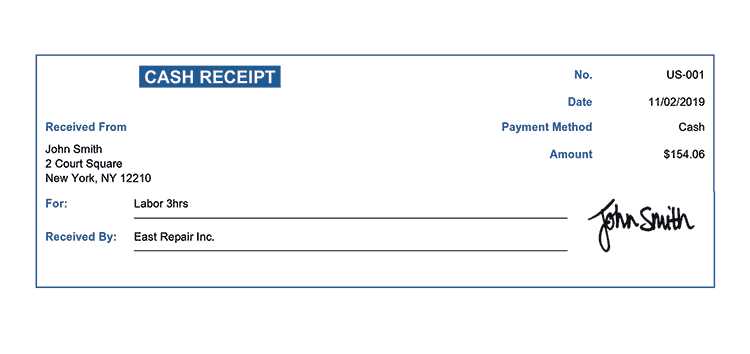

Include essential details such as date, payment amount, balance due, and transaction reference. Specify payment methods, whether cash, bank transfer, or card, to eliminate confusion. A section for signatures or official stamps adds credibility and legal weight.

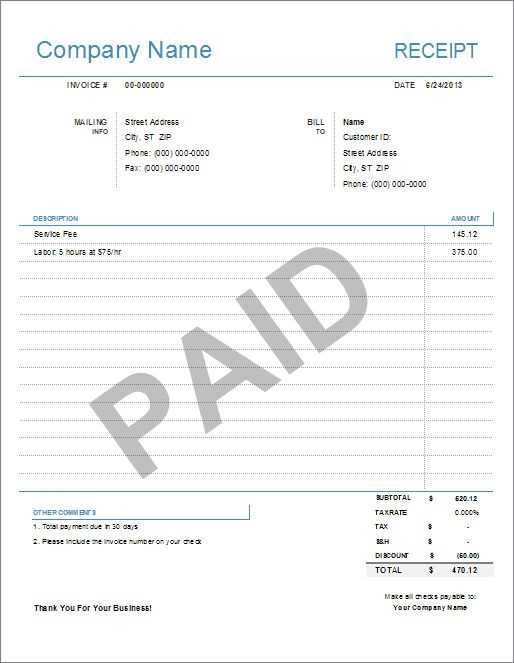

Customize the format to suit different needs. A simple layout with clear headings works best for quick transactions, while a detailed version with tax breakdowns and service descriptions fits business use. Digital templates with automated calculations save time and reduce errors.

Keep records accessible. Whether printed or stored digitally, a consistent filing system simplifies future reference. Providing a copy to the payer reassures them and helps maintain trust in financial dealings.

