If you want to ensure fast payments, use a “Payment Due Upon Receipt” template. This simple but clear wording on your invoices tells clients that payment is expected immediately upon receipt, helping you avoid delays in cash flow. To create this template, include basic invoice details such as the invoice number, issue date, payment terms, and total amount due. Make sure to highlight the “Payment Due Upon Receipt” phrase, so there’s no confusion for the client.

Include a clear description of the product or service provided, along with any additional fees or taxes that may apply. It’s also helpful to provide payment options, such as bank details or links to online payment portals, ensuring convenience for the client. By being transparent and straightforward with your terms, you set clear expectations and promote quicker processing of payments.

Lastly, consider adding a polite reminder of the payment terms in your email or message when sending the invoice. A friendly but firm reminder increases the chances of receiving timely payments without needing to chase clients later. This template can streamline your invoicing process and improve cash flow significantly.

Here’s the revised version, where words are not repeated more than 2-3 times:

For clearer and more professional communication, avoid using the same terms repeatedly. Try to vary the wording without changing the meaning. For example, instead of repeating “payment” multiple times, use synonyms or rephrase sentences. Here’s a guide on how to improve the structure of payment due statements:

- State the due date clearly without redundancy.

- Use precise language, like “Invoice total” or “outstanding balance” instead of repeatedly saying “amount due”.

- Implement a polite tone while keeping the request direct and clear.

- Avoid over-explaining payment instructions. If needed, provide a separate link to your payment portal.

- Minimize the use of phrases like “as stated” or “as noted.” These can be implied or omitted to enhance flow.

By simplifying and varying your phrasing, you create a more readable and engaging message that gets straight to the point while remaining professional.

