If you’re drafting a partial payment receipt for a vehicle, make sure your template includes the key details to avoid any confusion between the buyer and seller. The receipt should clearly state the amount paid, the remaining balance, and the due date for the full payment. Make sure to specify the method of payment, whether it’s cash, check, or bank transfer.

Incorporating a clear itemized list of the vehicle’s sale details is crucial. This means outlining the vehicle’s make, model, year, VIN, and any other specifics relevant to the transaction. Having these clearly listed helps protect both parties from future disputes or misunderstandings.

It’s also important to define the terms surrounding any outstanding balance. Include the interest rate, if applicable, and any late payment fees that may apply. Setting these expectations upfront ensures both sides are on the same page regarding payment terms.

Don’t forget to include a statement indicating that the seller retains ownership of the vehicle until the full payment is made. This helps prevent complications should the buyer fail to make the final payment on time. Always have both parties sign and date the document for added security and legal protection.

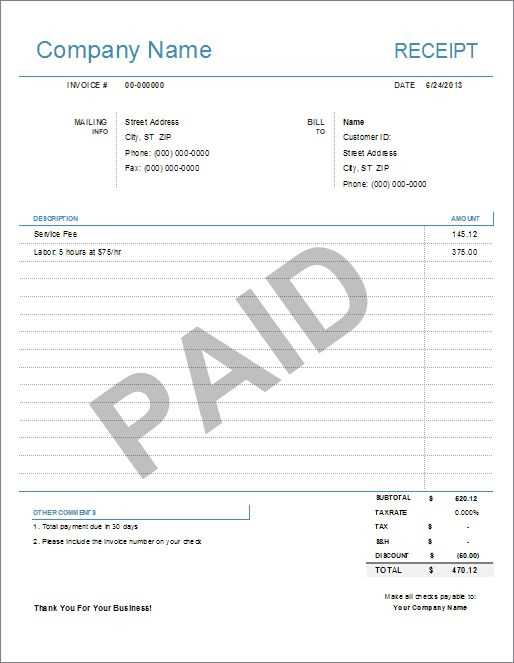

Partial Payment for Vehicle Receipt Template

For a clear record of partial payments made for a vehicle, it’s crucial to have a structured template. The receipt should capture key details such as the buyer’s name, vehicle description, total amount due, amount paid, and balance remaining. Include a section that specifies the payment date and the agreed-upon payment terms (e.g., due date for the next payment or final payment). This ensures transparency and keeps both parties informed of the financial arrangement.

Be sure to include both the seller’s and buyer’s signatures at the bottom of the receipt to confirm the transaction. This helps avoid misunderstandings and adds a layer of legal protection. You can also add a reference number for easy tracking of the transaction in case of future inquiries.

It’s helpful to outline any late fees or penalties in case the buyer does not meet the agreed payment schedule. This can act as a reminder for timely payments and protect both parties from future disputes.

How to Create a Clear Payment Schedule in Your Receipt Template

Begin by specifying the total amount due for the vehicle. Then, break it down into the installments, showing the amount for each payment. Clearly display the dates when payments are expected, so the buyer knows when each is due.

Define Payment Amounts

Ensure that each installment amount is easy to understand. For example, if the buyer is paying in two or more installments, clearly state the value of each. Avoid confusing calculations or hidden fees–clarity helps prevent future misunderstandings.

Include Due Dates

List the exact due dates for each installment. If the payment schedule extends over several weeks or months, show the timeline in a format that’s easy to follow, like a table or bullet points. This will keep the buyer on track and make it simple to reference.

Lastly, add a section for the buyer’s signature or an acknowledgment to confirm the payment terms. This creates an official record of the agreed-upon payment plan, making the process smoother for both parties.

Legal Considerations When Using Partial Payments for Vehicle Purchases

Ensure that the agreement clearly outlines the terms of the partial payment arrangement. This includes specifying the total purchase price, the amount due at the time of the initial payment, and the remaining balance. A well-drafted contract should avoid ambiguity about due dates, interest rates (if any), and payment methods.

Payment Schedule and Default Clauses

It’s crucial to set a clear payment schedule in the contract. Specify due dates for each installment and outline the consequences of missed payments. Make sure the buyer understands the impact of defaults, such as late fees or the potential for the vehicle to be repossessed. Be transparent about how missed payments affect both parties’ rights and responsibilities.

Title Transfer and Ownership

Partial payments do not transfer full ownership of the vehicle until the total amount is paid. Ensure the buyer understands that while they may possess the vehicle, the seller retains the title until full payment is completed. This is a key point to clarify in the agreement to avoid disputes. Keep all documentation regarding the transfer of title, including any conditions for release upon final payment.

Customizing Your Template for Different Payment Methods

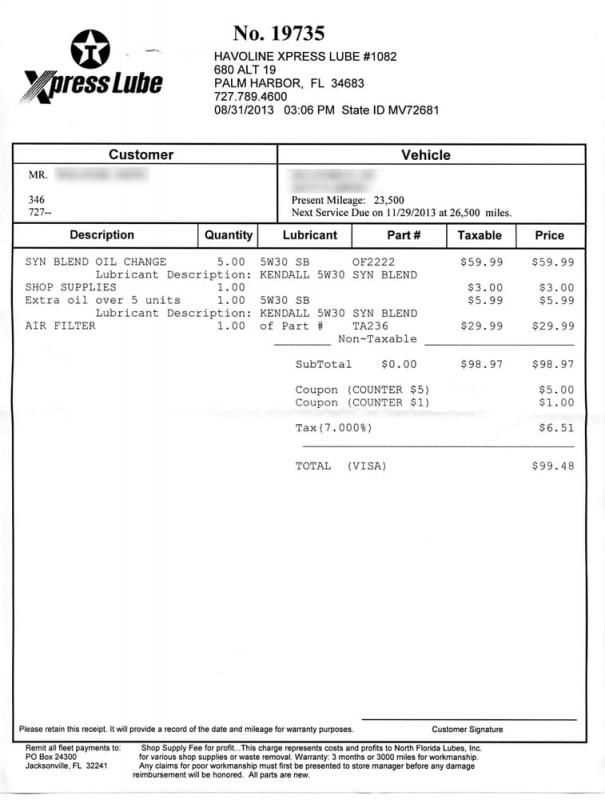

Adjust your template to reflect the specific payment methods your clients use. This ensures clarity and smooth processing of partial payments for vehicle receipts.

- Credit/Debit Card Payments: Include fields for card details, expiration date, and security code. Make sure there’s a clear space for the transaction amount and the total balance due. Highlight any processing fees, if applicable.

- Bank Transfers: Provide bank account details, including the account name, number, and routing code. Clearly state that the payment needs to be confirmed before issuing the receipt.

- PayPal or Other Online Services: Add a dedicated section for PayPal transaction IDs and email addresses. This helps in verifying payments and tracking them easily.

- Cash Payments: For in-person payments, make sure there’s a space to record the amount received and any change given. Include the date and time of the transaction.

- Cryptocurrency: If accepting cryptocurrency, specify the type of crypto (e.g., Bitcoin, Ethereum) and the wallet address. Ensure that exchange rates and conversion values are clear to prevent misunderstandings.

For each method, tailor the receipt’s wording to match the transaction process. Include specific instructions or links where necessary, especially for digital payments, to guide clients on completing their payment securely.