Part Payment Receipt Template: Practical Aspects and Customization

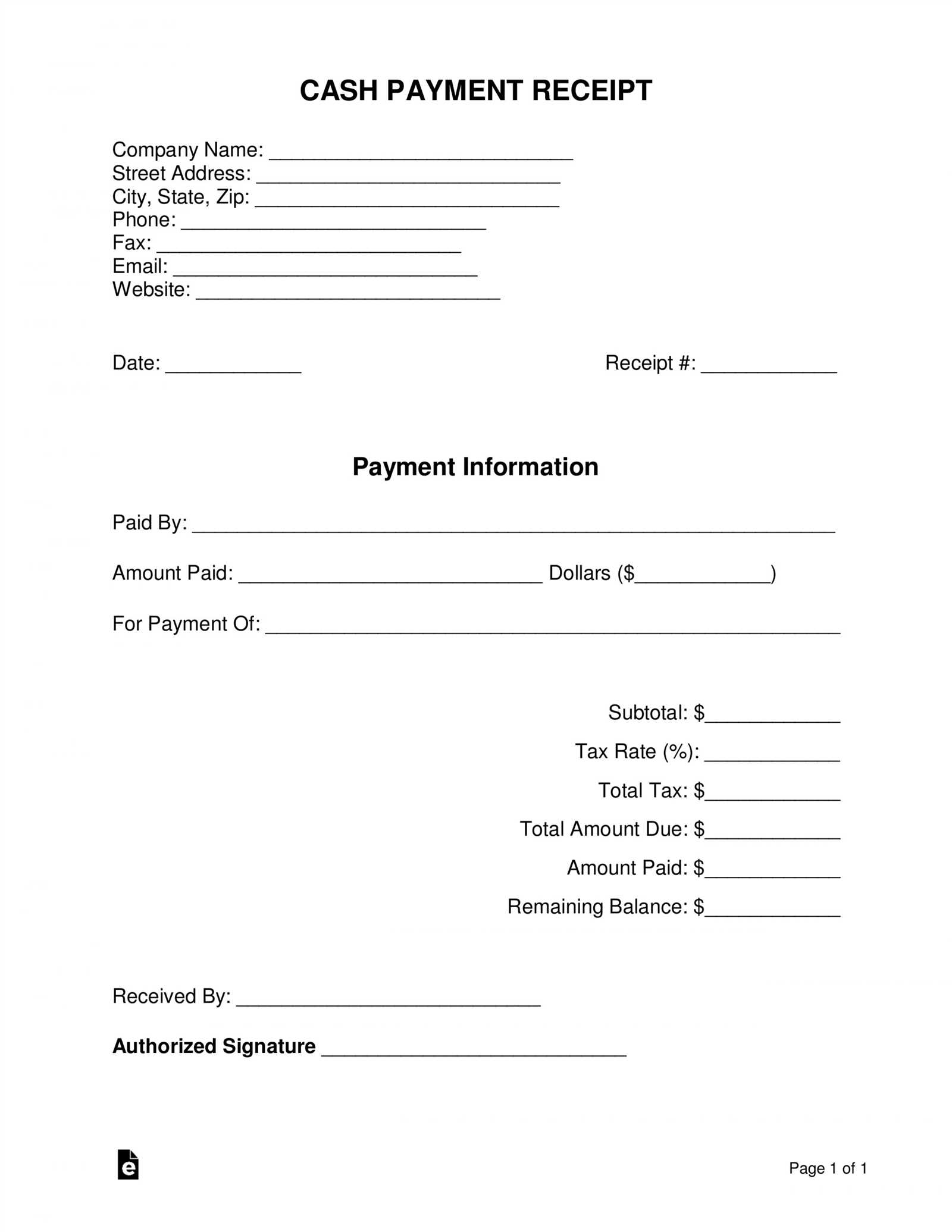

Use clear formatting to ensure a part payment receipt is easy to read and legally sound. Include key details:

- Payer and Payee Information: Full names, addresses, and contact details.

- Payment Details: Amount paid, outstanding balance, and total due.

- Transaction Date: The exact date of the partial payment.

- Payment Method: Specify if it was made via cash, bank transfer, or card.

- Reference Number: A unique identifier to track the transaction.

- Authorized Signatures: Signatures from both parties if required.

Adjust the template layout for clarity. Consider:

- Font Size and Spacing: Ensure readability with structured sections.

- Automated Calculations: If using a digital format, include fields that auto-calculate totals.

- Custom Branding: Add logos and company details for a professional look.

- Legal Clauses: Include terms about late payments, refunds, or contract conditions.

Save receipts in PDF format for secure storage and easy sharing. For recurring payments, use a template that allows quick updates while keeping past entries accessible.

Key Elements to Include in a Partial Payment Receipt

Payment Details: Specify the amount received, the remaining balance, and the total cost of the transaction. Use clear formatting to ensure readability.

Customer and Payee Information: Include the full name, address, and contact details of both parties. This prevents disputes and ensures accountability.

Transaction Date and Reference Number: Record the exact date and assign a unique identifier to track payments efficiently.

Payment Method: Indicate whether the transaction was made via cash, card, bank transfer, or another method. This helps with bookkeeping and verification.

Description of Goods or Services: Outline what the payment covers, including item names, quantities, or service details. Clarity here prevents misunderstandings.

Authorized Signature: Ensure that either the seller, service provider, or an authorized representative signs the receipt. A digital or handwritten signature adds legitimacy.

Legal Disclaimer (if applicable): If the agreement includes terms about refunds, penalties, or additional charges, state them concisely. This protects both parties from future disputes.

How to Customize a Receipt Template for Different Business Needs

Adjust the layout for clarity. A retail store may need a simple, itemized format, while a service provider benefits from a design that highlights labor costs and service details. Modify spacing, font size, and section arrangement for readability.

Include business-specific details. Add a company logo, contact information, and a unique invoice number format. Restaurants might include table numbers, while rental services can specify contract terms.

Customize payment sections. A subscription-based service may require recurring payment details, while a contractor might include milestone payments. Adapt fields to match payment structures, ensuring transparency.

Incorporate tax and discount calculations. Businesses operating in different regions should adjust tax fields accordingly. Retailers can highlight promotional discounts, while wholesalers might display bulk pricing adjustments.

Enhance with digital features. If receipts are emailed, consider adding clickable payment links or QR codes for customer convenience. E-commerce businesses benefit from tracking numbers and return policies directly on the receipt.

Ensure compliance with industry regulations. Medical and legal services may need specific disclaimers, while financial transactions might require additional authorization details. Tailor receipts to meet industry and regional requirements.

Legal and Accounting Considerations for Partial Payment Documentation

Specify the terms of partial payments in the initial contract to avoid disputes. Include due dates, payment amounts, and conditions for late fees or penalties. Both parties should sign the agreement to ensure enforceability.

Legal Compliance

Ensure that the receipt includes all legally required details, such as payer and payee names, payment amount, date, and reference to the original invoice. In some jurisdictions, tax authorities require specific wording or additional disclosures–verify local regulations to maintain compliance.

Accounting Best Practices

Record each partial payment separately to maintain accurate financial records. Use a unique reference number for every receipt to track transactions efficiently. If the payment covers multiple invoices, break down the allocation clearly to simplify reconciliation and audit processes.

Include tax details if applicable. For example, in VAT-registered businesses, a partial payment may require a proportional tax calculation. Consult an accountant to ensure correct tax reporting.

By following these steps, businesses can minimize legal risks and maintain accurate financial records, ensuring transparency and accountability in all transactions.