- Payment Due Upon Receipt Template

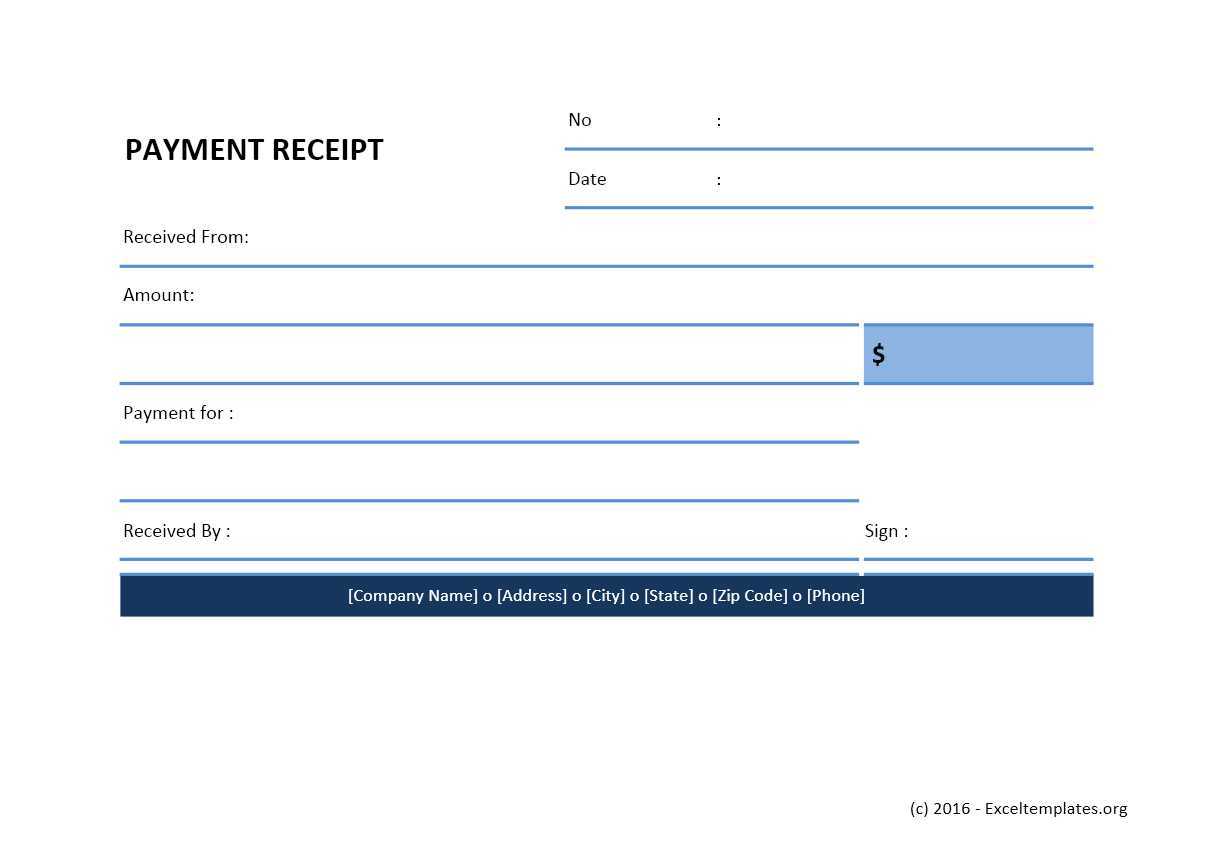

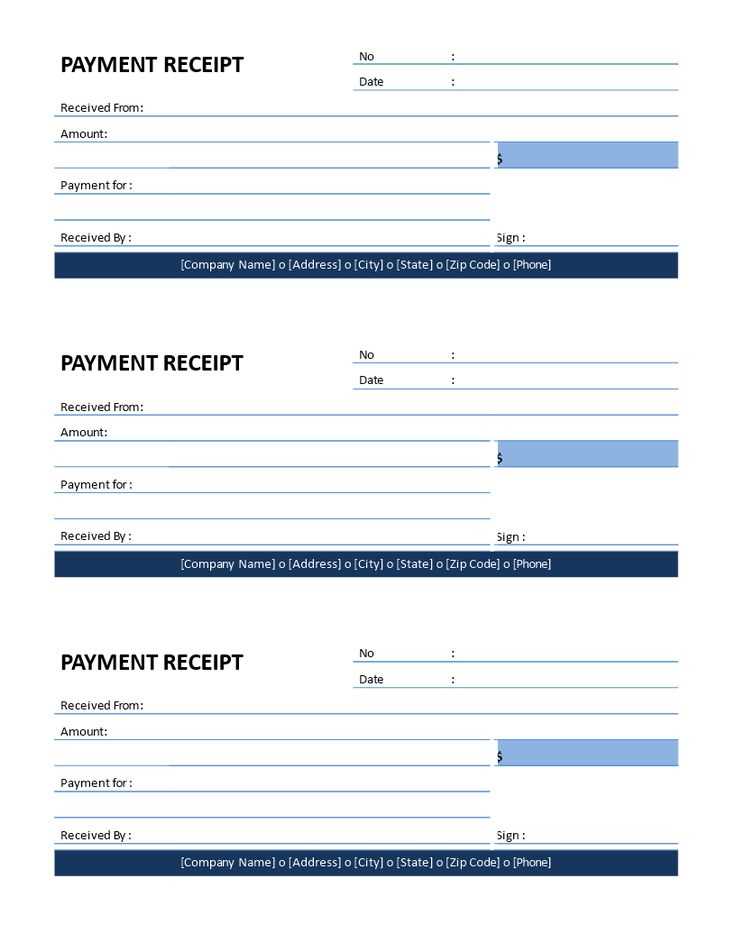

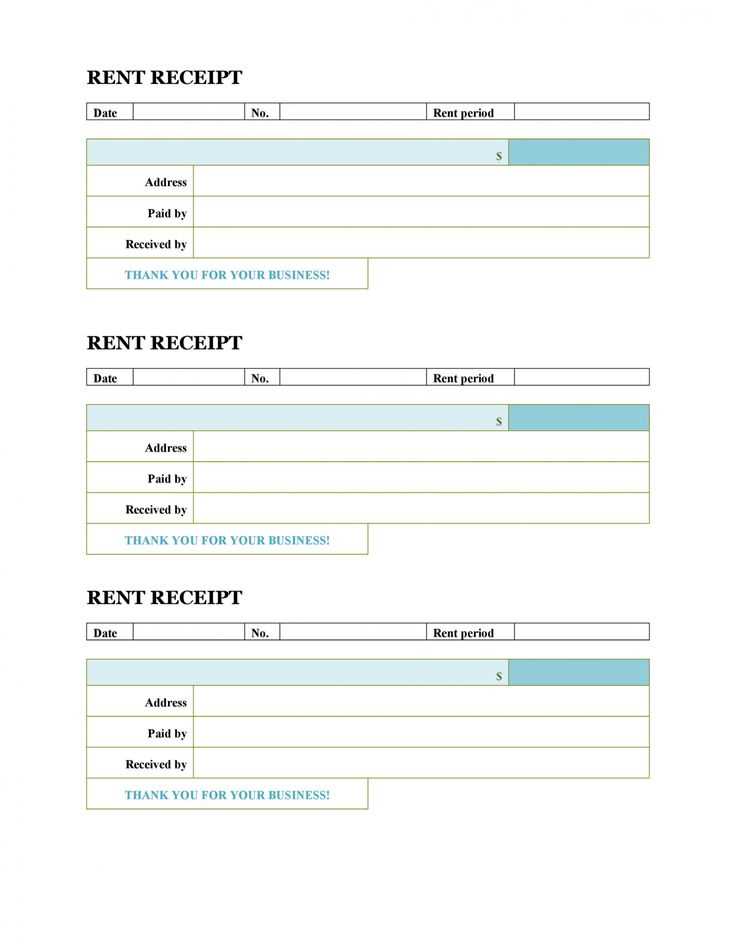

A Payment Due Upon Receipt template helps streamline invoicing by clearly stating that payment is expected immediately after the customer receives the invoice. To ensure clarity and prompt payment, include the following elements in your template:

- Invoice Title: Make the title clear and specific, such as “Invoice Due Upon Receipt” or “Immediate Payment Due Invoice”.

- Invoice Date: Always add the date the invoice is issued.

- Due Date: Clearly state that the payment is due upon receipt, and include any payment instructions.

- Payment Terms: Specify that the payment must be made immediately or within a short time frame (e.g., “Payment Due Immediately” or “Due within 24 hours of receipt”).

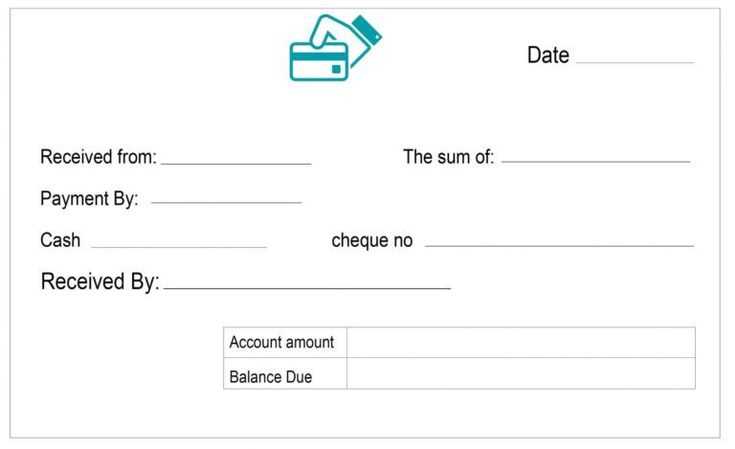

- Payment Methods: List all accepted payment methods, including bank transfer, credit card, or online payment systems.

- Itemized List of Products or Services: Provide a detailed breakdown of the products or services being charged.

- Total Amount Due: Clearly state the total amount due, including taxes, shipping, or additional fees if applicable.

- Late Payment Terms: While the invoice specifies immediate payment, consider briefly mentioning consequences of late payments (e.g., a late fee or interest).

To make your invoice easier to process, keep it straightforward, without excessive wording. This will help avoid confusion and encourage timely payment. Make sure to keep a record of all invoices sent and track their status for follow-up if needed.

To ensure clarity and prompt payment, place “Payment Due Upon Receipt” in a bold, noticeable position at the top of the invoice. This serves as a clear reminder for the client that payment is expected immediately upon receipt of the invoice.

Invoice Information

Include all necessary details such as the invoice number, date, and due date. Although the payment is due upon receipt, having this information allows both parties to keep track of the transaction and avoid confusion.

Itemized List of Charges

Provide a detailed breakdown of the goods or services provided. Include item names, descriptions, quantities, rates, and totals. This transparency helps your client understand exactly what they are paying for, reducing the likelihood of disputes.

Ensure the total amount due is clearly visible and matches the sum of the itemized charges. Highlight the payment method options (e.g., bank transfer, PayPal) and include the required details, like account numbers or links.

Ensure your payment terms are clear and legally binding by stating that payment is due upon receipt. This minimizes the chance of misunderstandings and disputes. Specify the method of payment (e.g., bank transfer, check, online payment), including details like account numbers or payment links to avoid confusion.

Define the payment period explicitly. A “due upon receipt” clause means the payment is expected immediately after the invoice is received, but it’s important to state if there are exceptions, such as holidays or weekends, to avoid ambiguity.

Include late payment penalties. Even with immediate due dates, adding a clear penalty or interest rate for overdue payments can deter late payers and protect your business. Be mindful of the legal limits in your jurisdiction regarding interest rates on overdue payments.

Make sure your terms comply with local laws. Some regions may have specific regulations about payment due dates, interest rates, and collection practices. Ensure that your template aligns with those to avoid legal issues down the line.

Clarify the consequences of non-payment. Address what will happen if the payment isn’t received, including any additional fees for collection or legal actions. This will help you set expectations and provide leverage in case of disputes.

Clear and concise payment terms are crucial for maintaining smooth client relationships. Start by ensuring your payment terms are easy to understand and accessible. Use simple language to avoid confusion and make it easy for clients to know what to expect.

1. Set Clear Payment Deadlines

State the exact date or number of days within which payment is due. For instance, “Payment due upon receipt” or “Net 30” (30 days after invoice date) should be clearly indicated. Specificity removes any ambiguity and helps clients plan their payments accordingly.

2. Highlight Late Fees and Consequences

Clearly mention any late fees or actions that may result from delayed payments. This sets a clear expectation for clients regarding penalties for non-payment. For example, “A 5% late fee will be applied for payments received 10 days after the due date.”

3. Provide Payment Method Options

Offer multiple payment methods to suit client preferences. Make sure clients know which methods are available–bank transfer, credit card, PayPal, etc. This flexibility can increase the likelihood of timely payments.

4. Send Reminders

Send gentle reminders before the due date to keep payment terms fresh in clients’ minds. Include a polite note in your email or message reminding them of the upcoming due date and payment methods available.

5. Include Payment Terms on All Documentation

Ensure that all contracts, invoices, and agreements include the payment terms. This reinforces clarity and minimizes disputes about when and how payments should be made.

6. Be Open to Negotiation

Some clients may request flexibility. Be willing to discuss extended terms if appropriate, but make sure any changes are documented and agreed upon in writing to avoid misunderstandings.

| Action | Recommended Approach |

|---|---|

| Setting Payment Deadlines | Be specific with dates, e.g., “Due upon receipt” or “Net 30” |

| Late Fees | Clearly communicate fees, such as “5% fee after 10 days” |

| Payment Methods | Offer options like credit cards, bank transfer, PayPal |

| Reminders | Send reminders a few days before the due date |

Payment and Receipt Terminology

Ensure that the words “payment” and “receipt” are not repeated more than three times per sentence. Using these terms sparingly maintains clarity and flow, avoiding redundancy. Instead, rephrase your sentences to use synonyms or alternative expressions for variety. For example, use “invoice” or “bill” as substitutes for “payment,” and “confirmation” or “acknowledgment” for “receipt.” By doing so, you will keep the language precise and professional while delivering the necessary message.

Another tip is to separate the concepts of “payment” and “receipt” into different sections if possible. This helps to avoid confusion and ensures that each aspect of the transaction is addressed clearly. For instance, the payment terms can be discussed in one paragraph, while the receipt process can follow in the next. This approach keeps the content organized and easy to understand.

Try to use “payment” or “receipt” in their most relevant contexts, focusing on what they represent. For example, when discussing a transaction, “payment” refers to the exchange of money, while “receipt” confirms the completion of that exchange. Keeping these definitions clear helps your audience understand the process better.